Throughout the article, we will refer to COIN-& USDT-settled contracts as COIN- & USDT-margined contracts interchangeably.

Contract Specifications

To begin, we shall first compare the contract specifications of both USDT-margined and COIN-margined products.

| COIN-margined contracts | USDT-margined contracts | |

| Margin | Cryptocurrency (i.e. BTC, ETH) | USDT |

| Margin Type | Isolate/Cross | Isolate/Cross |

| Settlement | Yes | No |

| Cross Collateral | No | Yes |

COIN-margined contracts on Binance offer the following characteristics:

Settlement in cryptocurrency: contracts are denominated and settled in underlying cryptocurrency, this eliminates the need to hold Stablecoins as collateral.

Contract Multiplier: Contract multiplier represents the value of a contract. Each BTC contract represents 100 USD, while others, each contract represents 10 USD. For example, 1,000 USD of BTCUSD Quarterly 1225 (100 USD x 10 contracts) and 1,000 USD of ETHUSD Quarterly 1225 (10 USD x 100 contracts).

Expiration: Perpetual, Quarterly, and Bi-Quarterly

Meanwhile, USDT-margined contracts offer the following characteristics:

Settlement in USDT: contracts are denominated and settled in USDT. A versatile settlement currency across the USDT-margined futures product line.

No expiration date: you can hold positions without an expiry date and do not need to keep track of various delivery months, unlike traditional futures contracts.

Clear pricing rules

: each futures contract specifies the base asset's quantity delivered for a single contract, also known as "Contract Unit". For instance, BTC/USDT, ETH/USDT, and BCH/USDT futures contracts represent only one unit of its respective base asset, similar to spot markets.

Pros of COIN-settled Futures

Binance’s COIN-margined contracts are denominated and settled in its quote currency. To open a position in BTCUSD Quarterly 1225, you can simply fund the initial margin in Bitcoins. Therefore, you do not need to convert Bitcoins to a quote asset such as Tether (USDT).

If you are a miner or long-term investor, this is ideal for you. Especially in this bull market today, investors are more inclined to hold on to their cryptocurrencies. As contracts are settled in the underlying cryptocurrency, any profits can contribute to your long-term stack. Furthermore, as prices continue to rise, the value of your collateral will increase correspondingly. This is simply a great way to increase your cryptocurrency holdings over the long-run.

With COIN-margined futures, miners and long-term investors can hedge their positions in the futures market without converting any of their holdings into USDT. As such, they do not need to sell any cryptocurrencies at a compromised price.

To hedge, you can simply open a short position in any Binance COIN-margined quarterly futures. If the price of the underlying asset goes down, profits from the futures position can offset your portfolio’s losses.

Cons of COIN-settled Futures

However, you need to enforce tighter risk controls when trading COIN-margined futures as the underlying collateral is often exposed to price volatility. Unlike stablecoins such as USDT, most cryptocurrencies experience high volatility several times in a year. These trends may persist for months before stabilizing.

For instance, Bitcoin experienced a prolonged bear market in the second half of 2019 before a brief recovery in early 2020. In this period, Bitcoin investors saw the value of their holdings fall dramatically. On March 12 this year, Bitcoin marked one of its worst trading days in history after a price plunge of more than 40% in a single day. In these situations, investors need to react quickly to hedge their exposure via a futures contract to protect themselves against downside risk. Ultimately, this is the main function of the futures market.

