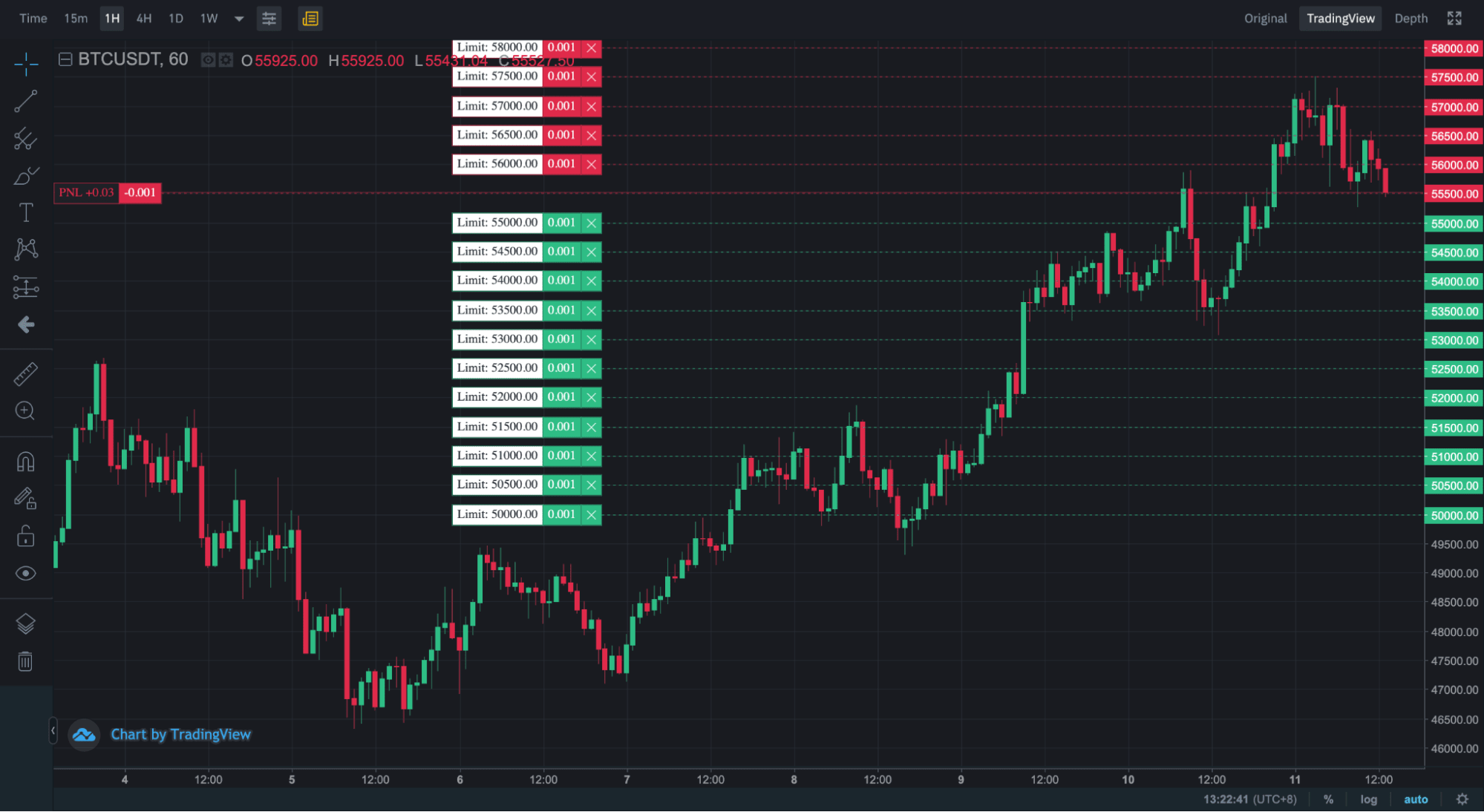

Grid trading is when orders are placed above and below a set price, creating a grid of orders at incrementally increasing and decreasing prices. In this way, it constructs a trading grid. For example, a trader could place buy-orders at every $1,000 below the market price of Bitcoin while also placing sell-orders at every $1,000 above Bitcoin’s market price. This takes advantage of ranging conditions.

Grid trading performs the best in volatile and sideways markets when prices fluctuate in a given range. This technique attempts to make profits on small price changes. The more grids you include, the greater the frequency of trades will be. However, it comes with an expense as the profit you make from each order is lower.

