In contrast, successful traders are not gamblers. They take responsibility for their actions and control factors that are within their means. When you feel in control, you are ready to act decisively.

Trading should be well planned and deliberate. If you want to make profits consistently, you must trade responsibly.

What Is Responsible Trading?

The beauty of a free market is that everyone can participate in it. When you’re in a trade, the market will do whatever it wants to do - it could go up, down, or even sideways. This is entirely out of your control.

What you can control instead is risk, and decide how and when you trade, under market conditions that are conducive to your methods and style.

Responsible trading is about having complete control over your trades and taking responsibility for your actions. Trading responsibly calls for not spending beyond your means. In other words, don’t risk money that you can’t afford to lose.

The best way to be a responsible trader is to practice. Practice does not make perfect; in this case, no one can guarantee you a positive return - the key is to understand and adopt good practices.

Here are some tips and good practices that will help you be a more responsible trader:

4 Areas Of Responsible And Safe Trading

1. Practicing Self Discipline.

Self-discipline is the ability to avoid unhealthy excess of anything that could lead to negative consequences. In trading, this means telling yourself to avoid harmful excesses like compulsive trading or gambling.

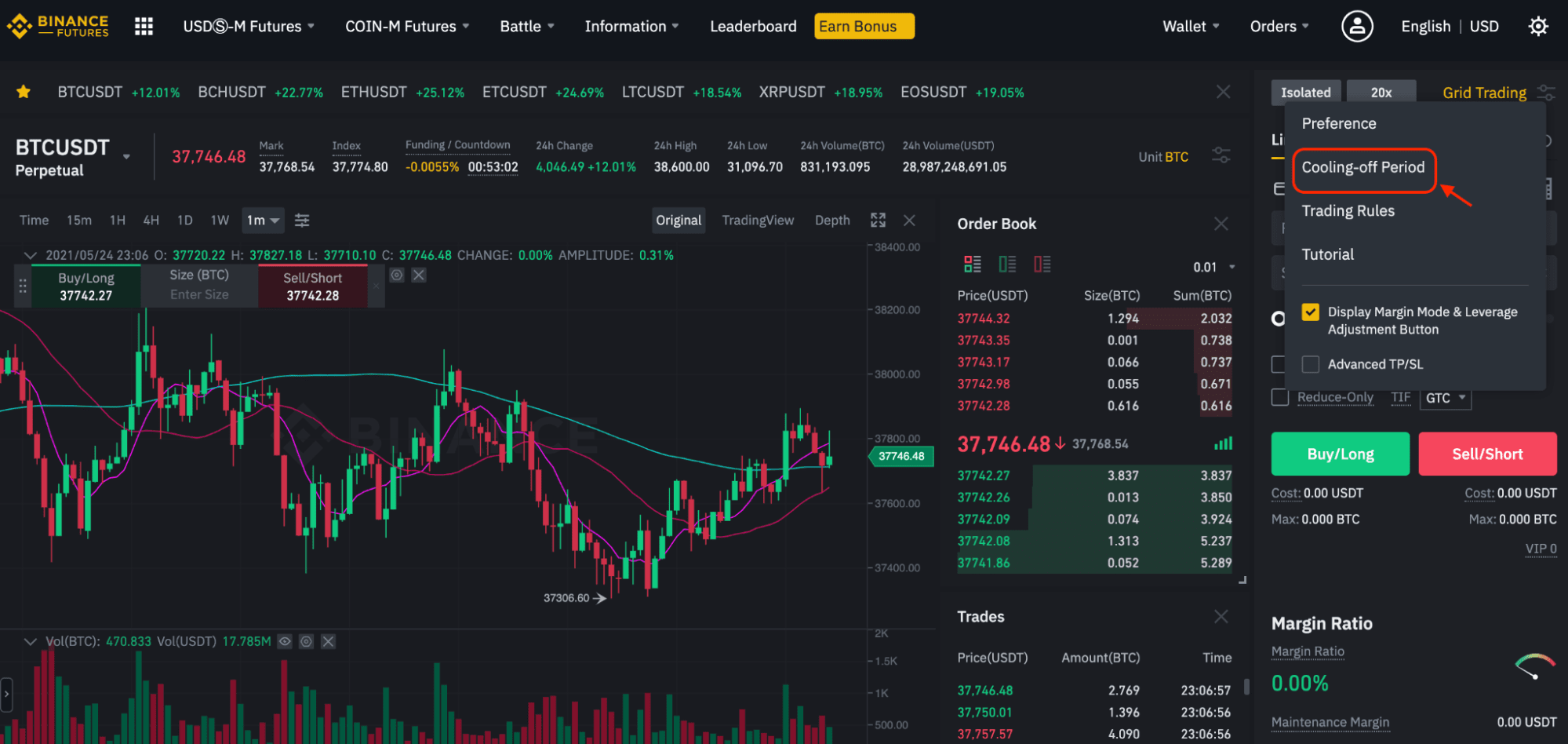

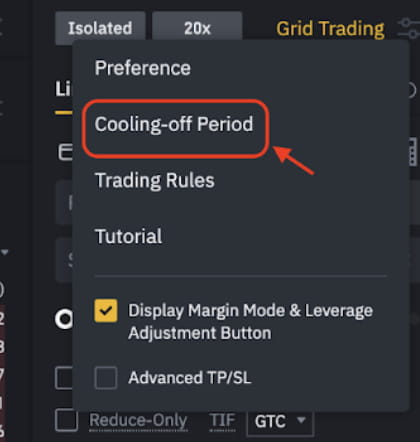

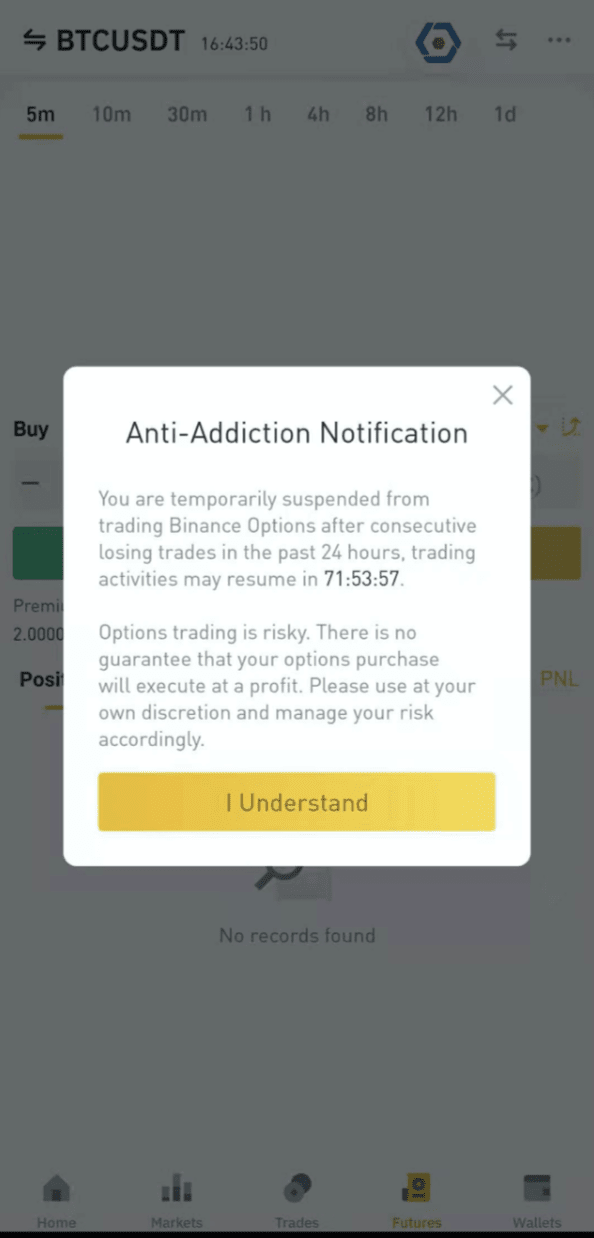

At Binance, we encourage users to trade responsibly and practice self-discipline, especially when they feel pressured by losses or a losing streak. As such, we have launched the Cooling-off Period function for users to disable Futures trading activities temporarily to prevent compulsive trading behavior.

