Before buying a car, you would consider factors such as the history of the brand, safety features, and etc. And finally, test drive to see if the vehicle is a good fit for you. Ultimately, you want to know whether it is worth your money. The same principle extends to trading. So what exactly is backtesting?

What is backtesting?

Simply put, backtesting is a process of evaluating a trading strategy based on historical prices. Suppose you want to backtest how a simple moving average crossover strategy would perform on Bitcoin. To do so, you would need to gather Bitcoin's historical data and test the strategy's parameters. The backtest would assess which lengths of moving averages produce the best results based on Bitcoin's historical performance.

How Backtesting Works

Traders use backtesting as a means of evaluating and comparing different trading strategies without risking capital. If a backtest shows promising results, traders may have the confidence to deploy the tested strategy in real-time. While the market never moves precisely the same, backtesting relies on the assumption that markets move in similar patterns as they did historically.

A successful backtest is typically evaluated for two key objectives: overall profitability and the amount of risk taken. A backtest should also consider all trading costs, however insignificant. These can add up throughout the backtesting period and have a significant impact on a strategy's performance. Thus, traders should ensure that their backtesting software accounts for these costs.

4 Essentials of Backtesting in Crypto Futures Markets

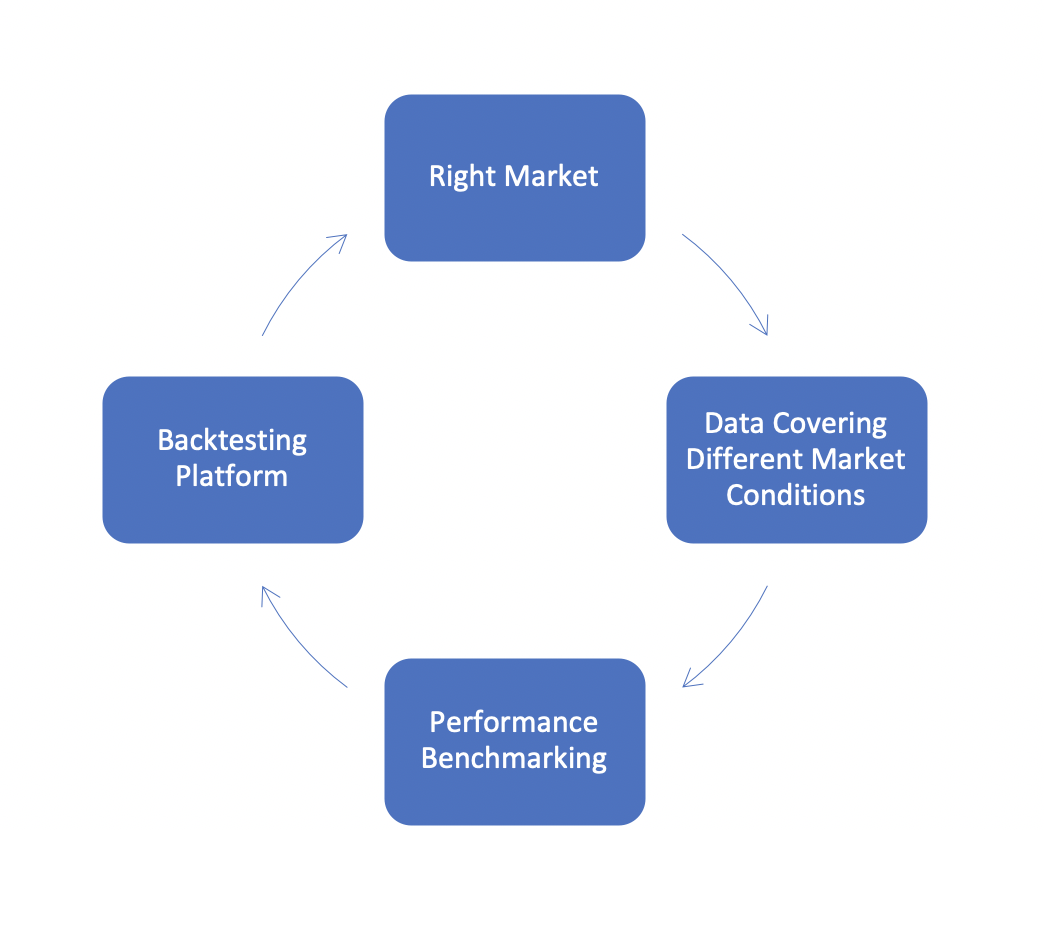

1. Picking the right futures market - Binance offers a vast selection of crypto futures contracts, each with varying characteristics. Certain crypto assets experience higher volatility than others but can produce higher returns and vice versa. Two assets with varying degrees of volatility will produce different backtest results. Therefore, you must ensure that your strategy's parameters match the crypto asset's underlying characteristics.

2. Historical data covering different market conditions - Market factors and major announcements often dictate the price of cryptocurrencies, including protocol upgrades, strategic partnerships, and even macroeconomic trends. This means market movements can be unpredictable and will not always behave in the same way. For instance, a backtest during the dramatic crash in March would yield different results to a backtest in a bull market today. As such, traders need to assess trading strategies under various market conditions to understand how they perform.

3. Backtesting platform - Many platforms provide the functionality to perform backtesting on historical data. Choose a platform that supports the markets you want to trade in and study the sources of market data it supports. Most backtesting platforms require users to have a basic knowledge of programming to code a backtest. Therefore, you must familiarize yourself with the native programming languages that are used on each platform.

4. Benchmark performance - Results from backtests should be assessed based on key performance metrics such as maximum profit vs. maximum drawdown, win/loss ratios, Sharpe ratio, etc. This enables you to compare one backtested strategy with another.

What do you need to begin backtesting?

