Common Mistakes to Avoid When Day Trading Crypto

For a time after Bitcoin’s inception in 2009, the world's first digital currency was primarily a niche product promulgated by a loyal online following.

Sure, Bitcoin was being traded on early crypto exchanges like the now-disgraced Mt. Gox, and some enthusiasts like Laszlo Hanyecz actually used Bitcoin as currency, but they were an aberration, not the norm.

In reality, Bitcoin was more of a digital collector’s item, like pogs or Pokémon cards, than it was a serious investment asset.

Oh, how things change.

Today, Bitcoin is one of the most famed investment vehicles around, competing, and often winning, against more established mechanisms like stocks, bonds, gold, and other commodities.

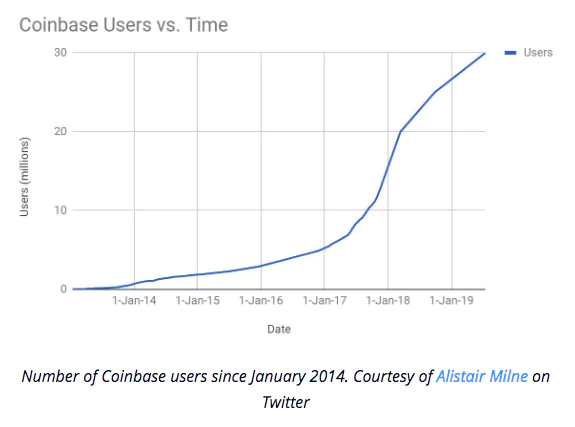

It’s incredibly prominent with near-unanimous name recognition, which has made it uniquely popular. For instance, prominent trading platform Coinbase added eight million users in the past twelve months.

Other institutions report similar growth, as cryptocurrency trading matures as an investment vehicle that feels like the most natural financial expression in the digital age.

That’s not to say that it’s without its troubles. Navigating this unique landscape can be tricky as crypto’s idiocracies and relatively novel ecosystem create a trading environment that demands intentionality and careful consideration.

Fortunately, by understanding the common mistakes that plague crypto day traders, new and experienced investors can put their best foot forward into this financial ecosystem that’s ripe with potential.

Letting Emotions Take the Wheel

Few communities are as replete with enthusiasm and despair as the crypto community.

It’s easy to see why. Digital currencies have soared in value and popularity in the past several years, but their journey hasn’t always been steady.

The sector is known for its volatility and wild, unexplainable price swings that have prompted its own industry parlance.

For instance, “FUD” an acronym for fear, uncertainty, and doubt, is intended to convey the sometimes erratic nature of digital assets. In addition, the term “HODL” a misspelling of “hold” encourages investors to white-knuckle their way through difficult seasons.

At the same time, it’s easy to be caught up in the “to the moon” ethos that often permeates cryptocurrency culture. With hundreds of new platforms promising transformative services, it can be difficult to tell the difference between a dud and an actual world-changing platform.

Consequently, FOMO (fear of missing out) too often drives investment decisions, something that only exacerbates volatility and makes investors personally liable for price movements.

Rather than relying on your emotions to dictate investment decisions, develop an investment strategy and, with few exceptions, stick with it.

To be sure, investors should continue to read the news, monitor the markets, and make intentional, strategic investment decisions.

However, fleeting feelings and momentary price movements make for a terrible investment strategy.

Instead, prioritize a long-term strategy over haphazard decision-making. This list of crypto trading do’s and don’ts is a helpful place to start when building a long-term strategy.

Underestimating Technological Capabilities

While the technological infrastructure supporting the cryptocurrency movement is quickly evolving to include comprehensive tools for individual investors and prominent tools from financial institutions, not all crypto products were developed with day trading in mind.

Day traders need to identify the technology that works best for them, this includes

Wallets that incorporate security while accounting for the fast-paced nature of day trading maneuvers.

Exchanges that provide advanced metrics and professional-grade tools to accommodate the unique needs of traders used to cutting-edge capabilities.

Software solutions that enhance the trading experience to accommodate for the burgeoning needs of crypto day traders.

At the same time, day traders are competing with high-frequency and automated trading operations that rely on powerful technology to execute complicated trading strategies. This approach accounts for hundreds of thousands of crypto trades each day, and they can create a chasm in the trading experience. Fortunately, there are affordable, easy-to-use platforms, like those provided by CryptoHopper, that can make this functionality a reality for all times of investors

Crypto day traders can compete with these operations, but they need to be aware of the environment, and they need to harness the best technology to appropriately address their goals.

To be sure, technology alone can’t make a cryptocurrency investment strategy successful, but investors can incorporate these things into their holistic pursuit of a successful investment strategy.

Getting in Too Far Too Fast

Like any investment vehicle, cryptocurrency investment carries inherent risks, and successful day traders will navigate these risks by accounting for the complete ecosystem.

First, and perhaps most obviously, the crypto space is clogged with projects with varying degrees of efficacy. For instance, cryptocurrency-related scams are big business, ccounting for $1.7 billion in losses in 2018.

As a result, choosing the right projects to include in your portfolio is a critical first step. When choosing, consider several components of a project, consider:

Does the team have experience running successful projects in the past?

Is there a realistic market for the platform’s product or service?

Is the community sizable and enthusiastic about the platform?

Can the platform’s technological components accomplish its stated goals and mission?

By evaluating crypto projects on their merits, you can avoid getting into a project too quickly or pursuing projects that are not worthy of your investment.

On the other hand, becoming over-reliant on a single asset, even a trustworthy one, exposes your portfolio unnecessarily volatility or other market movements.

Like any investment class, the crypto ecosystem is comprised of hundreds of projects with different purposes, ambitions, and long-term viability. Creating a differentiated portfolio comprised of currencies, stablecoins, utility tokens, and other delineations can help pursue profits while ensuring that all your proverbial eggs aren’t placed in a singular baske

To put it simply, be careful about determining your cryptocurrency investments.

Everything else, from strategy to technology falls into place when the right assets are selected. Cryptocurrencies represent a tremendous opportunity for investors. They just need to avoid the common mistakes first.

Check out our last blog: Crypto Exchanges: A look Under The Hood.