The 9,192 cryptocurrencies tracked by the website CoinMarketCap had a combined market value of $2.2 trillion as of April 30th, up 16.7% from March.

Bitcoin, the world’s largest cryptocurrency by market capitalization, had a rollercoaster month, posting a new all-time high of $64,854 on April 14th, and subsequently capitulating to $46,930. Consequently, Bitcoin traded marginally lower by the end of April, down 1.78% from March.

Bitcoin’s sell-off drove the BTC dominance index to its lowest reading in almost two years, falling under 48% for the first time since July 2018. Since the start of the year, the Bitcoin dominance index has been in freefall. Market dominance assesses how the market capitalization of a particular cryptocurrency stacks up against the total market cap of tradable cryptocurrencies.

Year-to-date, altcoins’ market capitalization grew from under $250 billion to $1.1 trillion, according to CoinMarketCap. Most altcoins have seen gains alongside BTC’s climactic bull run, but several coins have outperformed. Tokens like Ethereum, BNB, and Cardano have done the most damage to BTC’s dominance levels.

In contrast, Ethereum, the smart contract giant, had a phenomenal month, registering over 44% gains. Ethereum’s year-to-date gains stand over 320% by the end-April, bringing its market valuation to $350 billion at the time of publication.

Ether exchanged hands at $2,798 on April 30th and has continued to trend higher since then. At the time of publication, ETH has posted a new all-time high of $3,527 on May 4th.

