Crypto Trading 101 | Trading Strategies for Beginners

A comprehensive guide to active and passive cryptocurrency trading strategies utilized by investors.

Trading in digital assets is gaining mainstream adoption as institutions, investors, and corporations’ interest towards cryptocurrencies as an investment class grows. With even BlackRock, the world's biggest asset manager, becoming increasingly enthusiastic about Bitcoin, mainstream adoption has never been so close.

Cryptocurrency trading can generate profit both actively and/or passively based on the moving prices in the markets.

Different cryptocurrency trading strategies are implemented by traders based on market requirements and inherent risks. A trading strategy helps a trader identify a framework to mitigate risks, follow a specific pattern, and engage in predictable outcomes.

In this guide, we explore the common active and passive cryptocurrency trading strategies accessed by traders to manage risks and generate profits.

Although this article examines trading in cryptocurrency markets, these trading strategies are often used in other financial markets including stocks, bonds, options, and more.

Active Cryptocurrency Trading Strategies

Active trading refers to buying and selling cryptocurrencies based on short-term movements to profit from the price movements of digital assets. As they are commonly used for short-term price goals, they require more monitoring and attention.

Day Trading

Day trading is often confused with active trading, as it is one of the most common cryptocurrency trading strategies used by traders. It involves opening and closing positions in digital assets within a very short duration, most often on the same days.

A day trader engages in multiple trades within a day with the intention to open and close the trades the same day. In other financial markets, day traders close their trades when the markets are halted and do not hold their positions overnight.

However, since cryptocurrency markets operate 24/7, day traders need to constantly monitor the markets to close their positions within a short-term time duration.

Day trading has become a popular cryptocurrency trading strategy as traders can leverage volatility in cryptocurrency prices and generate profits from a trade.

With this style, traders use technical analysis tools to gauge the price movements of a digital asset in a short span.

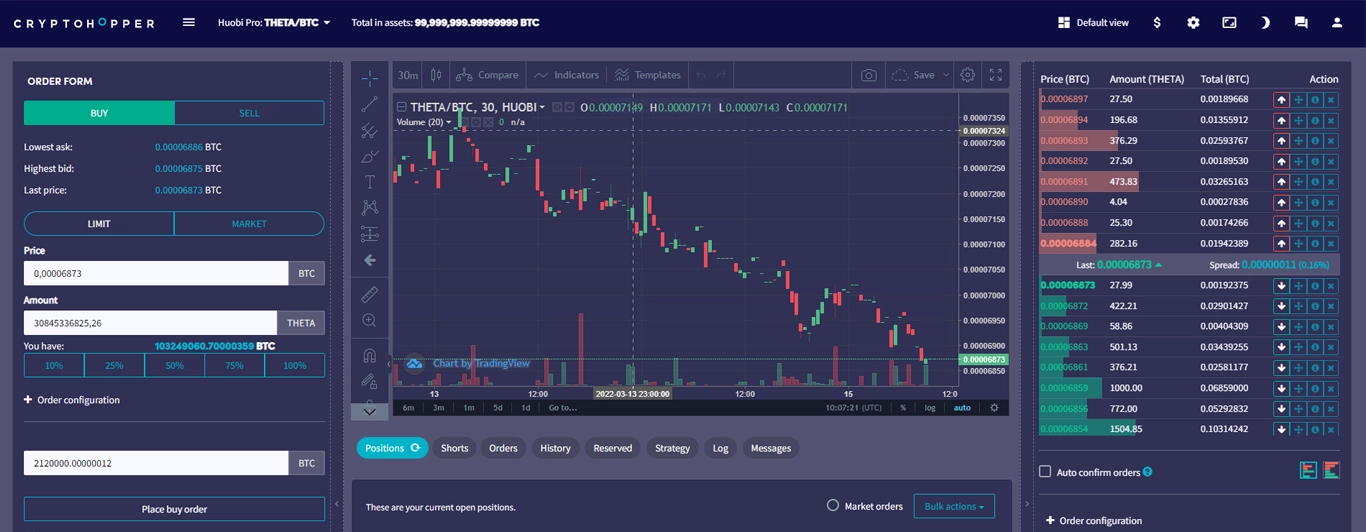

With Cryptohopper, a trader can analyze existing trading strategies against historical data and further improvise. When manual trading, day traders can specify the precise points to enter or exit a trade along with customized settings like stop-loss and not constantly monitor the markets.

