Binance added 16 new derivative contracts in July, bringing the total to 43 futures contracts and 8 leveraged tokens.

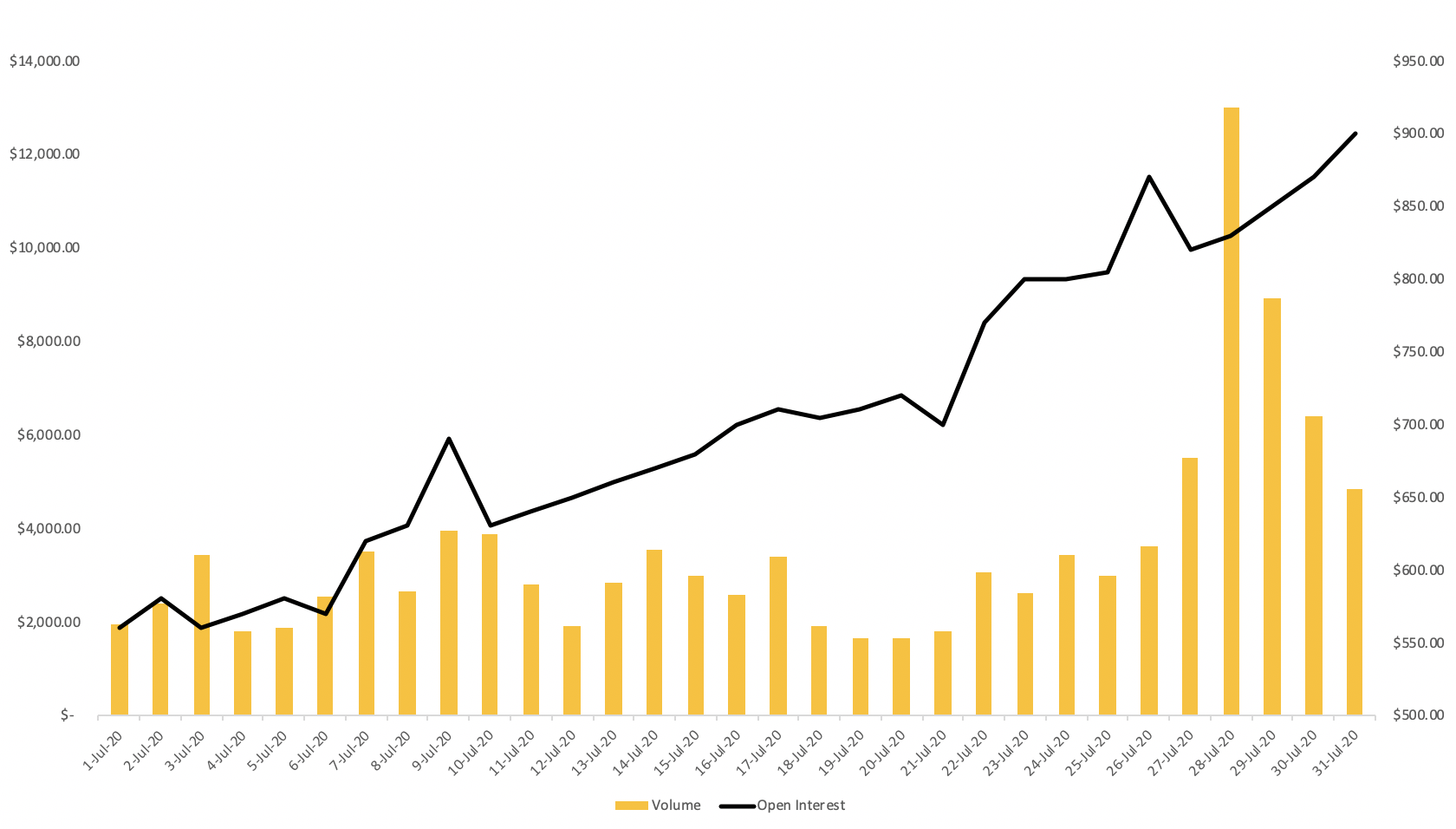

Volume on Binance Futures increased from $87.6 billion to $109.4 billion in July, a 25% increase from the previous month. Binance Futures also recorded a new all-time-high with over $13 billion in volume traded on July 28th.

Open interest also recorded tremendous growth, from USDT 580 mm to USDT 900mm, a 55% increase month-on-month. Total open interest recorded at USDT 900 million was Binance’s largest open interest since its inception.

In July, Ethereum (ETH) emerged as one of the best performers among large-cap cryptocurrencies as prices rallied more than 45% from $225 to $328. Many investors believe Ether’s momentum is uplifting the entire market, and possibly even propelling Bitcoin (BTC) upwards.

