The key to winning in the stablecoin race lies in mastering distribution channels and transaction volume. With regulatory frameworks in the U.S. becoming increasingly clear, stablecoins are gradually emerging from the legal grey zone. Their use cases are expanding well beyond traditional trading platforms to include cross-border payments, trade settlements, and commodity financing. Beyond payment rails, stablecoins like Tether are now entering the realm of trade finance, evolving into on-chain banks. Tether, for instance, has issued $8.8 billion in loans, invested $14 billion in capital, and, together with other assets, amassed a total investment and lending portfolio of around $30 billion—particularly within the commodity sector. Tether is no longer merely a stablecoin issuer; it now operates in a hybrid model akin to a bank.

Interestingly, the Genius Act effectively ensures that non-bank-issued stablecoins cannot scale competitively within the U.S. market. The law explicitly prohibits tech giants like Meta from issuing their own stablecoins, mandating that they must partner with regulated banks or fintech firms. However, fintechs like Circle and smaller banks lack the federal liability guarantees that Too Big To Fail (TBTF) banks enjoy. These large banks, by issuing compliant stablecoins, unlock cost advantages and earn yield spreads from holding U.S. Treasuries as reserve assets. To support stablecoin issuance, TBTF banks are expected to purchase up to $6.8 trillion worth of T-bills—indirectly helping the U.S. Treasury refinance its debt, effectively acting as a form of “fiscal QE.”

Beyond monetary policy implications, stablecoin-driven capital arbitrage is also gaining attention. About a month ago, U.S. SEC Chairman Paul S. Atkins publicly signaled plans to ease regulations around Security Token Offerings (STOs), substantially simplifying compliance procedures. Public companies are beginning to explore licensed issuance, Real World Assets (RWAs), reverse mergers, and Web3 integrations to create new capital structures. Both legacy and crypto-native firms are actively seeking entry points, revealing significant entrepreneurial and investment opportunities.

HTX and TRON have taken the lead in deeply integrating stablecoins into the payment ecosystem, building an end-to-end solution that covers issuance, circulation, and real-world usage. HTX is the first global trading platform to list a compliant stablecoin, USD1. Leveraging TRON’s network—with over $80 billion in USDT circulation (more than 50% of the global supply)—HTX was the first to support USD1 deposits on TRON and opened trading pairs like USDT/USD1, enabling low-cost cross-chain settlements. Thanks to its high throughput (2,000 TPS) and ultra-low fees (~$0.001 per transaction), TRON has made USDT a core tool for cross-border and retail payments in emerging markets like Turkey and Argentina, processing over $21.5 billion in stablecoin transfers daily. Under Justin Sun’s leadership, a compliance framework featuring BitGo custody + monthly audits and a global 500,000 merchant expansion plan is rapidly bringing on-chain payments into real-world consumer scenarios.

This article serves as Part I of our stablecoin industry report, focusing on the latest regulatory shifts, competitive dynamics, and strategic execution models. In Part II, we will dive deeper into the beneficiaries and current developments within the stablecoin sector.

1.What Stage Is the Stablecoin Market In?

1.1 Current Moment: A Critical Window for Stablecoins to Enter Mainstream Payments

The stablecoin market is now at a pivotal moment—a phase of accelerated legalization and institutional adoption. In the past few years, stablecoins were primarily used in on-chain trading, DeFi mining, arbitrage, and other crypto-native “coin-to-coin” ecosystems. Growth in that early phase was heavily reliant on trading activity. However, this path has gradually reached its ceiling, and new growth must now come from real-world payment demand.

Since 2024, we’ve observed a clear trend: stablecoins are evolving from speculative instruments into payment infrastructure. Two forces are driving this transformation:

Deep involvement of traditional financial institutions, including Visa, Mastercard, Stripe, and PayPal, which are actively experimenting with on-chain settlement.

A noticeable shift in global regulatory posture, especially in the U.S. and Europe, where there is growing consensus around formal legislation.

We are at a historic moment akin to the internet in 1998—transitioning from experimentation to compliance, scale, and industrialization.

This marks the first stage of the “two-stage rocket” model: stablecoin adoption in real-world use cases like cross-border remittances, import/export settlement, and commodity financing, driven by major payment networks and banks. Tether has already entered the commodity trade finance space, using USDT as a capital flow tool and expanding rapidly. Though largely invisible to retail users, these applications are quietly reshaping the underlying structure of global capital flows.

1.2 TAM (Total Addressable Market): From $2 Trillion to a $10 Trillion Long-Term Goal

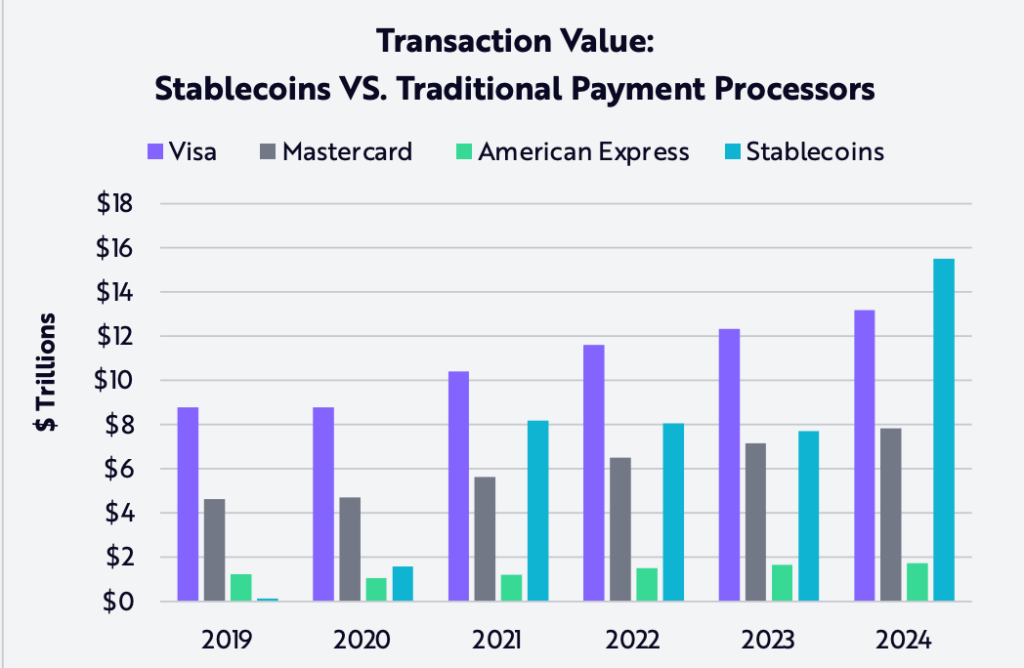

Today, the total market cap of stablecoins hovers around $140 billion, but in 2024 alone, on-chain stablecoin transaction volume reached $15.6 trillion, nearing the annual volume of Visa. Although much of this activity is centered around fund transfers and arbitrage, it clearly shows that the stablecoin system has already achieved infrastructure-level processing capabilities in payment and settlement.

