Fully diluted market value is what a digital asset’s market cap would be if all the coins or tokens in its total supply were issued.

For example, Uniswap will ultimately issue a total of 1 billion UNI tokens over the next four years. If we hypothetically price UNI at an even $3.00 per token, the FDV would be $3 billion. As of Oct. 15, the decentralized exchange’s governance token has a circulating supply of 185,059,564 and is actually trading at $3.36 per token, giving UNI a market capitalization of $623 million — which is still a far cry from its current fully diluted value of $3.364 billion.

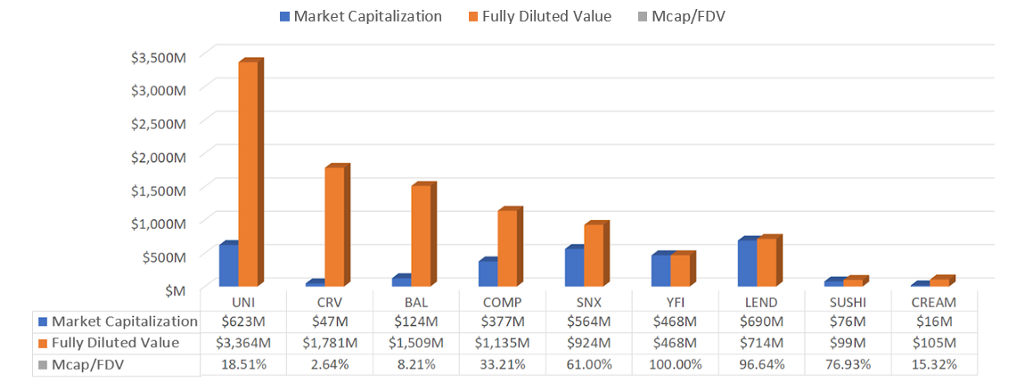

Well-known decentralized finance projects currently vary tremendously in terms of their market-cap-to-FDV ratio. For example, yearn.finance allocated its total supply of YFI tokens within a week, which means that its market-cap-to-FDV ratio is equal to 100%. Curve, on the other hand, distributes 2 million CRV tokens each day via liquidity mining, which will gradually inflate its supply to a maximum of 3.03 billion CRV — resulting in an extremely low market-cap-to-FDV ratio of 2.64%.

In comparison, SushiSwap hard-capped its supply at 250 million tokens on Sept. 20 — bringing its FDV down to $99 million, based on the Oct. 15 price of $0.76 per SUSHI. This makes SushiSwap’s market-cap-to-FDV ratio approximately 76.93%, after the reduction in supply. Its main competitor, Uniswap, has a ratio of approximately 18.51%.

How important is a cryptocurrency’s fully diluted value?

The question worth examining here is whether or not FDV is a critical metric in the cryptocurrency market. Are market participants rational to look at theoretical valuations placed years into the future?

In order to answer this question, we compare the numbers behind Uniswap, SushiSwap and Curve — three decentralized exchanges with proven cash flows.

First, CRV has the lowest market-cap-to-FDV ratio and, in terms of price, is the worst performer. As of Oct. 15, its price of $0.54 has fallen 99% from its peak of $54, and the price hasn’t risen much from the bottom of $0.46.

Among the three decentralized exchanges, Curve has the best market-cap-to-annual-fees ratio, at 6.26 — but it also has the highest FDV-to-annual-fees ratio, at 237. Given that its total value locked in is about 53% that of Uniswap’s and its seven-day average fees are 19% of Uniswap’s, we might infer that market participants are concerned about its massive ongoing token distribution. Also, we can see the steep curve of the increase in the CRV supply. As a result, the potential daily sell pressure is pushing its token price to only 16% that of UNI’s.

Visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.