There are many different futures markets to trade and at Binance, we offer futures trading through two flagship products: Perpetual Futures, and Quarterly Futures.

A common question we receive from users is, what are the differences between the two products and what are the key features that distinguish them.

In this article, we will dive down into the differences between the two futures contracts and get to know the different products you can trade, so you can find new ways to diversify.

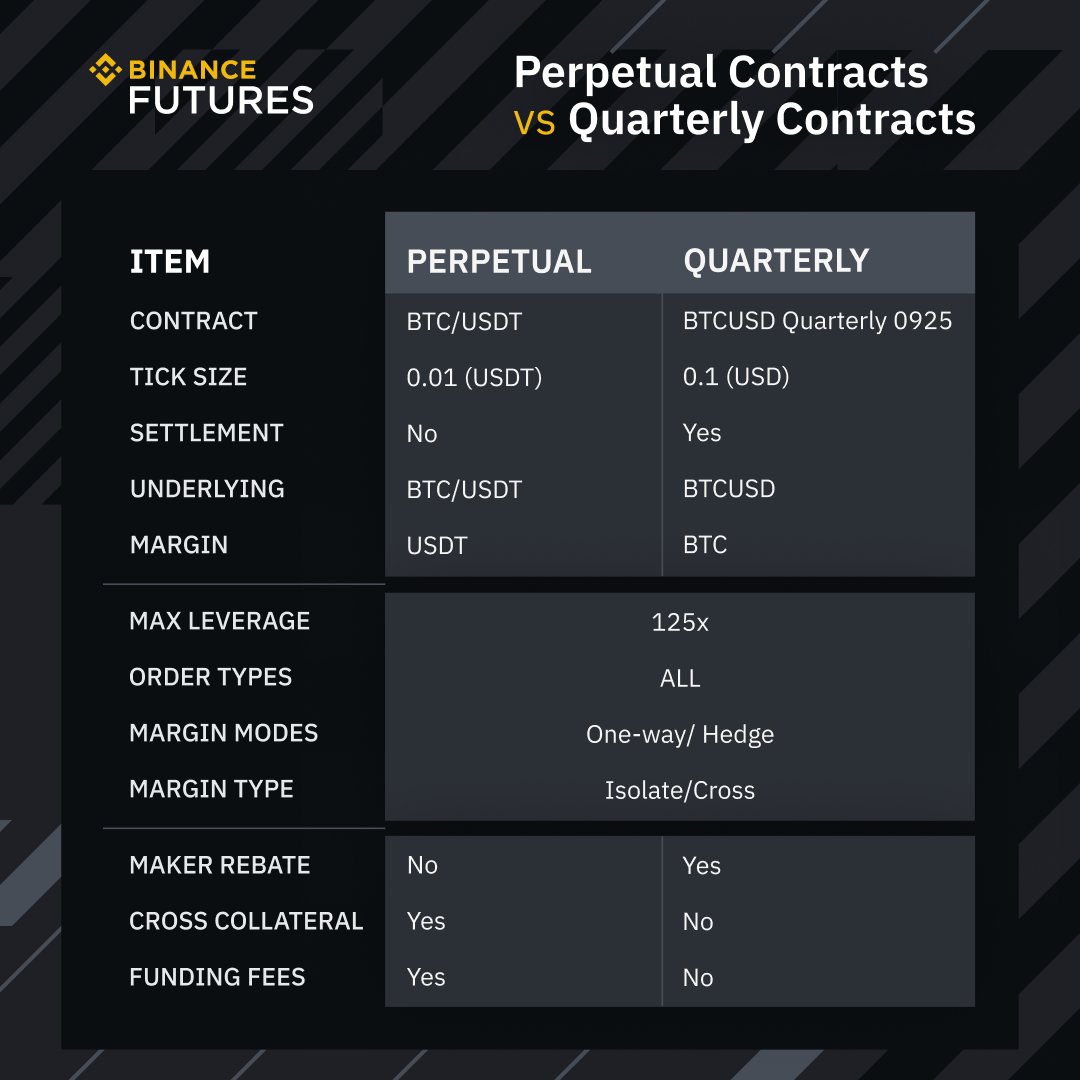

First of all, let’s compare the contract specifications of the two products.

