8 must read tips for new Cryptohopper users

Automatic trading is great because you can trade crypto 24/H a day without it affecting your day to day routine. Mr_Shiht_Coin put it in a funny way:

Here’s a few tips and tricks to get the most out of auto trading crypto with Cryptohopper.

Note: this is not trading advice, these are simply tips. Please create your own strategy, and, above all conduct your own research.

1) Select your coins wisely:

Every trader is usually busy with two types of coins. Coins they care about, and coins they believe other people care about.

In both cases, if their judgment is sound, they will have a good chance of profiting. Research your favorite coins thoroughly and subscribe to all the social channels to find new developments and partnership announcements which may drive their price up.

As for coins that other people care about, download apps like Blockfolio for on-the-go news, or go on TradingView and use the crypto screener to spot the best coins to buy and why- or of course, just subscribe to the “tradingview crypto screener” signaler to automate this process with cryptohopper.

2) If you’re using TA settings: Research your indicators!

Find out which indicators are best according to your specific market environments and your trading style.

Volatility indicators: if you want to make frequent, small gains you may be better off applying volatility indicators such as bollinger bands.

Trend indicators if you’re interested in long term investing (for coins you care about) you may be more interested in using trend indicators such as MACD and moving averages like SMA, EMA, KAMA. These all vary in different ways, so learn how to get the most out of them!

Volume indicators: Trade volume shows how heavily people have been investing in coins. So if you want to see if a coin is overbought or oversold, use momentum indicators (oscillators) such as Stoch, Stoch-RSI, RSI and more.

As you can see there are various completely different approaches to analysing a coin. It’s your job to find out which one is most applicable to your coins when trading with Advanced Multiple TA. If that’s too much work for you, subscribe to a signaler!

3) If you’re using TA settings: consider using more than one indicator (to play it safe).

Each indicator will tell you an optimum buy or sell moment, and only give your trading bot calls to action from what they measure. To ensure you’re not missing a big elephant in the room, it might be smart for your trading bot to consult more than one indicator at a time.

Take the screenshot below as an example. Having used both indicators helped you successfully make two highly profitable trades. If you had only used Stochastic, your trading bot would have bought (at the first oversold point) and then instantly sold the moment the first lines stuck above the purple bit, not buying again till much later.

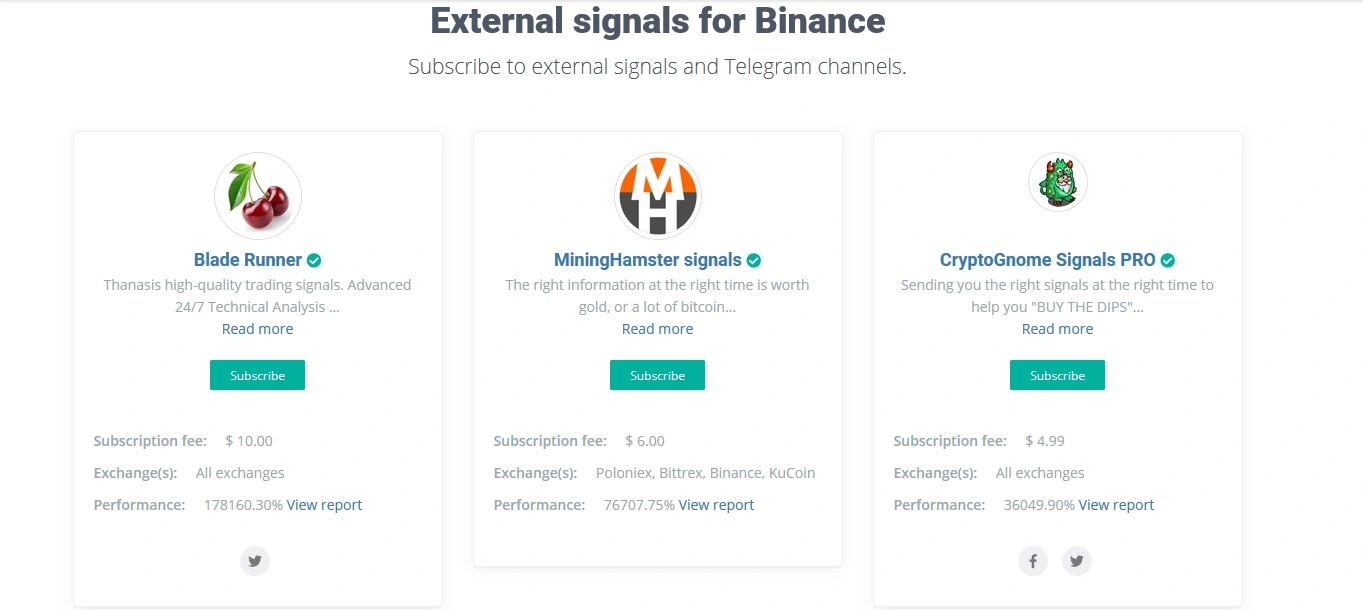

4) If you’re using a Signaler: Do your Research:

When subscribing to a signaler it may often feel like you really don’t need to do anything to be trading.

It may simply be as easy as connecting your trading bot to your exchange, clicking subscribe on a signaler and closing your laptop for the week; A little bit of time spent on researching your signaler however, can pay off very well. When choosing a signaler, don't forget to:

Check their realtime/past performance.

Check if they release signals to you quote currency, chosen coins and exchange.

Another thing you may want to do is Google the signalers. They often have their own website with info on how they work. Many are teams of highly capable analysts, using breakthrough tech to provide their signals.

Check blade runner Q and A for more info on this.

5) Get into the community!

