Crypto.com Alpha Navigator Quest for the month September

in this month's latest issue of Alpha Navigator, our institutional-focused report for the month of July by our official partner Crypto.com.

Macro View: Fed Pushes Back at Jackson Hole

Derivatives Pulse

Derivatives Pulse (cont.)

Fund Flow Tracker

Fund Flow Tracker (cont.)

Pair Trader: BTC vs. ETH

Pair Trader: ETH vs. ADA

Pair Trader: SOL vs. DOT

Event Driven

Macro View: Fed Pushes Back at Jackson Hole

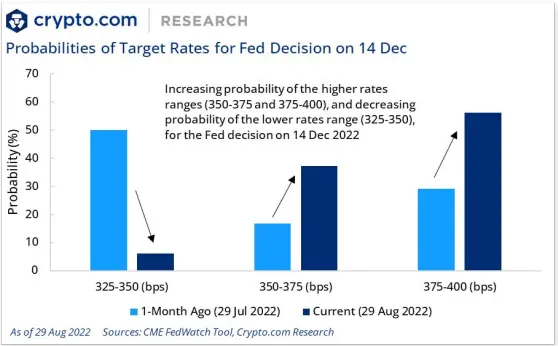

Market sentiment was buoyed by a lower than expected U.S. inflation print in early Aug and hopes that rate hikes would be slowed. However, this was quickly dampened by Fed Chairman Powell’s speech at Jackson Hole, in which he warned of “some pain” to come for the economy. Now, all eyes are on the European Central Bank to also send a clear signal with another rate step (decision on 8 Sep).

While the Ethereum Merge (expected in mid-Sep) could be considered a positive idiosyncratic catalyst for crypto, it could also potentially be a sell-the-news event, and some signals from the derivatives market are implying caution (see our Derivatives Pulse section below).

Derivatives Pulse

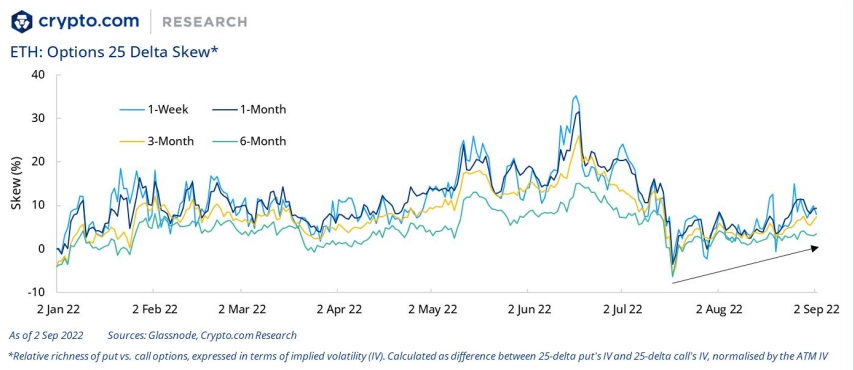

ETH skews (puts minus calls) dropped sharply in July when developers announced a soft target date of mid-September for The Merge, as traders placed their bets on a price surge by dumping puts for calls.

However, skews have been rising since then, as puts are being bid up—perhaps a sign that traders are looking to manage risk of an ETH reversal.

Derivatives Pulse (cont.)

The futures annualised rolling basis (3-month) for ETH and BTC plunged at the end of July 2022, with both breaking new lows in negative territory, potentially implying cautious sentiment and short positioning tilt (e.g. for hedging).

Derivatives Pulse (cont.)