More information can be found on our FAQs and guides.

1. Expiration

A traditional futures contract allows a trader to buy or sell the underlying asset at a predetermined price before a specified period. In other words, futures contracts have a limited lifespan and they will expire based on their respective calendar cycle. For instance, our BTC 0925 is a quarterly futures contract that will expire 3 months upon the date of issuance.

On the other hand, perpetual futures, as the name suggests, does not have an expiration date. Therefore, traders do not need to keep track of various delivery months, unlike traditional futures contracts. For instance, a trader can keep a short position to perpetuity, unless he gets liquidated.

As a trader, you need to be aware of the various expiration dates as this influences your exit strategy. There are two expiration related terms that you need to understand before you get started. These terms are Expiration date and Rollover.

Expiration date is the last day a trader can trade the contract. For instance, BTCUSD 0925 quarterly contracts will expire on the 25th of September, while BTCUSD 1225 will expire on the 25th of December. Prior to expiration, a trader has three options:

Close the position before expiry

Rollover from front month to a further-out month

Let the contract expire and settle.

2. Rollover

As perpetual contracts do not expire, there is no requirement for users to ‘rollover’ their positions to the next calendar contract. Rollover refers to the transition from the front-month contract that is close to expiration, to another contract in a further-out month. They are rolled over to a different month to avoid the costs and obligations associated with the settlement of the contracts.

How do traders rollover futures contracts?

To roll-over a futures contract, one can simply sell his or her front-month contract, and buy against another contract in a further-out month. For example, if you are long 10 contracts of BTCUSD September, you will sell 10 September contracts and simultaneously buy 10 December contracts.

Traders will determine when they need to move to a new contract by watching the volume of both the expiring contract and the further-out month contract. Typically, volume on the expiring contract will decline as it approaches the expiration date.

A trader may rollover any time before the expiry but it is best advised to rollover a few days ahead of the expiry date as market liquidity will decline drastically as traders move over to a new contract. This effect results in larger spreads and may lead to slippages.

3. Funding fee

Unlike perpetual futures, quarterly contracts do not carry a funding fee. This is favorable to long-term position traders and hedgers as funding fees may fluctuate over time. Especially as in extreme market conditions, high funding fees can be costly to maintain a long-term position in the market. Additionally, funding calculations consider the amount of leverage used, which may have a big impact on one’s profits and losses.