Looking ahead, as Security Token Offerings (STOs) gain regulatory approval, the market is poised to enter its second stage—“tokenization of everything”: traditional financial assets such as bonds, funds, stocks, invoices, and trade receivables will increasingly be issued as on-chain tokens. Stablecoins will serve as the liquidity anchor and settlement layer for this new tokenized economy, enabling the absorption of settlement demand from the traditional financial system, which exceeds hundreds of trillions of dollars.

Michael Saylor once predicted that stablecoins could reach a $10 trillion market cap—a figure that may seem ambitious today, but entirely feasible if stablecoins become the base-layer dollars of the global financial internet. For perspective, the current size of global M1 (cash and commercial bank digital currency) ranges from $40–60 trillion. If stablecoins can take over even a portion of B2B and international settlement roles within that framework, $10 trillion in stablecoin value is no longer a fantasy—it’s a strategic inevitability.

1.3 Current Definition and Usage: From 2C to 2B – Real-World Integration Underway

Historically, stablecoins have been widely understood as “on-chain dollars,” primarily used for peer-to-peer transfers and token swaps among retail crypto users (2C). However, this segment is now highly saturated, with strong brand lock-in and high user acquisition costs for newcomers. In contrast, the real expansion opportunity lies in enterprise-level (2B) integration—embedding stablecoins into corporate accounting systems, B2B cross-border payments, payroll, supply chain financing, and reconciliation processes.

The key insight is that “payment infrastructure changes often occur invisibly in the backend”. Infrastructure providers like Bridge and BVNK, for instance, are partnering with companies like LianLian and Stripe to integrate stablecoin settlement into existing payment rails. When users swipe a card and see Visa or Apple Pay, they might not realize that behind the scenes, the transaction is settled instantly via USDC or USDT on-chain. This “backend replacement with a static frontend” approach significantly lowers go-to-market friction and bypasses the need for consumer education.

More importantly, B2B adoption tends to be resource exchange-driven, not a zero-sum battle for consumer mindshare. If a stablecoin issuer offers sufficient incentives or superior settlement features, enterprises are willing to collaborate. This explains why Circle spends heavily on promotional budgets each year, while Tether can charge a 10-basis-point API usage fee—stablecoin issuers with capital strength and strategic integrations enjoy stronger pricing power in enterprise markets.

1.3.1 Why Payments Are the True “Killer App” for Stablecoins

The current global payment system was built in the 20th century and is riddled with layers of intermediaries, friction points, and high fees. International remittance fees can reach 6–10%, B2B cross-border settlements take 3–7 days, and typically involve 4–5 intermediaries, with transaction costs running into tens of dollars per transfer. Structurally, this creates a regressive tax that disproportionately impacts developing countries and small businesses.

In contrast, stablecoins, as native digital currencies, offer disintermediation, programmability, and global interoperability. They can directly replace traditional settlement layers. Today, SpaceX uses USDT for capital repatriation in Argentina and Nigeria; ScaleAI pays its global team using stablecoins; and Stripe allows merchants to settle in USDC, cutting fees to half the cost of traditional card networks. These are not futuristic concepts—they’re already in commercial use today.

This marks the early realization of the “WhatsApp for Money” vision: just as WhatsApp disrupted paid international SMS, stablecoins are poised to disrupt global payments. What once cost 30 cents per international message is now free and instant. Similarly, the future of cross-border payments will move away from SWIFT and legacy banks toward a decentralized, blockchain-based “Internet of Value.”

1.3.2 Why Now Is the Best Time to Join the Stablecoin Race

We’re at a historic inflection point, where stablecoins are transitioning from gray-market trading instruments to compliant payment infrastructure. Regulation is shifting from suppression to strategic planning: the U.S., EU, Japan, and Hong Kong are all working on clear regulatory frameworks to bring stablecoins into the mainstream financial system. This shift is akin to TCP/IP’s evolution—from hacker protocol to global communications standard—a powerful signal of systemic change.

At the same time, on-chain infrastructure has matured. The rise of DeFi and cross-chain bridges has created efficient liquidity rails for stablecoin circulation. Enterprises are no longer asking “What coin is this?”—instead, they care about whether it reduces cost and improves efficiency. This opens up vast new markets for stablecoin issuers, infrastructure providers, payment gateways, and on-chain clearing protocols.

Policy is loosening, infrastructure is ready, and enterprises are experimenting. The stablecoin market is evolving from a “crypto tool” into the railroad of global money. Those building this infrastructure today will become the new foundational players of tomorrow’s financial system.

1.4. Why Payments Are the True “Killer App” for Stablecoins

Today’s global payment system is built on a 20th-century architecture, riddled with layers of intermediaries, transactional friction, and high costs. International remittances often incur fees of 6–10%, cross-border B2B settlements take 3–7 days, and a single transaction may pass through 4–5 intermediaries, costing tens of dollars. At its core, this structure acts as a regressive tax—placing the greatest burden on developing countries and small businesses.

Stablecoins, as native on-chain monetary systems, inherently offer disintermediation, programmability, and global interoperability. They can directly replace traditional clearing and settlement layers. Today, this isn’t a theoretical vision—it’s already in motion:

SpaceX uses USDT for capital repatriation in countries like Argentina and Nigeria;

ScaleAI pays its global workforce with stablecoins;

Stripe enables merchants to settle payments in USDC, with fees only half of those charged by traditional card networks.

These are not sci-fi scenarios—they’re real-world applications already deployed at scale.

This marks the emergence of a “WhatsApp for Money” vision: just as WhatsApp disrupted SMS by making cross-border communication instant and free, stablecoins are poised to do the same for global payments. What once cost 30 cents to send a message abroad now costs nothing—likewise, future cross-border payments will move from relying on SWIFT and bank intermediaries to a blockchain-based “Internet of Value.”

1.4.1 Why Now Is the Best Time to Join the Stablecoin Ecosystem

We are at a historical turning point, where stablecoins are transitioning from unregulated trading tools to compliant payment infrastructure. Global regulation is shifting from suppression to structured policy support: the U.S., EU, Japan, and Hong Kong are all formulating clear legal frameworks to integrate stablecoins into the mainstream financial system. This shift mirrors the early transition of TCP/IP—from a fringe hacker protocol to a globally adopted communications standard. It’s a massive signal of legitimacy and readiness.

Simultaneously, blockchain infrastructure is mature. The rise of DeFi and cross-chain bridges has provided efficient and scalable liquidity rails. Enterprises no longer care “what coin this is”—they care whether it reduces costs and improves efficiency. This shift in mindset unlocks massive opportunities for:

Stablecoin issuers,

Infrastructure providers,

Payment networks, and

On-chain settlement protocols.

Policy is loosening, infrastructure is ready, and enterprises are experimenting.

Stablecoins are evolving from a crypto-native utility into the global monetary rail of the future. Those who build in this cycle—who power the next generation of payments and settlements—will become core infrastructure players in the financial systems of tomorrow.

2. Current Regulatory Landscape of the Stablecoin Sector

In recent years, regions around the world have accelerated efforts to establish legislation and regulatory frameworks for stablecoins, resulting in a diverse and evolving global regulatory landscape.

