Avoid These Common Mistakes in Technical Analysis For Better Trades

Crypto trading is a volatile market. Without market knowledge, expertise, or the right technical analysis tools, traders can quickly deplete their funds.

Experienced crypto traders, and even new investors joining the market, should be aware of technical analysis (TA) tools. These tools are extremely helpful and are widely used by many traders. Though technical analyses are based on historical price movements, live data, and charts, they do not guarantee success and are not error-free. These tools can be tricky, and even a simple mistake can result in a significant loss of capital.

Role of technical analysis or TA in crypto trading

Technical analysis is the process of using mathematical indicators and statistical trends to evaluate and predict price movements in the cryptocurrency market.

TA evaluates the following:

Indicators and metrics like charts and oscillators

Human psychology

Historical patterns

Supply and demand of crypto assets

Price changes

Past trading activities

Crypto trading is highly speculative in nature. Most of the time, crypto traders invest based on their emotions, intuitions, and guesswork rather than real-world data, which is risky.

Seven Mistakes to Avoid in Technical Analysis

Technical analysis does not guarantee sure-shot profits. It is a risk management tool that helps to prevent unforeseen losses in an investment strategy.

Here are the most common mistakes to avoid in technical analysis.

Trading without a cut-loss strategy

In crypto trading, it’s important to know when to exit the market to prevent incurring further losses.

A stop-loss strategy helps minimize losses and liquidate assets when the price reaches a specific point.

For beginners, the best strategy is to start with small capital investment and gradually work up the ladder instead of putting all the money at risk.

Overtrading

Overtrading is one of the most common mistakes traders make by holding too many positions in the market to maximize profits. Too many positions will undercapitalize an investor’s trading positions and dilute the allocation of capital. By holding too many trade setups, traders can lose their focus.

Evaluating multiple charts and technical analyses can be time-consuming as well as overwhelming, and traders may miss out on the right trading opportunities.

The best strategy is not to overestimate, but rather spend more time researching current positions to avoid mistakes and gain consistent profits.

Revenge trading

Sometimes after serious losses, traders may take irrational and impulsive actions. Revenge trading is an attempt by traders to cover up losses from previous trades.

Often these traders try to hit back at the market and “take revenge” without a proper plan and strategy. When traders act out of anger and frustration, their actions are much less likely to succeed.

Irrational trading can eventually wipe out an investor’s initial trading capital.

Being obstinate in trading decisions

We all know that the crypto market is highly volatile, and the market conditions may change at any time. It’s important to adapt to changes in the market.

Emotional trading, being too stubborn, or acting on instinct can act against the trader in the market. Remember that there is no universal trading strategy when it comes to crypto trading.

Sticking tightly to one strategy, no matter how the market behaves, can lead to significant losses in investments.

Ignoring market sentiment

The crypto market is largely influenced by the overall emotions and opinions of investors. These emotions transmit to mass psychology that can affect the market cycles and value of crypto assets.

Technical analysis tools may give wrong readings or fail to understand these market sentiments. Sometimes technical tools can give extreme results and, in such cases, traders should critically evaluate these results, and consult alternative analyses as needed.

Thinking that TA is based on absolutes

Like weather forecasting, TA forecasts future market prices based on past movements of asset prices. It anticipates in which direction the prices may move in the future based on indicators, supply and demand of crypto assets, and market analysis, but the results may not be absolute.

These tools sometimes show extreme price movements which can be incorrect. Take extreme readings with a grain of salt.

Operating without a strategy

To become a master crypto trader, one must develop essential trading skills, be well-informed about the market, and study technical analysis.

The key is to develop your own trading strategy, rather than blindly following or copying veteran traders.

The crypto market is ever-changing and one needs to keep up with the shifting trends and optimize strategies. The best approach is to study the methods used by experienced traders, and learn from their successes and mistakes.

Just because a trading strategy has worked now, it does not mean that it will garner positive results in the future. Little variations in trading strategies now and then are imperative to achieve success. The key is to keep your trading strategy uncomplicated and simple.

Bottom Line

Technical analysis is the foundation of crypto trading, but it does not guarantee success or profits. Crypto trading is complicated, and it takes time to achieve consistent results.

Technical analysis helps to understand the market, but traders must identify their own shortcomings and strengths to make better decisions in the long-term.

No matter how exciting crypto trading may look, it does not make you rich overnight. Traders must concentrate and choose their investments wisely. Most importantly, they must take time to study and learn how to use these technical analysis tools, rather than making hasty decisions.

Technical analysis on Cryptohopper

Technical analysis on Cryptohopper can be done in several ways. Let's discuss three ways to start trading and ensure you won't make any mistakes mentioned in the blog.

