Since the record $19 billion liquidation on 10 October, market volatility has cooled considerably, with total BTC options open interest contracting by roughly $7 billion to $31 billion, the sharpest weekly drop since June. The unwinding of short-dated upside exposure between $115,000–$120,000 strikes has neutralised dealer gamma, and reset speculative positioning. Implied volatility has compressed into the low-40s, and realised volatility continues to drift lower, 30-day at 44.1 percent and 10-day at 27.9 percent, suggesting that traders now expect consolidation rather than breakout. The data points to a maturing post-liquidation reset: elevated but stabilising volatility.

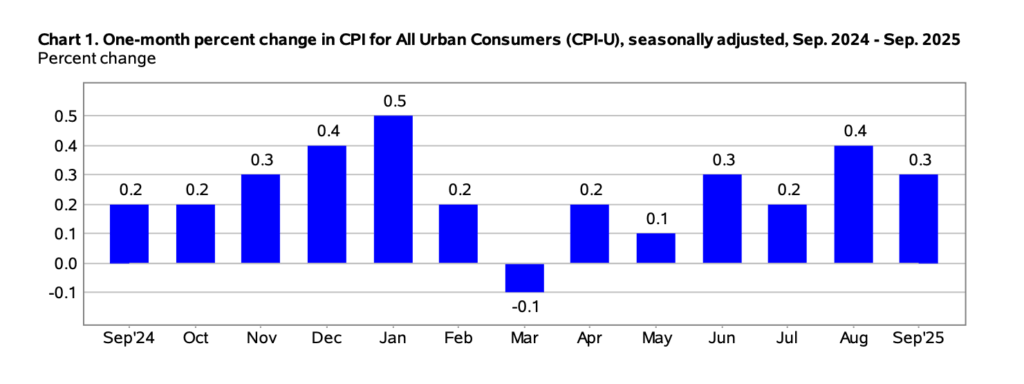

US inflation eased in September, rising just 0.3 percent for the month and 3 percent year-over-year, signalling progress toward the Federal Reserve’s target and setting the stage for an expected rate cut at the end of October.

Yet beneath the headlines, the data revealed a tale of two economies: one buoyed by market gains and another strained by everyday costs. While investors celebrated fresh record highs in the S&P 500 and Dow Jones indices, many households continue to struggle with higher gas, food, and service prices.

At the same time, surging debt in the US, now at $38 trillion, or 124 percent of GDP is testing global confidence. With rising interest costs, political gridlock, and waning demand for Treasuries, the US risks borrowing more just to pay interest on what it already owes. Japan and China have reduced holdings, while domestic institutions increasingly shoulder the burden. Though US bonds still offer attractive yields, cracks are forming in the “safe haven” narrative that underpins global finance. Together, easing inflation and a swelling debt load paint a complex picture: an economy stabilising at the surface but carrying deep structural imbalances beneath.

Japan’s Financial Services Agency is set to relax its strict stance on digital assets by allowing domestic banks and their subsidiaries to trade, hold, and potentially offer crypto exchange services. This marks a significant shift from Japan’s previous policy, which prohibited banks from owning cryptocurrencies due to volatility and financial stability concerns. Meanwhile, US President Donald Trump granted a full pardon to Binance founder Changpeng “CZ” Zhao, who was convicted of anti-money-laundering violations and served four months in prison. The administration framed it as ending the “war on crypto,” though critics raised concerns about potential political motives and Binance’s ties to Trump-linked ventures. The pardon removes a key obstacle to Binance’s US re-entry following its $4.3 billion settlement with regulators.

At the same time, gold advocate and Bitcoin critic Peter Schiff announced a blockchain-based gold platform via his company Schiff Gold. The project allows users to buy and tokenise vaulted gold, spend fractions through a debit card, or redeem it physically.

The post appeared first on Bitfinex blog.