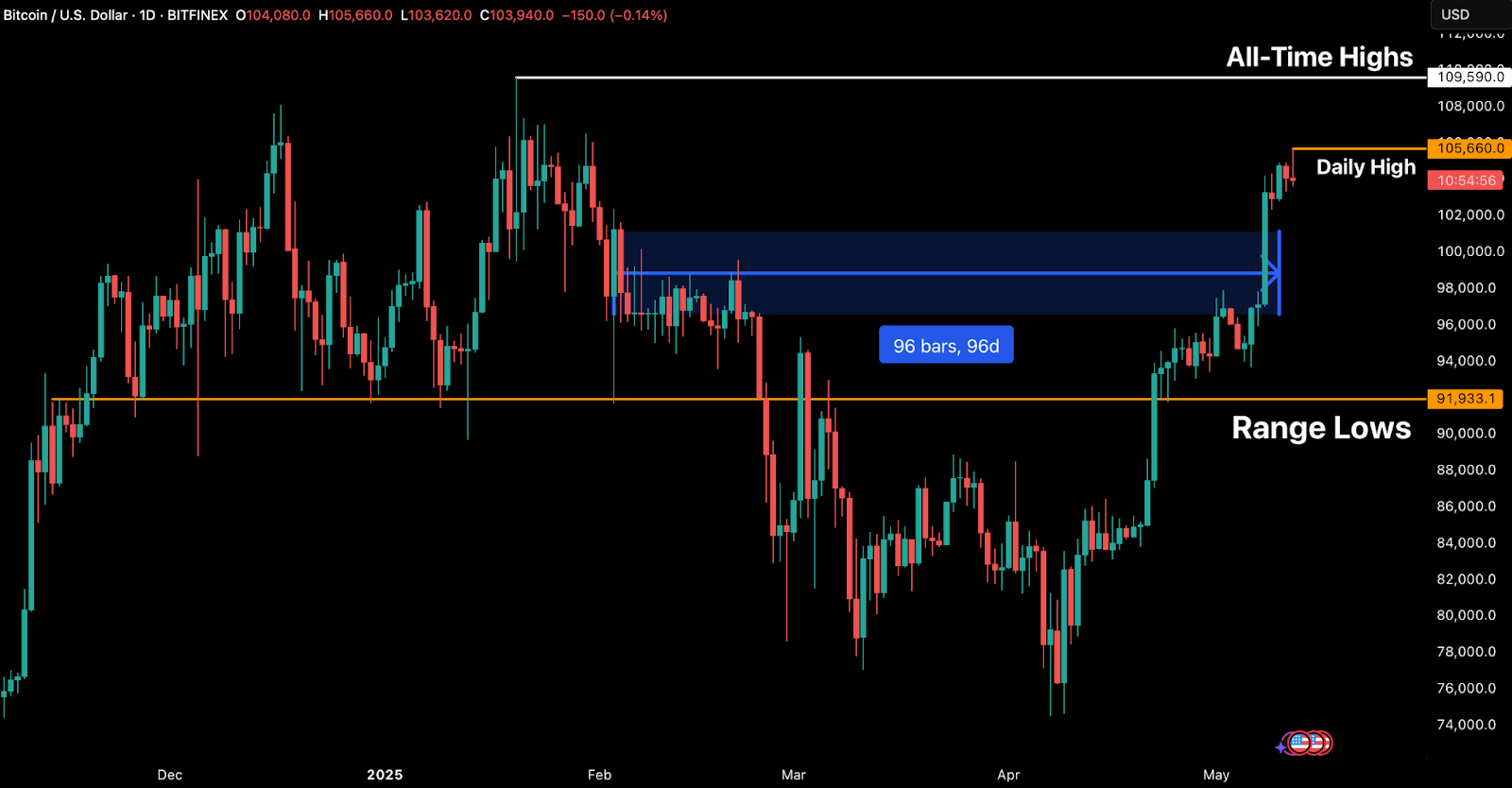

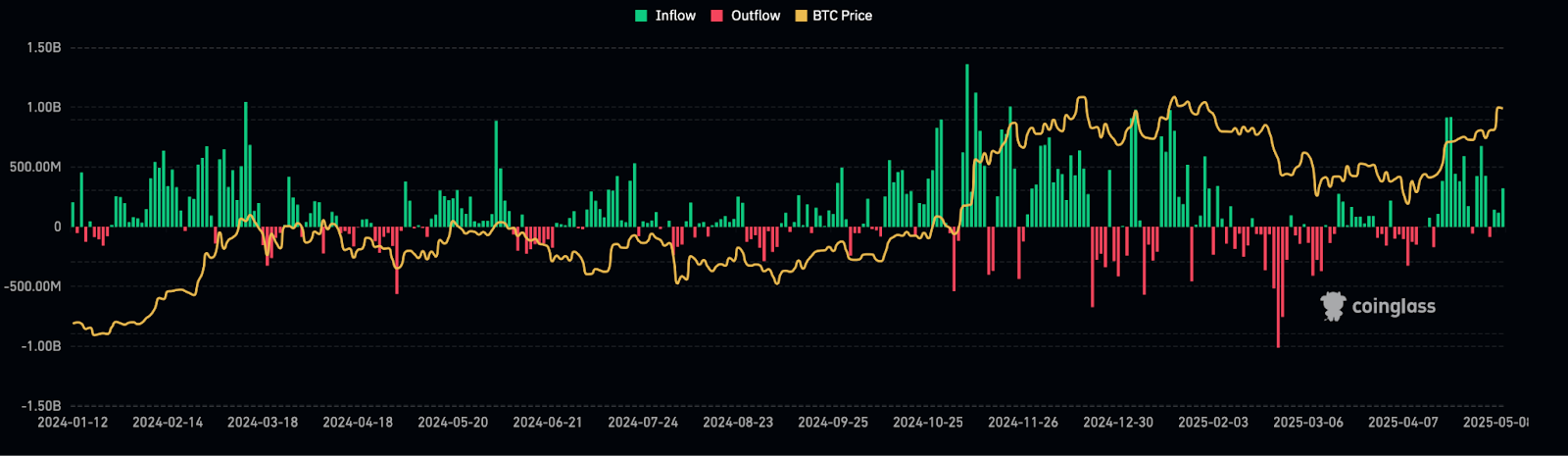

Importantly, capital rotation into Bitcoin appears sustained, as reflected in the realised cap reaching a new all-time high and ETF inflows exceeding $920 million over the past two weeks. On-chain data also confirms a significant drop in coins held at a loss, with over 3 million BTC returning to profit. Coupled with rising spot volumes and institutional-led ETF flows, Bitcoin now sits on a structurally solid footing. As long as macro conditions remain supportive, short-term dips are likely to be absorbed quickly, reinforcing the upside bias and leaving BTC well-positioned for a potential new leg toward fresh highs.

In the meantime, the Federal Reserve has held interest rates steady as concerns rise over both increasing inflation and unemployment, highlighting the risk of stagflation. Fed Chair Jerome Powell has stressed the uncertainty surrounding the economic outlook, noting the Fed’s need for more data before deciding on further policy action. Despite market expectations of a rate cut by July, the Fed’s stance remains cautious, prioritising price stability over reacting quickly to slowing growth.

In the energy sector, crude oil prices have plummeted due to OPEC+’s shift to higher production targets, yet gasoline prices in the US remain firm due to tight refining capacity and seasonal demand. This divergence, driven by refinery bottlenecks and widening crack spreads, suggests that retail fuel costs may only ease if these supply issues resolve and oil prices stay low.

The highly touted US-UK trade agreement also offers limited economic relief, even though there are now reductions on select goods like UK vehicles and US agricultural exports. However, the deal lacks comprehensive scope, offering modest gains while broader trade challenges remain unresolved.