The European Union has taken the lead with the implementation of the Markets in Crypto-Assets (MiCA) regulation, which introduces a passporting regime—”licensed in one country, recognized across all member states.” As of now, 14 stablecoin issuers and 39 crypto asset service providers have been granted licenses, including crypto-native firms like Coinbase, Kraken, and OKX, as well as traditional financial institutions such as BBVA, Clearstream, and fintech companies like N26 and eToro. This unified regulatory threshold, combined with strong enforcement mechanisms, is enabling a cohesive and cross-border-operable crypto market within the EU.

In contrast, Hong Kong has adopted a more cautious regulatory approach. The Hong Kong Monetary Authority (HKMA) is expected to implement a stablecoin issuer licensing regime starting August this year, with only a handful of licenses to be issued initially. The new regulations require 100% high-quality asset reserves, strict risk segregation, and explicitly prohibit the use of reserve assets for active investment purposes. While these measures enhance systemic stability, they also put pressure on the business model of issuers, whose returns mainly rely on interest from reserve assets and transaction fees. Given the current interest rate environment, annualized returns of just 1–3% may be insufficient to cover technology, compliance, and security costs.

To address this, Hong Kong regulators view stablecoins as a “clearing currency layer” in on-chain finance, encouraging their integration into broader ecosystems like payments, asset management, and credit services. In support of compliant innovation, regulatory sandbox mechanisms have been introduced. Notably, the Project Ensemble initiative by the HKMA is actively exploring tokenized applications for bonds, funds, carbon credits, and supply chain finance, marking a serious push into real-world asset (RWA) integration.

Regarding RMB-denominated stablecoins, several research bodies have proposed a “dual-track model” that coordinates onshore and offshore development:

Offshore issuance would be based in Hong Kong (e.g., CNHC), possibly initiated by joint ventures or authorized mainland institutions operating through Hong Kong legal entities.

Onshore issuance would be piloted in the Shanghai Free Trade Zone (e.g., CNYC).

Together, this model would create a dual RMB stablecoin system, enhancing the international usability and competitiveness of RMB assets in on-chain finance, cross-border settlements, and RWA scenarios. This approach advocates for top-down design led by China’s central financial regulators, coordinated with Hong Kong authorities, and supported by regulatory sandboxes and technical frameworks like geofencing for secure and testable deployment.

In the United States, a unified federal licensing framework has yet to be established. However, legislative progress on two major bills—the 2025 Digital Asset Market Clarity Act (CLARITY) and the GENIUS Act (Guarding the United States’ Innovation for National and Economic Security)—is bringing stablecoins closer to being formally integrated into the national payment and settlement system.

The CLARITY Act seeks to define digital asset categories and regulatory jurisdiction through a “bright line test,” likely classifying controversial assets such as XRP as commodities, thereby exempting them from SEC oversight and reducing compliance burdens.

The GENIUS Act outlines regulatory responsibilities based on issuer type:

Depository institution issuers are to be regulated by the Federal Reserve;

Non-bank issuers fall under the Office of the Comptroller of the Currency (OCC);

Issuers with market caps below $10 billion may still be overseen by state-level regulators.

This structure aims to embed stablecoin compliance into America’s broader digital financial infrastructure. Major players like Circle and Ripple are now actively pursuing federal trust bank charters, positioning themselves to directly access the Federal Reserve’s settlement systems and play a core role in the emerging “digital dollar” architecture.

2.1 Key Regulatory Focus Areas Across Jurisdictions

Despite differences in approach, stablecoin regulations across regions tend to focus on three core pillars:

Issuer Qualifications:

Requiring sufficient capital strength, robust risk management capabilities, and credible operational experience.

Value Stability & Reserve Management:

Mandating full (or over-) collateralization of stablecoins with high-quality liquid assets, along with regular audits and transparent public disclosures to ensure the safety and traceability of reserves.

Circulation Compliance:

Enforcing strong Anti-Money Laundering (AML) and Know-Your-Customer (KYC) policies to mitigate illicit use risks.

In the sections that follow, we will take a closer look at Hong Kong and the United States—two of the most influential regions—examining how their evolving regulatory frameworks are shaping the market and impacting industry players.

2.2 Hong Kong Stablecoin Regulatory Framework

2.2.1 Regulatory Timeline

January 2022: The Hong Kong Monetary Authority (HKMA) published a discussion paper on crypto-assets and stablecoins, initiating a preliminary exploration into the nature of stablecoins and potential regulatory frameworks.

December 2023: The HKMA, in collaboration with the Financial Services and the Treasury Bureau (FSTB), released a consultation paper proposing a legislative framework for regulating stablecoin issuers with a focus on issuer qualifications and investor protection.

March–July 2024: The HKMA launched a “Stablecoin Sandbox” initiative, providing a dedicated testing environment for stablecoin issuers. Companies like RD Technologies and JD Chain were among the first participants undergoing compliance trials.

December 2024: The Hong Kong government published the Stablecoin Bill in the official gazette and submitted it to the Legislative Council for its first reading on December 18. The bill is expected to pass by 2025 after completing all three readings in accordance with the legislative process.

2.2.2 Legal Text and Regulatory Authorities

The core document for Hong Kong’s stablecoin regulation is the Stablecoin Bill, published in December 2024. This bill establishes a regulatory system for stablecoin issuers, mainly enforced by the Hong Kong Monetary Authority (HKMA) and the Financial Secretary. Once the bill comes into effect, all activities involving the issuance of a clearly defined “designated stablecoin” within Hong Kong — including those issued outside Hong Kong but pegged to the Hong Kong dollar — will require a stablecoin issuance license from the HKMA.

2.2.3 Core Elements of the Regulatory Framework

Definition of Stablecoins:

Article 3 of the Stablecoin Bill broadly defines a stablecoin as a crypto asset that simultaneously possesses the following features: it is used as a store of value or unit of account, is accepted by the public as a medium of payment or investment, is deployed on a distributed ledger and electronically transferable and storable, and maintains price stability by referencing a single asset or a basket of assets [source] (as cited in the original text). More importantly, the bill clearly stipulates that only “designated stablecoins” meeting specific criteria are subject to regulation. According to Article 4, if a stablecoin maintains price stability solely by referencing one or more fiat currencies, it is classified as a “designated stablecoin” and falls under this bill’s regulatory scope. In other words, stablecoins pegged to a basket of assets (e.g., commodities or cryptocurrencies) are currently excluded; licensing requirements only apply to fiat-pegged 1:1 stablecoins.

Regulated Activities:

Under Article 5 of the Stablecoin Bill, issuing a designated stablecoin within Hong Kong, issuing a Hong Kong dollar–pegged designated stablecoin outside of Hong Kong, and actively promoting designated stablecoin-related activities to the public all constitute regulated activities. Institutions engaging in any of these must obtain a stablecoin issuance license from the HKMA in advance; otherwise, such operations are deemed illegal.