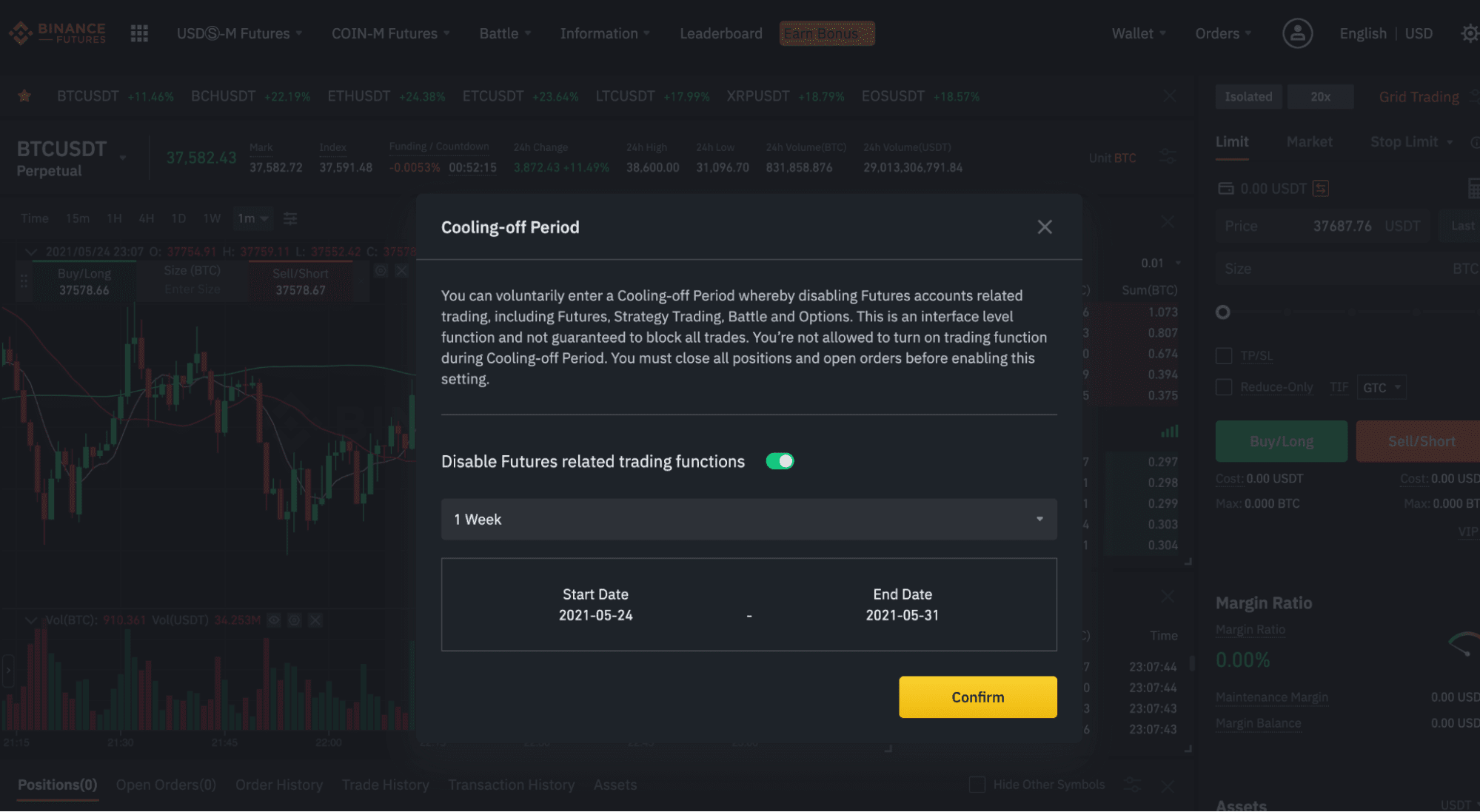

Once the Cooling-Off Period function is enabled, you will not be able to trade all futures-related products such as USDⓈ-M and COIN-M Futures, Grid trading, Options, and Futures Battle via app or desktop.

To get started with the cooling-off period function, simply go to the futures trading interface and click [Trading Rules].

Next, select the duration of your cooling-off period and click [Confirm] to activate.

Learn more about the Cooling-off Period function in our FAQ.

2. Continuously Educating Yourself.

Cryptocurrency trading is a vast subject that may seem overwhelming to novice traders. The truth is trading is complicated; there are no shortcuts. As such, it is important for users to continuously educate themselves to stay sharp and competitive.

Binance has continuously worked towards educating its users on every aspect of crypto trading, from the underlying technology of cryptocurrencies to the complexities of crypto-economics. These are freely available on Binance Academy, Binance Research, and even beginner-friendly product overviews such as Bitcoin Futures Overview.

3. Protecting Your Capital at All Times

Risk management is a core concept that is key to every winning trader’s success. It helps you avoid substantial losses that can lead to you losing your entire trading account.