Two factors that appear to be driving the strong Ether rally are Decentralized Finance (DeFi) and Ethereum 2.0 upgrade.

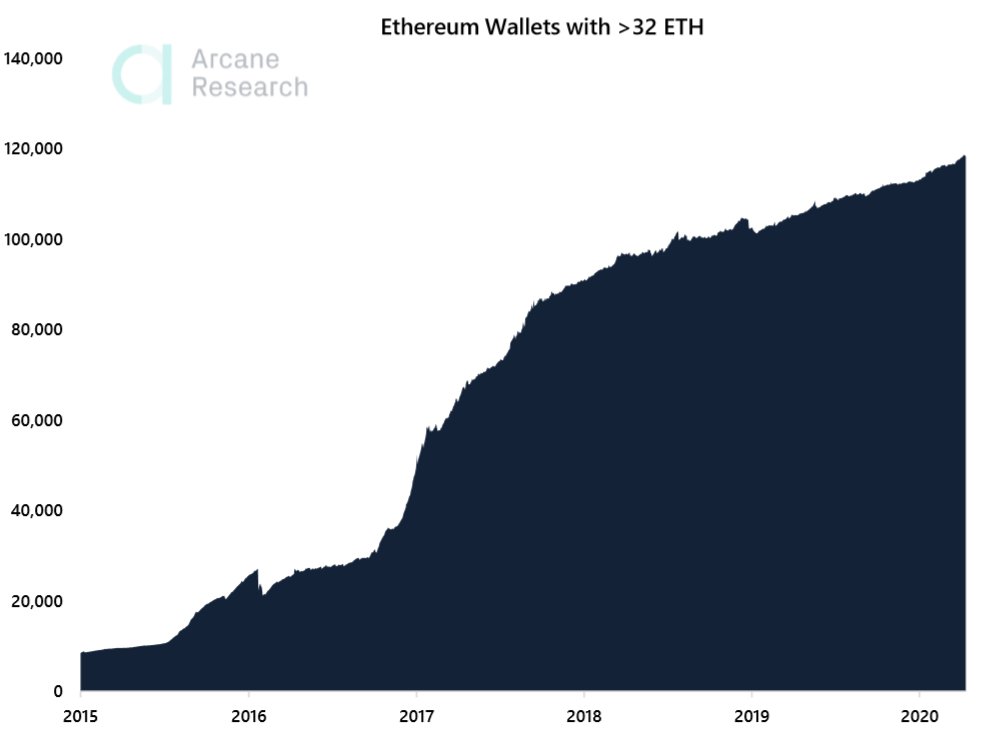

Since the start of the year, investors are anticipating the Ethereum 2.0 upgrade, where its blockchain network will transit to a Proof of Stake consensus. The upgrade incentivizes users to participate in the network and enables them to earn staking rewards on their holdings over a long period. To qualify for staking rewards, users must hold more than 32 ETH.

As such, the number of Ethereum wallets with more than 32 ETH has gradually increased, with now more than 120,000 addresses eligible to participate in staking.

