What Is A Copy Trading Bot?

Do you want to start with crypto trading but have no idea how it works? Honestly, you don’t need to attend expensive courses or hit the books, it's easier than you think! All Copy Trading, Social Trading, or Mirror Trading really is, is copying other traders’ buy and sell signals on a trading platform.

Cryptohopper's Copy Bots are an easy and convenient way to get started with automated crypto trading. Here's how it works in just three simple steps:

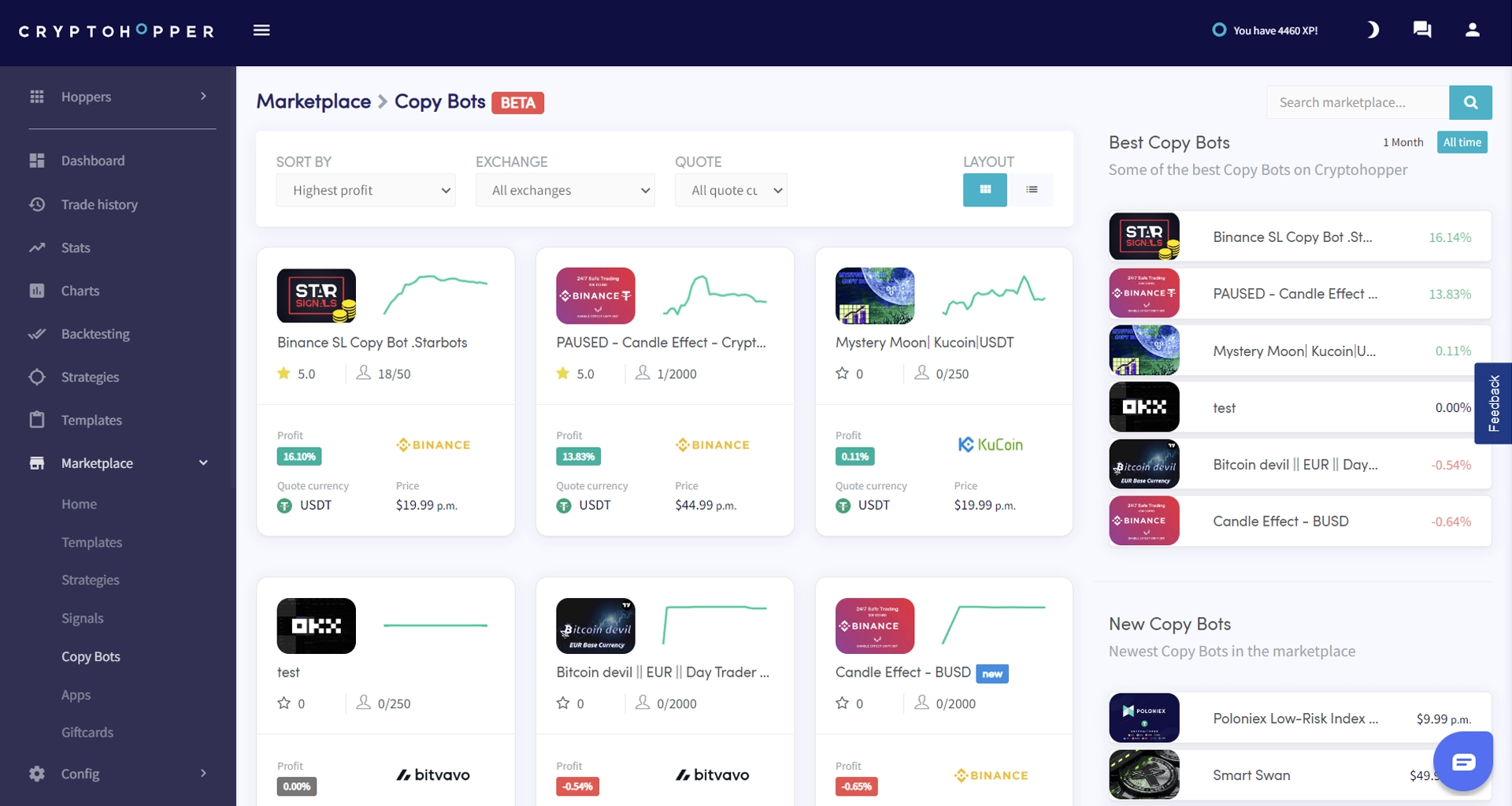

Go to Cryptohopper's Marketplace Copy Bots - Cryptohopper Marketplace and choose the Marketplace Seller you want to copy. You can make informed decisions based on the exchange they use, the currencies they trade, their trading results, and reviews.

Connect your exchange and rest assured that your funds will remain safe. Connect Cryptohopper using API keys. We have a "How to connect" tutorials available for all supported crypto exchanges, including Bybit, EXMO, OKX, One Trading, Bitvavo, HitBTC, Huobi, Bittrex, Binance, Binance US, Coinbase, Poloniex, Bitfinex, Kraken, KuCoin, and Crypto.com.

Keep track of your trades. With our Copy Bots, you can easily keep track of your investments without having to manually enter them into a portfolio tracker. Your Dashboard will show all positions your Copy Bot has opened.

Whether you're new to crypto trading or an experienced trader, our Copy Bots offer an efficient and hassle-free way to trade. Try them out today and start seeing results.

In our blog " Trading system - what is it?" we explain what algorithmic trading can be useful for and how it can improve your trading results. Algorithmic trading is based, on mathematical formulas often called Technical Indicators. Technical indicators are a fundamental part of technical analysis and are typically plotted in charts to try and predict the market trend. Indicators generally overlay on a price chart to indicate where the price is going, or whether the price is "overbought" or "oversold".

Making use of technical indicators can be somewhat difficult to understand and to apply when you do not have much experience in trading.

In 2005, for the first time in the financial world, the possibility to copy other traders arose. Nowadays, it's commonly known as social trading.

It all started when users of a forex trading platform started sharing their trades so that others could follow. This lets successful traders share their positions in every market without unveiling the core of their trading strategies.

At the same time, it allowed other traders to benefit from their success by mirroring their actions. Traders who send buy and sell signals are often compensated in the form of a certain percentage of profit or by selling subscriptions to their services.

In addition to starting traders being able to copy their signals (trades), it is also possible to copy the successful trader's settings, such as stop loss, take profit, trailing stop loss, etc.

Cryptohopper was the first trading platform that offered a trading signals marketplace for the cryptocurrency market. On Cryptohopper, the traders every user can follow are called “Signallers”.

Cryptohopper users can currently choose from over 30 signallers that can be applied to 16 exchanges! Cryptohopper offers the most options to personalize the signals of successful traders. In addition, the trade history of all signallers can be checked and there are both free and paid signallers that can be followed!

Do you want to know more about how you can start with copy trading? Check out our documentation about Copy trading or check out a Signallers’ performance report and start trading today!