Margin trading opens up arbitrage opportunities in the futures markets, especially when funding rates are volatile.

After following or trading in the cryptocurrency markets for some time, perhaps performing spot and futures trades, the idea of trading with margin might have caught your attention. Not only does trading with margin offer an interactive experience, but it can also become a successful source of income. That is, of course, if carefully and strategically executed.

Trading crypto with margin requires experience and knowledge about how markets operate. Given that, Binance offers some of the best margin trading options for traders, and below we’ll discuss why it just might be a good option for you.

What is Margin Trading?

Margin trading blends elements of spot and futures trading to allow investors to trade cryptocurrencies with leverage. Similar to spot trading (directly buying or selling an asset), margin involves the immediate exchange of a crypto asset. The difference is the ability to incorporate leverage into these trades, multiplying the trade value anywhere from 2X to 10X, as is possible with futures contracts.

Margin trading has its own characteristics beyond these two basic concepts as well. For instance, to utilize leveraged funds, traders must invest collateral (known as margin) and then select the desired leverage they wish to trade (2x, 10x, etc.).

When margin trading, traders must be vigilant to market changes that occur, especially with crypto, as margin calls may happen often. A margin call occurs when a trade goes unfavorably, potentially costing the trader large amounts of losses, depending on their leverage ratio. In such cases, the exchange will perform a margin call in which a trader has two options: Reduce position or add collateral. To avoid being liquidated, a trader can reduce the notional exposure of the position, in turn, reducing the position’s leverage. Alternatively, the trader can further invest margin towards the trade to prove they have enough funds to continue managing the trade.

Margin trading is used in several cases; one of the most popular use cases is to hedge against a portfolio or other asset. Hedging involves opening new positions that negatively correlate with existing positions. Investors and traders hedge their portfolios as a form of insurance to mitigate potential losses.

While margin trading can help you earn large profits, it should never be done without implementing strategies such as using stop-limit orders. Otherwise, small market shifts can be extremely costly to a trader. Just as one may find success with high leverage, one may also incur a loss of the same magnitude.

Exotic pairs - Margin trading offers access to exotic trading pairs. This involves two cryptocurrencies paired together (e.g. BTC and ETH). Instead of buying or selling the currencies themselves, the trader is speculating on the relative performance of the two. With Binance, traders can trade pairs with leverage of up to 10X. Keep in mind that the more volatile an asset’s price is, the less liquidity the market will hold for it. This is because the asset is less reliable to bet on, causing fewer trades to be established in that market.

Multi-assets collateral - Unique to margin trading is the ability for users to invest multiple assets as collateral to borrow leverage. On Binance, this can be done in the cross margin mode. So instead of investing BTC only into a BTC-based margin trade, investors can use their BTC and ETH, or BUSD, USDT, and so on, to denominate their collateral. Investing multiple assets as collateral allows traders to operate with more flexibility when opening trades.

Arbitrage - Margin traders can take advantage of arbitrage opportunities when the funding rate on futures pairs is volatile. For instance, when the BTC/USDT perpetual funding rate is negative, users can use margin to short the trade with BTC/USDT while using a long futures BTC/USDT perpetual trade to make a profit with low risk. Thus, traders aren’t necessarily dependent on the price of underlying assets but are more concerned with the markets’ actions. Since the two trades are placed in opposing directions, it doesn’t matter how the market trends, minimizing the risk to the trader.

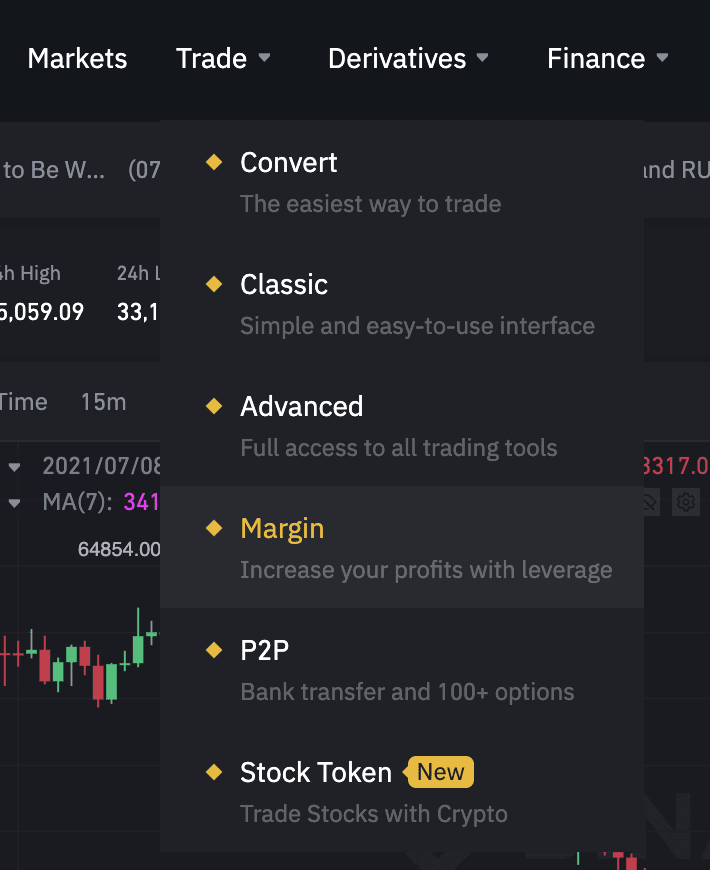

[Step 1] Click the dropdown menu labeled [Trade] located at the top panel of your screen; and click on [Margin].