Source: Arcane Research

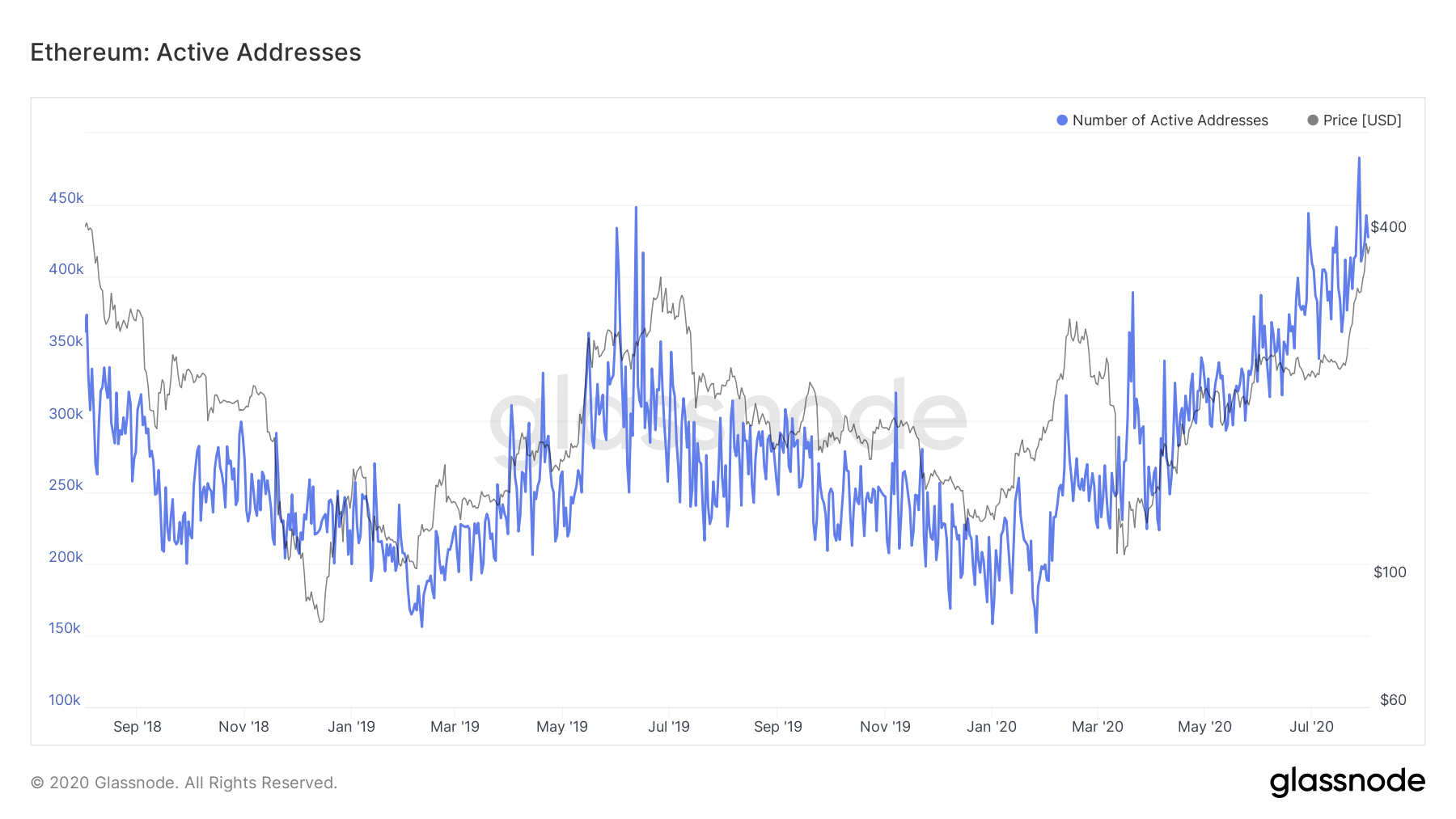

The proposed upgrade also led to tremendous growth in the number of active addresses. As shown in the chart below, active Ethereum addresses doubled in size since January.

Source: Glassnode

Decentralized Finance (DeFi) is another factor that has contributed to the Ether rally. The DeFi boom has spawned several innovative projects which were all crafted on the Ethereum network. The surge in capital inflows to DeFi is driving the rising price of Ethereum. As such, the explosive growth of the DeFi market has driven up demand for many DeFi-related tokens, as well as its infrastructure platform, Ethereum.

Bitcoin hits $11,000 for the first time since 2019

Bitcoin has finally crossed above $10,000, following a period of consolidation. The breakout was supported by strong momentum as Bitcoin continued its rapid surge and passed $11,000 within the same day, closing July with a 24% gain. Bitcoin’s abrupt increase has undoubtedly caught many off-guard as traders and investors scrambled to jump onboard of the explosive trend.