Issuer Qualification Requirements:

Institutions intending to engage in regulated stablecoin activities must meet stringent qualification standards. First, applicants must be legally incorporated entities — either companies registered in Hong Kong or eligible banking institutions registered outside Hong Kong. Second, applicants must have sufficient financial strength to fulfill payment obligations. Specifically, their paid-up capital must not be less than HKD 25 million, ensuring enough reserves to handle redemption pressures. Additionally, shareholders, directors, ultimate controllers, and senior management must all meet the fitness and propriety requirements set forth in the bill, demonstrating good credentials and integrity.

Stability Mechanism and Reserve Assets:

Once licensed, issuers must ensure that their designated stablecoins’ price stability mechanisms and reserve asset arrangements comply with legal requirements. Issuers must strictly segregate the reserve asset portfolio for designated stablecoins from other business assets to prevent misuse and ensure reserve asset independence. At all times, the market value of reserve assets must be equal to or greater than the circulating value of the designated stablecoins, thereby achieving full or over-reserving. This means issuers must hold sufficient highly liquid assets (e.g., cash, government bonds) to back their stablecoins. Furthermore, issuers must establish robust risk and reserve management systems and regularly disclose to the public their policies for managing reserve assets, risk assessments, asset composition, market values, and audit results, ensuring transparency and public oversight.

Compliance in Circulation:

According to the Stablecoin Bill, licensed institutions must develop sound risk and compliance management systems, particularly to comply with the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance of Hong Kong. These systems should effectively prevent risks of money laundering and terrorist financing associated with stablecoins. Additionally, every holder of a designated stablecoin has the right to redeem their holdings, and issuers are not permitted to impose unreasonable redemption conditions or fees. This ensures investors’ freedom to convert stablecoin assets. The bill also requires issuers to establish dedicated risk control policies for stablecoin business, addressing operational, legal, compliance, and technical risks.

Hong Kong’s Stablecoin Sandbox:

To promote compliant innovation in the industry, the HKMA has also launched a stablecoin sandbox program to provide testing environments and compliance guidance for issuers. As of now, initial sandbox approvals have been granted to Circle Technology, JD Chain, and Standard Chartered Bank. These institutions are expected to become among the first in Hong Kong to officially issue compliant stablecoins. Although they have not yet completed final issuance processes, the projects are expected to launch products meeting Hong Kong’s regulatory standards in 2025.

Through this regulatory design, Hong Kong’s stablecoin framework aims to enhance system security through high standards and guide the industry toward compliance-driven development.

2.3 U.S. Stablecoin Regulatory Framework

2.3.1 Regulatory Progress and Landscape

The United States has not yet established a unified federal licensing regime for stablecoins, resulting in a fragmented regulatory landscape. On one hand, Congress is advancing two key bills: the Guaranteed and Uniform Safe Transactions and Innovation for Digital Assets (GENIUS) Act and the Stablecoin Transparency and Accountability Act (STABLE Act). The former was introduced by Senator Bill Hagerty and passed the Senate on March 13, 2025, with an 18–6 vote. The latter, proposed by Representatives Bryan Steil and French Hill, passed the House Financial Services Committee on April 3, 2025 (32–17 vote) and awaits a full House or Senate vote. These two bills are not mutually exclusive but aim to clarify and complement each other in defining the regulatory framework for stablecoins. According to Bryan Steil, Chair of the House Digital Assets Subcommittee, the revised STABLE Act is now closely aligned with the Senate’s GENIUS Act, with only about 20% textual differences. These legislative efforts aim to clarify complex regulatory boundaries and incorporate stablecoins into the federal payments and clearing system.

On the other hand, existing federal agencies have independently staked claims over parts of the stablecoin market. Both the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have asserted regulatory authority over certain stablecoins. The SEC, citing structural similarities to money market funds, has previously sought to classify some stablecoins as securities. However, on June 28, 2024, the U.S. District Court for the District of Columbia ruled in favor of Binance, rejecting the SEC’s claim that BNBUSD (a stablecoin jointly issued by Paxos and Binance and regulated by the New York State Department of Financial Services) constituted a security. The ruling aligned with previous decisions that stablecoins pegged 1:1 to fiat currencies (like BUSD and USDC) do not meet the definition of an investment contract and thus fall outside the SEC’s jurisdiction. Meanwhile, the CFTC has long treated stablecoins as commodities. For example, it fined Tether USDT $41 million in 2023 for violations related to U.S. sanctions. Overall, the absence of a unified legal framework complicates compliance for stablecoin issuers and could pose risks to financial stability. Some industry experts argue that incorporating stablecoins into a bank-like regulatory framework could reduce systemic risk and provide clearer compliance guidance.

Notably, under the guiding principles of both the GENIUS and STABLE Acts, stablecoin issuers with a total market value exceeding $10 billion will be subject to federal regulation. Specifically, stablecoins issued by deposit-taking institutions will fall under Federal Reserve oversight; those issued by non-bank entities will be regulated by the Office of the Comptroller of the Currency (OCC); and issuers with under $10 billion in market value may still be regulated by state authorities. This dual system of federal and state regulation aims to build a more comprehensive and systematic regulatory regime for the U.S. stablecoin sector.

2.3.2 Core Framework for Stablecoin Regulation

Based on the latest draft of the STABLE Act, the U.S. regulatory framework for stablecoins can be summarized as follows:

Definition of Payment Stablecoins

A “payment stablecoin” is defined as a digital asset used for payments or settlements that meets all of the following criteria: Denominated in fiat currency; Issuer is obligated to redeem, repurchase, or exchange at a fixed nominal value; The asset is neither fiat currency itself nor a security issued by an investment company. In essence, regulation targets stablecoins pegged 1:1 to fiat currencies, primarily the U.S. dollar, and intended for payment use.

Issuer Eligibility Requirements

Only entities with regulatory approval are permitted to issue stablecoins. Recognized issuers include: Subsidiaries of FDIC-insured depository institutions; Federally approved non-bank stablecoin issuers; State-chartered issuers authorized by state regulators.

This framework ensures that both banks and finch firms must secure appropriate licenses before launching stablecoin operations. Notably, the GENIUS Act prohibits large technology companies like Meta from issuing their own stablecoins independently; they must partner with regulated financial institutions—effectively centralizing issuance authority within traditional finance.

Reserve Backing and Asset Requirements

Issuers must maintain 100% reserves to back circulating stablecoins at all times. Eligible reserve assets include: U.S. dollar cash; Deposits at the Federal Reserve; Demand deposits at FDIC-insured banks; 93-day U.S. Treasury bills; Qualified overnight repurchase agreements; Money market funds invested in such instruments.

Issuers are required to disclose reserve holdings monthly and engage independent registered auditors. Reports must include written attestations from both the CEO and CFO to certify the accuracy and completeness of disclosures. Furthermore, issuers must adhere to capital adequacy, liquidity requirements, and robust risk management standards, covering operational, compliance, IT, and cybersecurity risks.

Redemption and Compliance Obligations

Issuers must publish clear redemption policies to ensure that holders can redeem stablecoins promptly and without unreasonable barriers or fees. To prevent speculative misuse, the Act prohibits issuers from offering any form of interest or yield, thereby distinguishing stablecoins from interest-bearing products and preserving their utility strictly for payments and settlements.

