From a cycle perspective, realised capital inflows highlight the structural scale of the current bull market. Since January 2023, Bitcoin has absorbed $678 billion in net inflows, 1.8 times the size of the entire prior cycle driven by institutional adoption and deepening liquidity. Unlike earlier cycles, this one has advanced in three distinct multi-month surges, each punctuated by heavy profit-taking when more than 90 percent of coins moved were transacted in profit. Long-term holders have already realised 3.4 million BTC, surpassing all prior cycles and underscoring the unprecedented maturity of this cohort and the depth of capital rotation underpinning today’s market. With the third wave of distribution now fading, conditions favour a cooling phase as realised gains are digested before the next structural leg higher.

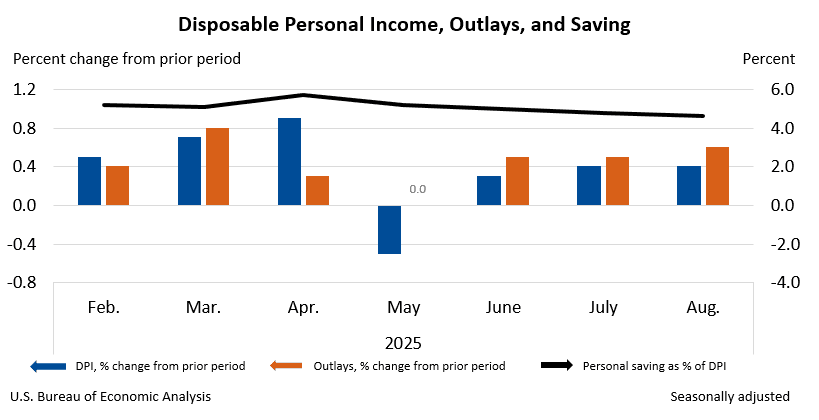

The US economy is showing a complex mix of resilience and strain. Consumer spending remains strong, with households boosting outlays on services, travel, and goods, helping drive second-quarter GDP growth to its fastest pace in nearly two years and keeping third-quarter projections close to 4 percent. This momentum, however, is unevenly distributed: higher-income households, supported by rising wealth, continue to spend, while lower-income families are increasingly relying on savings as wages stagnate and essential costs like food and energy climb.

Inflation remains stubborn, with the Fed’s preferred measure, the Personal Consumption Expenditures Index, rising 2.7 percent year-over-year in August and core inflation holding at 2.9 percent, driven by persistent service-sector and goods price pressures.

The Federal Reserve cut rates by 25 basis points on September 17th to 4–4.25 percent, aiming to balance slowing job growth with inflation control. Yet this easing highlights a delicate tension: while short-term yields have fallen, long-term Treasury rates remain elevated as investors demand compensation for fiscal risks. National debt has surged to $37.3 trillion, with annual interest costs exceeding $1.1 trillion, making debt service the government’s second-largest expense. This backdrop has steepened the yield curve, leaving mortgage rates stuck near 7 percent and borrowing costs high for households and businesses.

The cryptocurrency landscape is being shaped by a mix of political risk, regulatory shifts, and financial innovation across major economies. In the United States, a looming government shutdown on September 30th, the end of the fiscal year, underscores deep political polarisation. While short shutdowns have historically had little impact on markets, today’s backdrop of fiscal strain and global fragility could amplify risks. Equities may face pressure from delayed data releases, bond yields could swing on deficit concerns, and crypto may draw renewed attention as investors question Washington’s stability.

Across the Atlantic, the UK is beginning to take a more constructive path to crypto adoption, with leading banks including Barclays, HSBC, and NatWest launching a live pilot for tokenised sterling deposits. Running through mid-2026, the program will test use cases such as peer-to-peer payments, faster mortgage processing, and digital asset settlement, all within existing regulatory protections.

Meanwhile, Australia has moved to tighten its regulatory perimeter. Draft legislation released by the Treasury would require crypto exchanges and custody providers to obtain financial services licenses, aligning them with traditional intermediaries under the Corporations Act.

The post appeared first on Bitfinex blog.