Curve Finance Resolves Frontend Hack

Decentralized trading platform Curve Finance is the latest victim that succumbed to a series of exploits targeting blockchain companies and the crypto space. Find out more here.

Ethereum Final Test Merge Goes Live

The third and final test merge has been finalized on the Goerli testnet, marking the completion of all dress rehearsals before the eventual mainnet Merge, which is scheduled in September. Find out more here.

MakerDAO Founder Calls to Drop Dollar Peg

The U.S. Treasury Department's jaw-dropping decision to ban Tornado Cash, a leading privacy solution in the crypto industry, has pushed many market participants to reconsider their exposure to centralized products within regulatory authorities' reach.Find out more here.

DeFi Updates of the Week

This week, we take a look at Maker, the largest DeFi protocol by TVL.

The U.S. Treasury recently imposed a sanction on Tornado Cash, leading to Circle, the USDC issuer, blacklisting Tornado Cash contracts and freezing USDC owned by those addresses. Circle’s response prompted investors to turn to decentralized stablecoins such as DAI to avert censorship but, on the other hand, exposed Maker’s collateralization risks of USDC.

Read more here as we unravel Maker’s recent developments and the centralization risks of USDC on DAI.

Deep Dive of the Week

This week, we bring you up to speed with the developments of Ethereum PoW.

With The Merge just around the corner, a prominent Chinese Ethereum miner called for a hard fork of Ethereum, dubbed Ethereum PoW, which will continue to adopt proof-of-work (PoW), thus diverging from the proof-of-stake (PoS) model upon The Merge. Diving deep into the development reveals miners’ dilemma of losing the lucrative profits they used to gain from mining activities.

Read more details here as we delve deep into whether Ethereum PoW and ETC can resolve the Ethereum miners’ dilemma.

On-Chain Round-Up for the Week

The broader market continues to ride the wave of the Merge-inspired rally. Macro Major digital assets reached local tops — BTC flirted with the $25k before correcting downwards, while ETH cracked the $1,900 mark upon the completion of the Goerli test merge. Meanwhile, decelerating inflation in the U.S. prompted Nasdaq Composite to rebound over 20% from its low, clearing the way for cryptocurrency’s rebound. However, it is still hard to rein in investors’ expectations for risky assets as the possibility of a further 75 bps rate hike is not completely out of the picture.