Issuers must also implement compliance programs aligned with U.S. anti-money laundering (AML), customer identification (CIP), and sanctions laws. They must possess the technical capacity to enforce lawful actions such as freezing, burning, or blocking illicit transactions. In matters of national security, U.S. law enforcement and intelligence agencies may be granted exemptions from secondary market restrictions.

Regulation of Foreign Issuers

The STABLE Act seeks to bring foreign stablecoin issuers within regulatory oversight. Issuers aiming to operate in the U.S. must: Originate from jurisdictions with regulatory standards comparable to those of the U.S.; Register with the Office of the Comptroller of the Currency (OCC); Maintain adequate reserves in U.S. financial institutions to support domestic liquidity.

While critics argue that the rules are overly lenient toward foreign issuers—potentially disadvantaging U.S.-based firms—regulators maintain that these measures are vital to national financial security.

Through the above system, the new U.S. stablecoin regulatory framework clarifies key elements such as issuer qualifications, reserve requirements and compliance processes, significantly reducing the uncertainty caused by legal gaps in the past. It is foreseeable that these policies will force stablecoin issuers to turn to compliance paths, and stablecoins will gradually integrate into the mainstream financial system.

2.3.3 Impact on the Market and Industry

As stablecoin regulations become clearer, mainstream U.S. financial institutions are accelerating their entry into the stablecoin and crypto asset space, prompting a notable market response:

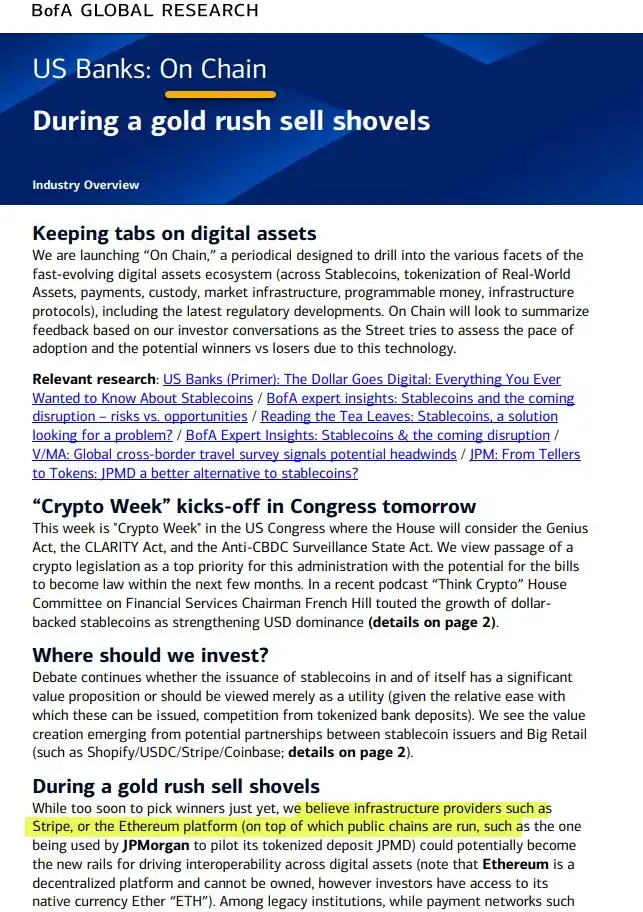

Banking sector embraces stablecoins: Major U.S. banks have shown strong interest in developing stablecoin products. For instance, Bank of America has publicly stated that it is actively preparing to launch stablecoins and is working with other institutions on solution design while continuing to await clearer regulatory guidance. CEO Brian Moynihan remarked, “Once the rules are clear, we’re ready to launch.”

Meanwhile, the bank’s crypto research team released an on-chain research report titled On Chain, which focuses on stablecoins, real-world assets (RWAs), and opportunities in payment settlement and infrastructure. The report also revealed that the bank is collaborating with major retail platforms such as Shopify, Coinbase, and Stripe to pilot stablecoin-based payment and transaction solutions.

Citibank’s strategic stance: Citibank has also identified stablecoins as a key pillar of the future global payments network, believing they can significantly lower the cost of cross-border payments and improve overall efficiency.

Traditional banks introduce crypto-native services:

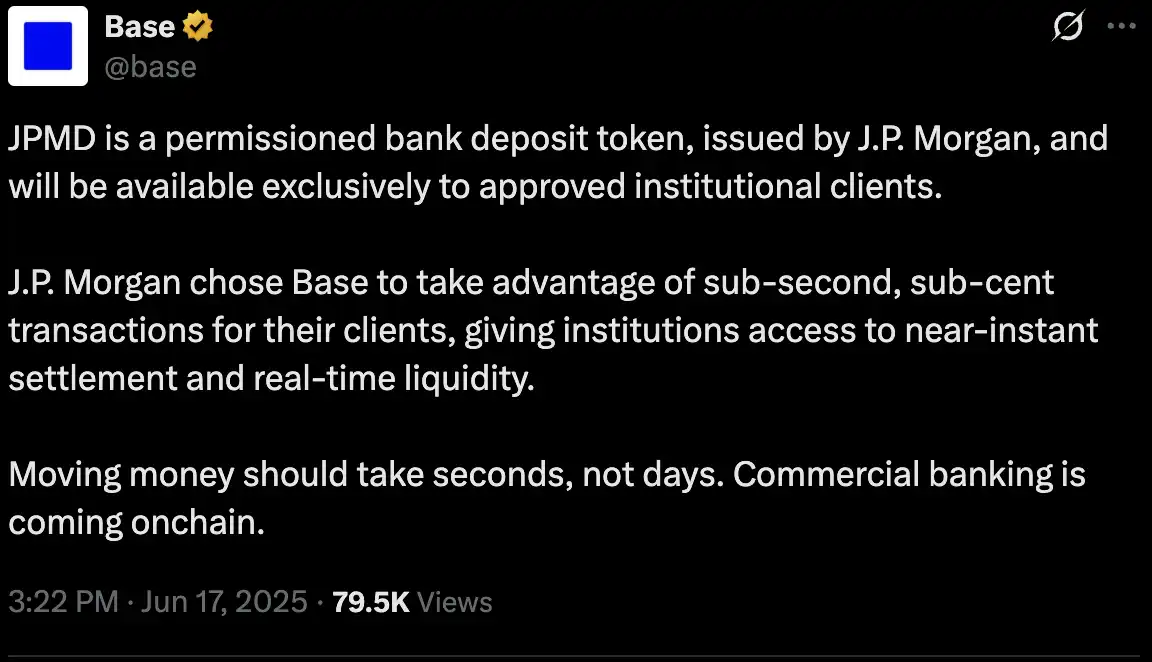

JPMorgan Chase has taken a leading role in digitizing bank deposits. On June 18, 2025, the bank announced a pilot program for a deposit token called “JPMD” (JPMorgan Dollar) on Base, a blockchain supported by Coinbase.

This licensed token is fully backed 1:1 by U.S. dollar deposits at JPMorgan Chase. It enables 24/7 real-time transfers with transaction fees as low as $0.01, while retaining the key features of traditional deposits, including FDIC insurance and interest-bearing treatment.

Initially, JPMD will only be available to institutional clients, with plans to expand access to a broader user base once regulatory approval is secured.