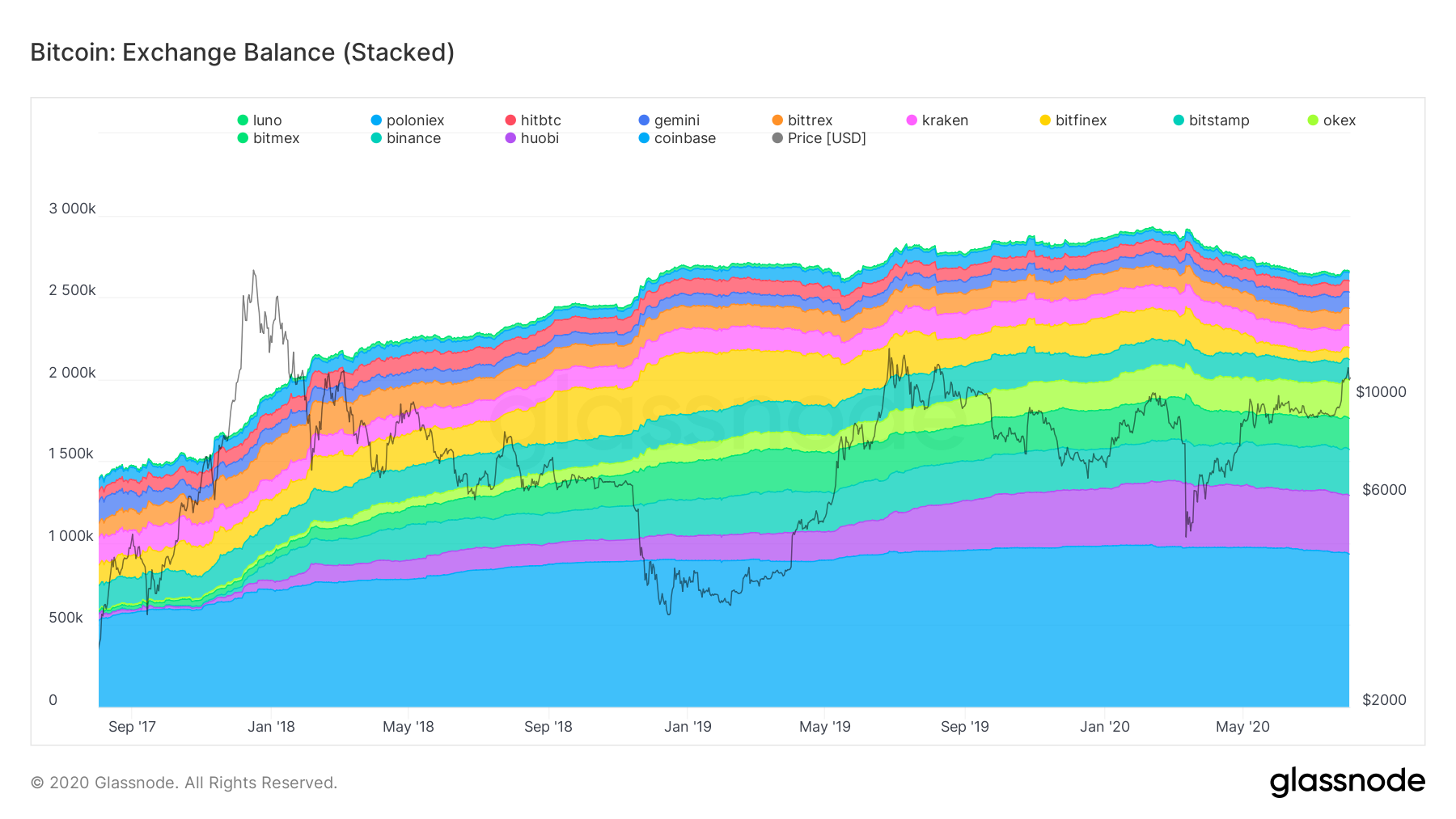

As such, demand for Bitcoins has improved in the last few weeks as supply on exchanges is close to 12-month lows, this signals a strong commitment to holding Bitcoins for the long term.

