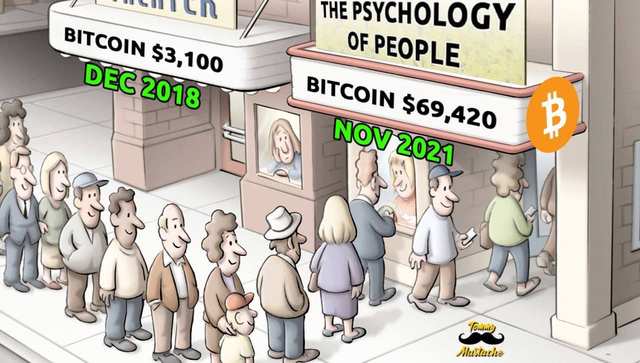

This is a quite familiar image, isn’t it?

Unfortunately, this picture is the exact situation that we see when BTC is reaching its ups and downs. At EXMO, we usually say that if your granny asks what Bitcoin is, it’s too late to buy it. While thousands of people are queueing to buy overpriced assets, there is only 30% of the customers who are ready to buy when the market is down (EXMO data).

There are plenty of reasons for that, let’s take a look at the two main ones:

FOMO

This is probably one of the main reasons for the described behaviour. FOMO (Fear of Missing Out) can lead to poor decision-making, lack of long-term thinking, and can cause people to trade without thinking too much about it. People are afraid that they are missing out wonderful opportunities to become rich. FOMO is driven by many emotions and fears, such as greed, impatience, jealousy, fear, overconfidence, and anxiety. When markets are fast-moving or volatile, such as with cryptocurrencies, FOMO trading gets even worse. It can also be caused by a winning streak, hearing news about a coin, seeing speculation on social media, or seeing other people have successful investments.

Loss aversion

Loss aversion is a behavioural bias in which individuals tend to experience more emotional pain from a loss than the emotional pleasure from a corresponding gain. To avoid emotional discomfort and financial loss, individuals may impulsively sell assets at a loss to avoid further declines — even when they are losing money. Those clients tend to buy high and sell low, just because loss gives them more emotional pleasure than a potential gain (weird, isn’t it?)

Follow the link to read the full article on Finextra .

was originally published in exmo-official on Medium, where people are continuing the conversation by highlighting and responding to this story.