Naveen Mallela, JPMorgan’s Head of Blockchain, emphasized that this is not merely a gesture toward crypto, but a redefinition of banking itself—a landmark step toward the deep integration of traditional finance and decentralized systems.

Regulatory guidance on crypto custody services: On July 14, 2024, the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC) and the OCC jointly issued guidance that banks can provide digital asset (including cryptocurrencies) custody services to customers, but they must meet key management, asset screening, network security, audit supervision and risk control requirements. This is the first time that regulators have systematically clarified their expectations for banks to provide crypto custody services, indicating that crypto finance is gradually moving from the previous “gray experimental area” to a formal regulatory track. After this guidance was issued, major traditional banks have accelerated the deployment of crypto businesses. For example, Standard Chartered announced on July 15, 2024 that it will provide Bitcoin and Ethereum spot trading services to institutional clients in London, Hong Kong and Frankfurt. This is the world’s first systemically important bank (G-SIB) to provide crypto spot trading to institutional clients. The service hours are 5×24 hours a day, and it is connected with traditional foreign exchange trading platforms, allowing corporate customers and asset management institutions to directly trade cryptocurrencies without opening cross-border accounts. Rene Michau, head of Standard Chartered’s global digital assets, said that the company will expand to more crypto products in the future, including futures, structured products and non-deliverable contracts, and its business line will be completely aligned with crypto trading platforms. Other large banks such as JPMorgan Chase and Bank of America are also actively preparing cryptocurrency custody and trading services. 12 months ago, the outside world was still questioning whether JPMorgan Chase would custody Bitcoin, but now the question is “which bank will be the first to grab the largest market share?”

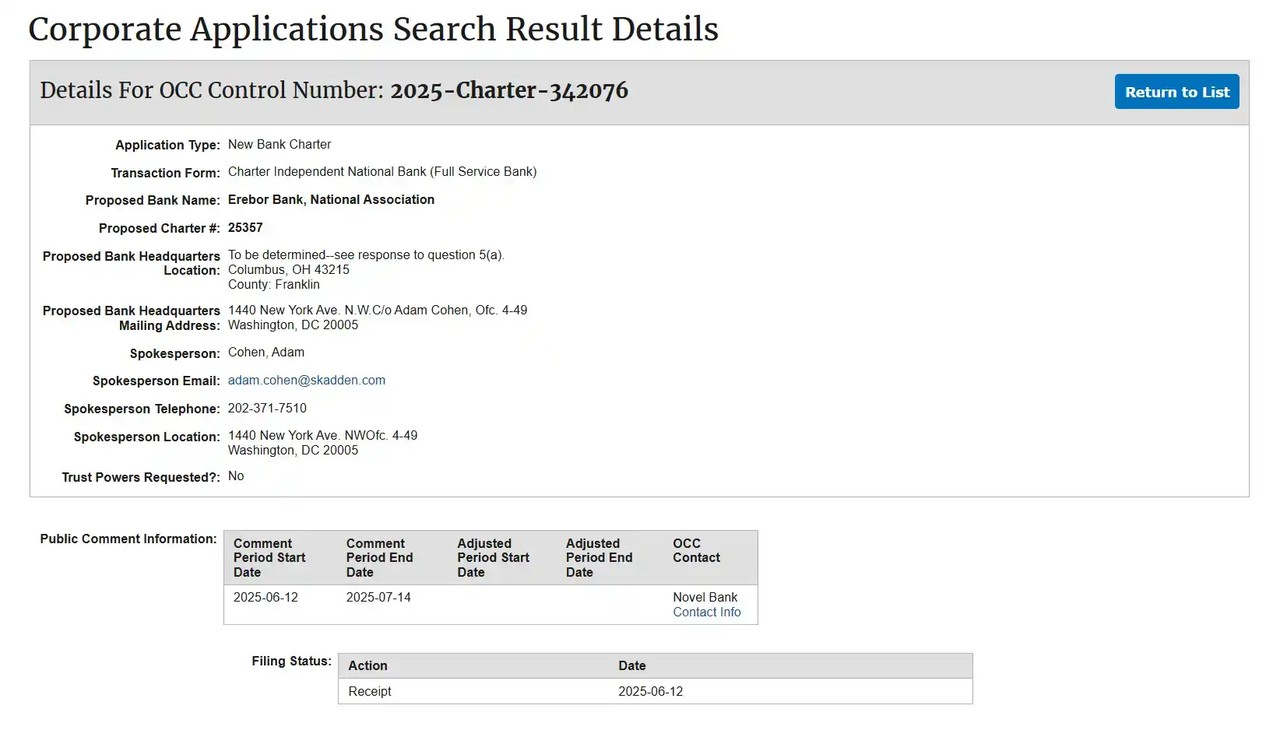

New banking institutions: In addition to traditional giants, “new-school banks” are also ready to move. Revolut, a new British fintech bank, is planning to apply for a US local banking license due to its considerable income from crypto trading, trying to enter the mainstream financial system directly. The innovative banking project “Erebor” led by Peter Thiel in the United States has also been put on the agenda. According to mainstream media reports in the United States, Peter Thiel and other technology giants such as Palmer Luckey (founder of Oculus) and Joe Lonsdale (co-founder of Palantir) jointly launched Erebor Bank and applied to the OCC for a national banking license. The bank is positioned to serve cryptocurrency, artificial intelligence, defense and manufacturing startups that traditional banks are reluctant to touch, aiming to become a “replacement” after the collapse of Silicon Valley Bank. According to the application documents submitted by the OCC, Founders Fund (Peter Thiel’s venture capital company) will participate in the investment as the main funder. The three founders will not participate in daily operations, but only participate in governance as directors, while the management will be served by former Circle consultants and former CEOs of compliance software company Aer Compliance, etc., to highlight its professional operations. Erebor’s business plan includes issuing 1:1 USD-backed deposit tokens and providing corporate clients with services such as stablecoin custody, minting and redemption. The goal is to create “the most fully regulated stablecoin trading institution” and provide clients with compliant fiat currency in and out channels and on-chain asset services. The bank explicitly proposed to implement a 1:1 deposit reserve system, control the loan-to-deposit ratio below 50%, and limit traditional mortgage loans to avoid maturity mismatch problems similar to Silicon Valley Bank. Since Erebor’s target customer base (crypto, AI, defense startups and their employees and investors) has previously had difficulty obtaining traditional banking services, the bank is expected to become the first “dollar transit bank” to compliantly custody mainstream stablecoins such as USDC and RLUSD.