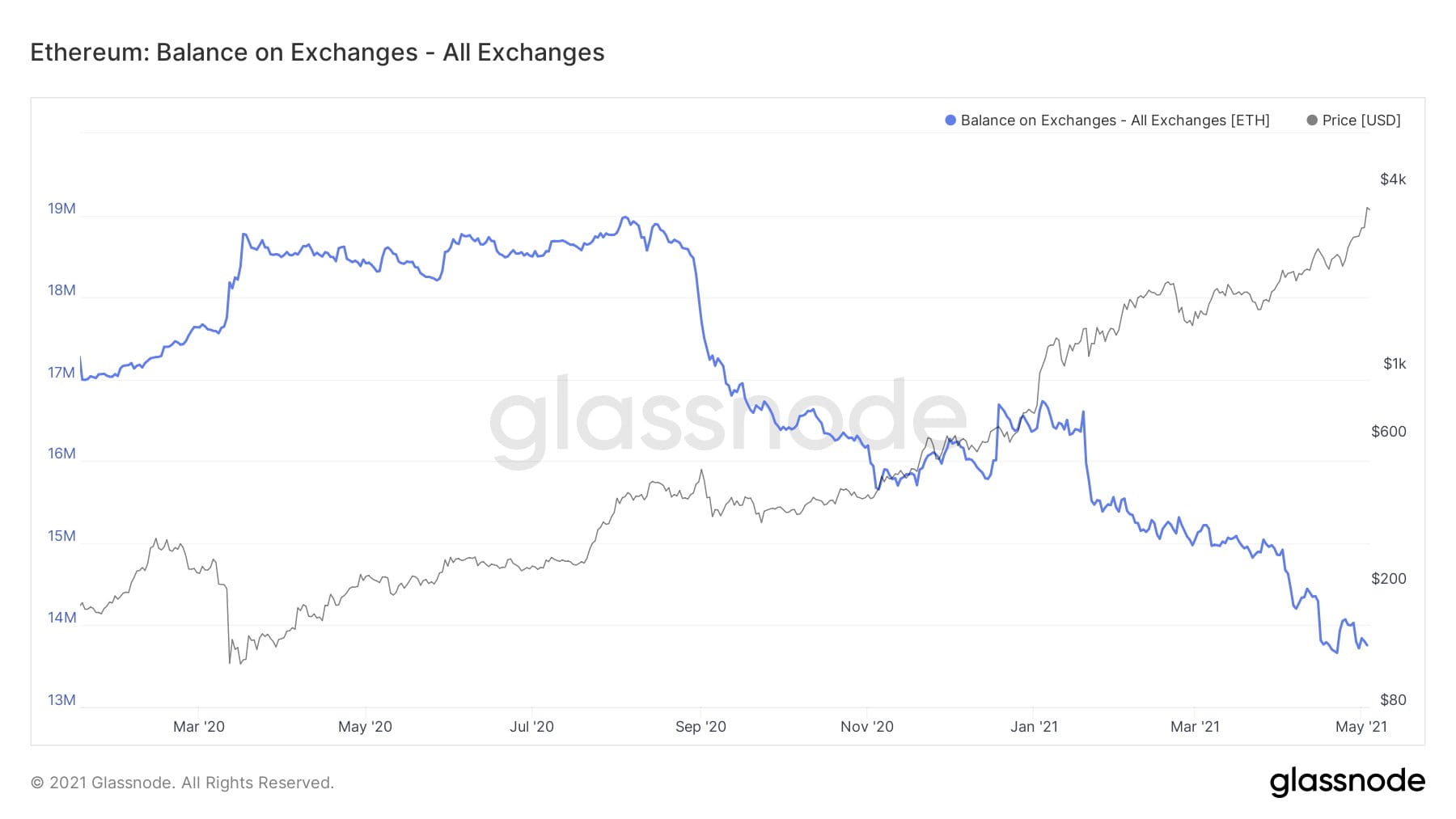

Ether’s resilience can be attributed to its strong on-chain activity as the Ethereum network continues to grow despite challenges. According to data-analytics provider Glassnode, the amount of ETH locked in smart contracts has almost doubled since a year ago, growing from 12% of ETH’s supply to over 23% today.

Source: Glassnode

With more Ether locked in smart contracts, its supply on exchanges continues to decline, reaching a one-year low of under 13.5 million ETH. In total, this metric has dropped 27% in the last year, indicating an increasing demand for ETH.

Source: Glassnode

Investors are currently bullish on Ether because of an upcoming upgrade to the Ethereum network. Ethereum Improvement Proposal 1559 (or EIP-1559 for short) is set to go live on July 14 as part of the network's scheduled "London" hard fork. The EIP-1559 upgrade aims to address the Ethereum network's persistently high gas fees. The upgrade will alter how these fees are calculated and distributed to miners. When the upgrade is complete, the network will ‘burn' a portion of the ETH mining fees to help reduce the cost of operating smart contracts on Ethereum. As a result, the total supply of ETH will be reduced, which some analysts believe will result in ETH demand exceeding supply.

BNB continues to break records with a 105% surge in April. The price of BNB exchanged hands at $622 on April 30th. BNB has been one of the top performers year-to-date with an astonishing 1544% gain. BNB’s mind-boggling rally has catapulted the token to become the third-largest cryptocurrency by market capitalization.

