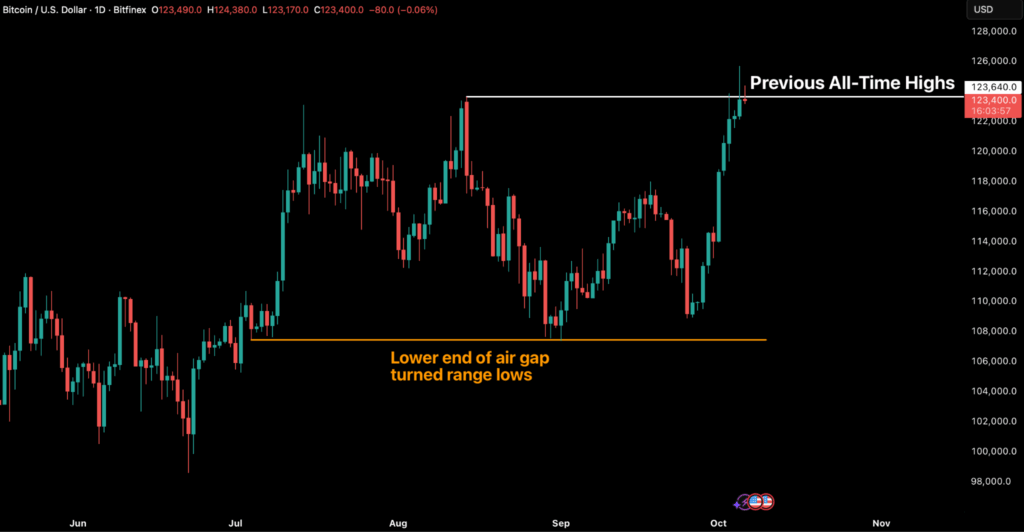

A major factor behind Bitcoin’s rebound has been a sharp reduction in sell pressure. The late-summer correction was primarily driven by Short-Term Holder capitulation and heavy whale distribution, coinciding with profit-taking after the Fed’s first rate cut. With leveraged positions flushed and the $110,000–$112,000 zone reclaimed, fresh demand has absorbed supply, reigniting momentum. Macro tailwinds have strengthened in parallel. US spot Bitcoin ETFs have reversed outflows, recording over $647 million in average daily inflows last week, while whale distribution has slowed materially. The setup remains favourable: a dovish Federal Reserve, easing inflation, renewed ETF inflows, and stable on-chain support suggest the corrective phase is likely behind us.

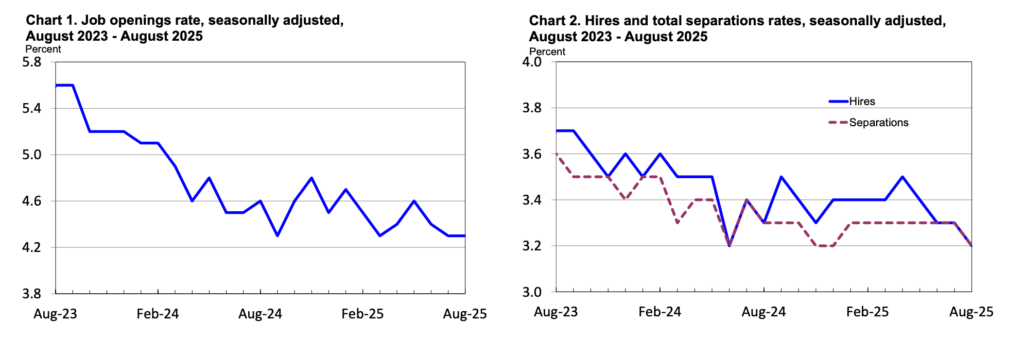

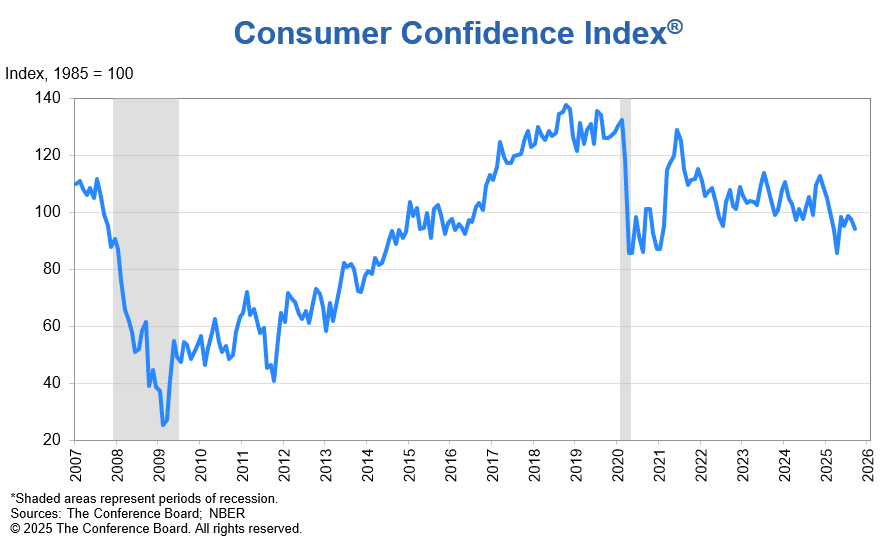

The US economy is showing renewed strain as labour market data signals slowing momentum and rising uncertainty. August’s JOLTS report showed job openings holding steady at 7.2 million but hiring falling sharply, while the quits rate declined for a third straight month, reflecting weaker worker confidence.

ADP’s September data confirmed job losses across small and mid-sized firms, pointing to fragility despite the Federal Reserve’s rate cut in mid-September. That weakness has been compounded by the government shutdown that began on October 1st, threatening to push unemployment higher and weigh on consumer sentiment, which was already sliding by late September.

Global momentum toward digital asset integration accelerated this week. The European Central Bank finalised agreements with several tech firms to develop core infrastructure for a potential digital euro, though progress remains subject to EU legislation. In the US, CME Group announced plans to introduce 24/7 crypto futures and options trading by early 2026, aligning traditional markets with the nonstop nature of crypto and eliminating the long-standing “CME gap”, that has been created as a result of no weekend trading. Meanwhile, the SEC saw a surge of over two dozen new crypto ETF filings from issuers like REX Shares, Osprey Funds, and Defiance ETFs, taking advantage of new listing standards that streamline approvals. However, the US government shutdown has temporarily stalled progress, delaying potential launches. Together, these moves underscore rapid institutional expansion into digital assets amid ongoing regulatory uncertainty.

The post appeared first on Bitfinex blog.