Swing Trading

One of the popular active cryptocurrency trading strategies used by beginners is the practice of swing trading. In this strategy, traders typically hold their positions for a longer duration than day trading but shorter than trend trading, which we discuss below. In most cases, traders hold their positions for up to a few weeks or a month.

Swing traders generally take advantage of price volatility to buy or sell a digital asset. In this trading strategy, a mix of fundamental and technical indicators are studied to identify price patterns of a cryptocurrency asset.

For a beginner, swing trading is more convenient and easy to apply than day trading as unfolding a trade requires a longer duration.

Cryptohopper offers a trader to change their setting in accordance with their trading strategy.

In case of swing trading, a swing trader can set accurate settings for take profit, stop loss, trade size, and other technical indicators. Refer this article to identify the accurate setting that may be adopted as per trading strategy.

Trend Trading

Also referred to as position trading, trend trading involves holding positions in a cryptocurrency trade for a longer duration, often weeks or months.

In this trading strategy, traders take advantage of the upward or downward trendsetting in a digital asset. This involves traders entering a long position in an uptrend and/ or entering a short position in a downtrend.

In most cases, trend traders look for directional trends and not forecast price levels. They enter a trade when an uptrend or downtrend has been established, and exit the market when the trends start to reverse.

A mix of fundamental and technical analysis is carried out by trend traders to predict the directional trends in cryptocurrency markets.

Trend traders also use advanced technical parameters including Moving Averages (MA) to curb financial risks and define their strategy

Scalping

Scalping is one of the quickest active cryptocurrency trading strategies that involve exploiting various price gaps over and over again.

In scalping, traders take advantage of small price movements including the bid-ask spread, order flows, and inefficiencies in the market.

Scalpers do not hold their positions for a longer time duration or trade in large volumes. Instead, scalpers trade in small volumes and small moves more frequently to take advantage of small differences multiple times during a day. Scalpers often trade in markets with higher liquidity so as to enter and exit a position quickly.

Scalping is also a strategy that is more commonly accessed by whales, individuals or entities trading in huge amounts, that often trade in large positions. As the profit percentage of trades in scalping is small, whales often access scalping with larger positions.

Passive Cryptocurrency Trading Strategies

Passive cryptocurrency trading strategies involve holding positions in digital assets for a longer duration to make profits with long-term investments. In this style, managing a cryptocurrency portfolio requires considerably less time and attention as compared to active trading strategies

Buy and Hold

It is one of the passive cryptocurrency trading strategies which, as the name suggests, requires buying and holding on a digital asset for a considerably longer time duration. In this strategy, investors plan to hold the positions of their cryptocurrency assets such that the price or timing do not play a major factor.

In Buy and Hold, investors study the fundamental analysis of a digital asset and are not much concerned with technical analysis. Moreover, investors do not bother themselves with short-term price movements or constantly monitoring the markets.

Index Investing

Index investing, typical to traditional investing markets like ETFs and Indices, has become a passive cryptocurrency trading strategy. It involves selecting a group of digital assets with common characteristics, categories, and parameters.

A crypto index incorporates a basket of cryptocurrencies, often with similar properties, in a token that measures their combined performance. Crypto indexes can be formed of utility tokens, DeFi protocols, yield farming coins, privacy coins, and more.

An index investor may choose a group of DeFi coins and form an index combining multiple DeFi protocols instead of selecting individual tokens.

The performance of crypto indexes does not depend upon any individual token and is measured collectively based on the performance of major coins in an index. This eliminates the risk of betting on a single coin.

Bottom Line

Trading strategies act as frameworks with rules to facilitate investments or trades in any specific markets with defined intentions. These rules help mitigate risks and trade effectively based on rules rather than emotions.

Active and passive cryptocurrency trading strategies help investors clearly define their intentions so as to generate profits from strategic investments. These trading strategies help investors to not indulge in speculative, random, and haphazard trades.

It is beneficial to keep a trading journal that will help track the performance of digital assets. Moreover, with data, experience, and records, a trader can adjust to different strategies and methods.