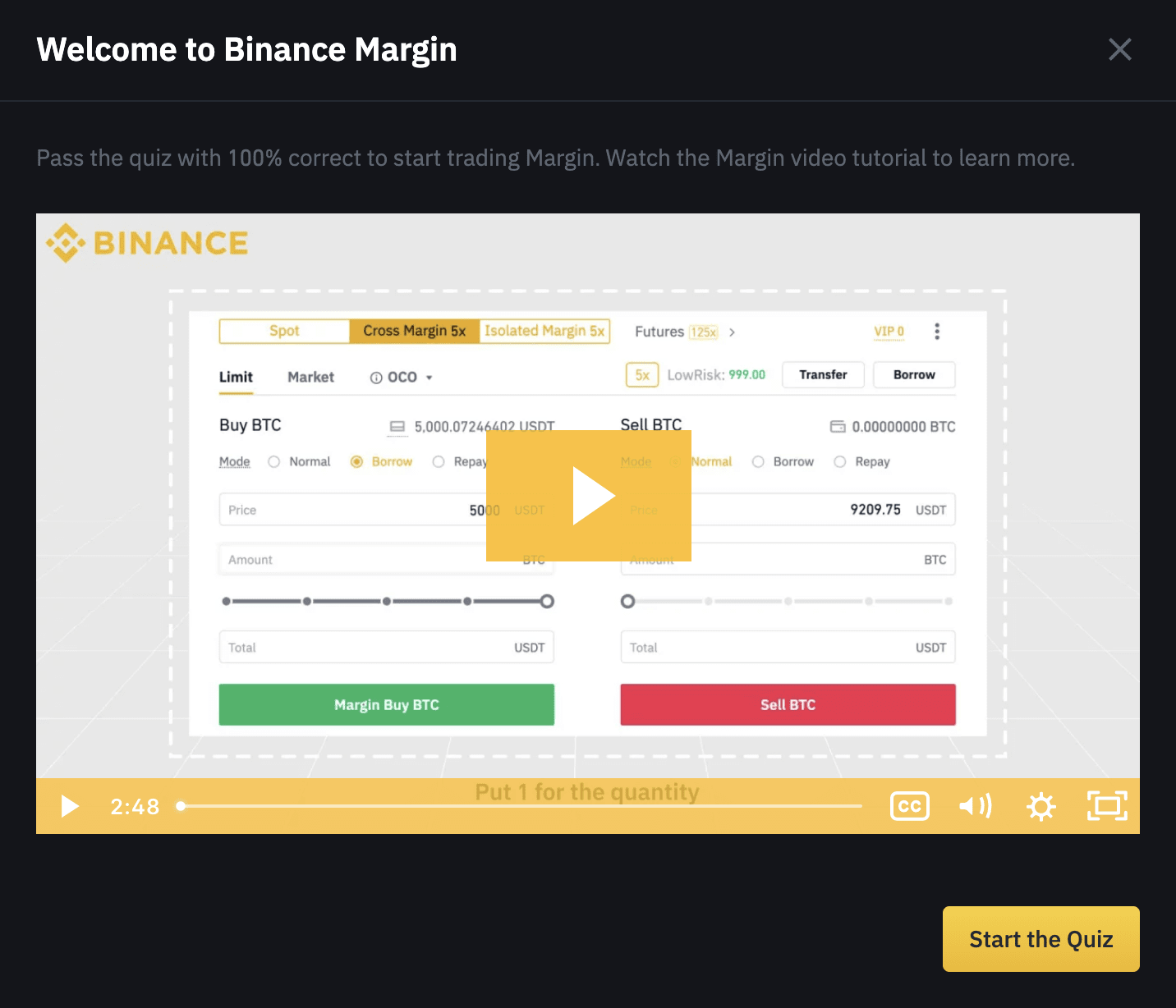

[Step 2] Before you begin trading, please note that you are required to complete a short quiz. All users must obtain a 100% passing rate before trading on margin.