Source: Glassnode

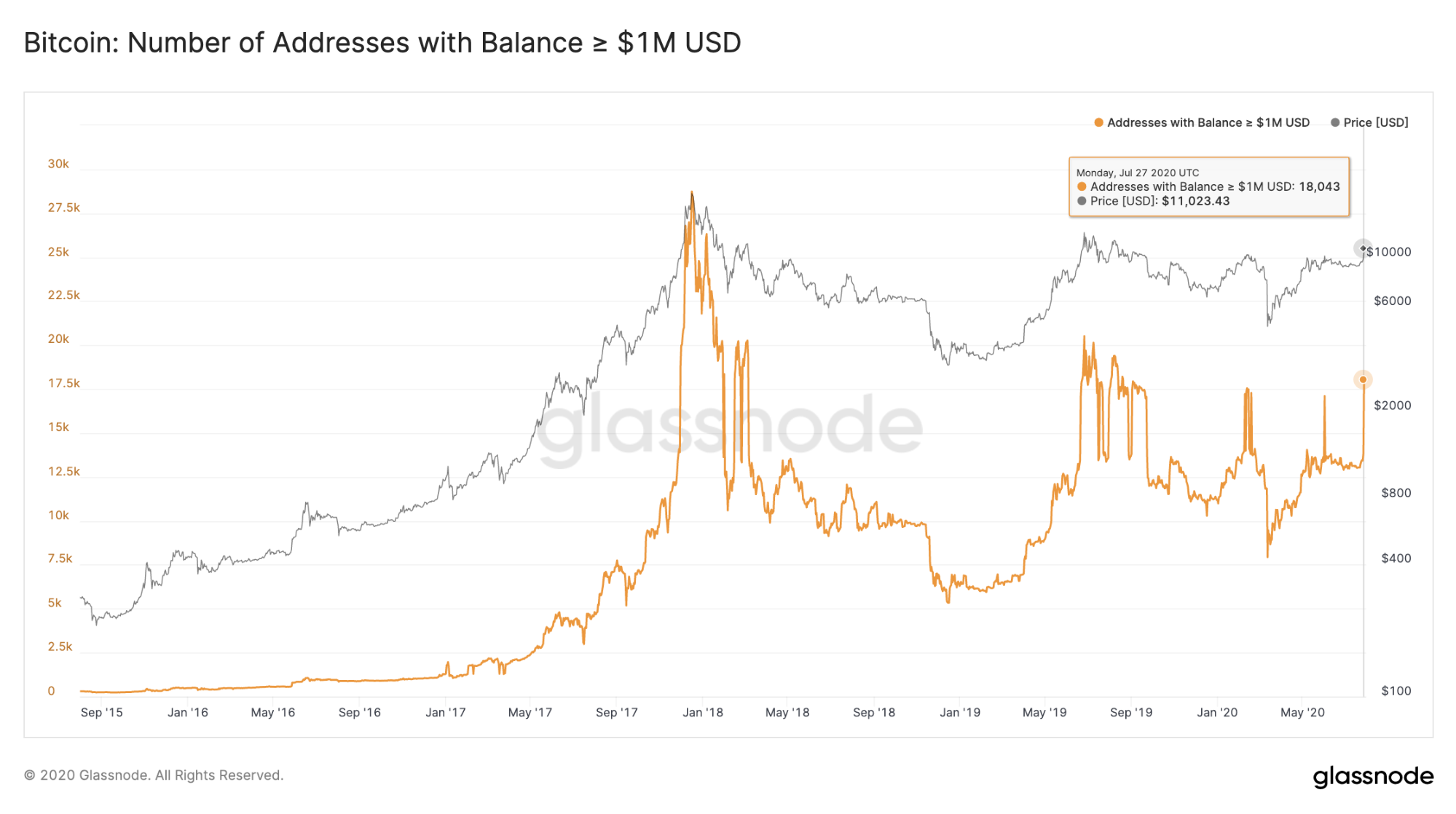

Following its rally to $11,000, we observed the growth of addresses with more than $1 million in Bitcoin, also known as Bitcoin whales. According to data provider Glassnode, the number of addresses with more than $1 million in Bitcoin has grown by 40% to more than 18,000 addresses.