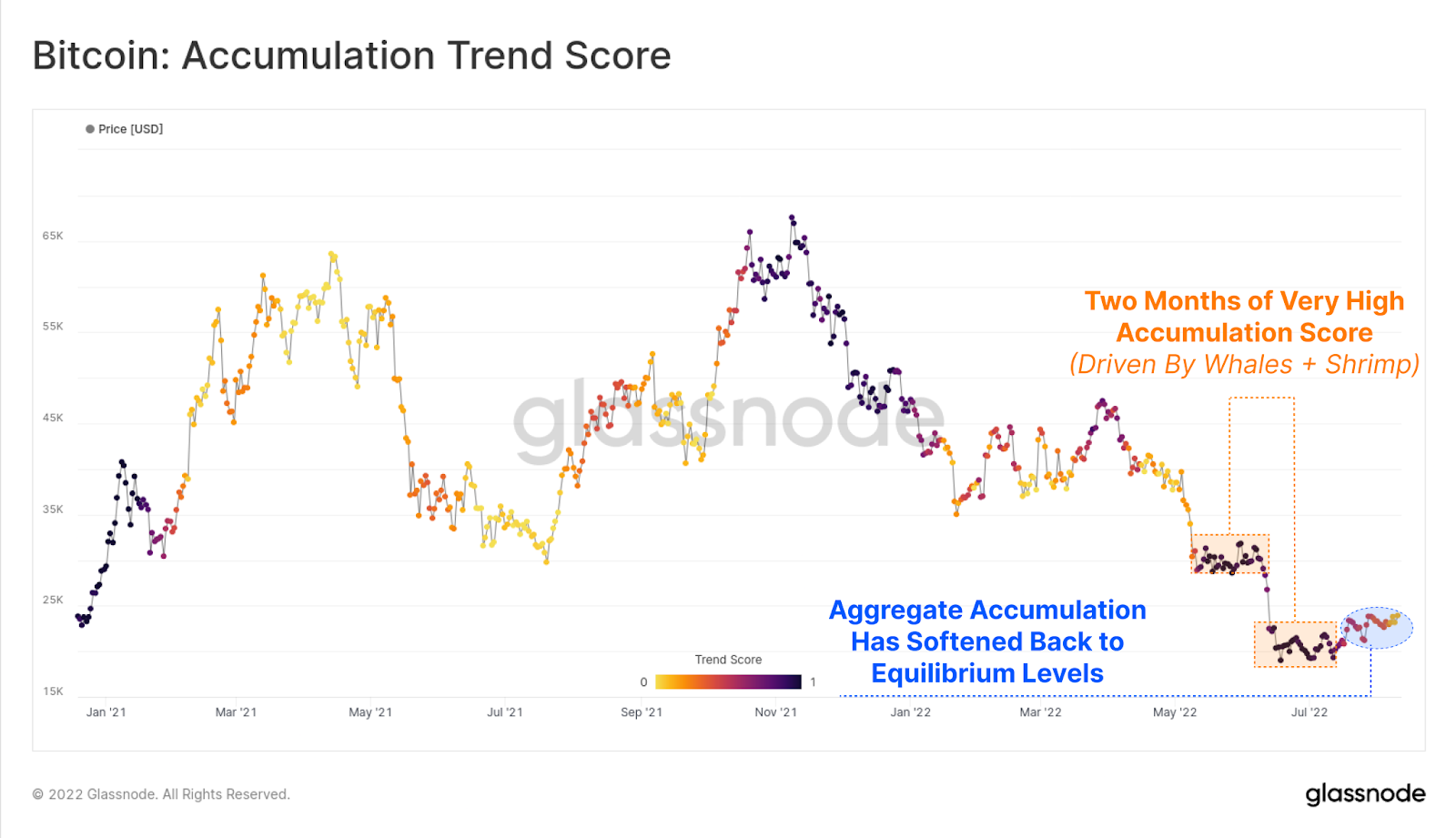

BTC’s on-chain accumulation trend score indicates that accumulation behaviors among whales and small-time retailers have cooled significantly after two months of aggressive balance increases. Meanwhile, ETH/BTC ratio is fast approaching 0.08 after the ratio dived to 0.05 in June, suggesting that capital is betting on the positive impact of the Merge on the second largest cryptocurrency.