Youtube - Cryptohopper has got some awesome youtubers talking about them like MiggityMiner, NerdyDudeStuff, LifeZoltar, Cryptopotluck, Crypto Gnome, The Crypto God, and many more. Their videos will often show screen recordings of how they’ve laid out their configurations and they post quite regularly.

Academy - You can even find a full lesson on Cryptohopper over here.

Discord - Join here to speak to experienced users who will be glad to provide trading tips. Cryptohopper employees cannot legally give any specific trading advice, but experienced users may be able to point you in the right direction!

6) Fire up some config pools

Trading crypto is like playing asteroids. Coins are bouncing all over the place, some heading up and some heading down, all at different speeds. Once you start getting to know the coins in your portfolio, you can set up specific indicators and actions for those coins.

You may be more interested in scalping some coins, while treating others as more of a long term investment. Config pools will let you do this!

7) Don’t be afraid to short

Plain and simple. Coins will decline and you can avoid the heaviest of bags if you short on time. Consider perhaps shorting half your bags, that way if the market dips lower than you expected, you’ve done the right thing.

Below, all of these positions have been better off since they were shorted. QKC has dropped 2.25% since you sold it, and must drop a further 13.79% for you to be able to buy it back with 0 loss to your initial investment in QKC. Alternatively, if you had HODL’d QKC, you would have been sitting on -18.29% bag.

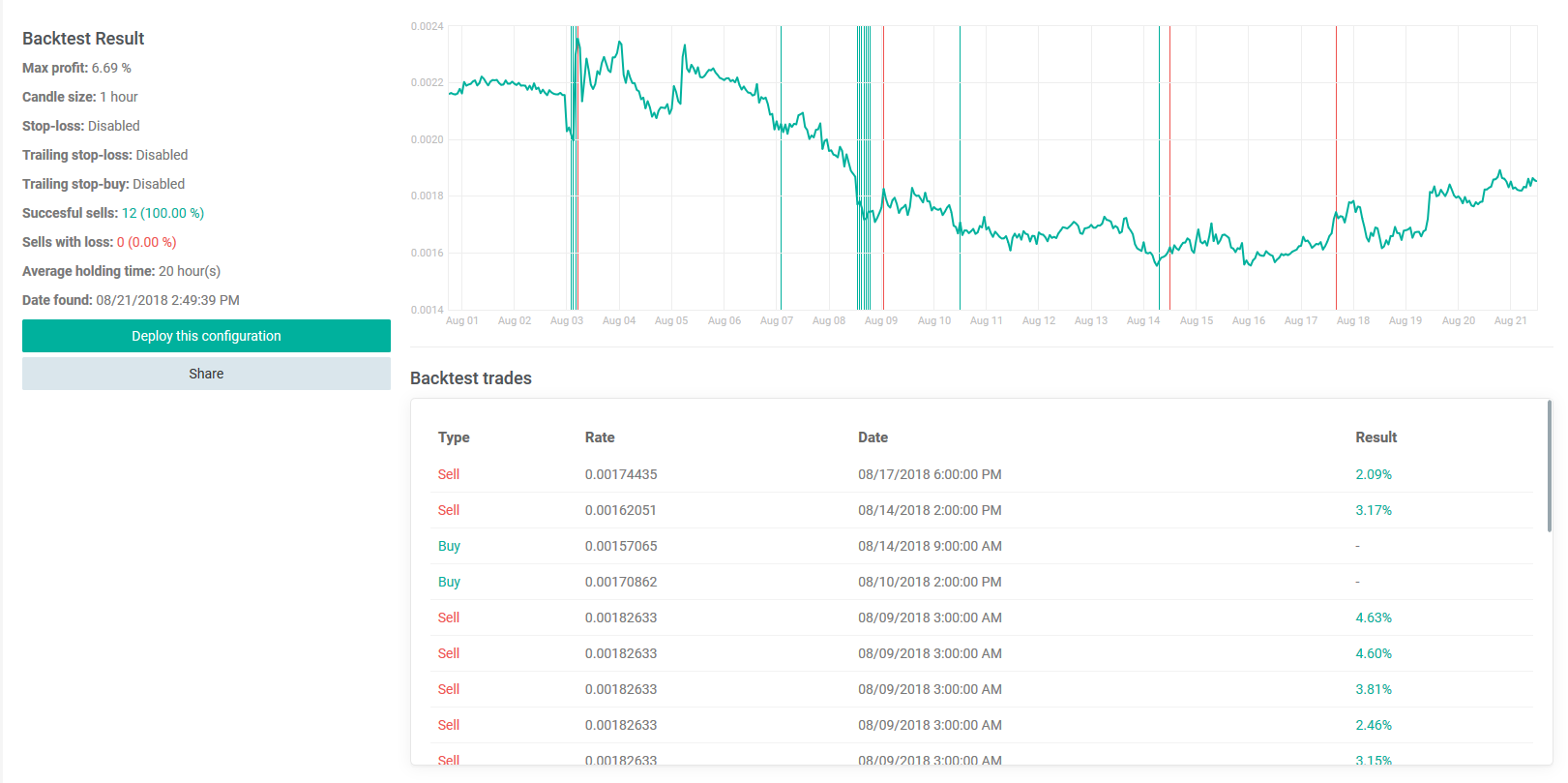

8) Backtest, Backtest, Backtest!

We say it three times because we can’t stress how important this is for TA traders. Before you use any configuration, backtest it. You’ll see an approximation of where you would have bought and sold if you had applied it.

Although you can’t predict the future, you absolutely can learn from the past. Here’s a backtest that looks just about ready to load into your config!