Its aim is simple but far-reaching: to unlock more than $100 trillion in traditional financial assets and bring 6 billion banked users on-chain by combining institutional safeguards with the openness and interoperability of public blockchains.

Institutional-Grade Infrastructure

Financial institutions demand privacy, predictable performance and regulatory certainty—conditions public blockchains were never designed for. Rayls addresses this through a unified three-layer architecture that separates private institutional execution from public blockchain liquidity and interoperability. This enables institutions to bring key operations on-chain—from client account management and near-real-time cross-border and FX settlement, to the tokenisation and distribution of real-world assets (RWAs)—all within the same compliant ecosystem.

At a glance, Rayls Privacy Nodes are private, single-node EVM chains operated individually by each institution for high-throughput internal workflows and confidential execution, with support for gasless or alternative-fee models.

Rayls Private Networks are permissioned, multi-institution settlement layers that connect groups of Privacy Nodes into shared, governed environments for interbank settlement and regulatory-aligned collaboration. Multiple Private Networks can exist, each serving specific jurisdictions, asset classes or consortium groups.

Above these sits the Rayls Public Chain, an EVM Layer-1 offering predictable USD-pegged gas fees payable using stablecoins including USDt, fast and deterministic finality, harmful MEV (Maximal Extraction Value) protection and compliant access to global liquidity. The Rayls Public Chain also periodically commits state roots to Ethereum, inheriting Ethereum’s security features, providing censorship-resistance and recovery assurances aligned with the broader Ethereum ecosystem.

All three components run on a unified execution stack powered by Reth, ensuring consistent performance and seamless interoperability across private and public environments. Both the Rayls Public Chain and Private Networks currently use an RBFT-based consensus model, with the public chain scheduled to migrate in 2026 to Rayls Axyl,a next-generation consensus engine engineered for sub-second block times, deterministic finality and institutional-scale throughput with design targets in the tens of thousands of transactions per second.

Rayls also incorporates Rayls Enygma, a next-generation cryptographic framework that enables private transactions and encrypted balances through a combination of zero-knowledge proofs, encrypted state commitments, and post-quantum secure key exchange. Enygma allows institutions to transact confidentially while still providing regulators with selective visibility, a requirement for CBDCs, tokenised deposits, and interbank settlement. Rayls meanwhile, provides native on-chain identity services, enabling institutions to verify counterparties and enforce compliance requirements using cryptographic attestations, while preserving user privacy and EVM compatibility.

Although Rayls is designed primarily for banks, its public chain is fully open and, being EVM-compatible, allows developers, dApps and retail users to build and transact on the same infrastructure used by such institutions.

Rayls infrastructure is already being used by more than 25 major financial institutions across production and pilot environments.

The Brazilian Central Bank’s Drex CBDC pilot, for example, is using Rayls to enable private institutional settlement and encrypted transaction flows for both central and commercial banks. Núclea , the largest financial market infrastructure provider in the Southern Hemisphere, is using Rayls to power tokenisation and receivables platforms at national scale. Meanwhile Cielo , Brazil’s largest merchant acquirer, began building payment and yield-bearing asset products on Rayls in Q4 2025. The network was also ranked No.2 in J.P Morgan’s 2024 EPIC report , recognising it as one of the most advanced institutional blockchain architectures tested in real-world financial environments.

What Is the RLS Token?

RLS is the Rayls ecosystem’s native utility token, used across all three layers of the network for transaction fees, staking, security and governance. Institutions operating Privacy Nodes and participating in Private Networks generate usage fees denominated in USD but settled in RLS, while users on the public chain pay predictable USD-priced gas fees in stablecoins, which are automatically converted into RLS at settlement. This creates a unified fee market where all activity, public or private, ultimately settles in the same token.

RLS also secures the Rayls Public Chain through proof-of-stake. Validators must stake RLS to participate in consensus, process transactions, and verify zero-knowledge proofs coming from private networks. Honest validators earn RLS rewards funded by network fees, while malicious behaviour can lead to slashing, providing strong economic incentives for correct behaviour.

Beyond fees and staking, RLS functions as the governance token of the Rayls ecosystem. Token holders vote on protocol upgrades, validator requirements, burn parameters, ecosystem grants and other decisions that shape the evolution of the network as institutional adoption increases.

Importantly for crypto-native users, RLS represents a direct economic link between institutional usage and token demand. As more financial institutions move settlement, payments, tokenisation flows and cross-border activity onto Rayls, their usage generates fees that must be settled in RLS, creating a natural source of ongoing demand that scales with real financial volume rather than speculative activity.