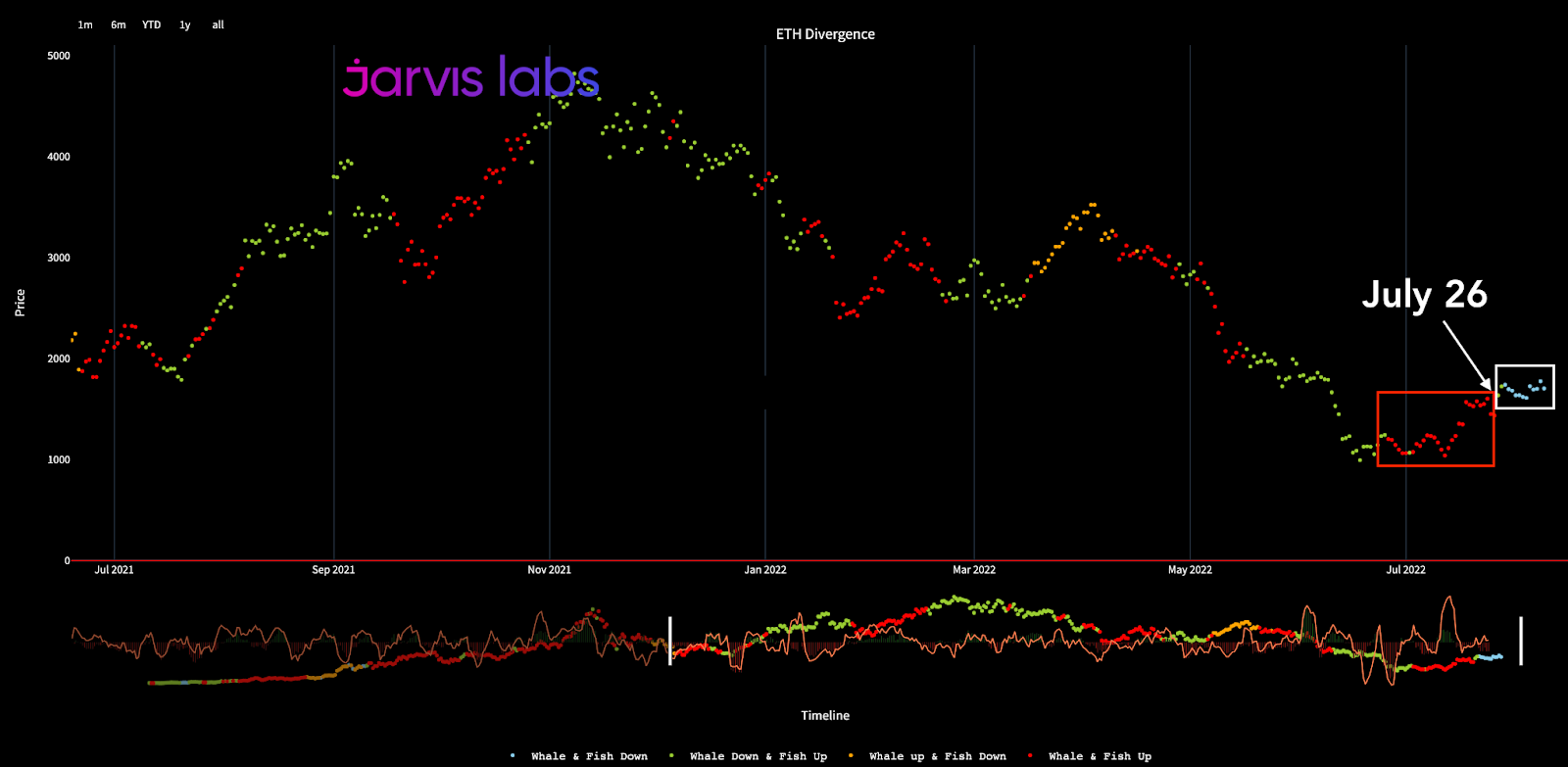

The ETH divergence chart shows that whales and small-time retail traders have been accumulating since ETH carved out a local bottom as the broader crypto market tanked. However, the accumulation behaviors seem to be switched off on July 26, and these two cohorts have since tapered their accumulation despite raging spot prices.