Strategy Designer

With the strategy designer on Cryptohopper, you can create your trading strategy for your trading bot. Here you can combine multiple indicators and candlesticks. Cryptohopper shows multiple Technical analyses every week so you can get inspired and try your own.

To be safe, you can use simulated funds (fake money) to test your strategies before you use real money.

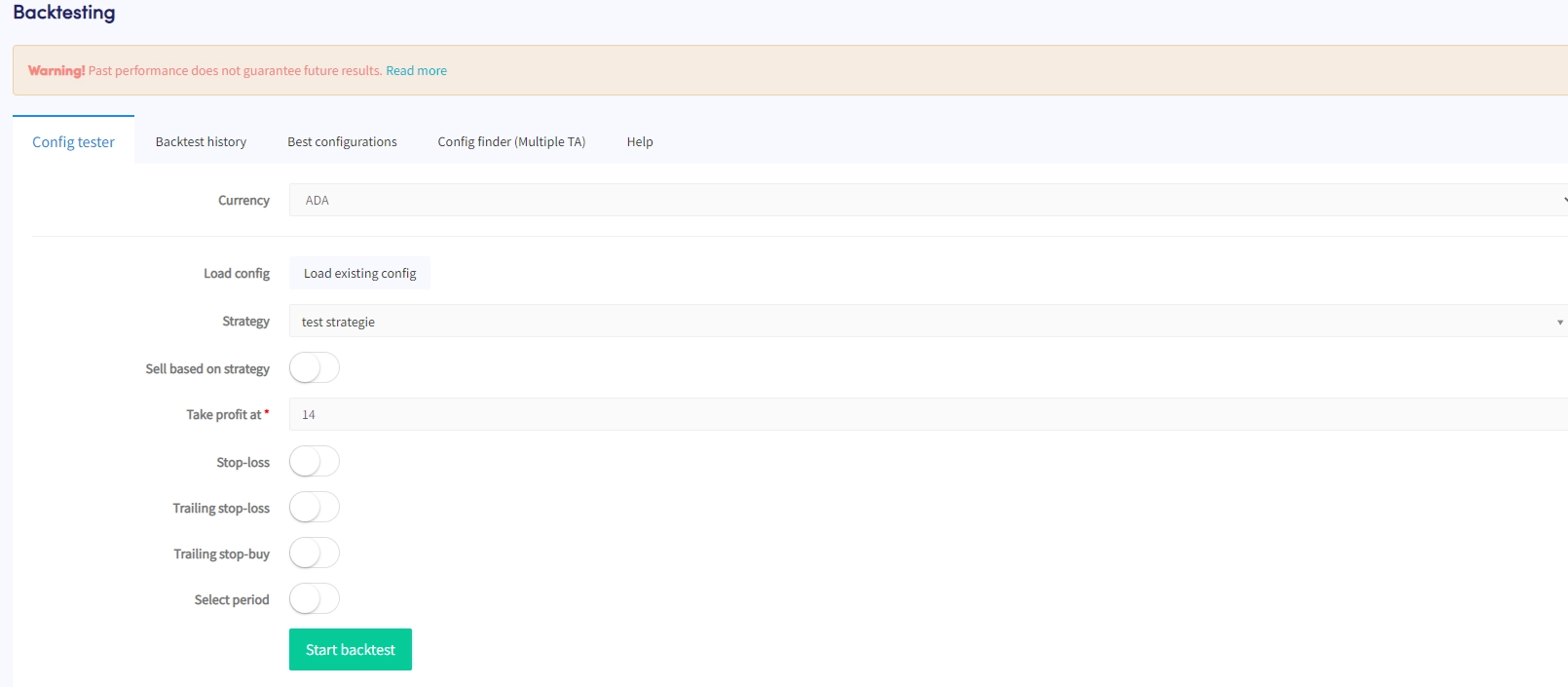

Backtesting

Once you have created your strategy, it is possible to backtest it. The backtesting tool is essential because it tests your strategy and configuration to see what would happen if you sell now. It's a perfect way to analyze if your Stop-Loss, Trailing Stop-Loss, and other settings need to change so you have a higher chance at success with every trade.

Your Strategy Builder strategy will only be as good as the strategies inside of it. That's why we recommend testing your strategy first. Once you start experimenting, you'll learn how to find what you want quickly.

Trailing Stop-loss

When using the Trailing Stop-Loss feature, your stop-loss price will automatically adjust when the market moves in favor of your position. If the market returns, your TSL will activate and sell your position. This is an ideal way to follow an upwards trend and prevent yourself from selling too early.

Start trading on cryptohopper now!