Seasonality adds weight to the current consolidation narrative. August closed with a 6.5 percent decline, consistent with its historically weak profile, while September is traditionally the softest month with an average −3.3 percent return. That said, the “ red September” effect has weakened recently, and Q4 seasonality is historically powerful, with October and November averaging outsized gains.

If the Fed confirms a September rate cut, falling real yields and a weaker dollar could amplify BTC’s seasonal upside, setting the stage for renewed momentum. Until then, consolidation remains the base case, with ETF flows, macro policy shifts, and derivatives positioning acting as the critical signals to watch.

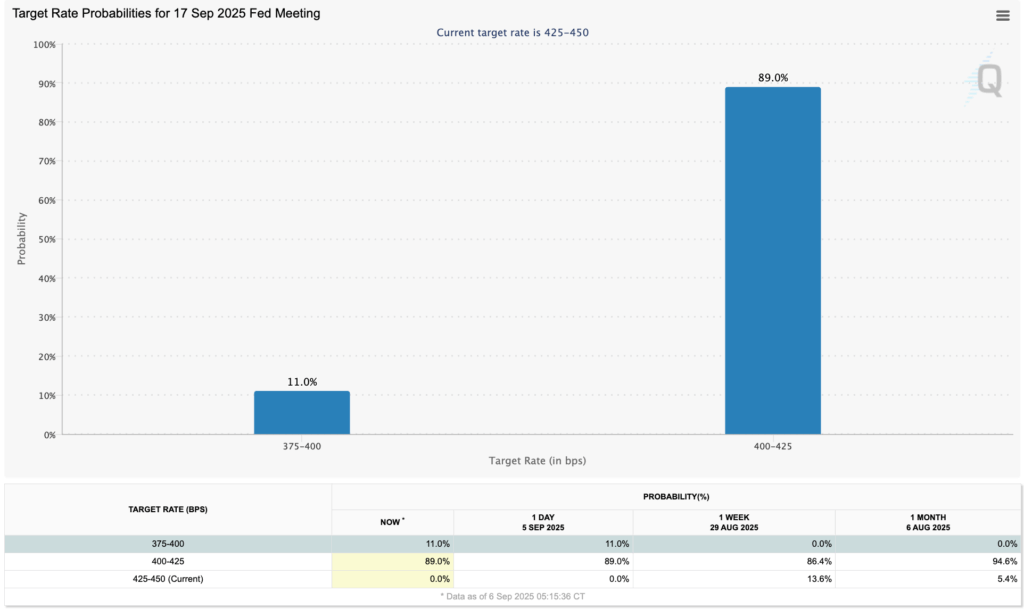

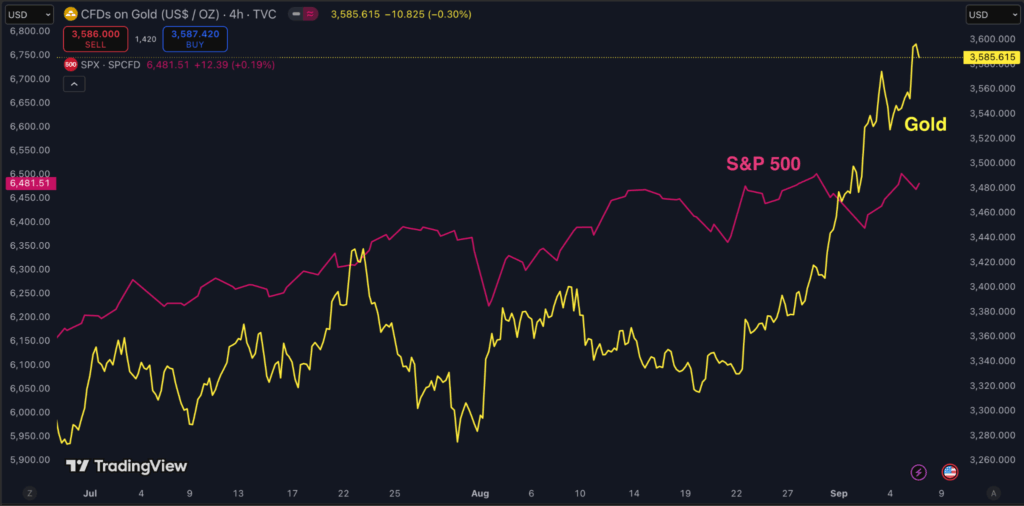

The US economy is under mounting pressure as weak labour data, bond market tension, and political machinations around the Fed converge. The August jobs report on Friday, September 5th, revealed payroll growth of just 22,000 with heavy downward revisions, pushing unemployment to 4.3 percent, its highest in nearly four years. The softness strengthens expectations for a Fed rate cut at the September 16th–17th meeting, though sticky inflation complicates the decision. Bond markets reflect the tension: short-term yields have dropped on expectations of a rate cut, but the 30-year remains near 5 percent, signalling investor concern over deficits and fiscal credibility. This disconnect has steepened the curve, raising long-term borrowing costs and fuelling a flight to gold, which surged to record highs near $3,600 per ounce. Political risks compound the challenge as President Trump moves to dismiss Fed Governor Lisa Cook and threatens new tariffs on the EU, leaving investors to weigh not just economic fundamentals but also growing uncertainty over Fed independence and US policy direction.

In the meantime, the global crypto landscape is shifting as regulators and markets move toward clearer frameworks. In the US, the Securities and Exchange Commission and Commodity Futures Trading Commission issued a rare joint pledge on Friday, September 5th, to coordinate more closely on digital asset oversight, targeting clearer rules for spot crypto products, perpetual contracts, portfolio margining, and DeFi.

A joint roundtable on September 29th will advance this agenda, and is further buttressed by the Responsible Financial Innovation Act of 2025, which requires the creation of a Joint Advisory Committee on Digital Assets and mandating public responses to its recommendations. The bill also introduces a measure of protection and clarification of the status of DeFi developers, Decentralised Physical Infrastructure Networks, airdrops and staking rewards. It also directs a study on tokenised real-world assets. Together, these moves show Congress and regulators working in tandem to strengthen US competitiveness in digital markets.Institutional confidence in Solana is also rising. Last weekend, SOL Strategies announced it had secured approval to uplist to the Nasdaq under the ticker STKE, a milestone for the Solana-focused firm that has surpassed CAD $1 billion in delegated assets and holds a treasury of nearly 400,000 SOL. Meanwhile, South Korea’s Financial Services Commission unveiled sweeping lending rules on September 5th, 2025, capping interest rates, banning overcollateralised loans, and restricting eligible tokens to top-tier assets, underscoring a proactive push to safeguard investors and stabilise domestic markets.

The post appeared first on Bitfinex blog.