Limit downside losses in a declining market.

Generate profits in periods of high volatility.

Speculate on price movements with relatively low risk.

While futures are more popular, cryptocurrency options are also gaining traction and are offered by leading cryptocurrency exchanges such as OKEx. If you want to trade crypto options, this tutorial will help you get started.

Features of Crypto Options on OKEx

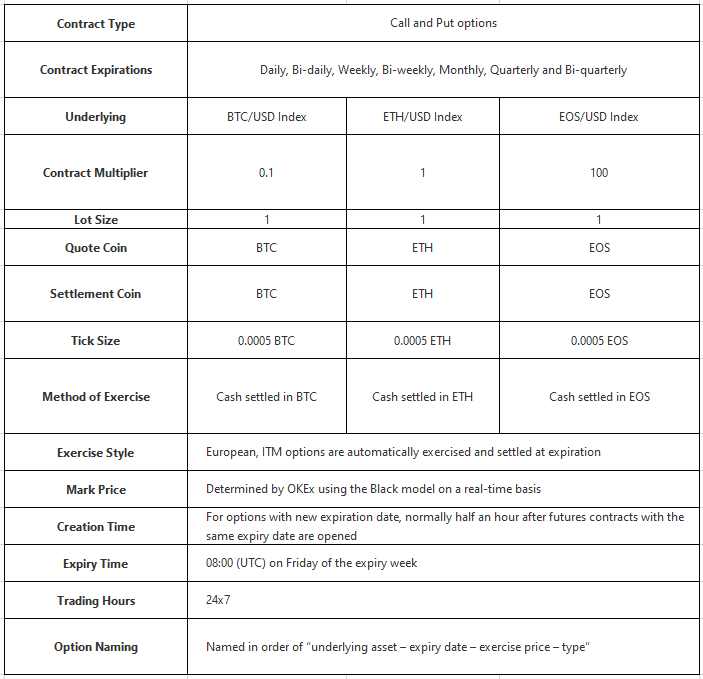

OKEx supports the trading of options contracts with three cryptocurrencies — Bitcoin ( BTC), Ether ( ETH) and EOS — as the underlying assets. Particulars to note in terms of crypto options on OKEx are as follows:

Call and put options contracts are available for trading.

Contracts expire on one-day, two-day, weekly, bi-weekly, monthly, quarterly and bi-quarterly time frames.

Contracts follow the European style and can only be exercised at the date of expiry (and not before).

Contracts are settled at 8:00 am UTC on Friday of the expiry week.

Contracts are traded 24/7.

The chart below provides additional details that can be helpful for users new to options trading on OKEx.

Step 1: Go to the options section

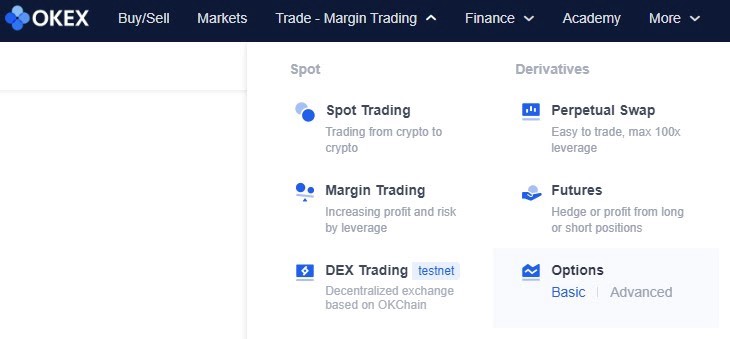

Go to the OKEx homepage and navigate to Trade in the top menu to see the available markets. Then, click on Basic under the “Options” label to open the options section. The basic version offers a good starting point for options-trading beginners, but if you are an experienced trader, you can choose Advanced for a more comprehensive dashboard.

