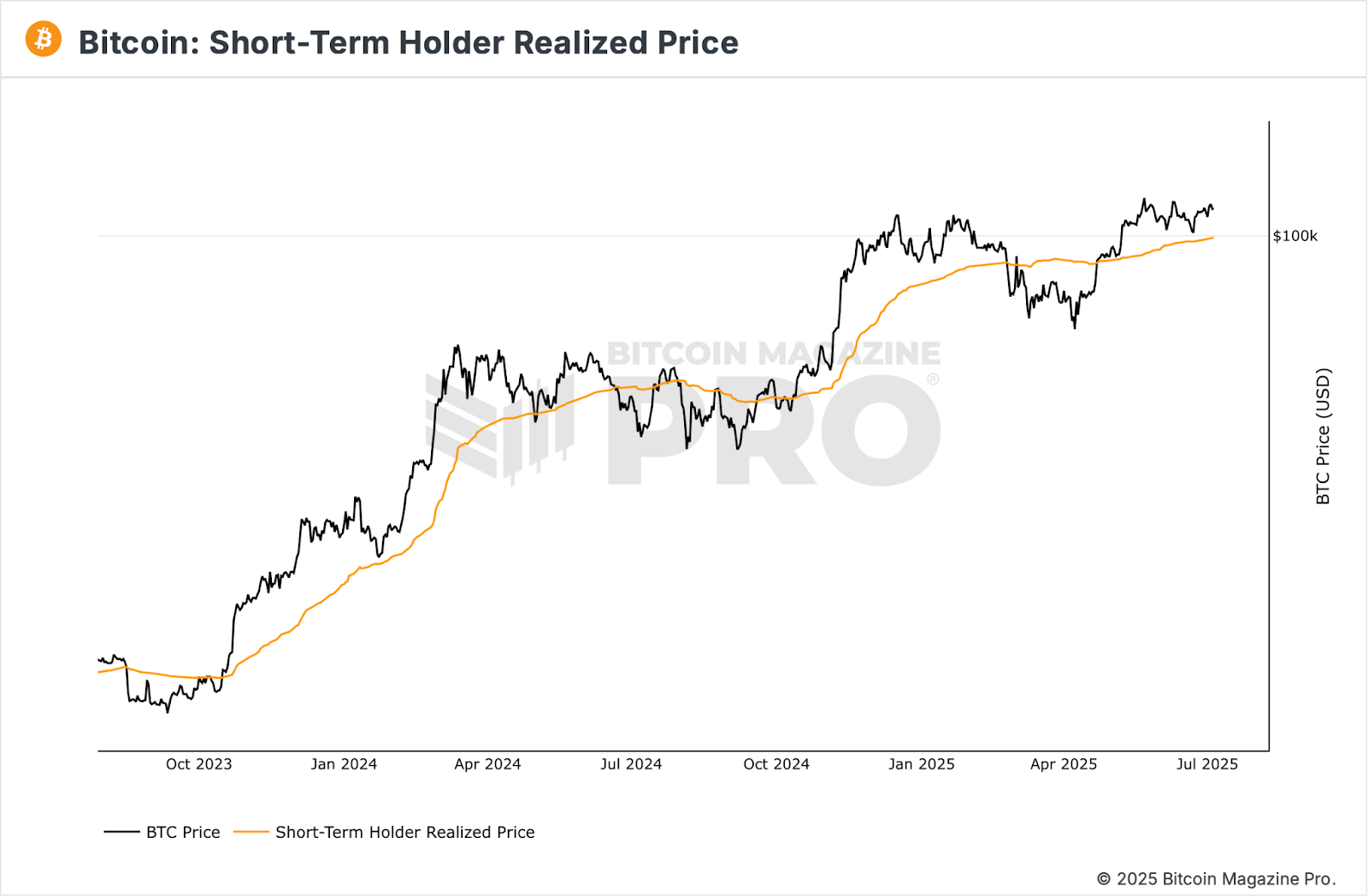

Importantly, the market’s repeated defence of the rising STH-RP underscores continued structural strength. This key on-chain level has historically acted as a pivot for trend continuation, and its resilience in recent weeks indicates that bulls still hold control of the broader structure. The rising cost basis reflects ongoing accumulation, likely by institutional players via ETFs and corporate inflows offering a more durable foundation than in prior cycles. However, the lack of follow-through at the range highs, and recent drawdowns in aggregate open interest and whale holdings, highlight growing caution, particularly among experienced market participants.

