What is a funding rate?

Funding rates are periodic amounts of an asset paid between short and long traders that hold perpetual contracts positions. The reason for funding rates is that perpetual futures contracts, as their name suggests, can be held indefinitely without expiry. And as traders go long or short, contract prices diverge from the index price of the underlying crypto asset. So, to enforce convergence with said index price, exchanges use funding rates where shorts pay longs on a negative funding rate and longs pay shorts on a positive funding rate.

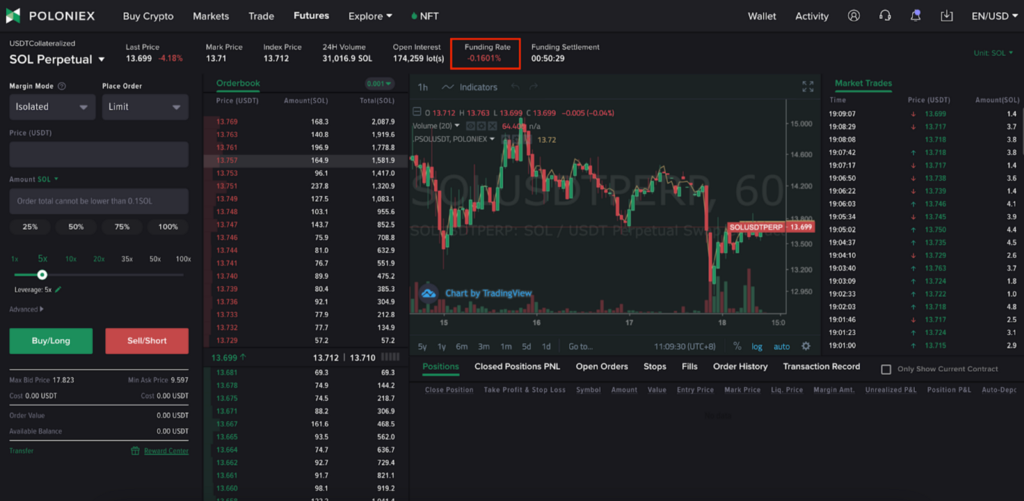

In a bullish market, the funding rate will be positive and trend upward, whereas in a bearish market, the opposite happens. Below, you can see an example. The funding rate (and funding settlement timer) can be found at the top of the Futures trading screen. Funding occurs every 8 hours at 04:00 UTC, 12:00 UTC and 20:00 UTC. Traders will only pay or receive funding if they hold a position at one of these times. If the position is close prior to the funding exchange, traders will not pay or receive funding.

Why are funding rates used and why should you pay attention to them?

As aforementioned, because funding rates have no expiry, there has to be a way to make perpetual markets and spot markets converge. Of course, this correction has to happen often. On Poloniex, the cadence at which funding rates are recalculated and funds are paid happens every 8 hours, and every time this happens, traders either receive or pay funding.

Depending on the amount of leverage used, funding rates can have a big effect on a trader. In fact, depending on their leverage, a trader’s position may get liquidated when paying for funding. Funding rates also indicate trader sentiment, and can be used to make informed decisions when trading.

How Poloniex calculates funding rates

So, how does the funding rate “shake out”, exactly? Let’s take a look:

First, we’ll talk about how much funding a trader would pay or receive in a given scenario. The formula for this is Funding = Position Value * Funding Rate

Note: Position Value is determined by the Mark Price at funding timestamp.

In this scenario, Trader A holds a long position of 10 lots BTC/USDTPERP and the Mark Price is 8,000 USDT at the funding timestamp with the current Funding Rate at 0.01%.

According to the descriptions above, we could find out:

Position Value = 8,000 * 10 = 80,000 USDT

Funding = 80,000 * 0.01%= 8 USDT

As the Funding Rate is positive, longs pay the shorts. Therefore, Trader A needs to pay a funding fee of 8 USDT and Trader B who shorts the same sized positions will receive 8 USDT. If trader A closes the position before the Funding timestamp, then they do not need to pay the funding fee.

Now, let’s see how the funding rate is determined:

Funding Rate Calculation

The Funding Rate is composed of the Interest Rate and Premium Index:

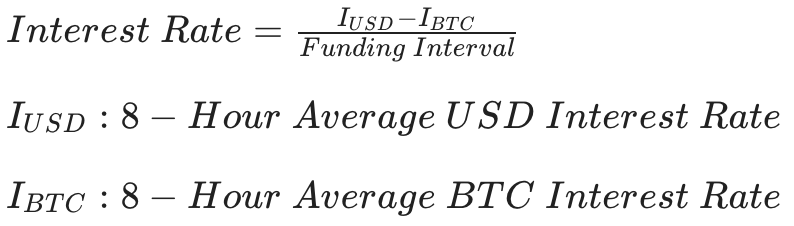

Interest Rate

Each contract on the Futures platform consists of two instruments: Base Currency and Quote Currency. The Interest Rate is the function of the interest rates between the two currencies, indicating the differences between the Quote Currency(USDT) and the Base Currency(BTC) in specified funding intervals. The formula is as follows:

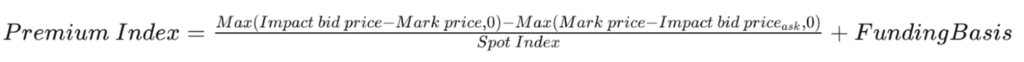

Premium Index

The perpetual contract may trade at a significant premium or discount to the Mark Price. In these situations, the Premium Index will be used to raise or lower the next Funding Rate.

Premium Index:8-hour TWAP of the PXBT/USDT Index

Funding Basis = Funding Rate * (Time until Funding / Funding Interval)

Note: Traders can check the Premium Index at Contract Specifications and the historical data.

Funding Rate

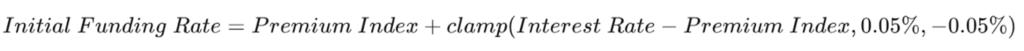

The initial Funding Rate is calculated based on the 8-Hour Interest Rate and Premium Index.

The final Funding Rate is calculated based on the initial Funding Rate, previous Funding Rate (T-1), Initial Margin, and Maintenance Margin and will be applied for use at the funding timestamp.

The final Funding Rate calculated above is then applied to the trader’s position to determine the Funding amount to be paid or received at the funding timestamp.

Ready to start trading futures? Sign up to start today: https://poloniex.com/signup

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.