Options Discovery Tool

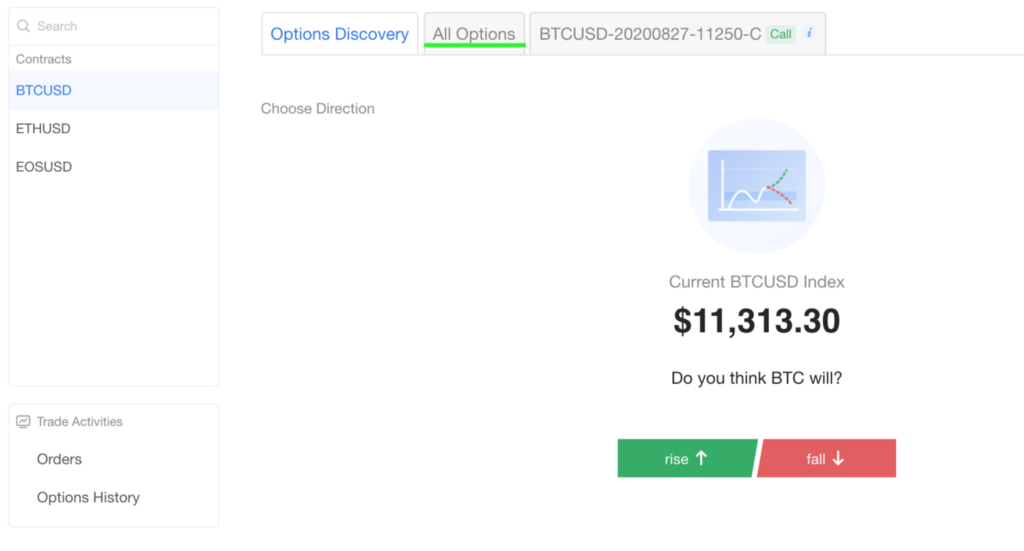

New traders often face a steep learning curve when trading derivatives. In order to help users get acquainted with cryptocurrency options, OKEx has developed the Options Discovery feature, which walks you through the process of buying options.

When a user navigates to the options section, they see the discovery tool by default. If you want to use the tool, the tutorial video and step-by-step guidelines for Options Discovery can be viewed here.

For the purposes of this guide on how to trade cryptocurrency options, we will use the basic dashboard as a reference for trading crypto options on OKEx, which can be accessed by clicking on the All Options tab.

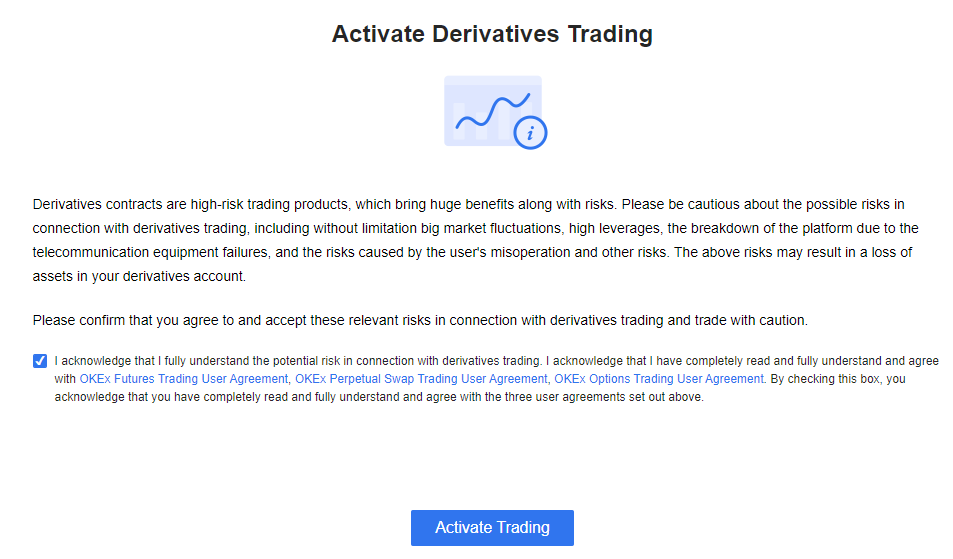

Step 2: Activate options trading

Options-trading beginners need to understand and acknowledge the risks involved, and only after checking the box will it be possible to Activate Trading of derivatives on OKEx, as shown in the screen below.