Source: Glassnode

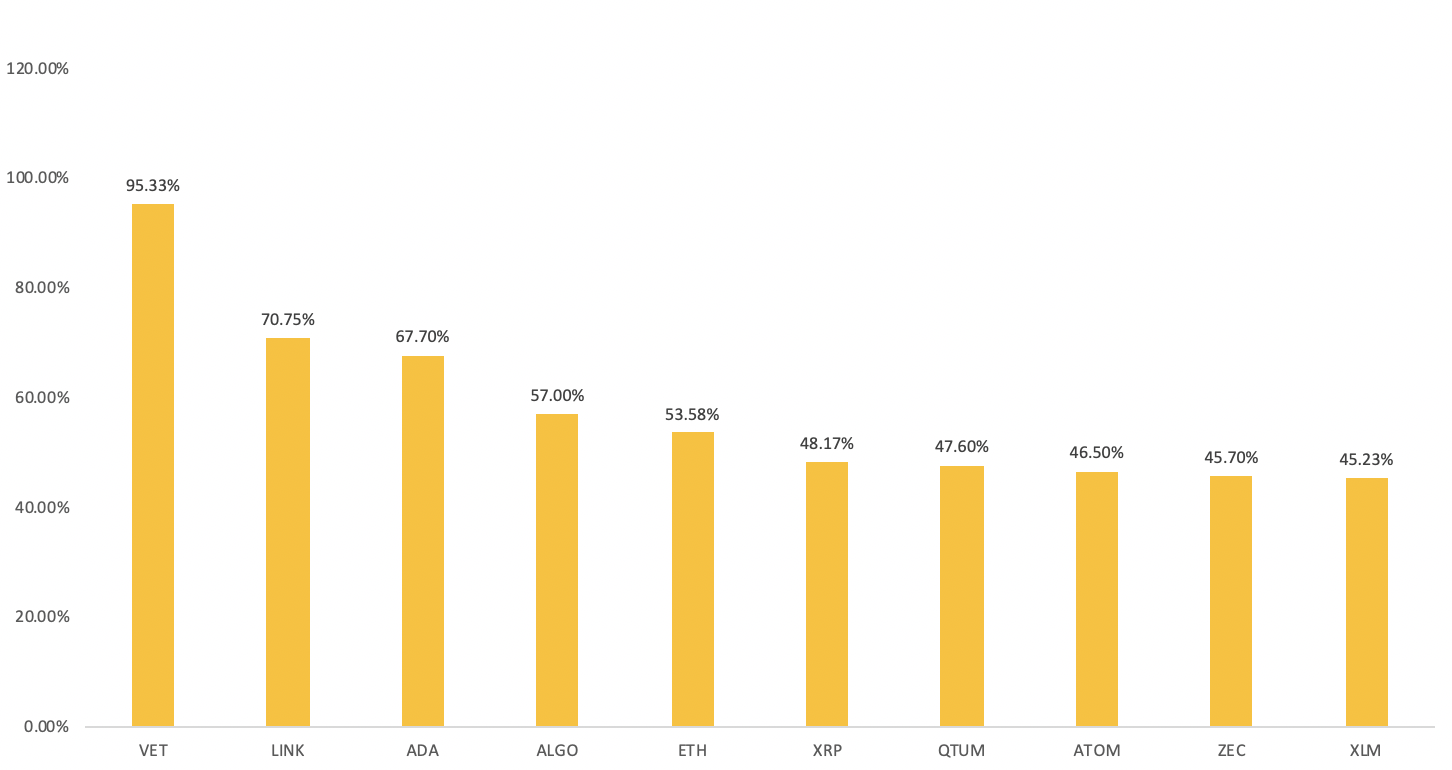

Top 10 gainers generated no less than 45% in July

Following a period of low volatility, cryptocurrencies burst into action in July as Bitcoin and altcoins delivered spectacular returns for investors. Bitcoin, in particular, delivered 24% in July while Ethereum produced more than 50% return in the same period. In general, futures contracts on Binance generated positive returns. VET and LINK were stand-out performers after recording 95% and 70% gains, respectively. The top 10 performers of July gained no less than 45%, which may suggest that a crypto bull market may be on its way.

Chart 1 - Top 10 gainers across USDT-Margined contracts

Source: Binance Futures

Additionally, Binance introduced COIN- and USDT-margined product categories for its range of perpetual and quarterly futures. The new categorization highlights the use of Bitcoin and altcoins as settlement currencies and reflects the increased interest in futures margined and settled with Bitcoin and altcoins.

Users on Binance Futures can now select futures contracts as follows:

COIN-margined Futures (displayed as “COIN-Ⓜ” on the web and mobile app)

- Quarterly Futures

- Perpetual Futures (to be launched in Q3 2020)

USDT-margined Futures (displayed as “USDT-Ⓜ” on the web and mobile app)

- Perpetual Futures

Further expanding its range of futures products, Binance added the following contracts in July:

|

Contract (USDT-Margined) |

Inception |

Leverage |

|

DOGEUSDT |

10th July |

50x |

|

SPXUSDT |

21st July |

50x |

|

LENDUSDT |

23rd July |

50x |

|

KAVAUSDT |

28th July |

50x |

|

BANDUSDT |

29th July |

50x |

|

RLCUSDT |

31st July |

50x |

|

Contract (Coin-Margined) |

Inception |

Leverage |

|

BTCUSD 0925 |

1st July |

125x |

|

ADAUSD 0925 |

20th July |

75x |

|

LINKUSD 0925 |

22nd July |

75x |

|

ETHUSD 0925 |

24th July |

75x |

|

Contract (Leveraged Tokens) |

Inception |

|

ETHUP |

13th July |

|

ETHDOWN |

13th July |

|

ADAUP |

16th July |

|

ADADOWN |

16th July |

|

LINKUP |

16th July |

|

LINKDOWN |

16th July |

Binance added 16 new derivative contracts in July, bringing the total to 43 futures contracts and 8 leveraged tokens.

Volume and Open Interest set a new record as crypto markets rally

The market rally has led to increased trading activity across the board. Volume on Binance Futures increased from $87.6 billion to $109.4 billion in July, a 25% increase from the previous month. Binance Futures also recorded a new all-time-high with over $13 billion in volume traded on July 28th. This record volume coincided with Bitcoin crossing above $11,000. With this bullish momentum, open interest also recorded tremendous growth, from USDT 580 mm to USDT 900mm, a 55% increase month-on-month. It is also worth noting that the total open interest recorded at USDT 900 million was Binance’s largest open interest since its inception.

