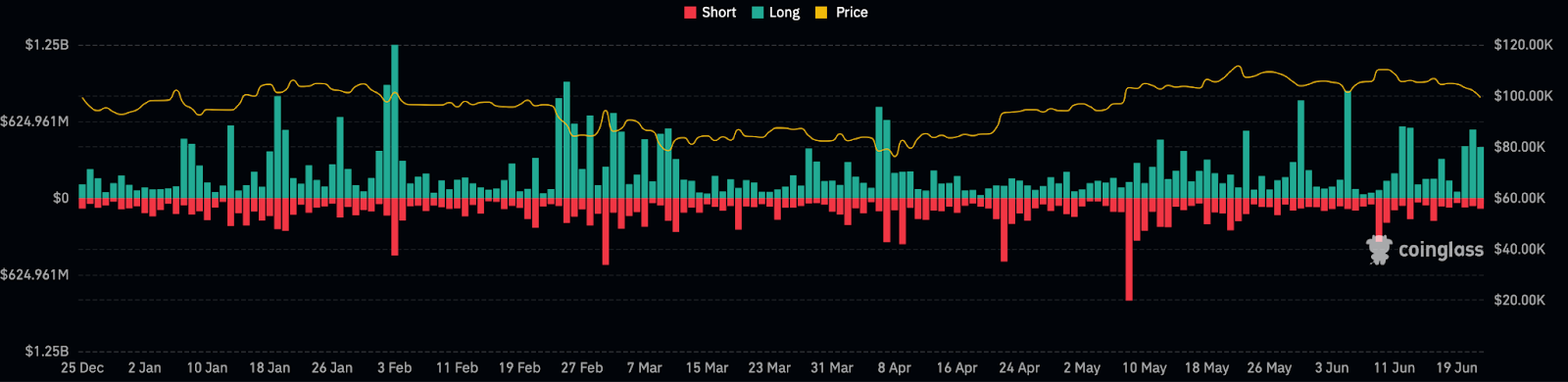

Total crypto market liquidations surged past $2.6 billion, with altcoins like ETH and SOL plunging over 20 percent. Yet amid the chaos, Bitcoin spot ETFs recorded strong net inflows of $1.02 billion, underlining growing institutional conviction. This structural demand helped stabilise BTC’s price within a wide $94K–$110K range, even as derivatives markets underwent a major deleveraging. With open interest now resetting to healthier levels and funding rates normalising, the path ahead will hinge on whether ETF inflows continue—or whether a break in this support signals a deeper shift in market mood.

The Federal Reserve kept interest rates steady in June but signaled growing concern over slowing economic growth, persistent inflation, and political pressure. Powell warned that tariffs will likely cause a “meaningful” increase in consumer prices as businesses pass on the cost, reinforcing the Fed’s cautious stance.

Adding to inflationary pressures, geopolitical tensions in the Middle East, especially around the Strait of Hormuz—a critical oil route—have rattled global oil markets. A spike in freight costs and falling tanker activity signal market anxiety, and oil prices could soar if disruptions escalate. Gasoline futures have already climbed sharply, tightening consumer budgets and posing a challenge for central banks, which now face the dilemma of either delaying rate cuts or risking inflation persistence.

On the consumer side, May retail sales showed a 0.9 percent drop, led by declines in car, fuel, and restaurant spending. However, core retail sales still grew, hinting at resilient discretionary spending. Businesses, anticipating tariff hikes, have built up wholesale inventories since late 2024, but retail shelves remained understocked. As retailers restock at higher costs in the coming months, especially ahead of the holiday season, a second wave of inflation may emerge. Together, rising oil prices, tariff pass-throughs, and seasonal restocking could push inflation higher by fall, complicating the Fed’s path and delaying expected rate cuts.

Donald Trump’s 2024 financial disclosure showed over $600 million in income, driven largely by crypto ventures like the $TRUMP coin and World Liberty Financial. His deep involvement in crypto, real estate, and global branding has sparked ethical concerns over blurred lines between business and politics.

At the same time, Vietnam passed a landmark law giving legal status to crypto assets starting in 2026, offering incentives to attract blockchain innovation and positioning itself as a regional tech hub. Meanwhile, Iran’s largest exchange, Nobitex, was hit by a politically driven cyberattack that destroyed up to $100 million in assets—highlighting crypto’s growing entanglement with global conflict.

The post appeared first on Bitfinex blog.