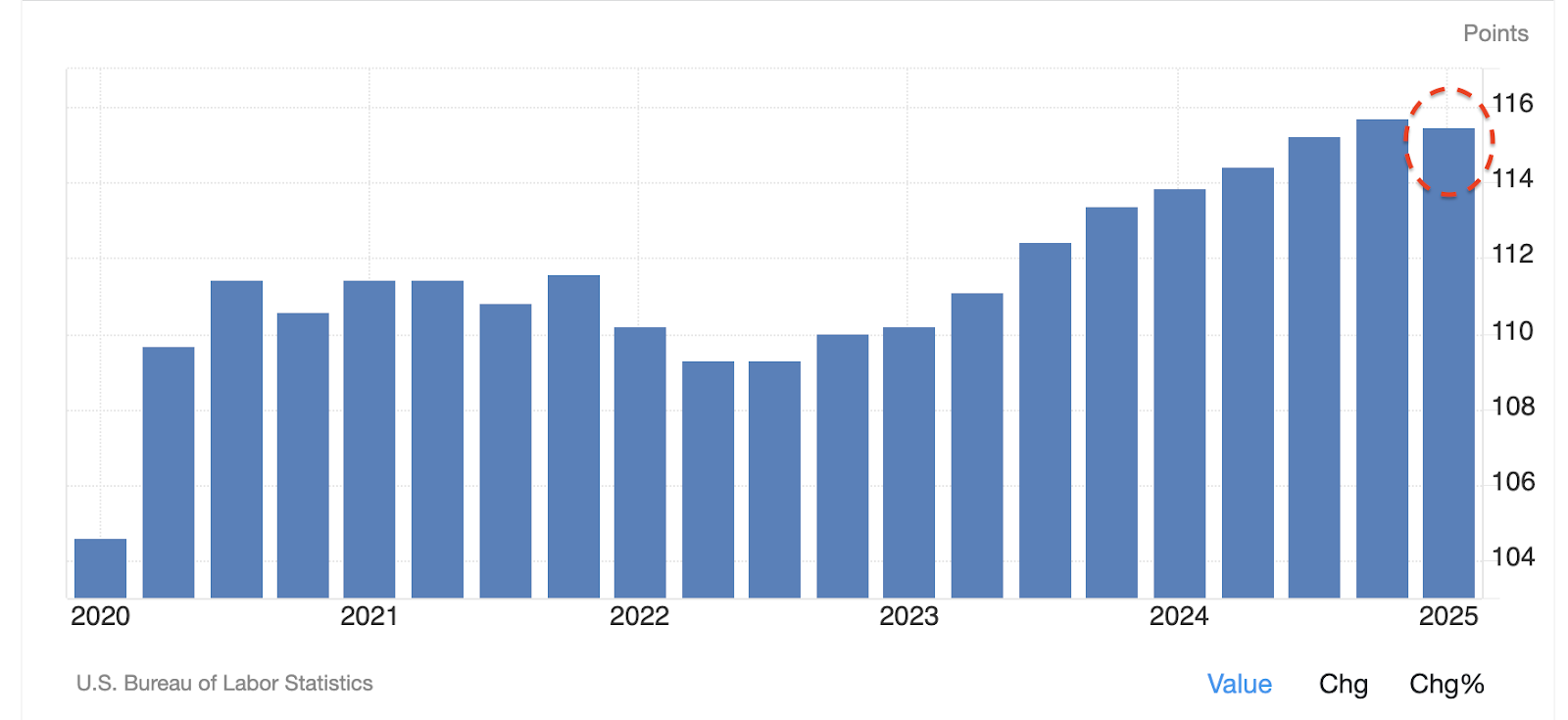

Adding to economic strain, US labour productivity declined for the first time in nearly three years while unit labour costs surged, exacerbated by tariffs and trade disruptions. Businesses are struggling with rising compensation costs and reduced efficiency, which may lead to tighter margins and hesitant investment, unless productivity rebounds or trade tensions ease.

In the cryptosphere, new developments signal rising institutional and governmental interest in crypto markets, though political and regulatory hurdles remain. New Hampshire has taken a bold step in financial innovation, becoming the first US state to enact a law permitting investment in cryptocurrencies and precious metals. This move reflects the growing state-level momentum around digital asset integration amid evolving national policy debates.

Meanwhile, legislative gridlock in Washington continues. The US Senate narrowly failed to advance the GENIUS Act by a vote of 48-49, with three senators not voting and a motion to reconsider filed. This highlights the current difficulties in reaching a bipartisan consensus on key economic and innovation-focused legislation.In the private sector, BlackRock deepened its regulatory engagement by meeting with the SEC to discuss introducing staking features and refining options trading rules for crypto ETFs. The meeting marks a significant development in crypto asset regulation, with BlackRock advocating for staking in Ethereum-based ETFs and broader product functionality. It also reflects a shifting regulatory tone as the SEC becomes more active in shaping the digital asset space.

The post appeared first on Bitfinex blog.