Universal Music Group Partners with LimeWire

In some good news, major music label Universal Music Group (UMG) has announced an official partnership with LimeWire, an up-and-coming music platform that only recently unveiled its own Algorand-based marketplace in March. Find out more here.

Do Kwon Pushes for a Terra Hard Fork

The founder of Terraform Labs, Do Kwon, has put forth a hard fork proposal for the Terra blockchain, one that has received mixed responses from the Terra community. Find out more here.

Ethereum's Merge to Take Place Before September

On Thursday, Ethereum core developer Preston Van Loon said on a panel at the Permissionless Conference that the odds of Ethereum's Merge taking place before September is high "if everything goes to plan".Find out more here.

L1/L2 Development of the Week

This week, we dived deep into the Terra network and the recent de-pegging of UST. We explored the latest updates on the situation as the Terra community attempts to revive the chain.

Click here for the full story.

Bybit x SolanaFM Quarterly State of the Solana Network Report May 2022

Bybit x SolanaFM Quarterly State of the Industry Report in our first-of-its-kind state of the Solana network report, we provided some updates on the overall ecosystem health of the Solana network, and also appraised the extant state of the network’s DeFi and NFT ecosystems and infrastructure.

Go here for the full report.

Bybit x Nansen Monthly State-of-the-Industry Report May 2022

This week, we used Nansen’s data to track the current general on-chain/off-chain market sentiment as well as the overall health of the broader crypto market. We also took a deep dive into the general NFT ecosystem to figure out if the space was really flatlining as many purported it to be.

Go here for the full report.

On-Chain Round-Up for the Week

Throughout the entirety of the past week, the broader crypto market continued to observe choppy trading patterns due to a number of factors. In particular, the brutal de-pegging of UST has severely shaken investors’ confidence in stablecoins, the dominant means of exchange within the crypto space.

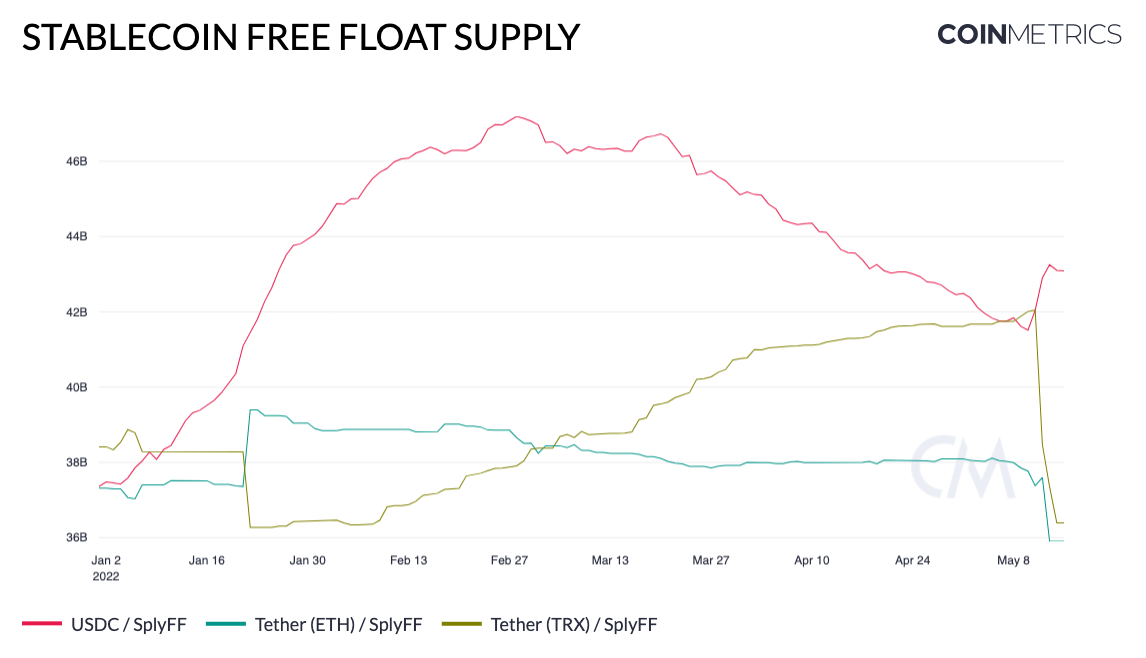

Top stablecoins like USDT and DAI experienced significant redemptions in the immediate aftermath of the LUNA/UST saga, with the circulating supplies of both these stablecoins suffering double-digit percentage declines in the past few days alone. Tether has since cut the amount of commercial paper in its reserve to maintain the integrity of USDT’s dollar peg.