Thus, it is a tradeoff between making small profits from many trades, versus a strategy with lower frequency but generates a bigger profit per order.

Let’s examine how it works.

Suppose you expect Bitcoin to hover in a price range between $50,000 to $60,000 in the next 24-hours. In this case, you could set up a grid trading system to trade within this predicted range.

On the grid trading panel, you could set parameters of the strategy, including:

The upper and lower boundaries of the price range,

The number of orders to be placed within the configured price range,

The width between each buy- and sell-limit order.

In this scenario, as the price of Bitcoin falls towards $55,000, the grid trading bot will accumulate buy positions on the way down at a lower price than the market. As prices recover, the bot will sell on the way up at a higher price than the market. This strategy essentially attempts to profit from price reversions.

Set-up Your First Grid Trading Strategy

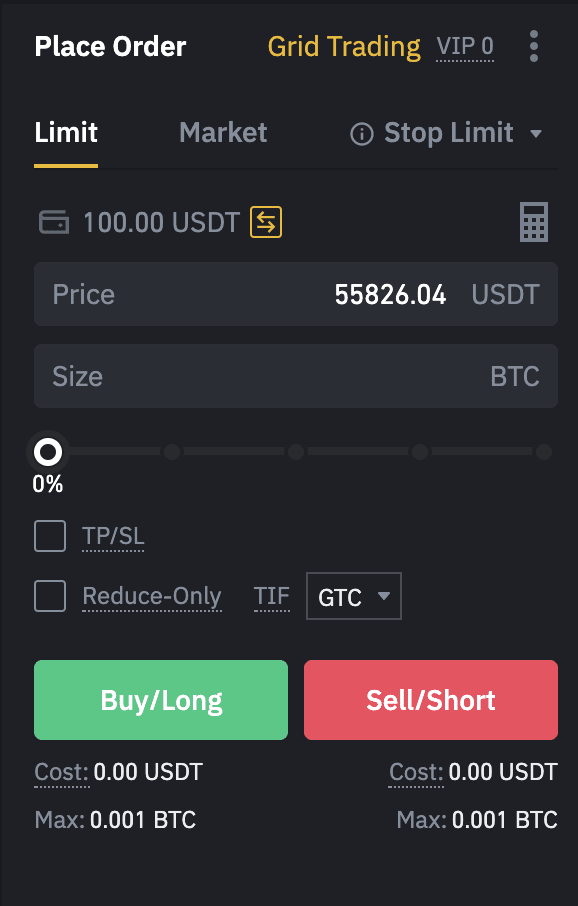

The grid trading bot systematically executes buy- and sell-limit orders based on the user’s parameters. Here’s how you can set-up your first grid trading bot.

First, launch your grid trading panel by clicking on the Grid Trading tab located on the top right-hand corner of the Binance Futures trading interface.

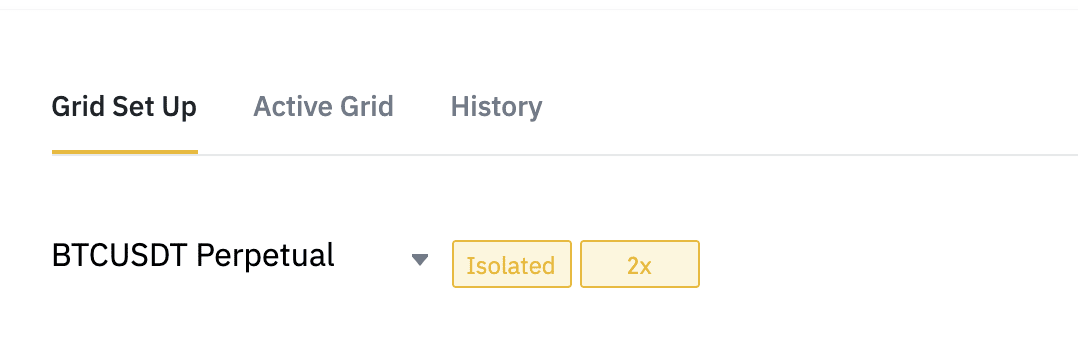

The first parameter that you must select is the contract on which the trading bot will be deployed. In this example, we will be using BTCUSDT perpetual contract.

Next, determine the type of margin for the grid trading position: Isolated or Cross margin modes. In an isolated margin mode, the margin is independent in each trading pair. Meanwhile, the margin is shared between all trading pairs in the futures account for cross margin mode.