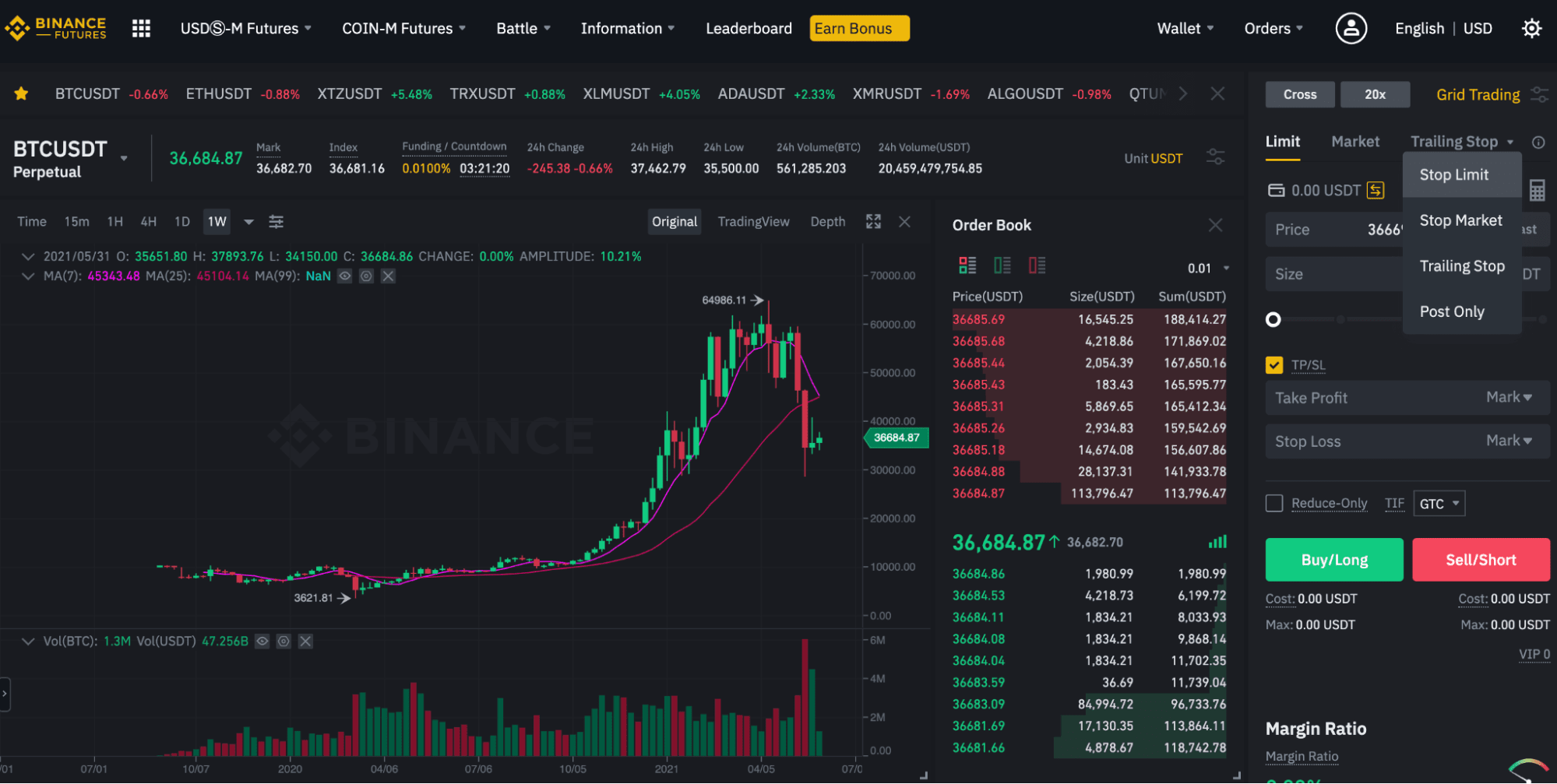

On the Binance trading interface, we have embedded risk management features such as stop-loss orders to help users manage the risk in individual trades (shown below).