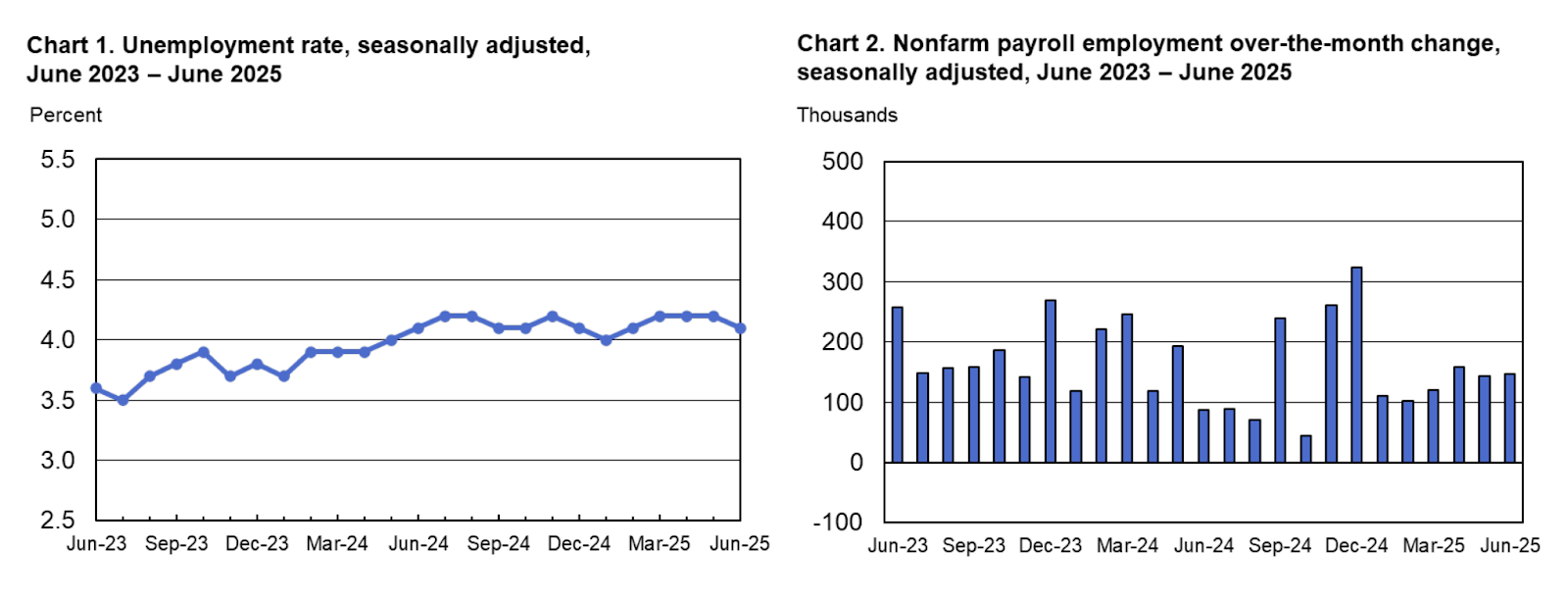

The US macroeconomic landscape is increasingly marked by signs of strain, with recent data underscoring a labour market losing momentum amid broader economic headwinds. June payrolls showed a headline gain of 147,000 jobs, yet nearly half stemmed from government hiring linked to seasonal factors, while private sector job creation weakened to its slowest pace in eight months. Sectors like manufacturing and wholesale trade shed jobs, and the overall drop in labour force participation masked the rise in long-term unemployment.

Wage growth softened, the average workweek shrank, and aggregate hours worked fell, reflecting cautious employer sentiment and hinting at subdued consumer demand ahead. Manufacturing, too, remains under pressure; the ISM PMI stayed below the 50 mark for the fourth consecutive month, with businesses grappling with supply chain bottlenecks and trade uncertainty, further clouding prospects for a recovery. While job openings rose, largely in lower-wage leisure and hospitality roles, hiring lagged, exposing the fragile underpinnings of labor demand. Against this backdrop, the Federal Reserve appears set to hold rates steady in the near term, with markets eyeing potential easing toward year-end.

In parallel, the cryptocurrency sector is capturing growing institutional interest, with developments that are in contrast with the tentative macroeconomic mood. The debut of the first Solana staking ETF, SSK, marked a milestone, drawing $33 million in volume on its first day and offering 5–7 percent staking yields, positioning Solana as a credible player in regulated capital markets. Similarly, corporate Bitcoin treasury strategies are accelerating: Spain’s Vanadi Coffee pivoted dramatically from its café business to amass Bitcoin holdings, aiming for €1 billion in BTC exposure, though there is concern about the company’s strategy given its overall financial fragility. Meanwhile, Tokyo-based Metaplanet has intensified its Bitcoin accumulation strategy, now holding a total of 15,555 BTC following its latest purchase of 2,205 BTC, with ambitions to reach 210,000 BTC by 2027 and solidify its role as Asia’s leading corporate Bitcoin holder. Together, these crypto moves highlight a growing divergence: while traditional markets wrestle with uncertainty, digital assets are increasingly seen as a vehicle for yield, treasury diversification, and inflation hedging — signalling shifting priorities in institutional capital deployment.

The post appeared first on Bitfinex blog.