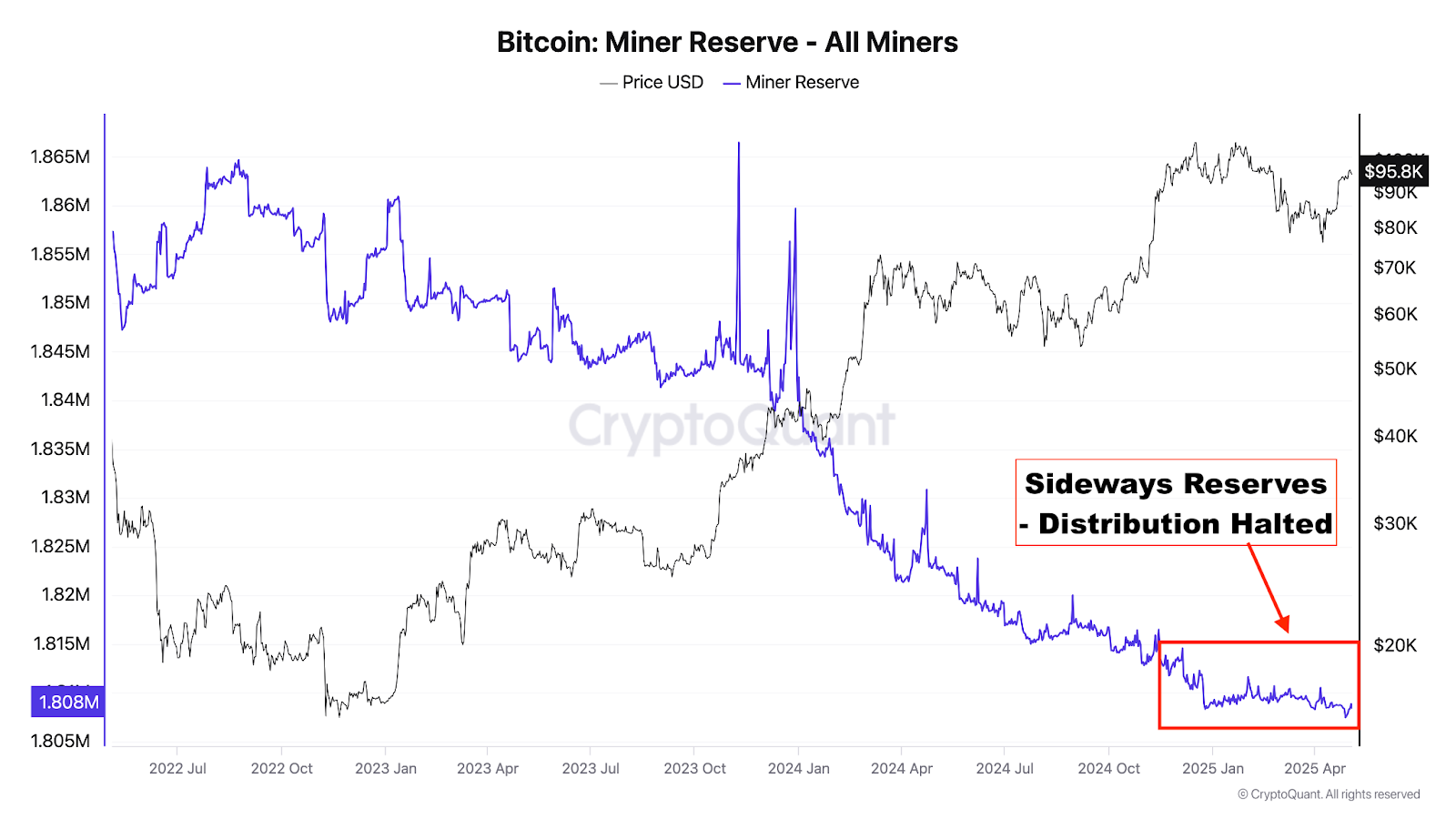

On-chain data supports this narrative: miner reserves remain stable and the Puell Multiple suggests little incentive for large-scale miner selling, indicating confidence in further upside. While the near-term hinges on whether BTC can convert this reclaim into sustainable support, structural signals continue to lean bullish—setting the stage for a potential continuation of the current cycle once macro conditions stabilise.

The US economy showed surface-level resilience in April, with 177,000 new jobs added and unemployment holding steady at 4.2 percent. Labour force participation grew, and key sectors like education, healthcare, and hospitality continued hiring. However, wage growth slowed to 0.2 percent monthly and 3.8 percent annually, job openings declined, and certain industries like manufacturing and retail lost jobs—signs of a cooling labour market.

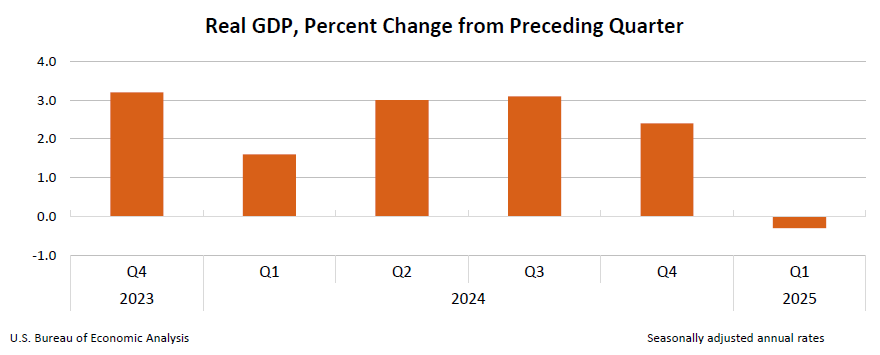

These positive headlines mask deeper structural issues, as companies may be “ labour hoarding” after past hiring struggles, and the jobs report is increasingly seen as a lagging indicator. Meanwhile, consumer spending appears stable on the surface but reveals cracks beneath—durable goods purchases dropped sharply, while nondurables and services rose. A temporary surge in equipment investment lifted private investment numbers, but broader economic momentum remains weak. Imports soared over 40 percent, widening the trade deficit and dragging GDP down by 0.3 percent in Q1, largely due to corporations front-loading goods ahead of tariff hikes.

Consumer confidence has plunged to its lowest level since 2020, with the Expectations Index dropping to a level historically linked to recessions. Rising concerns about income, job security, and inflation—driven by ongoing trade tensions—are weighing heavily on sentiment. As inflationary pressure from tariffs builds and household income growth stalls, the US faces a precarious period of economic deceleration.

In the cryptosphere, Nexo has reentered the US market after a two-year exit, citing a more favourable regulatory climate and political support, particularly under the Trump campaign’s pro-crypto stance. The company now aims to offer a fully compliant suite of crypto-backed financial products, reflecting a broader industry shift toward cooperation with regulators. Meanwhile, the Arizona House passed two bills that would allow the state to invest up to 10 percent of its funds in Bitcoin and other cryptocurrencies, potentially making it the first U.S. state to hold crypto in its treasury and retirement systems—though the outcome remains uncertain due to Governor Hobbs’ veto warning tied to broader budget concerns. Across the Atlantic, the UK government introduced draft legislation to regulate crypto platforms, emphasising consumer protection and transparency, while also strengthening collaboration with the U.S. to establish a transatlantic regulatory framework. Lastly, the SEC concluded its investigation into PayPal’s stablecoin PYUSD without enforcement action, signalling potential regulatory clarity for stablecoins and reinforcing PayPal’s position in the evolving digital asset landscape.

The post appeared first on Bitfinex blog.