In the previous post, we covered SMA and EMA, two essential tools for understanding trend direction. Now, let’s talk about momentum. Specifically, how to spot momentum shifts before they show up in price.

Enter: MACD (Moving Average Convergence Divergence).

What is MACD?

MACD stands for Moving Average Convergence Divergence. In simpler words, MACD is a momentum indicator. It shows whether the market is gaining steam in a direction or losing strength. In other words: “Is the market about to make a move?”

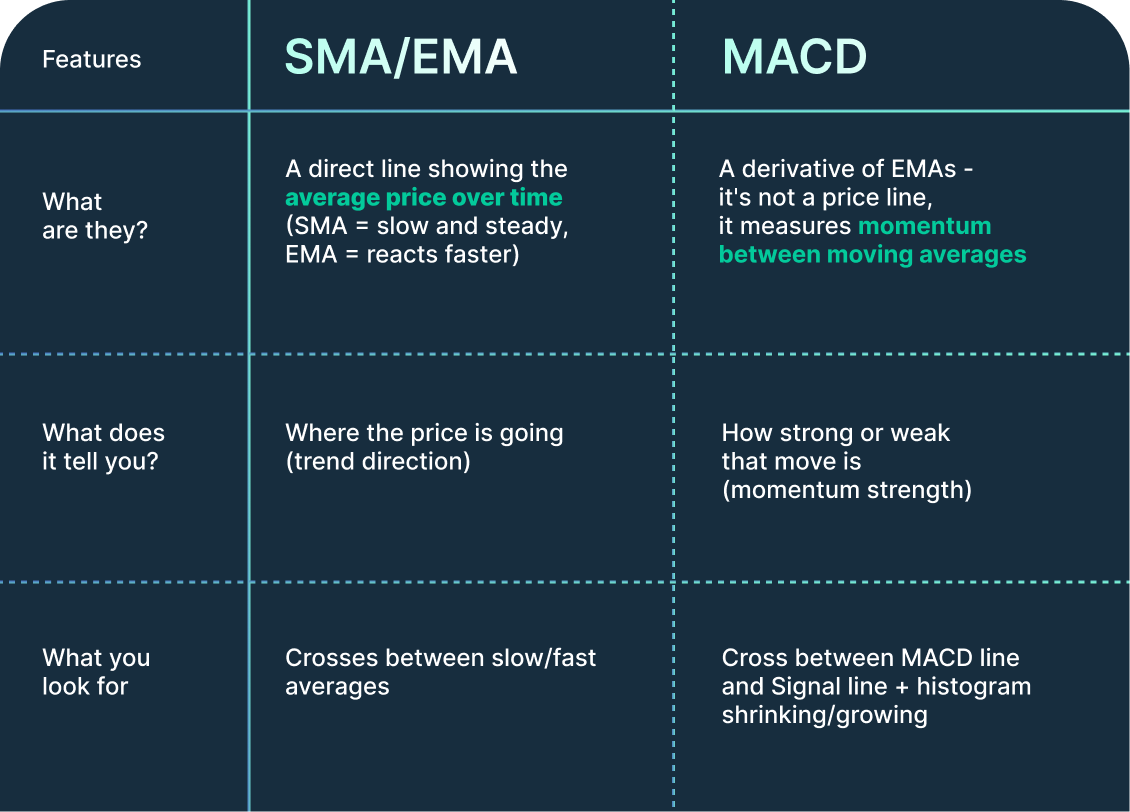

While moving averages help you see where the market is going, MACD tells you how strong that move is. It’s one of the fastest ways to spot early signs of trend shifts, before the price fully reacts.

It’s made up of three parts:

1. MACD Line (Blue)

Think of this as your momentum tracker.

It reacts when prices start changing direction showing if the market is gaining energy or slowing down.

2. Signal Line (Orange)

This line follows the MACD Line closely.

When the blue line crosses above the orange one, it often means momentum is turning upward (buy signal)

When the blue line crosses below, it can mean momentum is turning down (sell signal)

3. Histogram Bars (Red or Green Bars)

These bars show the distance between the blue and orange lines.

Here’s how to read them:

Bars growing = momentum is getting stronger

Bars shrinking = momentum is slowing down

Green bars = bullish energy (buyers are active)

Red bars = bearish pressure (sellers are active)

Why Use MACD?

MACD is great for identifying potential entry and exit points. It tells you:

When momentum is picking up

When a trend may be reversing

When to sit tight and wait

Example in Action:

MACD Indicator (Bottom Panel)

MACD Line (Blue): 326

Signal Line (Orange): –279

MACD Line just crossed above the Signal Line: bullish crossover

Histogram Bars turned green and are growing: momentum is building

This crossover happened below the zero line: early signs of trend reversal

Moving Averages (Main Chart)

20-day EMA (Blue Line): ~84,067

50-day MA (Green Line): ~84,170

Current BTC Price: 87,269. BTC price is above both averages, buyers are in control, trend likely continues up.

Pro Tips: Combine MACD with EMA or SMA for stronger confirmation

Use MACD crossovers near key support/resistance for higher accuracy

Avoid relying solely on MACD in sideways markets—it may give false signals

Try It Now on Bitfinex:

Log in to Bitfinex

Select any trading pair (e.g. BTC/USD)

From the Indicators tab, add “MACD”

Watch for:

Bullish Signal: MACD Line crosses above Signal Line

Bearish Signal: MACD Line crosses below Signal Line

Histogram Bars Growing: Trend is gaining momentum

Histogram Bars Shrinking: Trend is slowing down

This practice builds your intuition over time, so you can act with confidence, not confusion.

MACD is a favorite among traders for a reason: it offers early insights into shifts in momentum before they’re obvious in price action.

MACD vs SMA/EMA: What’s the actual difference?

Coming up next in our Chart Decoder Series: RSI – How to Know When a Market’s Overbought or Oversold.

The post appeared first on Bitfinex blog.