Trust bank license and federal settlement requirements: With the gradual implementation of stablecoin laws, the industry is generally concerned about whether it can further integrate into the U.S. financial system by obtaining a National Trust Bank license and a Federal Reserve master account. The National Trust Bank license is one of the core federal-level bank licenses in the United States, allowing licensed institutions to operate across states and provide services such as institutional-level asset custody, digital currency custody, corporate trust and pension management (but not retail deposits), which is highly consistent with the needs of crypto custody business. At the same time, the license is issued by the OCC and can be directly connected to the Federal Reserve payment and clearing system, greatly improving capital liquidity and settlement efficiency. Anchorage Digital is the first crypto company to obtain this license: the company was founded in 2017 and focuses on digital asset custody services. On January 13, 2021, it was approved by the OCC to be established as a National Trust Bank, becoming the first federally certified crypto custody bank in US history. Anchorage’s example has greatly opened up the institutional-level digital asset custody market, providing services to financial giants such as BlackRock and Cantor Fitzgerald. However, since then, U.S. regulation has tightened and new applications have almost stagnated. Until the crypto-friendly OCC leadership team was re-appointed recently, the market generally expects that a new round of license application windows may have opened. Circle, Ripple and many other companies are also actively applying for federal trust bank licenses, and plan to directly apply for the Fed Master Account, in order to deposit stablecoin reserves directly in the Fed and use the central bank’s clearing system. These trends show that stablecoins are becoming a new “bridge” between traditional financial institutions and crypto institutions. In the future, as license approval progresses, stablecoins’ dollar reserves and clearing capabilities are expected to compete with mainstream financial giants on Wall Street.

In summary, the U.S. stablecoin compliance policy is moving from broad boundary exploration to a clear legal framework. This not only provides clear regulatory guidance for stablecoin issuers, but also promotes traditional banks and emerging technology banks to accelerate the layout of stablecoin business, opening a new chapter in the deep integration of the crypto asset market and the real financial market. In the future, with the implementation of regulatory policies, the application of stablecoins in payment and clearing, international settlement and on-chain finance will further expand, bringing far-reaching impacts to the market and industry.

3. How the Stablecoin Act Pushes Banks to Buy Treasury Bonds and Reshapes the U.S. Macro Market and Strategic Positioning

3.1 The U.S. fiscal situation is facing the dual pressures of debt rollover and deficit

The United States is currently facing severe fiscal and refinancing pressures. According to data from the Treasury Department, the United States has a fiscal deficit of about $2 trillion per year, and another $3.1 trillion in debt will mature in 2025. At the same time, major U.S. spending items (such as defense, health care, and interest payments) have not only not decreased, but have grown faster than GDP itself, meaning that the fiscal gap will continue to expand.

In the past, the Federal Reserve could provide financial relief through tools such as interest rate cuts and quantitative easing, but the space for these tools is becoming increasingly limited. As the reverse repurchase balance (RRP) is close to exhaustion and the U.S. Treasury yield curve continues to invert, the Ministry of Finance urgently needs a new stable source of financing.

3.2 Stablecoins become the “silent buyer” of the Treasury

In this context, the strategic significance of the Stablecoin Act began to emerge. Through legislation, the right to issue stablecoins was handed over to regulated banks, especially TBTF (Too Big to Fail) institutions such as JPMorgan Chase.

According to current regulatory requirements, stablecoin issuers can only allocate reserve assets to short-term U.S. Treasury bonds or cash-like assets. Therefore, every stablecoin issued is equivalent to injecting a long-term and stable demand for Treasury bonds into the market. In other words, stablecoins have become a new “silent buyer” in the hands of the Treasury Department, helping to complete the financing of huge Treasury bonds without raising interest rates.

3.3 Short-term Treasury bonds will become scarcer and more expensive

The rapid growth of stablecoins has also driven the scarcity trend of dollar-denominated assets. Short-term government bonds have long become the core collateral in the global financial system due to their security and liquidity.

As stablecoin issuers continue to absorb these assets, high-quality collateral in the market will become more scarce. This may have several major impacts: shortage of collateral in the repo market, rising costs of mortgage financing, and increased volatility in financial markets. In response to this change, the Treasury may have to expand the issuance of short-term Treasury bonds from $7 trillion to $10-14 trillion.

3.4 The Fed’s monetary policy tools face weakening

Stablecoins use a full reserve model, which is different from the “partial reserve” mechanism of traditional banks and cannot create credit based on user deposits. As stablecoins occupy an increasingly higher proportion of broad money (M2), the money multiplier of the banking system will continue to decline.

This directly weakens the Fed’s ability to regulate money supply and interest rates. Once the proportion of stablecoins in M2 rises from the current 1% to 10%–20%, the Fed’s traditional monetary policy transmission mechanism will face structural challenges, and its policy effectiveness will gradually be lost.

3.5 Stablecoins strengthen the global strategic position of the U.S. dollar

Although stablecoins may bring monetary regulation difficulties in China, their amplifying effect on the global influence of the U.S. dollar cannot be ignored. Stablecoins allow non-US users to hold U.S. dollars without a bank account, greatly improving the accessibility and programmability of the U.S. dollar.

For countries with weak financial infrastructure, stablecoins are a new engine for the internationalization of the U.S. dollar in the digital era, helping the United States further consolidate its global financial dominance. The prototype of the digital dollar is quietly taking shape in the stablecoin ecosystem.

In summary, the Stablecoin Act is not only a product of financial regulation, but also a part of the strategic power reorganization between the Treasury Department and the Federal Reserve in a macroeconomic environment of high debt and low space. It not only provides the Treasury Department with structural buyers of treasury bonds, but also opens up new sources of profit for banks, while shaping the new landscape of the U.S. dollar in the digital age.

Whoever controls the flow of stablecoins in the future will have control over the anchor of the monetary order. All of this has gradually made the market realize that the so-called dream of freedom of “decentralized finance” is being quietly taken over by institutionalized monetary sovereignty.

4. Channels are king: Comparison of the stablecoin track pattern and path under the two-stage rocket

4.1 Channels are king: the underlying logic of stablecoin issuance

The essence of stablecoins is not technological innovation or protocol design, but the reconstruction of the currency distribution network. The core issue of stablecoin issuance is not “whether it can be created” but “whether it can be used”. The key to making stablecoins widely used is: who can spread their own coins into the most channels, including exchanges, payment systems, corporate settlements, cross-border transfers and trade financing networks. In this sense, the competition between stablecoin project parties is not about algorithms, but about “channel capabilities of currency”. Whether it is a trading platform or a wallet application, early stablecoins rely on “promotion fees”: that is, the project party spends money to subsidize the platform and users to guide them to use their own coins. Although this model is mainly used in trading scenarios, as stablecoins enter the payment and financing fields, new channel expansion logic has begun to emerge – the project party may in turn subsidize banks, payment companies, supply chain companies, and even foreign governments or cross-border chambers of commerce to promote them to adopt a certain stablecoin as a cross-border payment or settlement currency. Therefore, the future of stablecoins does not depend on which model is more elegant, but on which issuer can master more “currency usage touchpoints”. In other words, whoever controls the channel has the currency power.

