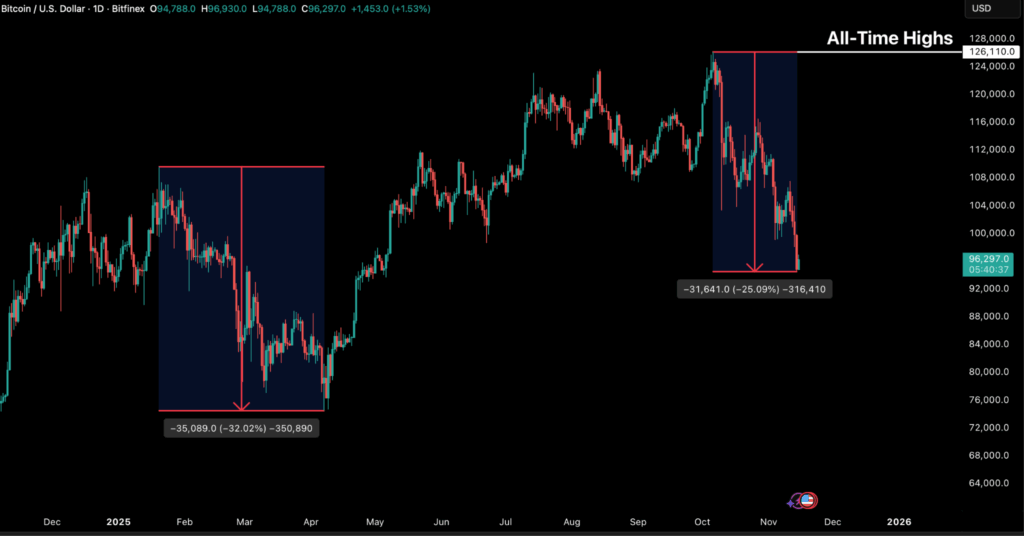

BTC is now trading firmly below the short-term holders’ (STH) cost basis of $111,900 and the –1 standard-deviation band near $97,500, keeping downside risks alive until this level is reclaimed. Still, on-chain exhaustion signals are emerging. The STH Realised Profit-Loss Ratio has dropped below 0.20, meaning that over 80 percent of coins moved on-chain are being sold at a loss, a zone historically consistent with local bottoms. Likewise, STH supply in profit has collapsed to 7.6 percent, levels last seen near prior cycle troughs. While further confirmation is needed via renewed demand inflows, this confluence of metrics implies that we are due to form a durable base soon, more in terms of time than in price, setting the stage for potential stabilisation into late Q4.

The US enters late 2025 with a noticeably softer macroeconomic backdrop. The 43-day government shutdown has ended but left clear economic scars, with approximately $7–$14 billion in permanent GDP losses, widespread liquidity stress among furloughed workers, and renewed concerns over fiscal brinkmanship ahead of another funding deadline in January. Markets initially shrugged off the disruption, but sentiment deteriorated quickly afterward, with the S&P 500 pulling back as investors reassessed fiscal risks and the prospect of a Fed pause.

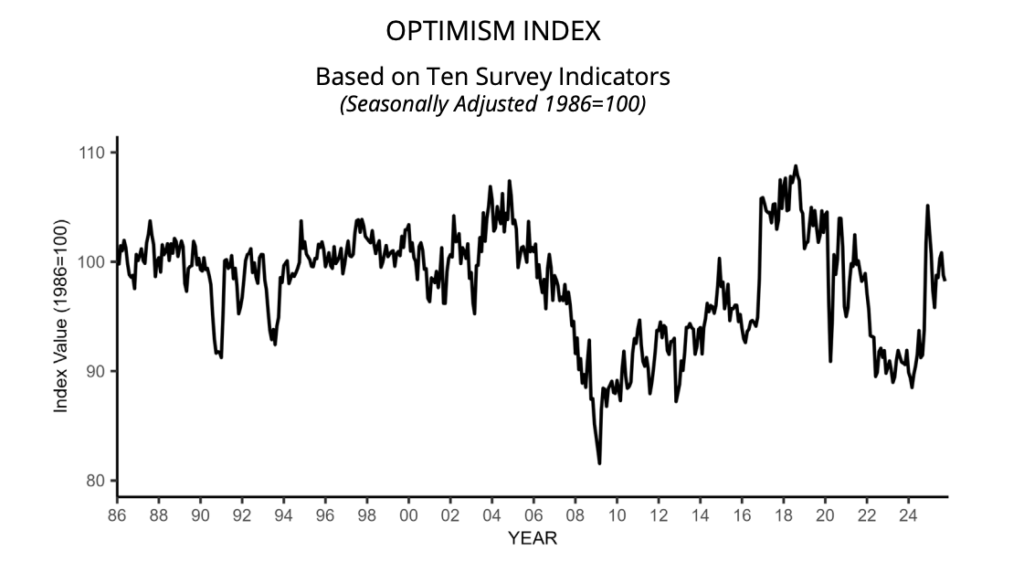

At the same time, domestic business sentiment is cooling. The NFIB Small Business Optimism Index slipped in October, reflecting weaker sales, tighter profits, and persistent labour shortages. This fall aligns with weakening global demand: the Global PMI New Export Orders Index fell to 48.5, marking its fastest contraction in nearly two years, with both manufacturing and services showing broad-based declines.

Inflation adds another layer of pressure. With official CPI data unavailable during the shutdown, alternative indicators point to persistent price stickiness, New York Fed expectations sit at 3.2 percent, and market-based breakevens hover near 2.2 percent. Elevated inflation expectations and heavy fiscal spending suggest the Fed may keep rates higher for longer, keeping mortgage rates above 6 percent and leaving households with little relief.

US crypto regulation took a major step forward this week as a bipartisan Senate draft bill proposed shifting primary oversight of digital assets from the SEC to the CFTC. The legislation would classify most tokens as “digital commodities” and require exchanges and custodians to register under a commodities-style framework, though key questions around DeFi, AML rules, and agency coordination remain unresolved.

Crypto also expanded further into entertainment as TKO Group Holdings, parent of the UFC, signed a multiyear deal with Polymarket to integrate real-time prediction-market data into live events starting in 2026. The partnership marks a deeper convergence of sports engagement and Web3 tools.

Meanwhile in Europe, the Czech National Bank launched a $1 million pilot portfolio containing Bitcoin, a stablecoin, and a tokenised deposit, its first direct exposure to digital assets. Framed as a technical experiment, the initiative reflects growing central-bank interest in understanding how blockchain-based instruments may shape future financial infrastructure.

The post appeared first on Bitfinex blog.