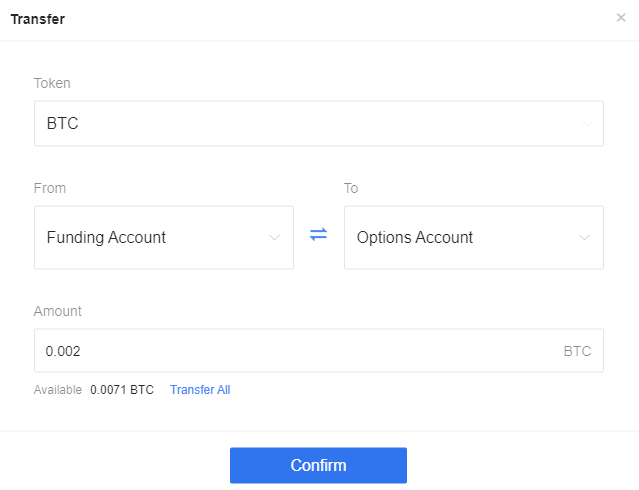

Step 3: Transfer funds to your options account

Your options account needs to be funded before you can start trading. If you do not have any balance in your options account, click on Transfer (either on the “Options Trading” page or on the “Assets” drop-down list in the top menu) to move funds between accounts.

If you do not have any crypto assets on your OKEx account, you can either buy crypto or learn how to deposit crypto on OKEx with our beginner’s guide to crypto trading.

When your account has crypto assets, you can use the “Transfer” section, as shown below, to move them from your “Funding Account” to your “Options Account” in order to start trading. Once you have filled in your preferred amount to transfer, click Confirm.

Step 4: Choose an options contract to trade

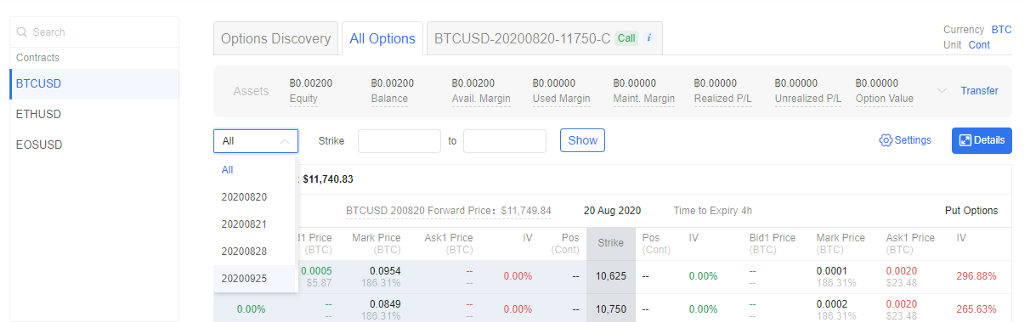

You can now select your desired contract type from the left bar on the options trading dashboard. Currently, the available options are BTCUSD, ETHUSD and EOSUSD, which are “Coin Margined Options,” meaning that they are settled in the underlying digital currencies.

Next, click on the All Options tab and choose the desired time frame for the contract’s expiration via the “All” drop-down list. The available options are one-day, two-day, weekly, bi-weekly, monthly, quarterly and bi-quarterly.

The bi-weekly options will be generated every Friday, while the monthly and bi-quarterly options will be generated every third-to-last Friday of the month and last Friday of the quarter, respectively.