Chart 2 - Daily volume and Open interest

Source: Binance Futures

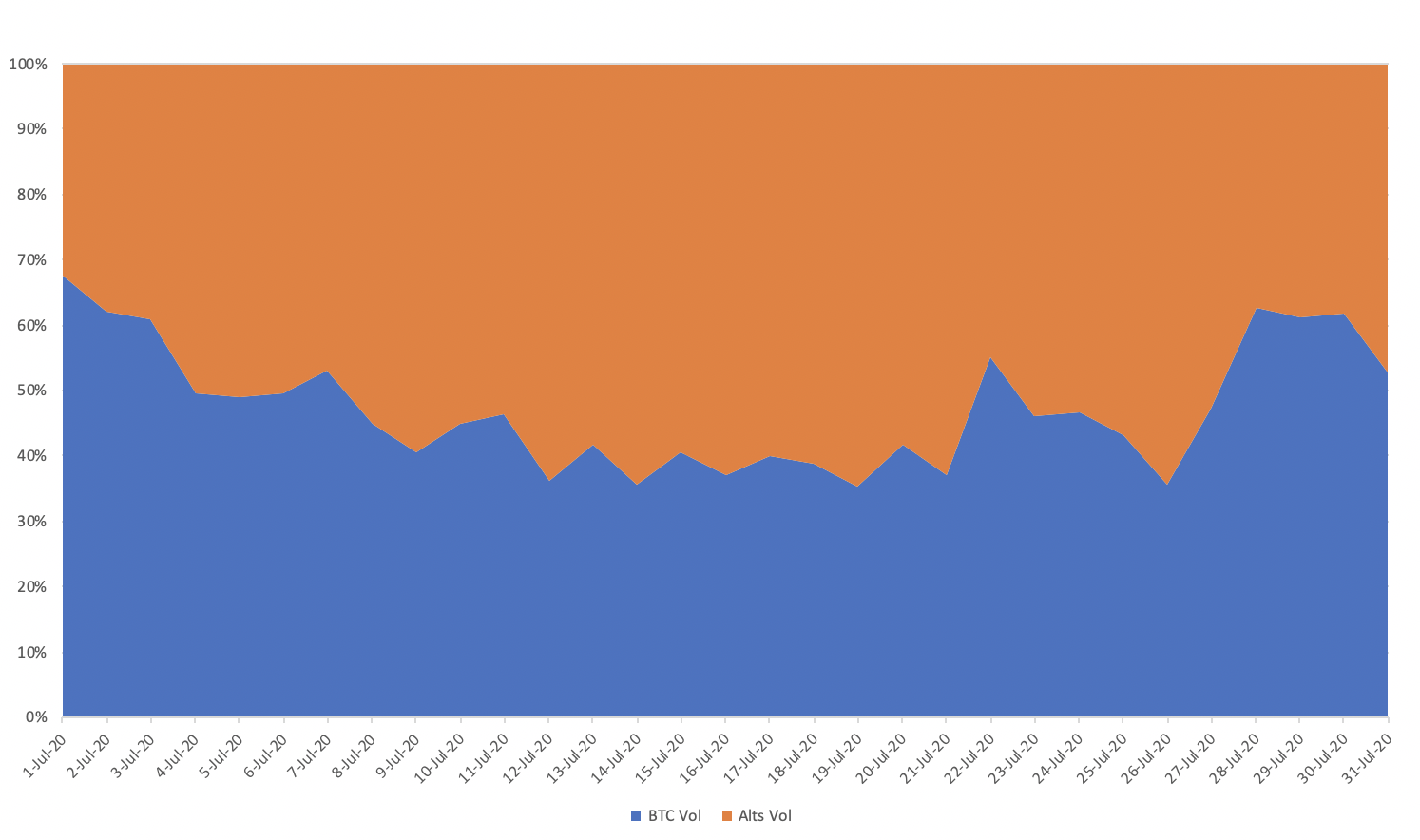

Chart 3 - Volume percentage of Bitcoin contracts vs. Altcoin contracts

Source: Binance Futures

Altcoin dominated headlines in the first two weeks of July as volume increased from 32% to 60%. In this period, we observed high volatility and volume in altcoin contracts such as LINK, ADA, and VET. Soon after, ETH and BTC followed as the explosive growth of DeFi drove ETH prices above its 52-week high, where Bitcoin volume normalized from 40% to 60% in a short period.