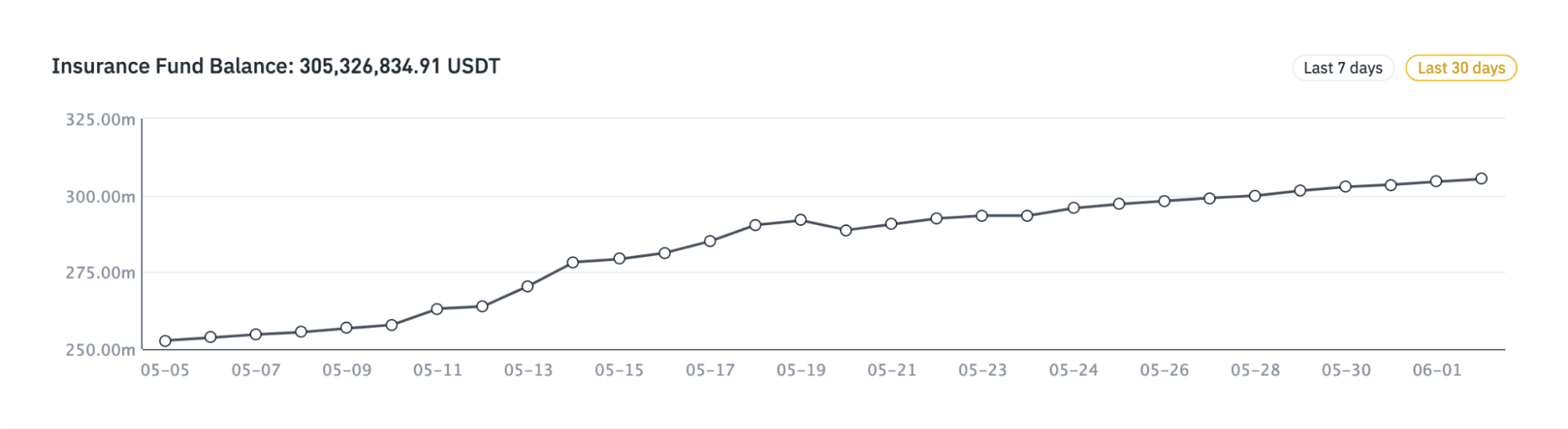

Additionally, Binance Futures have also established other safety features such as liquidation mechanisms and insurance funds to protect users from adverse losses.

For more information on liquidation mechanisms and insurance funds: Read more here.

4. Knowing When To Stop

Knowing when to stop, and learning to recognize unhealthy trading habits, calls for being honest with yourself about the risks you take on and the sort of behavior that accompanies it.

After losing, for example, do you then keep trading to recoup your losses and risk running up heavier losses in the process?

As a responsible trader, you should always keep yourself in check and ensure that you have procedures in place to avoid compulsive trading disorder.

Binance has set in place several procedures to remind users and prevent impulsive behavior.

For instance, when a user experiences a losing streak or suffers a heavy loss, we continuously remind them of the risk involved in trading and encourage them to hold back on trading activities.

Exchanges and Users Share Responsibility

Naturally, responsibility simply doesn’t end with the users. Every exchange is responsible for educating its users, as much as it is for enabling user access to the products. In a sense, because exchanges can easily list new projects or tokens, it is more important for exchanges to ensure responsible trading principles are inculcated in their DNA.

Binance has, for instance, made sure its products are embedded in a complete risk management system that delivers a safe and fair trading experience. We offer users the necessary means and tools to:

Prevent trading addiction by setting trading limits and self-exclusion tools.

Guarantee data privacy and security by adding security tools designed with privacy in mind and compliant with regulatory requirements.

Deliver a secure trading environment to users by integrating cyber-security monitoring capabilities.

Binance Supports Responsible Trading

We are conscious of our market-leading position. It is because users have a good experience with us, that we became the largest exchange. As a market leader, we have a great responsibility in educating and protecting users.

We continuously think of ways on how we can help promote and ensure responsible trading among our users so they can have a good and safe experience. These include:

1. Our insurance funds. Unlike other insurance funds, Binance insurance funds are used for what they were intended. On several occasions where market volatility was extreme, our insurance funds were activated to absorb losses from users.

2. Platform security. As one of the most exciting industries, the cryptocurrency market attracts a lot of attention. Unfortunately, this includes bad actors who will attempt to find ways to disrupt the market for their gain. There are often reports of hacking attempts, some successful, others thwarted. What is certain is that no one single platform or exchange can claim to be 100% hack-proof, so the goal is to ensure we have well-rounded protection to prevent these attempts. Even as volumes grow by the day, we continue to deliver the most stable and fastest matching in a safe environment protected away from bad actors.

These are just a few examples, and we will continue to improve on our innovation and offerings. As a service provider, we think of user-friendly ways to provide a safe and responsible trading platform. As a business, we think of sustainable and responsible practices that benefit our users and the market. As in the case of leveraged tokens, we actively took a stand to remove a product when the trading volume would generate revenue for us. Because the decision to make trading responsible and to create a secure and conducive environment is a common initiative for everyone.