Huobi Stablecoin Reserves on the Decline

Data from Nansen.ai reveals that Huobi's stablecoin exchange balances have dipped by 33%, leading to traders withdrawing $49 million in stablecoins. Over the last weekend, Hong Kong's financial media reported the detainment of several Huobi executives by Chinese police, an allegation that Huobi has categorically denied.

Earlier, Colin Wu from Wu Blockchain made a non-specific claim that senior executives from offshore cryptocurrency exchanges had been detained by Chinese authorities. Huobi is part of a complex landscape involving cryptocurrencies, where regulatory oversight can lead to sudden market reactions.

H2: Troubling Signs in Huobi’s Assets

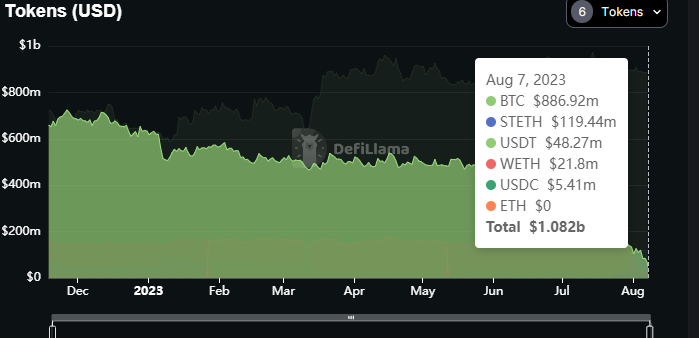

The analysis by DeFiLlama shows a significant shift in Huobi's balance, dropping from $3.1 billion at the beginning of the year to its current $2.5 billion. Interestingly, the exchange's largest holdings are connected to companies and protocols within the Justin Sun universe.

Huobi's holdings comprise 26.5% in TRX, TRON's token, and 20.32% in HT, its exchange token. The company retains $1 billion in highly liquid assets, including bitcoin, USDT, and USDC. A lack of ether in their possession is balanced by holdings in stETH and wETH.

Late in the previous year, analytics firm CryptoQuant expressed concerns over Huobi's reserves' quality. This skepticism appears to have resonated in the current climate, given the sharp withdrawal and decline in reserves.

Huobi's HT Token Remains Unaffected

Despite the swirl of rumors and speculations, Huobi's HT token is holding its ground, trading flat at $2.66. The market, though shaken by the news, seems to be awaiting solid evidence or official statements from either Huobi or Chinese authorities.

Conclusion: A Waiting Game

Huobi's situation reflects a broader uncertainty within the cryptocurrency exchange landscape. The rumors of executive arrests, even if unsubstantiated, have led to significant reactions from traders. Huobi's reserves have taken a hit, but the market appears to be playing a waiting game, pending further information or clarification. The events surrounding Huobi will undoubtedly be watched closely in the coming weeks, as they could herald further changes in the already dynamic and often unpredictable world of cryptocurrencies.