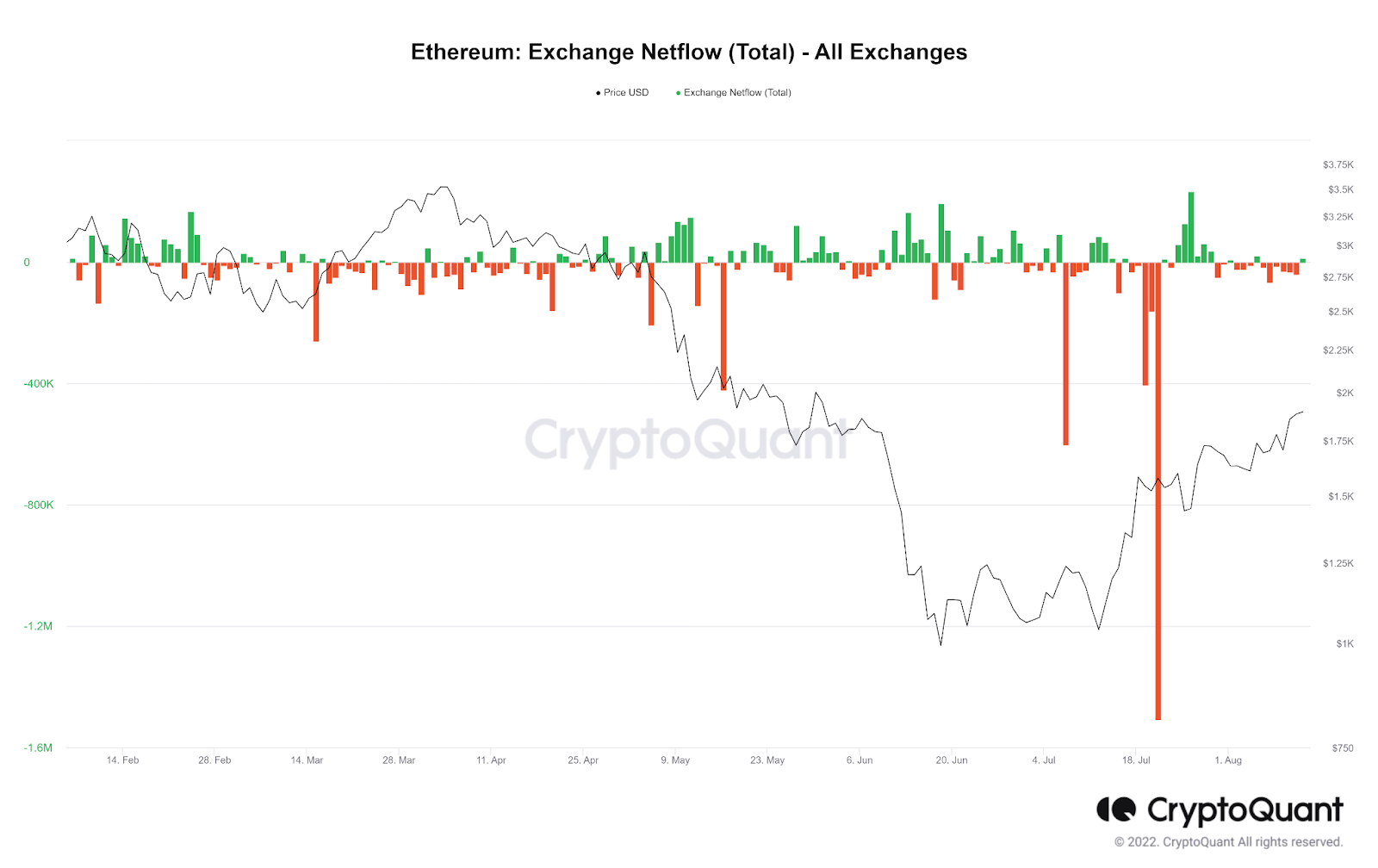

The net exchange position change in past weeks shows that smart money may have taken a price agnostic strategy, holding ETH in cold storage while shorting futures, as The Merge draws nearer.