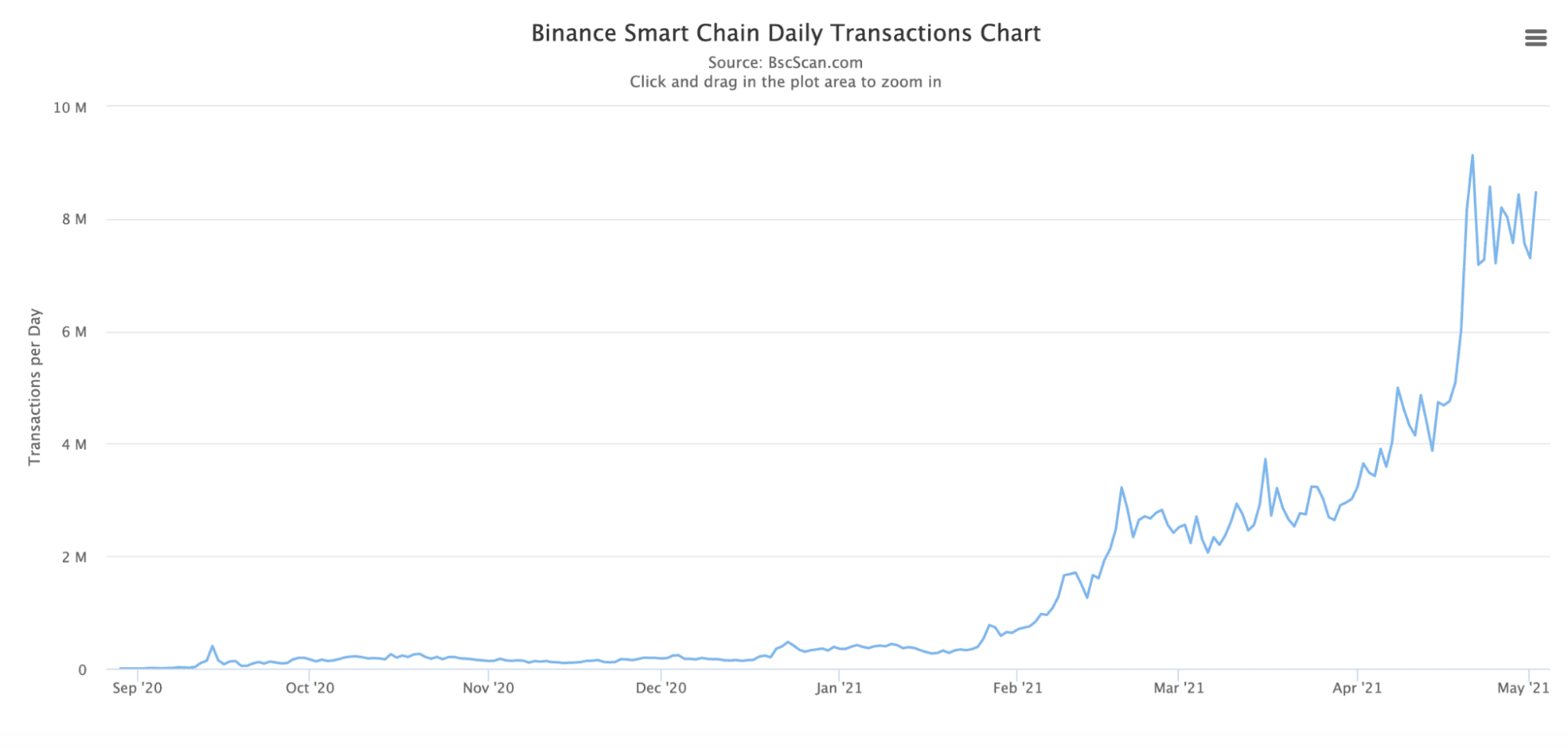

BNB’s latest rally has been driven by continued growth in Binance Smart Chain (BSC). According to BSCscan, the BSC network has surpassed the ETH network in daily transactions (date of comparison: May 2nd), 8.4 MM and 1.4MM, respectively. High ETH gas prices continued to be an issue for all verticals as multiple DeFi, NFT, and game Dapps announced their expansion to other chains.

Source: BscScan.com

The dominant narrative in the sector remained the emergence of the multichain paradigm. Ethereum contenders were active as ever. BSC proved to be the best alternative to Ethereum thus far as several top DeFi Dapps moved or announced BSC expansion. Notably, the total value of assets locked in BSC’s DeFi ecosystem grew 46x year-to-date.

