This resilience is drawing attention to Bitcoin’s evolving role as a macro-sensitive, conviction-driven asset that now trades more in line with global liquidity flows than retail sentiment. Notably, Metaplanet’s $104 million accumulation of Bitcoin, and Michigan’s proposed crypto-friendly legislation further validate the narrative of growing institutional and policy-level support for digital assets.

Looking ahead, Bitcoin’s ability to continue to consolidate above its short-term holder cost basis around $95,000 remains key. With over $11.4 billion in short-term holder profits realised in the past month, near-term supply overhang is expected—but so is structural demand. ETF bid strength, low volatility, and spot premium all suggest a maturing market poised for eventual continuation once macro clarity improves. The coming weeks will likely determine whether Bitcoin’s latest breakout was a local high or the prelude to a more aggressive leg higher in Q3.

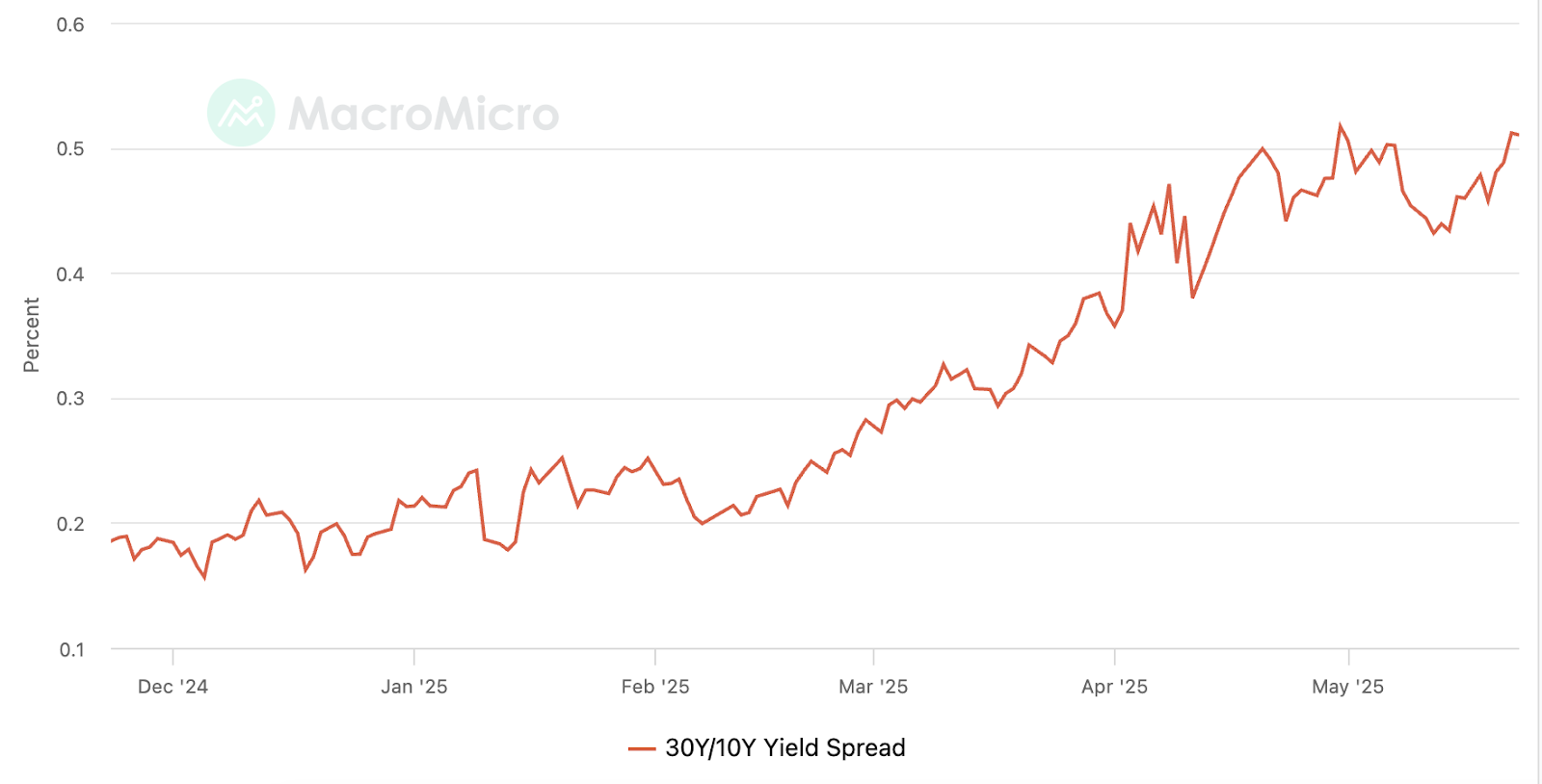

In the meantime, the US faces growing financial strain as long-term Treasury yields surge and the dollar weakens amid credit downgrades, rising debt, and looming tariffs. Investor confidence is shaken, with yields on 10-year and 30-year bonds surpassing 4.5 and 5 percent, reflecting scepticism over fiscal discipline and inflation risks.

The steepening 30Y/10Y yield curve, typically a growth signal, now reflects fears over long-term risk—not optimism. With foreign demand weakening and Fed support of the bond market fading, markets are pricing in a new era of higher rates and volatility. The bond market is no longer reacting to headlines—it’s warning of a structural shift in how risk is priced.

Last week, both institutional adoption and regulatory momentum advanced on multiple fronts. Publicly listed firms Strategy, Metaplanet, and Semler Scientific collectively acquired over 8,800 BTC, reinforcing Bitcoin’s role as a strategic treasury asset. Strategy now holds more than 2.7 percent of Bitcoin’s total supply, highlighting a growing trend among corporations to treat BTC as a long-term reserve in times of economic uncertainty.On the adoption front, FIFA announced it is building its own blockchain on Avalanche, shifting from previous partners Algorand and Polygon. The new EVM-compatible network will make it easier for developers and fans to access digital collectibles, positioning FIFA to scale its Web3 ambitions.

The post appeared first on Bitfinex blog.