Maker fees are generally less expensive than taker fees.

Paying close attention to transaction fees and liquidity in a market can help traders set up more successful trades that provide desired results between maker and taker fees.

So you’re interested in trading crypto futures? Crypto futures is a wonderful way to gain exposure without having to hold the underlying cryptocurrency. But before jumping in, let’s take a look at what exactly it takes to get started and some of the hurdles you’ll need to account for along the way.

Crypto futures are certainly more inclusive and available than traditional futures. Crypto investors can often trade at significantly smaller amounts and don’t have to be an accredited investor to participate. All of this is great, but even crypto exchanges and trading platforms have fees that investors must incur.

What are Trading Fees?

An inevitable part of crypto trading is the trading fees that exchanges implement to maintain operations. The fees occur at every point of transaction or exchange when customers purchase, sell, and even convert cryptocurrencies or futures contracts tied to crypto.

Types of Trading Fees You Should Know About

Among the types of fees customers may encounter on crypto-derivative exchanges like Binance Futures, the main two include Maker and Taker fees. Traders act as takers or makers depending on whether they are providing liquidity and therefore increasing the depth of the order book (makers) or if they are taking this liquidity on (takers). Maker and taker fees are also referred to as payment for order flow.

Maker Fees

Maker fees are paid when you add liquidity to the order book by placing a limit order below or above the market price. Increasing the size of the order book is good for the exchange and market participants. Thus, maker fees are generally lower than taker fees. Makers usually trade at high frequencies to execute strategies that profit by providing liquidity to other traders and gaining the ask/bid spread.

Taker Fees

On the other hand, taker fees are paid when you remove liquidity from the order book by placing market orders. As such, taker fees are generally more expensive than maker fees. Market players that act as takers can be hedge funds that want to make profits from short-term price changes. They can also be larger investment firms that want to buy high volumes of contracts for immediate execution.

How Trading Fees Impact Your Returns?

Fees can impact your returns depending on how entry and exit orders are executed. As we will explore below, maker fees are less expensive and, in some cases, can earn an investor a rebate.

Even a small transaction fee coupled with other related expenses such as funding fees will add up over time; the accumulated costs can significantly reduce your portfolio’s return. If your portfolio was up 20% for the year, but you paid 2% in fees and expenses, your return is only 18%. Over time, that difference adds up.