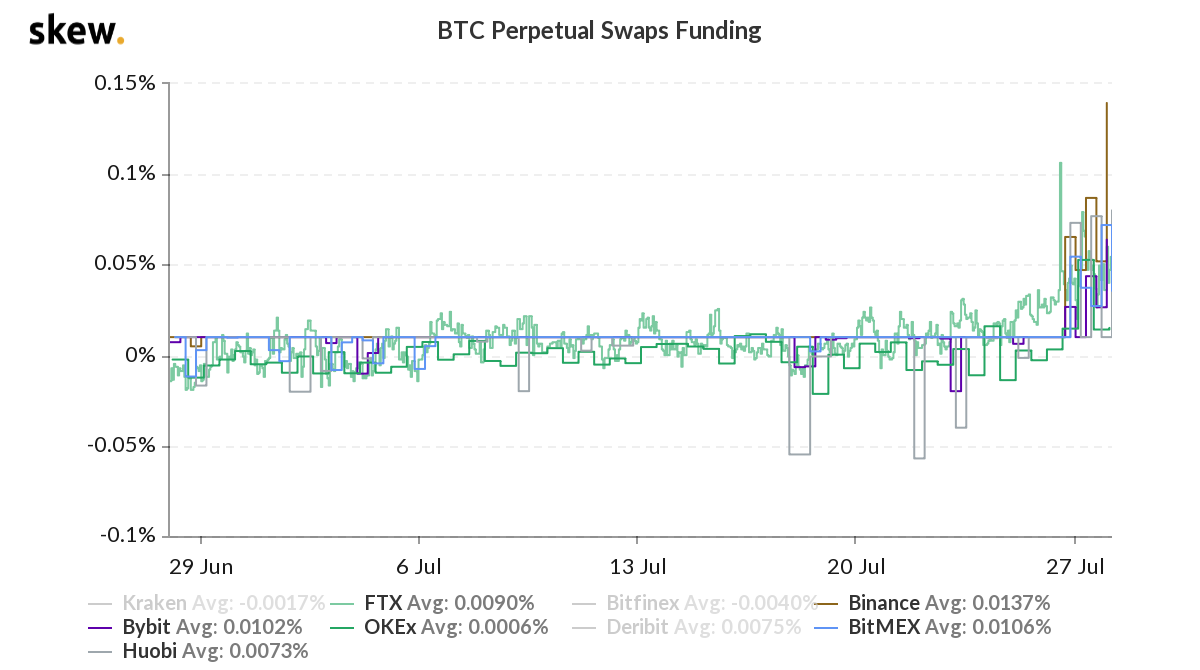

As shown in the chart, funding fees across BTC perpetual markets surge as Bitcoin prices rally, this indicates the imbalance of buying pressure in the market. As such, this effect results in long positions becoming more costly to hold over time. From the chart, we observed that funding fees have doubled in a matter of hours from 0.05% to 0.1%, as demand for BTC futures exceeds. In this instance, a $100,000 position would have cost you $100 in funding fees.

4. BTC vs USDT margined

Binance’s quarterly contracts are denominated and settled in BTC. In other words, you have to fund your initial margin in Bitcoins. This means that investors do not need to convert Bitcoins to a Stablecoin such as Tether (USDT) in order to fund their futures positions.

Long-term Bitcoin investors can now hedge their positions in the futures market without the need to convert any of their holdings into USDT. As such, they do not need to sell any Bitcoins at a compromised price.

To hedge your Bitcoins, you would need to open a short position in BTCUSD 0925 quarterly futures. If the price of BTC goes down, profits from the futures position can offset losses in your Bitcoin holdings. Since they’re settled in BTC, profits can increase your long-term BTC stack. This is a great way to simply increase your BTC holdings over the long-run.

5. Trading strategy

Quarterly Futures offers a multitude of trading opportunities and enables you to construct strategies that offer uncorrelated returns to the general market. These strategies are common in traditional futures markets and they can be applied to cryptocurrencies as well.

Here are some market-neutral strategies that you can consider:

Basis trading - A basis trade consists of a long position in the underlying crypto-asset and a short position in its derivative (in most cases, this refers to futures contracts). Basis refers to the price difference between the futures contract and the underlying spot market. It can be positive or negative, but usually, futures contracts trade at a premium to the spot market. Typically, the further away a contract’s expiration date is, the larger the basis.

Read more: Understanding Price And Basis Of A Futures Contract.

Spread trading - Spread trading is the simultaneous buying and selling of two related futures contracts. For example, if you bought the BTCUSD September contract and sold the BTCUSD December contract, you would have a spread trade. In a spread trade, you are trading the price differential between two contracts. In a spread position, you would want the long side of the spread to increase in value relative to the short side or vice versa.

Read more: The Ins And Outs Of Futures Spread Trading.

Final thoughts

Perpetual futures and Quarterly futures are designed to cater to the specific needs of users. Overall, the futures market offers unparalleled flexibility, which allows traders to go long and short on a cryptocurrency using leverage. Also, this flexibility allows traders to create market-neutral strategies that offer uncorrelated returns to the broader market.

Futures are especially useful for portfolio diversification. If you’re considering trading futures, it’s important to understand the pros and cons of perpetual and quarterly futures. To get the most out of trading futures, we recommend:

Finding the right exchange for you - Binance Futures offers a comprehensive range of crypto derivatives, such as perpetual futures, options, leveraged tokens, and our latest addition, quarterly futures.

Diversifying your portfolio - Consider non-directional trading strategies that offer many benefits, including strategy diversification, portfolio volatility reduction, and cushion against a market decline.