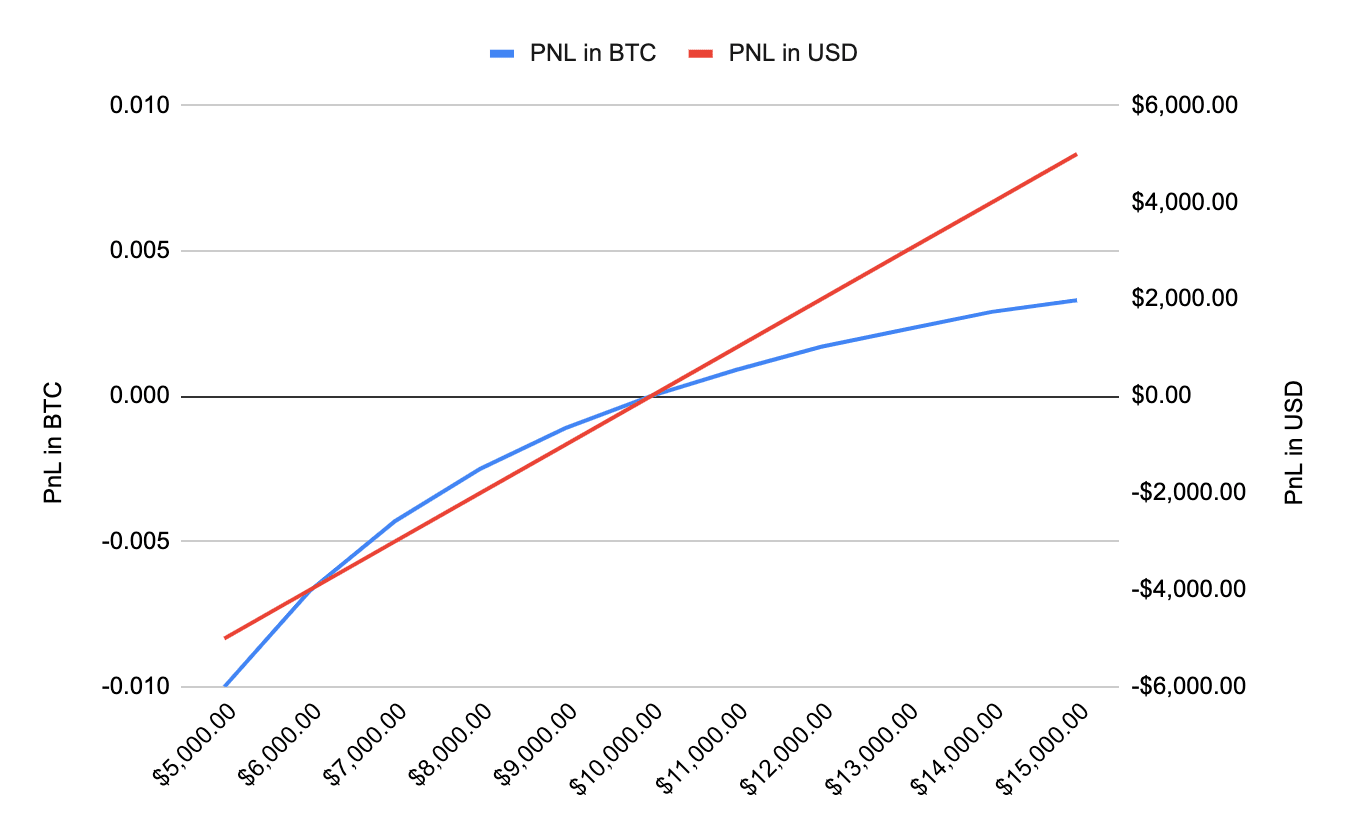

Due to price volatility in the underlying asset, COIN-margined futures have a non-linear payout structure. To explain its unique payout structure, let’s consider the example below.

Assume the price of Bitcoin is now $10,000 BTC/USD. On Binance, one BTC-margined contract is worth $100. Therefore, in BTC terms, one contract costs: $100/$10,000 = 0.01 BTC.

Suppose you go long 1 contract at $10,000 BTC/USD. By doing this, you are essentially short 100 USD and long an equivalent value of Bitcoin. Conversely, by short-selling a contract, you are long USD and short an equivalent value of Bitcoin. If Bitcoin’s price goes up against USD, this means that you can buy fewer Bitcoins with the same amount of USD and vice versa.

The graph below shows the profit and loss comparison between a non-linear and linear payout as Bitcoin's price moves by increments of $1000.

As shown, every $1000 increment in Bitcoin's price does not translate to a proportionate amount of profits or losses denominated in BTC. In fact, each subsequent increment in the BTC/USD pair returns diminishing amounts of BTC. This phenomenon is often described as the non-linear nature of inverse futures contracts.

Pros of USDT-settled Futures

On the other hand, a USDT-margined contract is a linear futures product that is quoted and settled in USDT - a Stablecoin pegged to the value of the U.S. dollar. One of the key benefits of USDT settlement is that you can easily calculate their returns in fiat instead of BTC. This makes USDT-margined contracts more intuitive. For example, when you make 500 USDT in profit, you can easily estimate that the profit is worth approximately $500 - since the value of 1 USDT is pegged closely to 1 USD.

Additionally, a universal settlement currency such as USDT, provides more flexibility. You can use the same settlement currency across various futures contracts (i.e., BTC, ETH, XRP and etc.) This eliminates the need to buy the underlying coins to fund futures positions. As such, you will not incur excessive fees as there is no additional conversion required when trading with USDT.

In periods of high volatility, USDT-margined contracts can help reduce the risk of large price swings. Thus, you do not need to worry about hedging their underlying collateral exposure. On several occasions this year, trading with USDT has been a prudent choice, especially in volatile periods.

Cons of USDT-settled Futures

When trading with USDT-margined contracts, you must allocate a significant portion of your portfolio in USDT. This ensures that you hold enough collateral to fund positions in the futures market. Otherwise, you will be forced to sell your cryptocurrencies at a compromised price should you need to trade in the futures market.

This is unfavorable for most cryptocurrency investors. Stablecoins such as USDT do not appreciate in value and are not investment assets, unlike conventional cryptocurrencies. A $100 USDT today is likely to be worth $100 in two years.

For many investors, the ability to trade Bitcoin and other cryptocurrencies against fiat currencies without the need to interact with fiat itself can be beneficial. From the exchanges’ perspective, excessive regulation can be avoided by eliminating fiat altogether.

Final thoughts

Now that you know the difference between the two futures contracts and its nuances. The question is, how can we use them to maximise returns?

Ideally, in a bull market, long positions with COIN-margined contracts can maximize profits. Conversely, as the market turns bearish, using USDT-margined contracts to short is a safer option to preserve your gains.

In short, COIN-margined contracts are more suited for hedging purposes. It enables miners and long-term investors to hedge the value of crypto holdings in terms of USD via short positions.

On the other hand, USDT-margined contracts are simpler to operate and do not need to hedge the margin risk like COIN-margined contracts.

Register from our tournament to win a share of the prize pool. More than $1,600,000 in BNB to be won! Sign up here!