4.2 Two-stage rocket: the phased expansion path of stablecoins

From the perspective of the development path, the stablecoin market can be described as a “two-stage rocket”. The first stage is driven by traditional financial institutions, such as Visa, Mastercard, Stripe, PayPal and other global payment hubs, which are integrating stablecoins into their payment systems. This stage is dominated by payment and clearing, especially in cross-border settlement, trade payment, and commodity trading. Taking Tether as an example, it has been widely involved in commodity financing business. USDT is used as a financing and settlement tool in international commodity trade. This combination of “stablecoin + financing + trade” is extremely expansive. The second stage of the rocket depends on regulatory breakthroughs, especially the relaxation of the issuance threshold of security tokens (STO) by the U.S. SEC. Once the compliance barriers are opened, traditional financial assets such as bonds, funds, and stocks can be tokenized and circulated freely on the chain. Stablecoins will not only be a payment tool, but also a liquidity anchor and clearing asset for the entire on-chain financial system. This means that the future growth of stablecoins does not depend on the transaction scale within the crypto industry, but on whether it can become the main settlement asset across chains, cross-borders, and systems.

4.3 Competition landscape: Competitiveness vs. lending

The main players in the current stablecoin track are Tether and Circle, which represent the “lending faction” and the “compliance faction” respectively. Circle’s USDC has achieved almost 100% high-quality reserve reserves, fully complying with the regulatory requirements of the GENIUS Act. But its problem is that its business model is “too regular”: it lacks the ability to leverage capital, cannot invest, cannot lend, and can only rely on payment channels and platform cooperation to expand scenarios, and most of these cooperations rely on promotion fee subsidies. It is estimated that of the $61 billion in circulation of USDC at its peak, about 60% of its revenue was used to subsidize promotion fees, and the actual profit margin was extremely low. In contrast, although about 18% of Tether’s assets do not meet compliance standards (such as gold, BTC, and BitDeer equity), this part is precisely its main source of profit. Tether uses these funds for lending, investment and acquisitions, with a cumulative loan balance of $8.8 billion and a total foreign investment of more than $30 billion. It is currently the largest stablecoin fund pool in the Web3 field. More importantly, Tether is no longer a simple issuer, but an on-chain banking entity with industry penetration capabilities. Its growth strategy is not to “convince others to use USDT”, but to “use money to force the other party to use USDT”. Logically speaking, the party that can borrow money can always decide what currency to use to repay the money.

4.4 Bank model vs. payment company model: fundamental differences between capital-bound and subsidy-driven

The payment company model adopted by Circle is a path of “compliance-driven + subsidies for users”. This approach is safe under the regulatory framework, but it grows slowly, consumes a lot of capital, and cannot deeply bind the upstream and downstream of the industrial chain. It has no credit capacity, and does not allow its own funds to invest in risky assets. It can only passively harvest interest spreads of “high-quality reserves”. Under this structure, if it wants to promote the use of stablecoins, it must continue to pay fees to partners, and cannot form a self-circulating flywheel. Tether’s banking model is completely different. It has a huge capital pool and completely independent lending decision-making capabilities. It can not only enter physical enterprises as an investor, but also promote the mandatory use of stablecoins through loans. The key to this model is that in order to obtain financing, borrowers must use USDT settlement, and Tether uses this binding effect to turn stablecoins into the “only currency” in the financing scenario, completing the closed loop from capital input to use control. In the international market, especially in emerging countries and commodities, this model is extremely effective. Tether has taken a controlling stake in Argentine agricultural giant Adecoagro (70%) and has become the second largest shareholder of BitDeer (25.5%). It even has gold and BTC reserves, equity investments, and other layouts, completely building a “lending-payment-investment” trinity ecosystem.

4.5 Regulatory variables: Only the law can truly end Tether

The biggest risk of the Tether model at the moment is not technology or market competition, but whether the regulatory attitude completely penetrates the offshore structure. If the GENIUS Act or similar bills in the future set long-arm jurisdiction over offshore stablecoins and require penetrating audits, KYC compliance and asset disclosure, then Tether’s arbitrage space will be significantly reduced and the business path must be redesigned. However, if the bill only regulates the onshore issuance part and the offshore is still operable, then Tether can continue its dual-track operation strategy: on the one hand, launch a compliant version in the United States as a “face project”, and on the other hand, continue to rely on the offshore version of stablecoins to promote its main business globally. Tether’s “regulatory arbitrage” ability will continue to exist for a long time in the current environment of inconsistent global regulations. Unless the supervision is enforced and unified and has actual law enforcement capabilities, it will still be able to stay in the “comfort zone” in the offshore market.

5. Summarize

Summary: Stablecoins are reshaping the underlying structure of the global monetary order

Stablecoins are no longer “speculative tools” in the crypto-native world, but are evolving into the settlement backbone and policy tool of the global financial system. Extending from on-chain transaction matching to cross-border payments, bulk trade financing and tokenization of real-world assets (RWA), stablecoins are gradually replacing the old payment system built by SWIFT and intermediary banks, becoming a more efficient, transparent and inclusive “value Internet” infrastructure unit.

Changes in regulatory policies in various countries, especially the introduction of the US GENIUS Act and CLARITY Act, as well as the MiCA-level regulatory system in Hong Kong, indicate that stablecoins are moving from “technical experiments” to “institutional confirmation of rights”. These laws not only regulate the issuance access, reserve mechanism and circulation compliance of stablecoins, but also embed them into the implementation system of the central bank and fiscal policy. For example, stablecoins have become a source of structural demand for government bonds, indirectly promoting fiscal refinancing and changing the monetary policy transmission mechanism. Their fiscal and strategic significance far exceeds the payment tool itself.

In terms of the competition pattern, the “two-stage rocket” model is accelerating: the first stage is to promote the popularization of payment scenarios by accessing traditional payment networks, and the second stage will explode after the STO compliance, and stablecoins will become the clearing and liquidity infrastructure in the era of “everything on the chain”. The compliance path represented by Circle focuses on stability and institutional docking, while Tether creates an on-chain banking ecosystem through lending and industry binding. The two correspond to the two stablecoin paradigms dominated by “institutional credit” and “capital power”.

In the end, what we see is not the victory of a certain issuer, but the popularization of stablecoins themselves as the “on-chain dollar operating system”. Whoever can control the distribution channels and penetrate the payment touchpoints in the real world can reconstruct the right to issue currency. In the next ten years, stablecoins will deeply penetrate into B2B cross-border payments, government settlements, trade financing, salary systems, RWA transactions and other scenarios, and gradually replace part of the M1 and M2 systems to reconstruct the foundation of the global monetary order. The three forces of supervision, technology and capital are working together to promote this historic transformation, and now is the best window period to build the next financial infrastructure giant.

About HTX Research

HTX Research is the dedicated research arm of HTX Group, responsible for conducting in-depth analyses, producing comprehensive reports, and delivering expert evaluations across a broad spectrum of topics, including cryptocurrency, blockchain technology, and emerging market trends. Committed to providing data-driven insights and strategic foresight, HTX Research plays a pivotal role in shaping industry perspectives and supporting informed decision-making within the digital asset space. Through rigorous research methodologies and cutting-edge analytics, HTX Research remains at the forefront of innovation, driving thought leadership and fostering a deeper understanding of evolving market dynamics.

Connect with HTX Research Team: [email protected]

References

https://www.theblockbeats.info/news/58988

https://www.theblockbeats.info/news/58240

https://www.theblockbeats.info/news/58075

https://www.theblockbeats.info/news/58244

https://www.theblockbeats.info/news/58252

https://www.theblockbeats.info/news/58321

The post first appeared on HTX Square.