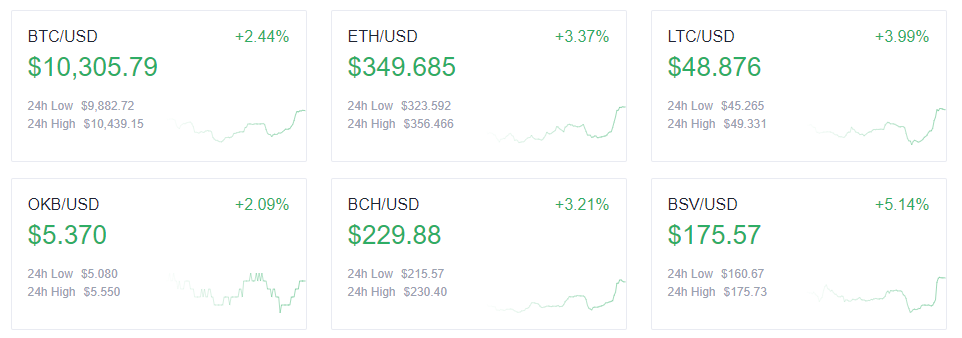

Major altcoins generally outperformed BTC, with Ether ( ETH) and Bitcoin SV ( BSV) surging 3.37% and 5.14%, respectively.

OKEx has updated its Earn feature on Sept. 7, adding an interface with the Compound ( COMP) protocol. Users can earn interest for the subscription and receive extra COMP tokens as a bonus. Moreover, OKEx revealed further information about staking OKB on Jumpstart to earn DeFi yield. OKB has been up for two consecutive days due to the company’s new movement into DeFi.

The cryptocurrency market was unaffected by the United States stock market, which was closed for the Labor Day holiday. The total crypto market capitalization stabilized around $334 billion as BTC dominance jumped 0.2%, as per data from CoinGecko. Traders will definitely be watching today’s stock market opening.

In the decentralized-finance sector, SushiSwap ( SUSHI) started multi-signature voting for community governance. Currently, there are 48 candidates for multi-signature governance, including OKEx CEO Jay Hao. Voting will last for 24 hours. The price of SUSHI jumped another 5% to the $2.90 level overnight.

UMA continues to be bolstered by the Coinbase Pro listing effect and has risen 14% to a short-term high of $17. Meanwhile, another protocol, IOST, joined in the movement and witnessed huge gains after the team announced plans to launch IOST’s version of SUSHI.

Top altcoin gainers and losers

In addition to SUSHI and UMA, FairGame ( FAIR) also made today’s top gainers list. It is up 23.53% over the past 24 hours and has doubled in price over the past 30 days.

DMM Governance token ( DMG) was the biggest loser of the day, falling 16.76%. It has fallen nearly 60% in the last seven days.

BTC technical analysis

On the daily chart, we can see that BTC has been testing the $10,000 psychological level for four days in a row and has printed several long wicks. This is an indication of strong support in the $9,900 to $10,000 area.

Yesterday’s selloff didn’t make a new low, but the following rebound wasn’t accompanied by an increase in trading volume. An intraday resistance is located at $10,370 with support at $9,900.

In the mid-term, BTC needs to recover $10,700 to reverse the current downtrend.

Visit https://www.okex.com/ for the full report.

Not an OKEx trader? Learn how to start trading!

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.