Binance Futures Fee Structure

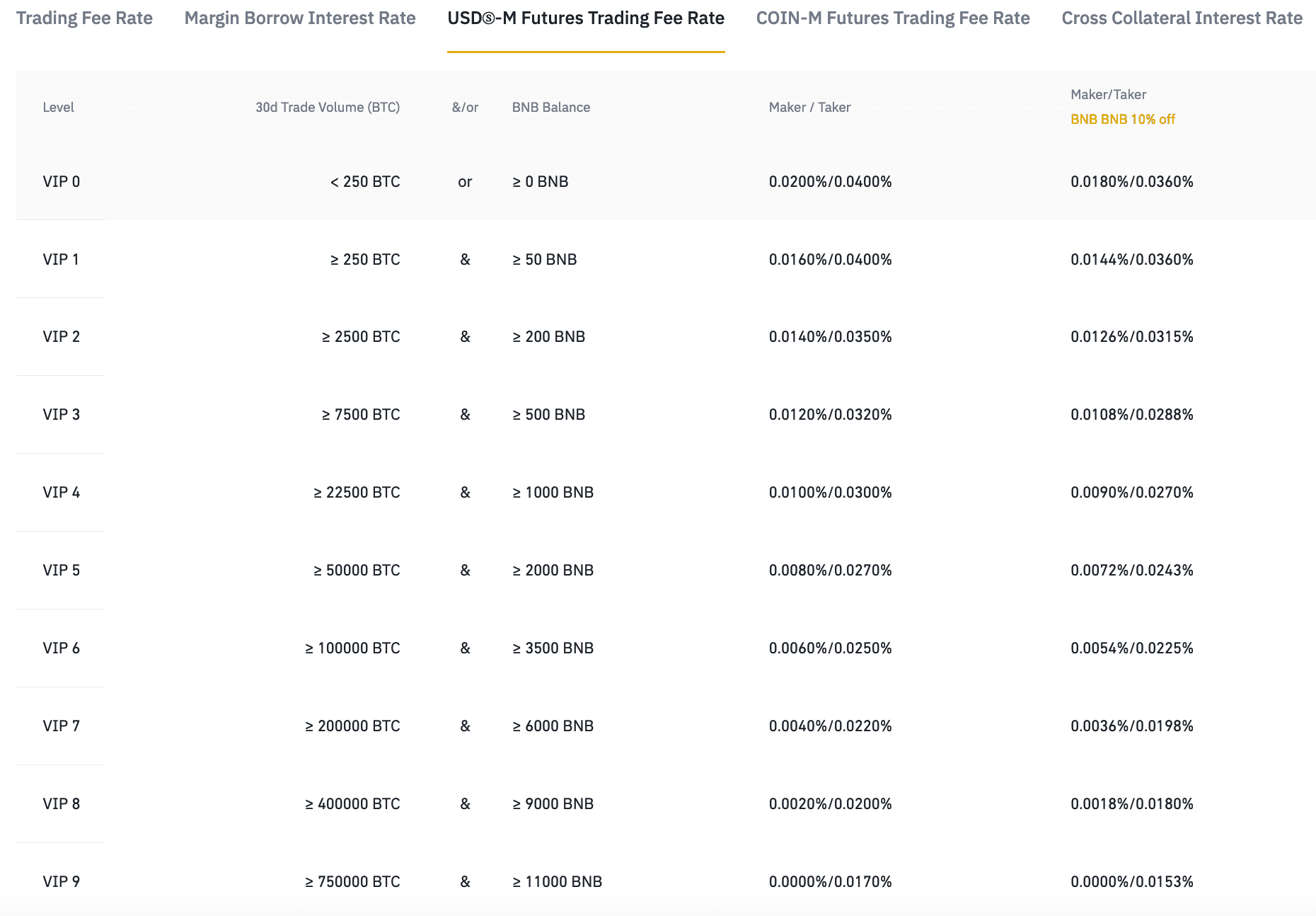

Across most of the crypto exchanges out there, Binance Futures has one of the lowest taker fee structures. The table below shows that Binance’s taker fee rates start at 0.04% and can be as low as 0.017%. Maker fee rates start at 0.02% and can be as low as 0.0000%. To trade at the lowest fee rates of either taker or maker rates on Binance, users have a 30-day trade volume of more than or equal to 750,000 BTC and more than or equal to 11,000 BNB. But just getting started requires a 30-day trade volume of 250 BTC or less and doesn’t require BNB.

More information on Binance Futures fee structure can be found on our support page.

Compared to taker fees of other main competing exchanges, only Huobi offers an equally low initial taker fee rate of 0.04%, and all other exchanges are higher. Binance’s initial maker fee rate is equal to that of Kraken, Huobi, and OKEx at 0.02%.

Calculating Binance Trading Fees

Binance users can calculate their trading fees with just a few values, including their entry and exit prices, contract quantity, and fee rate. The equation is calculated as follows:

Fee to Open = (Contract Quantity x Entry Price) x Trading Fee Rate

Fee to Close = (Contract Quantity x Exit Price) x Trading Fee Rate

Take an example: If you entered a long position for 1 BTCUSDT contract at $40,000 and wanted to close the position at $40,500, with the taker fee rate was set at 0.04%, and the maker fee rate was set at 0.02%, the various fee totals would come out to the following.

Fee to Open (USDT)

Fee to Close (USDT)

Net Fee (USDT)

Taker: 16 USDT

Taker: 16.2 USDT

Fee Paid: 32.2 USDT

Taker: 16 USDT

Maker: 8.1 USDT

Fee Paid: 24.1 USDT

Maker: 8 USDT

Maker: 8.1 USDT

Fee Paid: 16.1 USDT

Maker: 8 USDT

Taker: 16.2 USDT

Fee Paid: 24.2 USDT

Using the equations listed above, traders can better determine where they want to open and close trades to avoid higher fee rates. When both entry and exit orders are executed as maker orders (as in the example), trades will be privy to the lowest fee of 16.1 USDT. When both maker and taker orders are executed, the result is always a lower fee than that of a double taker order. Traders would be obligated to a 32.2 USDT fee if both the entry and exit orders were executed as taker orders.

Between all-taker-orders and all-maker-orders is a 16.1 USDT difference. In other words, all-taker-orders execution would double the cost of an all-maker-orders execution. Thus, aiming for maker orders is key for traders looking to minimize any losses to fees.

Conclusion

Paying close attention to fee rates and liquidity in a market can help traders set up more successful trades that provide desired results between maker and taker fees. Shopping for exchanges is a valuable time investment for investors to take so that they can trade at appropriate fee rates, and eventually take advantage of these rates. This will also eliminate any surprises traders could fall victim to when trading for the first time.

If you’re ready to start trading, Binance Futures is a great place to start with some of the lowest taker fees offered amongst exchanges. Get started here!

Read the following support items for more information:

And many more Binance Futures FAQ topics...