U.S. Treasuries, on the other hand, have become a safe-haven for investors, with the 10-year bond yield plunging to 0.6%. As was the case in March, gold did not play a safe-haven role in the selloff — and neither did Bitcoin (BTC).

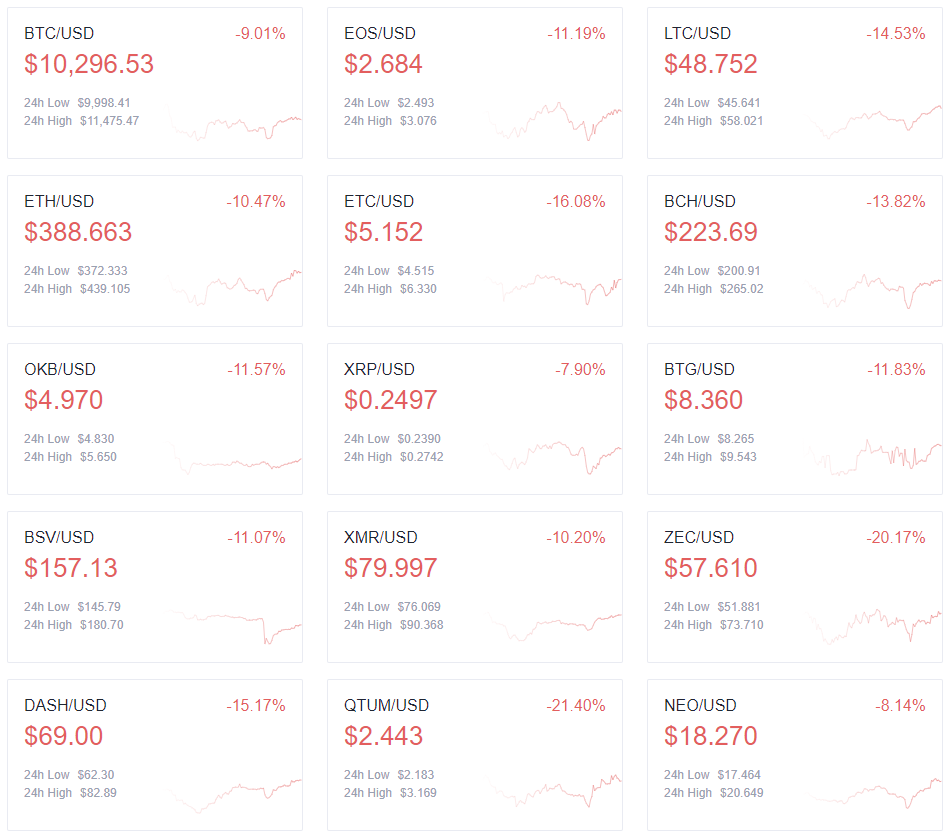

BTC plunged 9.01% overnight, effectively wiping out all of its gains made since the end of July. The OKEx BTC Index price hit a new low of $9,998 before bouncing back to the $10,300 level. The top 20 cryptocurrencies by market capitalization (excluding stablecoins) saw drops anywhere between 8% to 20% — except for TRON ( TRX).

The total crypto market capitalization plunged by another 10% in the last 24 hours and fell to $342 billion, as per data from CoinGecko.

As mentioned previously, the only strong performer was TRX, which saw an overnight increase of 13%. TRX’s countertrend performance has also put its market capitalization back into the top 10.

TRX has been boosted by its decentralized finance projects, in addition to the value being locked in SUN’s yield farming. There are over 5.8 billion TRX, or $250 million, in total lock-ups, as of 7:00 am UTC today. The TRX price peaked at $0.049 before correcting back down to its current price of $0.043.

There was also a huge pullback in the prices of various DeFi tokens. YFValue ( YFV) lost 41.60% of its value in 24 hours. SushiSwap ( SUSHI) dropped 31.43%. As many as 16 tokens are down more than 20%, according to OKEx’s DeFi Coin Info page.

Top altcoin gainers and losers

In addition to TRX, altcoins that bucked the trend were CELO and DigiByte ( DGB), which are up 15.47% and 4.97%, respectively. Altcoins that are firm in price when the market is down are, in theory, more likely to rise quickly when the market rebounds.

BTC technical analysis

Yesterday’s bigger-than-expected selloff wrecked the mid-term cutoff of $10,650. There is no clear sign of the end emerging from the current downward pattern on the one-hour chart.

The selloff was accompanied by a significant increase in volume, and a feeling of panic remains somewhat pervasive.

$10,200 is the intraday threshold. If the BTC price can hold this level, we may see another period of consolidation. The psychological price of $10,000 could be the next support level. A break below that level may induce a further slide to $9,300.

For a snapshot of the changing dynamics of derivatives data, readers can jump to OKEx Insights’ recently published Futures Friday article, which features a detailed analysis of derivatives trading indicators — such as the long/short ratio, open interest and quarterly futures premiums.

Visit https://www.okex.com/ for the full report.

Not an OKEx trader? Learn how to cryptocurrency-on-okex” target=”_blank”>start trading!

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.