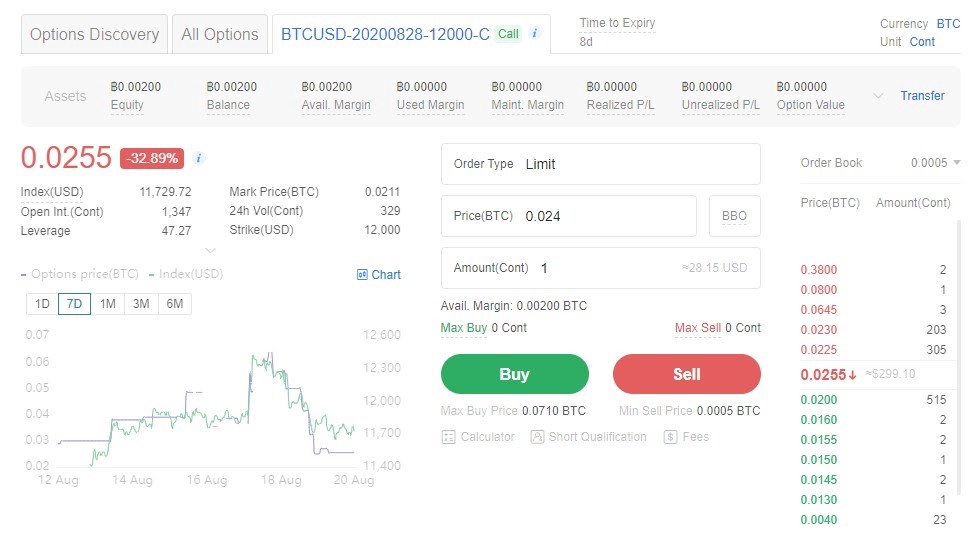

In this options-trading tutorial, we will select the weekly options contract labeled “BTCUSD-20200828–12000-C” as an example.

The naming convention followed by options contracts is: underlying-expiry-strike-type.

Based on its name, BTCUSD-20200828–12000-C, we can tell that BTC is the underlying asset, whereas 20200828 refers to the expiration date of Aug. 28, 2020, while 12000 refers to the strike price in USD. The letter C indicates that this is a call option, which gives traders the right to purchase the underlying asset at the strike price on expiry. Alternatively, the letter P denotes put options, which give traders the right to sell the underlying asset at the strike price on expiry.

Step 5: Enter order details and execute

After selecting your desired contract, you can enter your “Price” and “Amount” for the trade. For trading options at OKEx, limit order is the only type available to traders. If you would like to execute your order as soon as possible, you can click on BBO (i.e., the Best Bid Offer), which matches your order with the best offers on the market.

After entering order details, you can click on Buy or Sell to buy or sell contracts. In our example of BTCUSD-20200828–12000-C, going long would mean buying a call option, whereas a short position can be realized by buying a put option. Selling options contracts is an advanced undertaking and is not advised for beginners due to the high risk it involves.

Traders need to trade at least one contract in order to place their order successfully. In the example of BTC/USD, each contract represents 0.1 BTC.

For example, you can set up a limit order with a strike price of 0.024 BTC per contract and open a long position for “BTCUSD-20200828–12000-C” with one contract, or “Cont.”

The trading dashboard also displays basic information for the options contract such as “Index (USD),” “Mark Price” and “Open Interest.” Index(USD) tracks the average price of BTC/USD using five crypto exchanges, whereas the Mark price (BTC) is the reference price calculated from the underlying index (BTC/USD). Open interest here refers to the total number of outstanding options contracts.

You could visit https://www.okex.com?flag=activity&channelId=1850952/ for the full tutorial.

Not an OKEx trader? Learn how to start trading.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Follow OKEx

Twitter: https://twitter.com/OKEx Facebook: https://www.facebook.com/okexofficial/ LinkedIn: https://www.linkedin.com/company/okex/ Telegram: https://t.me/OKExOfficial_English Reddit: https://www.reddit.com/r/OKEx/ Instagram: https://www.instagram.com/okex_exchange

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.