After that, select your desired leverage amount. Leverage magnifies both gains and losses. With leverage, you can magnify relatively small price movements to potentially create profits that justify your time and effort. But do bear in mind that leverage is a double-edged sword, and you must use it prudently.

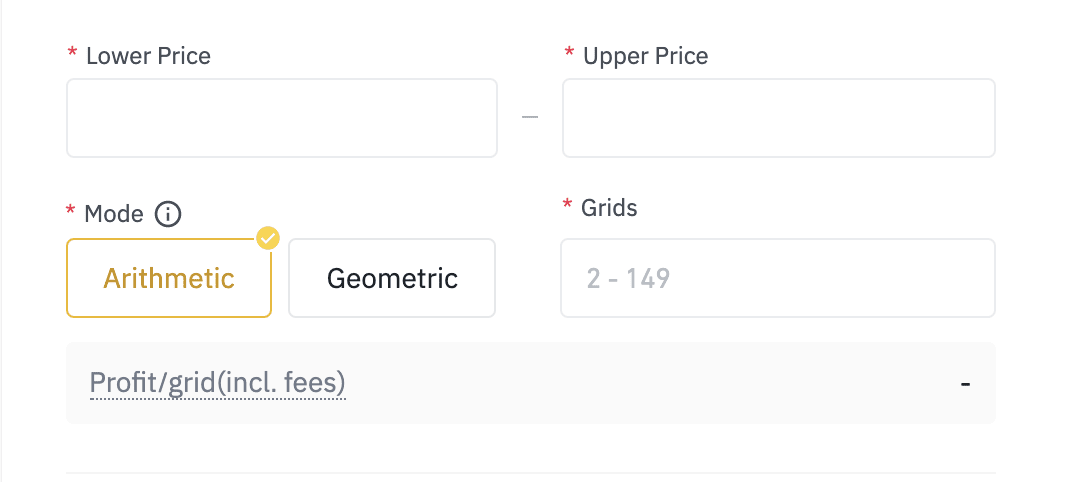

The lower and upper price boundaries are the two most essential inputs you must determine before launching the grid trading bot. This determines the range within which your limit orders will be placed. The lowest boundary will be your last buy-limit order, while the highest boundary line will be your last sell-limit order.

Next, you choose from two predefined modes: The arithmetic mode constructs each grid with an equal price difference, while the geometric mode constructs each grid with an equal price ratio difference. Remember to set the number of grids; this will determine the number of orders populated within your pre-determined grid range.

Lastly, assign the initial margin of the position. The system will calculate your Initial Margin value based on the number of grids, leverage, and the strategy’s price range.

Note that the denser the grid, the greater the corresponding initial margin.

Please ensure that your available balance and maintenance margin is higher than the initial margin to avoid liquidation. And finally, click Create to place the grid order.

Advanced Features

The grid trading bot also comes with enhanced functions that enable you to better manage your positions and risk. One of which is the trigger price. The Trigger price is a predetermined price level at which the grid trading bot will be activated. This allows you to dictate when the system will be active when market conditions meet your criteria.

When a grid trade is triggered, the system divides the asset price range into several grid levels according to your parameters and sets pending orders for each price level. When the asset’s price falls, a buy order is executed, and a sell-order is placed immediately at a high price. When an asset’s price rises, a buy-order is placed directly at a lower price as soon as a sell order is executed. This strategy sets you up to buy low and sell high and allows you to make profits in volatile market conditions.