As of the time of writing, USDT still commands a lion’s share of the stablecoin market, its dominance has been dwindling.

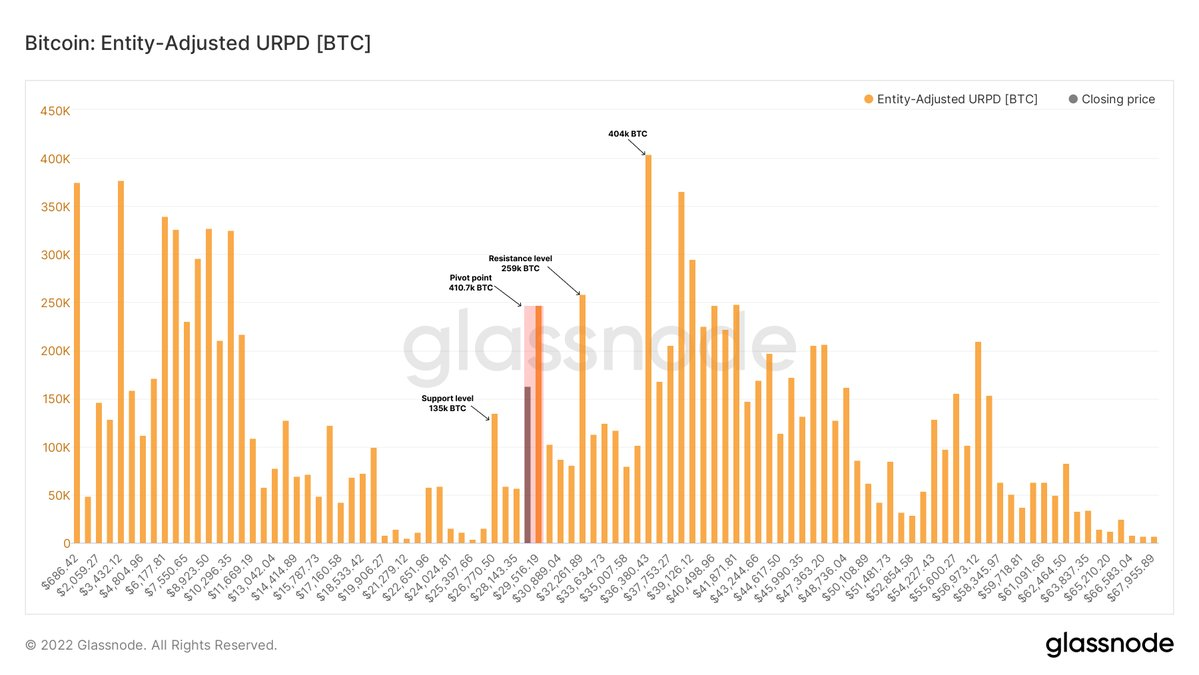

Meanwhile, BTC is currently (as of the time of writing) hovering near the $30K psychological support level with a low volume void lurking beneath its weekly support structure.

Looking at the Unrealized Price Distribution of BTC, we can see that the $29K to 30K range has become a major inflection point for the largest cryptocurrency by market cap. The on-chain price walls below this region are scarce, and BTC can easily descend into a downward spiral if the spot price were to breach the main support level at the $26K mark.

However, not all is doom and gloom within the crypto market.

The Entity-Adjusted NVT, an on-chain metric that represents the ratio between BTC’s market cap and transaction volume, is fast approaching previous lows that marked great buying opportunities in past cycles.

Moreover, BTC hash rates have also reached new highs, suggesting a sustained and strong demand for mining activities despite all the uncertainties currently surrounding risk assets.

Macro Events to Look Out For in the Coming Week

May 25, 2022 |

|

May 31, 2022 |

|

Jun 1, 2022 |

|

Jun 6, 2022 |

|

Jun 8, 2022 |

|

Three Coins to Watch in the Coming Week

Token | Token Highlight |

ETH | If all goes according to plan, Ethereum’s Merge should be coming in the near future. The Merge will not only usher in the PoS mechanism, but will also cut the issuance of ETH by about 90%. As less ETH in circulation may eventuate in a greater value per coin assuming demand stays the same, ETH is definitely something to keep a lookout for in the mid-term. |

LDO | In recent times, Lido has emerged as the largest service-platform for ETH staking. This could provide significant tailwinds for its governance token, LDO, to take off. |

ZEC | Zcash is about to undergo one of the largest network upgrades since its inception on May 31, 2022. The upgrade will introduce the Orchard Protocol for shielded payments, as well as the Halo proving system, a trustless setup that will remove any potential singular points of failure for ZEC. |