Crypto Trading 101 | What Is Dollar Cost Averaging (DCA)?

An overview of what DCA strategy is and its relevance to the cryptocurrency industry.

Day trading in cryptocurrencies can be intimidating for new and seasoned traders alike. The market’s extreme volatility demands time, research, and holds significant risks.

For those seeking a simpler, less stressful approach to investing, Dollar-cost averaging or DCA is a powerful solution. By investing small, fixed amounts over regular intervals, DCA minimizes risk while building wealth over time.

What Is Dollar-Cost Averaging?

Dollar-cost averaging, also called a ‘constant dollar plan’, refers to an investment strategy where an individual invests a fixed amount of money at regular intervals, regardless of the asset’s current price. This plan benefits investors by eliminating emotion-based actions associated with market fluctuations.

Using the dollar-cost averaging approach, a trader can navigate price volatility by distributing purchases across predetermined periods of time.

Rather than throwing a significant amount of investment into an asset class, an investor opts to invest a predetermined amount weekly, monthly, or even on a semi-monthly basis, undeterred by any changes in price.

How Does DCA Investing Work?

DCA works by dividing your total investment into smaller, consistent contributions made weekly, monthly, or semi-monthly. This way, you acquire more units of an asset when prices are low and fewer units when prices are high. Over time, this balances out the cost of your investments.

The first step with dollar-cost averaging is to determine the total amount of money you are willing to invest in a given asset. Instead of investing the whole amount simultaneously, you need to spread that amount over a length of time.

These regular investments can either be manual or through mediums such as 401(k) plans that can automatically do it for you. After initiating this plan, purchases happen automatically heedless of any changes in the market value of the crypto asset.

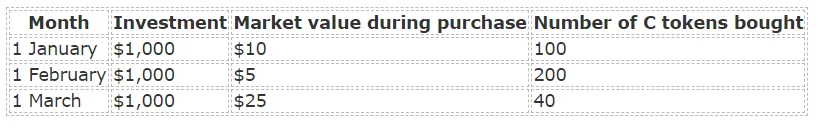

For example, let’s assume that you are planning to invest a total of $3,000 spread across a period of 3 months on ‘C’ tokens. That means that every month you will need to purchase ‘C’ tokens worth $1,000. Furthermore, the price of ‘C’ tokens is constantly fluctuating, which means that your $1,000 will buy a varied number of ‘C’ tokens every month.

Assume the price of C token in January was $10, and you managed to buy 100 C tokens. The following month, the market value of C coins plunged to $5, and you managed to purchase 200 C coins with your $1,000. The next month the market price of C rallies to $25, meaning that you bought 40 C coins.

Now, if we were just looking at a table, it’s obvious in hindsight that February would have been the most favorable month to buy and invest the entire $3,000. However, timing the market this precisely is nearly impossible due to its unpredictable nature. While February might appear ideal after the fact, it’s important to remember that such opportunities are only clear in retrospect.

By using DCA, you remove the pressure and risk of trying to identify the "perfect" time to invest. Instead, you gradually build your position over time, reducing the impact of volatility. This approach ensures you’re not caught in the trap of waiting for a dip that might not come or making emotional decisions during market surges.

Over the long term, the consistent contributions of DCA help smooth out the highs and lows of the market, creating a more stable and potentially profitable investment journey.

Is DCA Feasible for Cryptocurrencies?

Dollar-cost averaging is a suitable investment strategy for any volatile asset class. When it comes to price volatility, cryptos like Bitcoin Ethereum certainly fit the bill. It is difficult to foretell the prospects of price movements, but buying dips frequently can be highly profitable.

Across the crypto industry, the general consensus is that DCA is generally a much safer investment decision than investing a lump sum.

Bottom line, DCA is a powerful investment approach, particularly for novice investors and those unwilling to bother themselves with frequent technical analysis. Moreover, with its large price fluctuations and the potential for expansion in the future, HODLing cryptos remains a profitable investment method.

Benefits of Dollar-Cost Averaging

Mitigates Timing Risk: Markets are unpredictable, especially in crypto. DCA eliminates the need to time the market perfectly.

Reduces Emotional Decisions: Fear and greed often drive poor trading decisions. DCA helps you stick to a consistent plan.

Affordable and Flexible: Not everyone can invest large sums at once. DCA allows investors to allocate manageable amounts periodically.

Leverages Market Volatility: By investing during market dips, DCA enhances long-term profitability.

How to Apply Dollar-Cost Averaging

Steps to Get Started with DCA

Define Your Budget: Determine how much money you can consistently allocate toward investments.

Choose Your Asset: Select the cryptocurrency you want to invest in based on your research.

Set a Schedule: Decide on regular intervals for your investments (e.g., weekly, bi-weekly, or monthly).

Automate Your Investments: Use platforms or apps that support automated purchases for convenience.

Start Automating Your DCA Strategy with Cryptohopper

Dollar-cost averaging is a tried-and-true investment strategy for navigating the unpredictable world of cryptocurrency trading. Whether you're a novice trader or an experienced investor, DCA investing helps you manage risk and avoid emotional decisions.

Take the guesswork out of your crypto investments by using Cryptohopper to build your DCA investment strategy.

Get started with Cryptohopper today!