The massive drop triggered the largest daily liquidations in the derivatives market since March 12 — a total of $1.335 billion across major exchanges. All the traders who bought on the spot market in the last eight days have also been trapped.

While the BTC index currently stands at $16,800, the OKEx Quarterly Futures ( BTCUSD1225) are trading around $17,050 levels with a premium of $250, or roughly 1.45%, over the index price.

In last week’s Futures Friday article, we noted how the market was expecting a pullback and traders were bagging profits. But even though the price of BTC dropped $3,000 this week, the market’s optimism appears to be far from crushed.

Both the BTC long/short ratio and the margin lending ratio have been trending higher, indicating retail bullishness. Moreover, CME’s open interest is ahead of other exchanges for the first time after the correction, indicating that institutional investors are also betting on Bitcoin’s future.

OKEx trading data readings

Visit OKEx trading data page to explore more indicators.

BTC long/short ratio

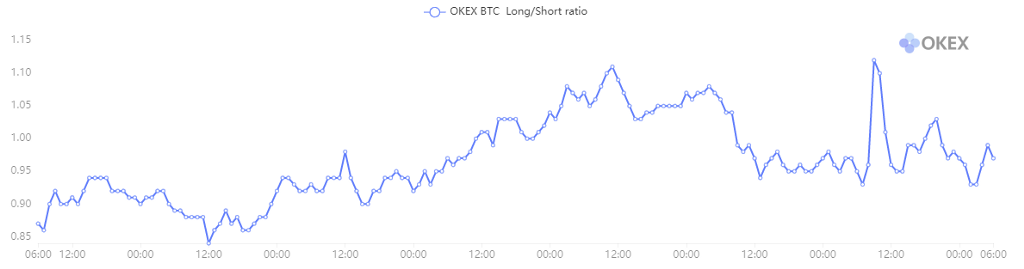

BTC long/short ratio reached a recent high of 1.12 after the index price broke through $19,000 on Tuesday, and then it fell sharply to 0.95 within 24 hours, indicating that traders entered short positions to protect their profits.

Another observation is that when the price fell to $17,000 on Thursday, the long/short ratio suddenly rose to 1.12, reflecting retail traders’ rush to buy the dip. As a result, the price briefly rebounded to $17,400 before a second pullback took it as low as $16,200.

The long/short ratio is still hovering around 0.95 — and when compared to its historical data over the past few weeks, this indicates that retail sentiment is still predominantly bullish.

The long/short ratio compares the total number of users opening long positions versus those opening short positions. The ratio is compiled from all futures and perpetual swaps, and the long/short side of a user is determined by their net position in BTC. In the derivatives market, whenever a long position is opened, it is balanced by a short position. The total number of long positions must be equal to the total number of short positions. When the ratio is low, it indicates that more people are holding shorts.

BTC basis

The market’s optimism is reflected in the premium of quarterly futures. After prices broke above $19,200 on Wednesday, the premium reached a recent high of $400, or 2%. With the December quarterly futures due to expire in less than a month, this premium is relatively very high.

However, excessive premium levels are also an indication of an impending market reversal. The BTC basis is now back at $250, or 1.4%, which is basically the same as last Friday, indicating that the market’s optimism is still intact.

Visit https://www.okex.com/ for the full report.

OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.