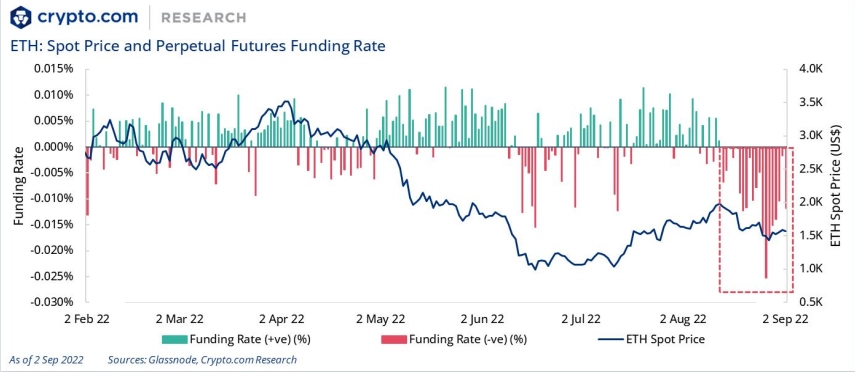

ETH perpetual futures funding rates have been printing negative since mid-August, potentially implying cautious sentiment and a shift of demand to the short side.

Fund Flow Tracker

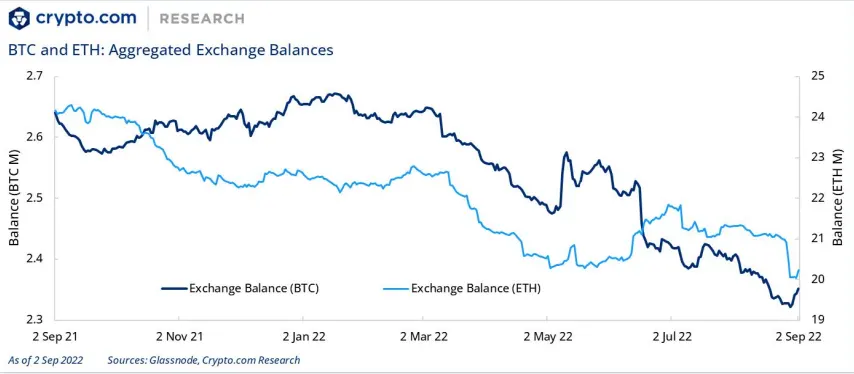

Aggregated exchange balances for both BTC and ETH reached new lows, potentially implying strengthening investor inclinations to hold.

Fund Flow Tracker (cont.)

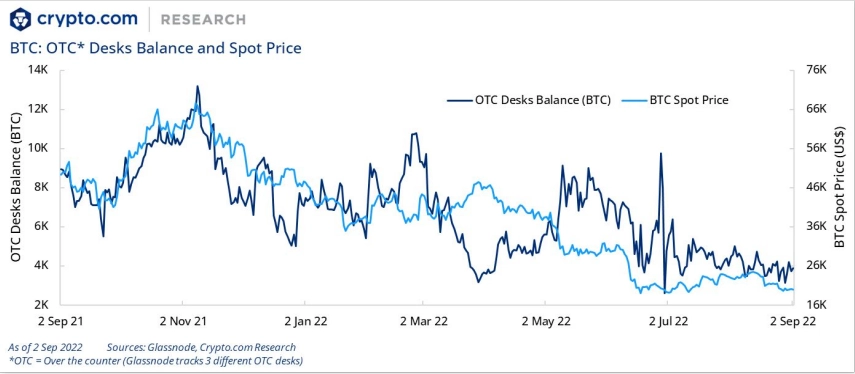

BTC balances held on OTC desks continued to drift down over the past month.

Pair Trader: BTC vs. ETH

BTC (Price: US$20,308.8, MCap: US$389.1B, Volume: US$27.7B). ETH (Price: US$1,555.1, MCap: US$187.4B, Volume: US$16.2B).

This trade has been playing out since our last issue, as ETH outperformed BTC. The price ratio (BTC price divided by ETH price) is now driven down to the 1-standard deviation (SD) floor band.

The Merge is drawing nearer (estimated in mid-Sep 2022). However, ETH has already surged substantially from its lows in June. Any delays would potentially be detrimental, given the high expectations surrounding this event.

Market-neutral pair trade (i.e., long one and short the other) on price ratio touching standard deviation bands.