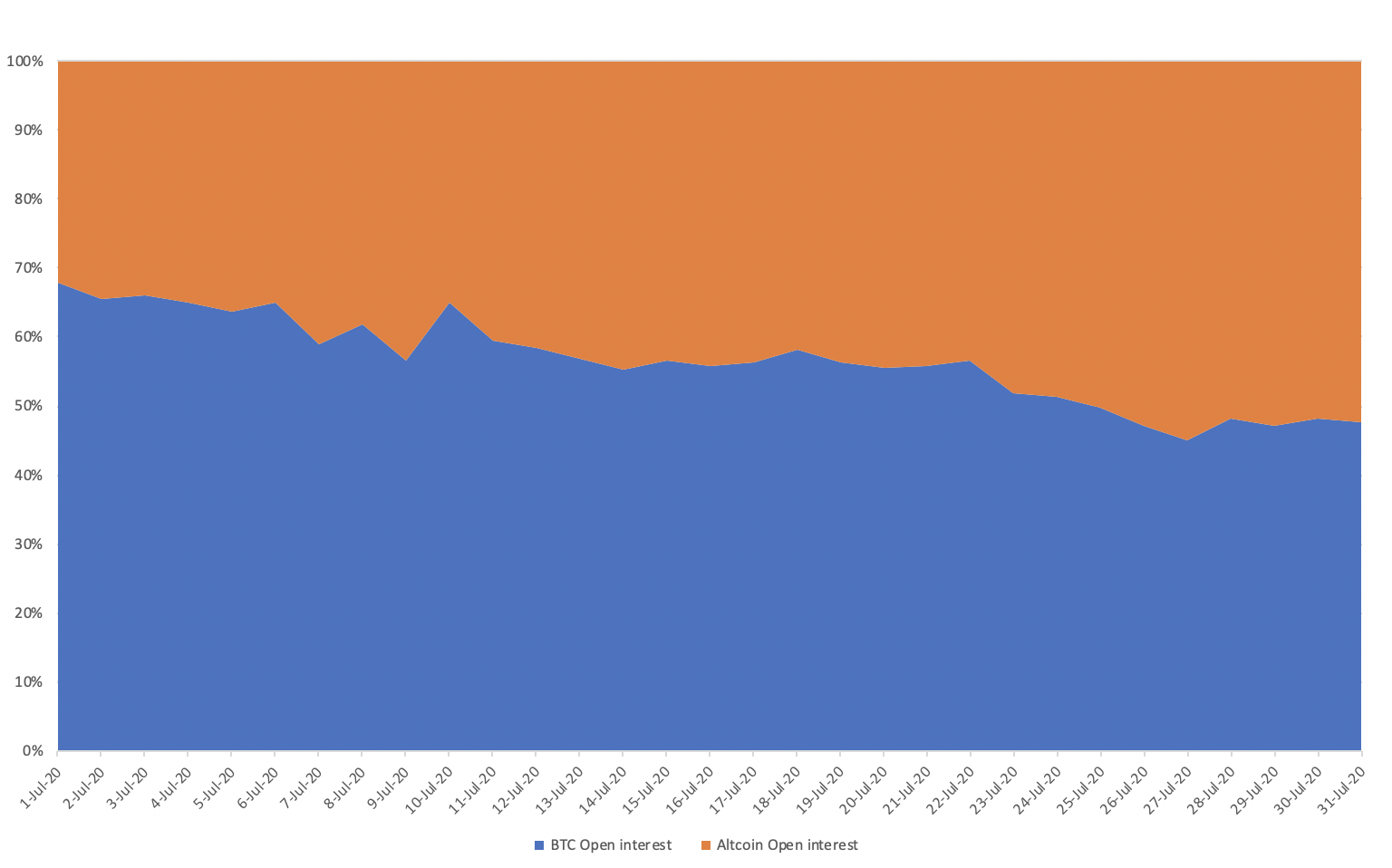

Chart 4 - Bitcoin’s Open interest dominance

Source: Binance Futures

Interestingly, Bitcoin’s open interest trended lower from 67% to 47% in July. This observation is contrary to the volume data shown earlier. In the previous chart, we observed more Bitcoin volume in the last two weeks of July. However, the increased volume percentage did not translate to a higher open interest percentage. Instead, Altcoin contracts have driven most of the open interest growth, which may suggest that traders are positioning long-term directional bets on Altcoins.

Final Thoughts

At the time of writing, crypto markets have just experienced a sharp pullback on August 2nd as Bitcoin and Ethereum retraced by 13% and 21%, respectively. Despite the sharp pullback, most investors are not deterred and remain bullish on the general direction of cryptocurrencies.

Today, Bitcoin and Ethereum investors are more convinced of a sustainable rally over a long period as prices hold firmly above 52-week highs. Investors are beginning to recognize the long-term prospects of cryptocurrencies as the landscape has now improved drastically. The crypto world today has established an extensive blockchain infrastructure with constant improvements to expand the existing ecosystem. As such, the optimism surrounding cryptocurrencies presently is supported by improved fundamentals and increased use cases of their underlying technologies.