Rayls Tokenomics

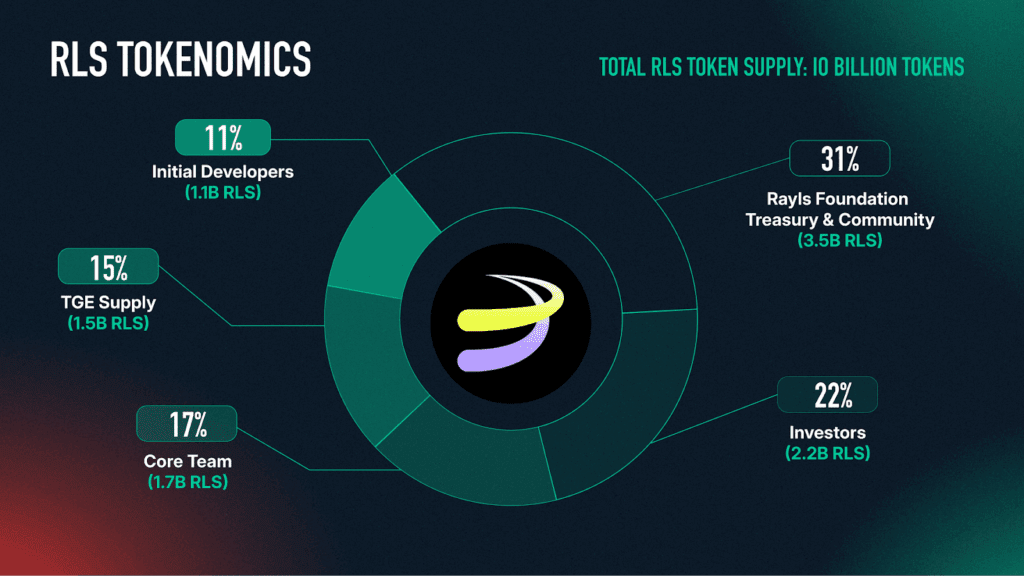

Initial Supply and Distribution

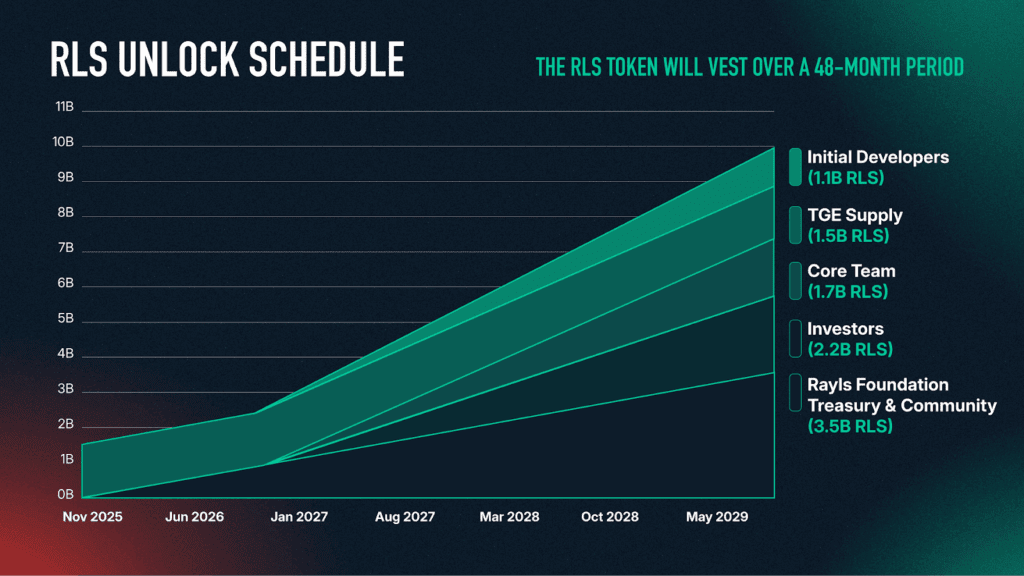

At the Token Generation Event (TGE), approximately 1.5 billion RLS (15% of total supply) entered circulation. The remaining supply is allocated across ecosystem development, contributors, investors and community initiatives, with long-term vesting schedules designed to align incentives with sustainable network growth.

Fixed Supply and Deflationary Design

RLS has a fixed total supply of 10 billion tokens. No additional RLS can be minted. Every transaction across Rayls generates RLS fees, which are split automatically: 50% are burned, permanently reducing circulating supply, and 50% fund the Network Security Pool, which compensates validators and supports ecosystem development. As adoption grows, particularly across institutional workflows, more RLS is removed from circulation, creating deflationary pressure. Once supply falls below 70% of the original amount, token holders may vote to adjust the burn rate.

Rayls will also soon introduce a Proof of Usage (PoU) framework, where anonymised cryptographic proofs of institutional activity are published on-chain, providing transparent visibility into network usage, fee generation and token burns without revealing sensitive transaction or counterparty data.

How to Buy RLS on Bitfinex

How to Buy RLS with Crypto

1. Log in to your Bitfinex account or sign up to create one.

2. Go to the Deposit page.

3. In the Cryptocurrencies section, choose the crypto you plan to buy RLS with and generate a deposit address on the Exchange wallet.

4. Send the crypto to the generated deposit address.

5. Once the funds arrive in your wallet, you can trade them for RLS. Learn how to trade on Bitfinex here.

How to Buy RLS with Fiat

1. Log in to your Bitfinex account or sign up to create one.

2. You need to get full verification to be able to deposit fiat to your Bitfinex account. Learn about different verification levels here.

3. On the Deposit page, under the Bank Wire menu, choose the fiat currency of your deposit. There’s a minimum amount for fiat deposits on Bitfinex; learn more here.

4. Check your Bitfinex registered email for the wire details.

5. Send the funds.

6. Once the funds arrive in your wallet, you can use them to buy RLS

Also, we have Bitfinex on mobile, so you can easily buy RLS currency while on-the-go.

[ AppStore] [ Google Play]

RLS Community Channels

Website | X (Twitter) | Discord | Github

The post appeared first on Bitfinex blog.