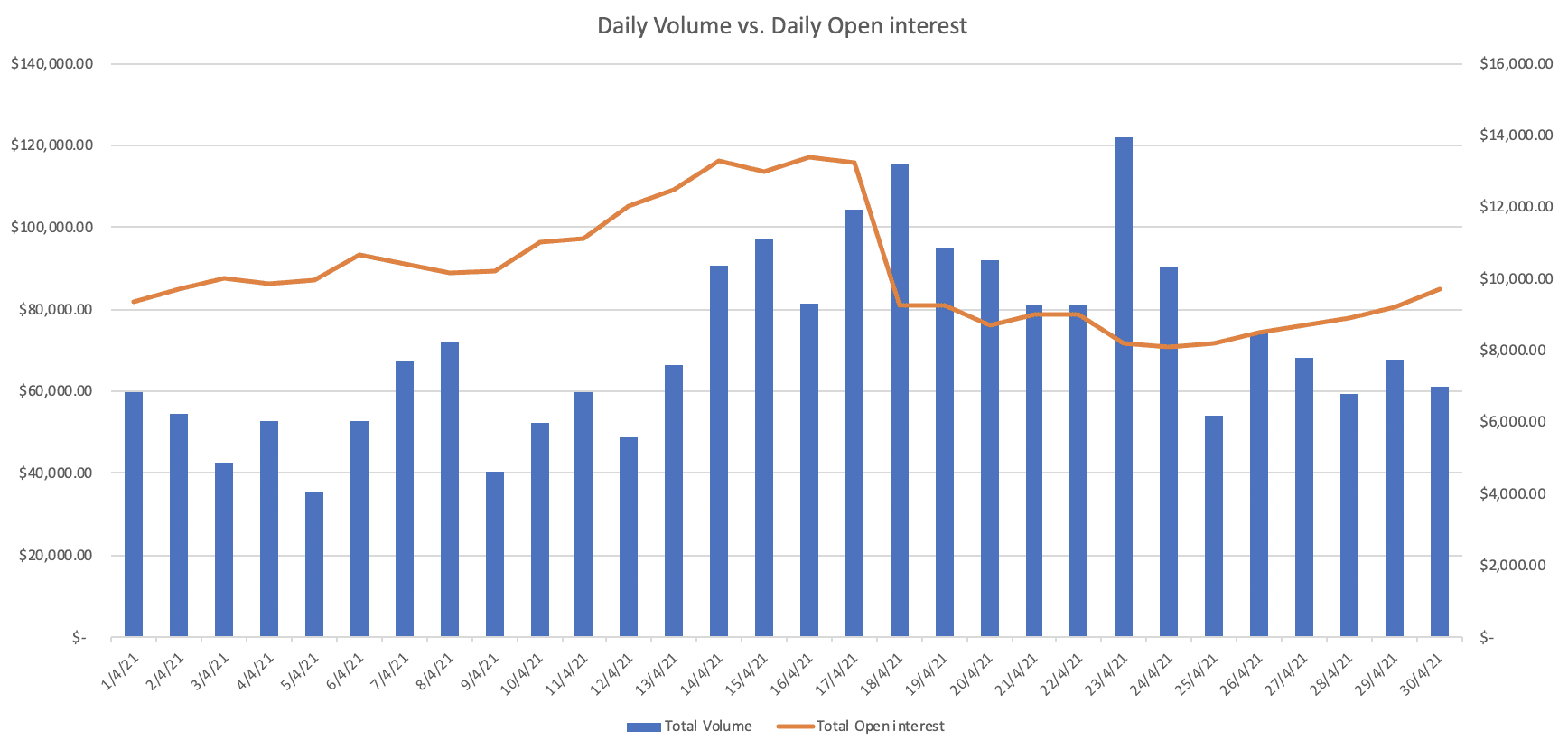

Record high futures trading volume despite Bitcoin’s underperformance

In April, Binance Futures processed $2.14 trillion in volume, up 54% from March. Binance Futures registered a new all-time high in 24-hour volume with $121 billion worth of contracts processed on April 23rd.

Open interest on Binance also posted a new milestone, topping at $13.4 billion on April 16th as Bitcoin hits a new all-time high of $64,500. However, as Bitcoin plunged below $47,500, traders were forced to unwind their BTC leveraged long positions due to liquidation losses. As a result, open interest fell to $9.2 billion and marginally recovered to $9.7 billion by the end of April.