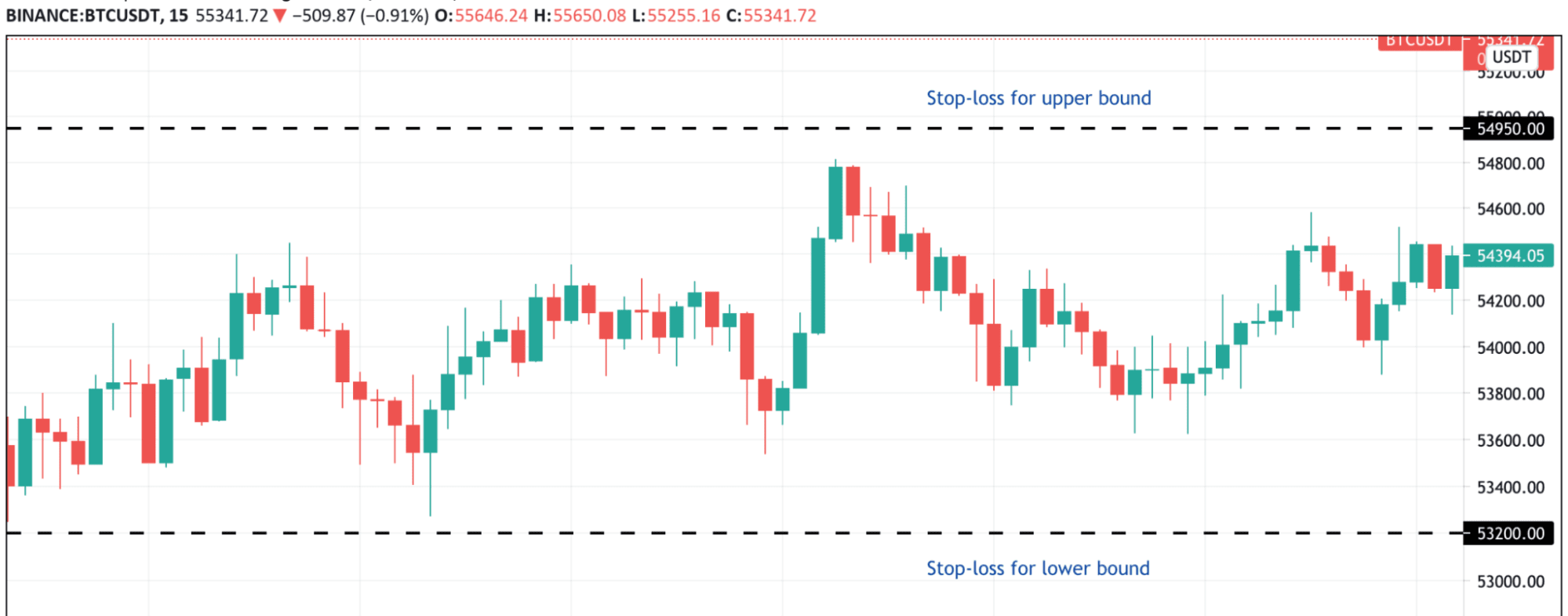

Additionally, you can set a stop-loss for your grid positions. Once the asset’s price crosses below or above the stop loss range, your entire grid position will be closed. This feature protects your position from incurring outsized losses when the market behaves unfavorably.

To monitor trading activity, click the Active Grid Tab to find grid trading details.

Lastly, click Terminate to end the grid trading system.

Benefits of Grid Trading

The main advantage of grid trading is that it allows you to trade cryptocurrencies systematically without forecasting the market direction. In ranging markets, grid trading tends to be more effective, but the question is, will it be applicable when prices are trending?

Even in trending markets, volatility continues to exist, especially in short timeframes where prices fluctuate rapidly due to a surge in trading activity. Grid trading benefits from small price changes and allows you to capitalize on increased market volatility. It is also convenient as it eliminates the need to place orders and monitor real-time market movements manually.

When grid trading, you are essentially a liquidity provider to the exchange. By placing multiple buy- and sell-limit orders across the order-book, you are increasing market liquidity; this is favorable to a cryptocurrency exchange.

As a liquidity provider, you will pay “maker” fees, which is usually cheaper than “taker” fees. Therefore, it lowers your overall transaction costs.

Grid trading always sets you up to buy at prices lower than the market or sell at prices higher than the market. Thus, when markets suffer from large price swings (5% up, then 10% down, etc.), grid trading enables you to take advantage of these spikes by providing liquidity with a grid trading bot to transform them into a tidy profit.

Grid Trading Tips

Determining a reasonable price range is the key to ensure your strategy’s profitability. This means that you need to be extremely selective on market conditions suitable for your strategy to avoid being on the wrong side of a trending market.

Importantly, you must ensure that proper risk management measures are in place. Therefore, you must determine a suitable leverage ratio and set appropriate take-profit and stop-loss orders to avoid losses caused by market fluctuations. For example, if a sell order is placed, a stop loss should be above the top of the price range, and if a buy order is placed, a stop loss should be below the bottom of the range.

Lastly, ensure that your grid trading parameters are compatible with the prevailing market conditions. Especially in range-bound markets, limits orders placed out of range are unlikely to get filled and, as such, causing missed opportunity. The grid trading parameters can be adjusted in real-time according to the prevailing market conditions.

Grid trading is ideal for novices who want to trade in a systematic approach. Don’t miss the opportunity to capitalize on market volatility. Grid trading is available on USDT-margined futures. Explore it today!