Backtesting software - There is plenty of backtesting software available on the internet. Some software is free to use but with limited capacity for backtesting. On the other hand, some software is paid but offers comprehensive and advanced features to support complex trading strategies.

Historical data - Historical data is a critical component of backtesting, which can be used to simulate varying market conditions at different points in time. Historical data is divided into two types: Tick data and Order-book data.

What is Tick Data? What is it used for?

Tick data refers to market data that shows the price and volume of every print. In crypto markets, professional traders use crypto futures tick data to analyze trading activity at its most detailed level. This means tick data displays each trade as it happens. Hence, transactions that occurred in a fraction of a second would be recorded and aggregated for analysis. Crypto futures tick data contains various useful information about each trade and the crypto futures market as a whole.

When tick data is incorporated into backtesting a strategy, it can realistically simulate market participants' buying and selling activities. Analyzing tick data may provide insights into trading behaviors that are usually not shown in a price chart. For example, large-volume trades may represent institutional investors, while small-volume trades may indicate retail-trading activity. Tick data can also be used as leading indicators for short-term price movements. For example, constant buying or selling activity within a narrow price range is often a precursor to a technical breakout of resistance or support levels.

What is Order-book Data? What is it used for?

Order-book data contains all outstanding buy or sell orders for a futures contract, organized by price level. The order-book shows the depth of liquidity there is in a particular market. Market liquidity is essential for high-frequency traders as it impacts transaction costs.

Order-book data is often used to better identify latency and slippage, thereby enhancing trading and operational performance. Order-book data shows the level of market liquidity present at any given time. A market that lacks liquidity will cause slippages and increase transaction costs. Additionally, it can be used to analyze slippage patterns at specific periods, especially in lull markets.

Getting Historical Data on Crypto Futures

If you're looking for historical data on Bitcoin Futures, you can use the Binance Futures Historical Data service to find your need.

Binance's Historical Data service provides an extensive collection of crypto futures historical data for all contracts, enabling you to backtest and optimize trading strategies. Users can access real-time and historical market data on all crypto derivatives products listed on the exchange.

With the Historical Data service, you will have access to all raw data, including tick data on both USDT- and Coin-Margined contracts and order-book snapshots on Bitcoin futures contracts. We provide derivatives data aggregations, including Candle data (via API), funding rate history, open interest, and trade volume for futures and perpetual futures contracts across multiple time periods.

Binance Futures Historical Data Service is now available on USDT- & Coin-Margined contracts. For access, click on the link below to register!