Source: Binance Futures

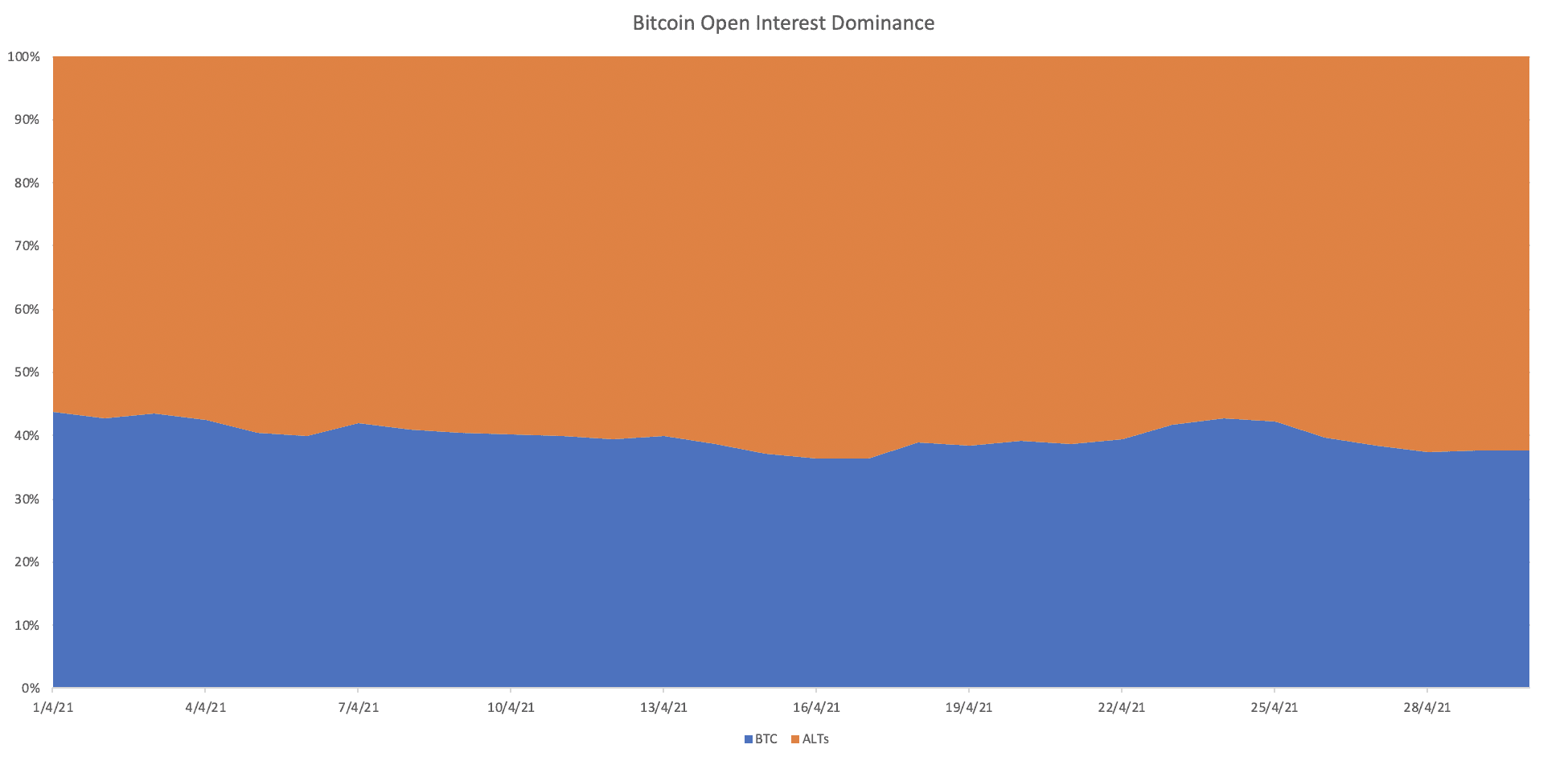

Unsurprisingly, Bitcoin’s open interest dominance, a measure of Bitcoin futures open interest as a percentage of total open interest on Binance, trended lower throughout the entire month of April. The Bitcoin open interest dominance index fell from 43.7% to 36.3% on April 17th before recovering to 37.6% by the end of April.

Source: Binance Futures

Altcoin contracts have driven most of the open interest growth in April with the likes of heavyweights such as Ethereum and BNB taking center stage. The phenomenal growth in altcoins over the past few weeks shifted investors’ attention to their respective futures contracts, particularly Ethereum futures which has seen an uptick in volume and open interest.

Will Bitcoin catch up with altcoins?

Despite Bitcoin’s underperformance, it has outpaced traditional assets such as Gold and Stocks, delivering over 100% return year-to-date. To put it in perspective, traditional assets have produced the following returns in the same period:

Crude Oil | +37% |

S&P500 | +13% |

Nasdaq | +9.2% |

Silver | -1.6% |

Gold | -9% |

Source: Tradingview, as of April 30th, 2021.

Cryptocurrencies are undoubtedly the best-performing asset this year, whose gains have been attributed to greater adoption by a clutch of prominent institutional investors.

Institutions are pushing cryptocurrency adoption to new heights. Checkout with Crypto, a new feature that will significantly expand cryptocurrency payments, has been launched by PayPal. PayPal customers with cryptocurrency holdings in the United States will be able to pay with their preferred cryptocurrency – Bitcoin, Litecoin, Ethereum, or Bitcoin Cash.

Meanwhile, more traditional banks and asset managers have announced plans to expand their cryptocurrency investment offerings. Goldman Sachs, for example, is said to be offering Bitcoin and other digital asset investment vehicles to clients of its private wealth management group.

Until now, traditional banks have largely avoided Bitcoin, believing it to be too speculative and volatile for their clients. However, Bitcoin's recent surge has sparked increased demand from institutional investors, corporations, and fintech players, leaving the banking titans with little choice but to cave.

While we can’t forecast whether the current bull-run will persist through 2022, we can confidently say that positive developments achieved this year by the entire cryptocurrency economy will not wane away anytime soon. Large institutional investors are beginning to see value in the digital asset space. They will continue to invest in transforming our industry to new heights.

With cryptocurrencies increasingly going mainstream this year, the crypto revolution is just getting started. A post-pandemic world will see a new digital economy across many industries, which could potentially garner support to push cryptocurrencies to a new level of adoption.