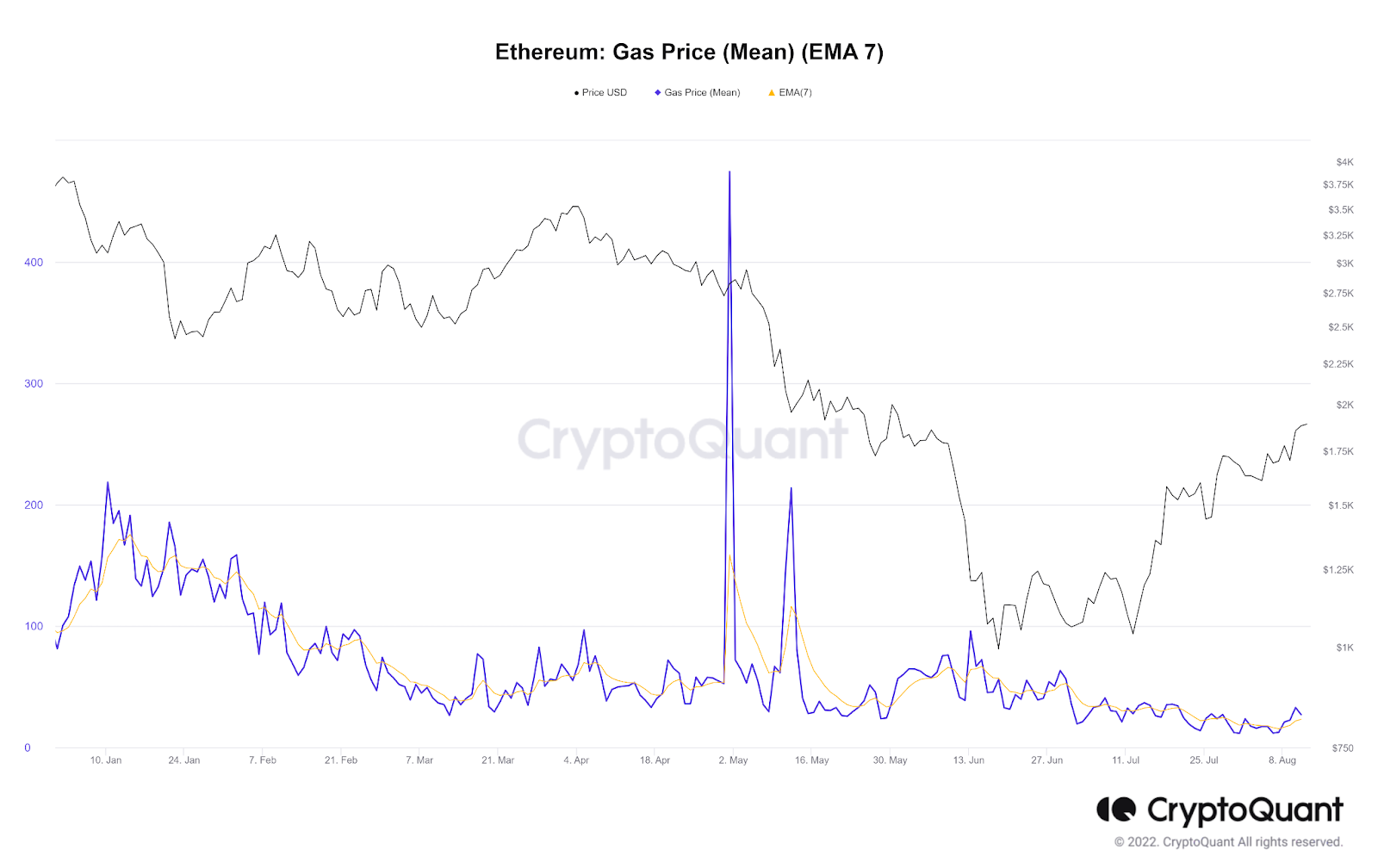

Amid the spot rally, Ethereum gas fees continue to trend down on the back of muted demand and low trading volumes across major exchanges.

Macro Events to look out for in the Coming Week

Aug 15, 2022 |

|

Aug 17, 2022 |

|

Aug 19, 2022 |

|

Three coins to watch

Token | Reason |

FLOW | The partnership with Meta on NFT integration has sent FLOW into overdrive, fuelling a price hike of more than 40% in a matter of days. The 2 billion active users that Instagram boasts of may just hold the key to FLOW further upside price actions. |

OP | OP’s recent rally is partly driven by the Optimism Foundation penciling in the Bedrock upgrade, a major step toward the rollup-based L2 solution, in Q4 this year. However, a more recent event may have also played a huge part: Optimism has briefly overtaken Arbitrum in terms of TVL and is currently the sixth-largest smart contract chain in the DeFi space. The impressive growth follows the launch of an Aave liquidity mining program on the network. |

SPELL | The U.S. Treasury recently imposed a sanction on Tornado Cash, leading to Circle, the USDC issuer, blacklisting Tornado Cash contracts and freezing USDC owned by those addresses. Governance token prices of decentralized stablecoins issuers took off after the news. The underlying collaterals of MIM are yield-generating tokens from Yearn or Convex, averting the censorship actions made by centralized players. |