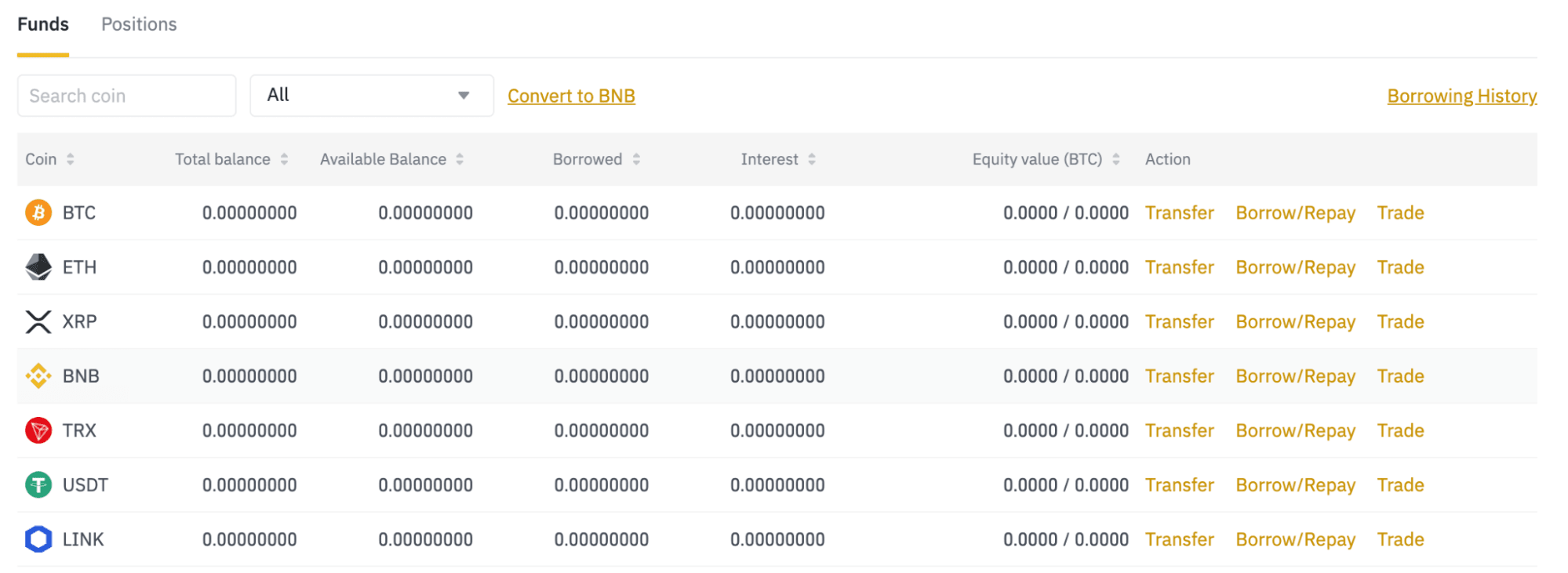

[Step 3] Then, you will be able to transfer funds into your new Margin Trading Wallet. For example, you can transfer BTC, ETH, and BNB from their Exchange Wallet to their Margin Wallet. These funds will act as collateral to any borrowed funds incorporated in a margin trade and determine how much you can borrow (3x, 5x, 10x etc.).

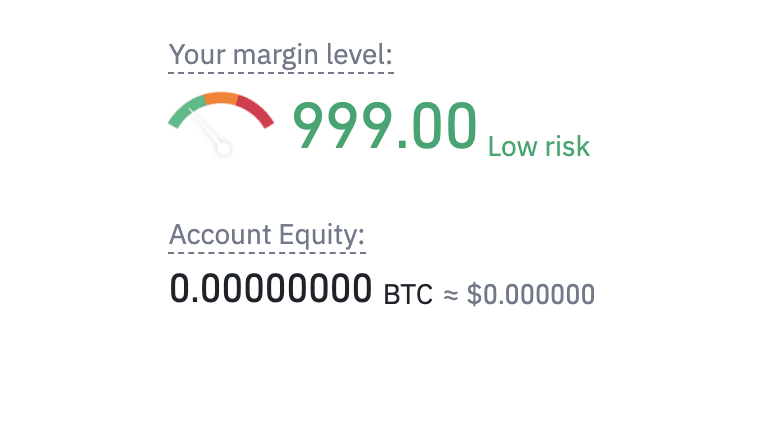

[Step 4] Click [Borrow/Repay], enter the amount you wish to borrow, note the hourly interest rate, and click [Confirm Borrow]. The funds will be credited to your margin account (which can be checked under your balance/margin button). The balance dashboard comes with a margin level gauge that relates the risk level to the borrowed funds, collateral you hold, and the market value. Margin level can be calculated as such: Margin Level = Total Asset Value / (Total Borrowed + Total Accrued Interest)

[Step 5] If your margin level decreases, you either need to increase your collateral or reduce your loan. A margin level of 1.1 will automatically be liquidated, or in other words, Binance will sell the positions at market price to repay the loan.

For further in-depth instructions and to learn how to repay debts owed, please see our Academy article on Binance Margin Trading Guide.

Conclusion

Margin trading can expose traders to opportunities unavailable in other forms of trade. When margin trading with purpose and attention, it can become a fun and profitable endeavor. As noted earlier, trading in margin should be done by those with experience in trading. In addition, traders must understand the risks involved in margin trading. Useful tools like stop-orders should be used whenever possible. At any rate, the options discussed above with trading margin are possible through Binance. If you’re truly serious about making your first margin trade, more information can be found here!

Read the following support items for more information:

And many more Binance Futures FAQ topics...