Pair Trader: ETH vs. ADA

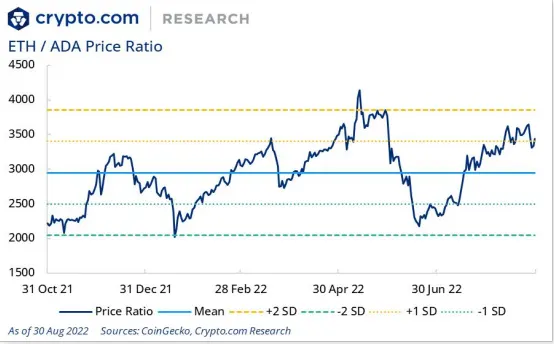

ETH (Price: US$1,555.1, MCap: US$187.4B, Volume: US$16.2B). ADA (Price: US$0.45, MCap: US$15.3B, Volume: US$668.7M).

Price ratio (ETH price divided by ADA price) is at the 1-standard deviation (SD) ceiling band.

It’s been a tale of two upgrades, with positive developments in Ethereum’s Merge contrasting with Cardano’s Vasil hard-fork running into bugs and delays - however, a 22 Sep 2022 date has been recently announced for Vasil.

Market-neutral pair trade (i.e., long one and short the other) on price ratio touching standard deviation bands.

Pair Trader: SOL vs. DOT

SOL (Price: US$32.4, MCap: US$11.4B, Volume: US$1.0B). DOT (Price: US$7.2, MCap: US$8.4B, Volume: US$471.5M).

Price ratio (SOL price divided by DOT price) is currently at the 1-standard deviation (SD) floor band.

Solana is working with Jump Crypto to improve software efficiencies.

Acala’s AUSD, the first stablecoin in the Polkadot ecosystem, broke its peg following a hack.

Market-neutral pair trades (i.e., long one and short the other) on price ratio touching standard deviation bands.

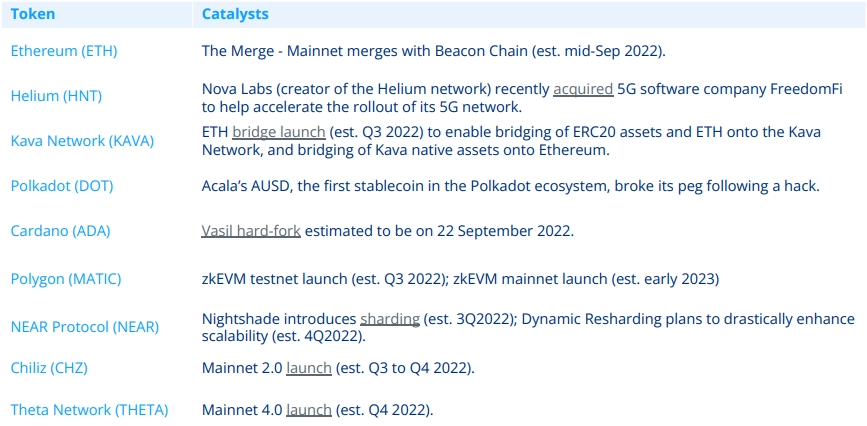

Event Driven

Create a Crypto.com account and start trading on Cryptohopper

Read the full report here

RESEARCH DISCLAIMER

The information in this report is provided as general commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. The views expressed herein are based solely on information available publicly, internal data, or information from other reliable sources believed to be true.

While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties. This report includes projections, forecasts, and other predictive statements that represent Crypto.com’s assumptions and expectations in light of currently available information. Such projections and forecasts are made based on industry trends, circumstances, and factors involving risks, variables, and uncertainties. Opinions expressed herein are our current opinions as of the date appearing in this report only.

No representations or warranties have been made to the recipients as to the accuracy or completeness of the information, statements, opinions, or matters (express or implied) arising out of, contained in, or derived from this report or any omission from this document. All liability for any loss or damage of whatsoever kind (whether foreseeable or not) that may arise from any person acting on any information and opinions contained in this report or any information made available in connection with any further enquiries, notwithstanding any negligence, default, or lack of care, is disclaimed.

This report is not meant for public distribution. Reproduction or dissemination, directly or indirectly, of research data and reports of Crypto.com in any form is prohibited except with the written permission of Crypto.com. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.