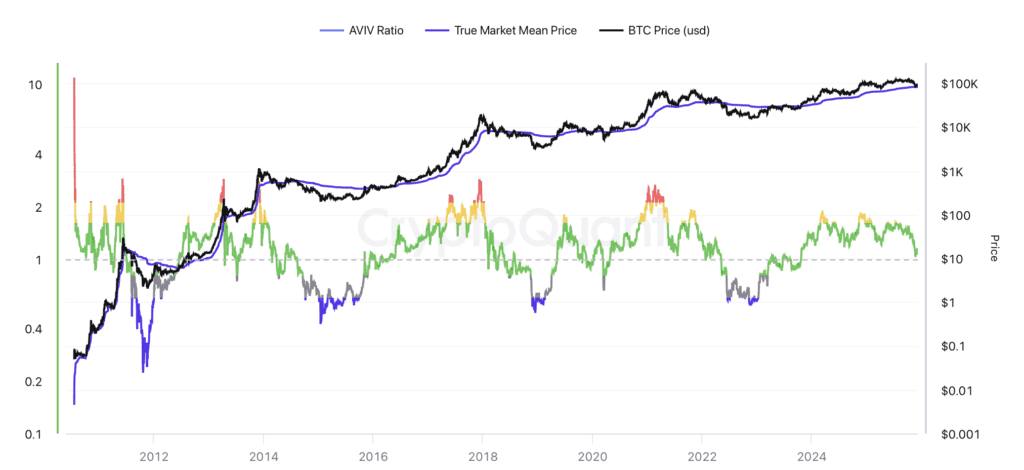

At the same time, spot-side demand has meaningfully eroded: US Bitcoin ETFs have logged persistent outflows, taker buying has deteriorated significantly, and Cumulative Volume Delta across major exchanges has turned decisively negative, signalling traders are selling into strength rather than accumulating.

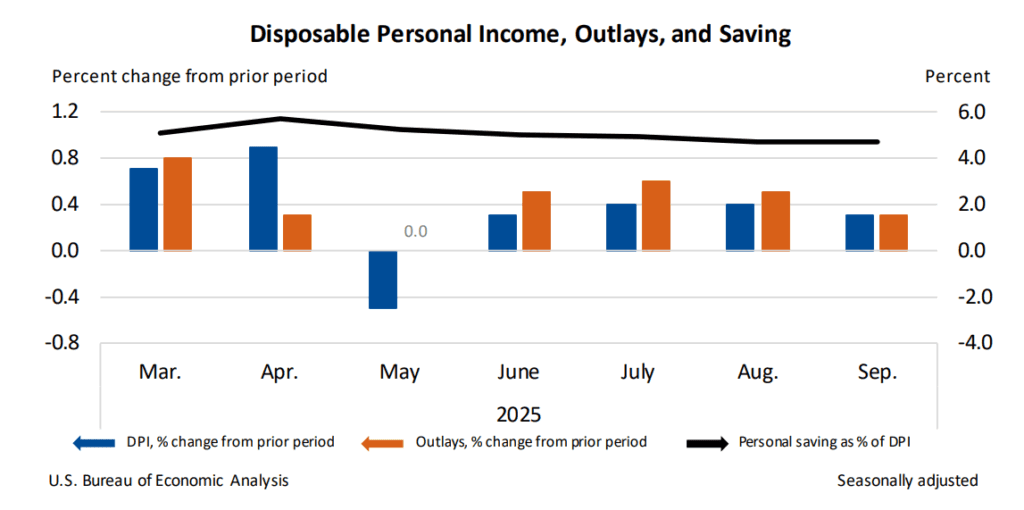

The latest economic data signals a US economy still advancing but much more slowly, with slowing consumer spending, persistent inflation, and signs of strain emerging. Real consumer spending was flat in September, with incomes barely keeping up with prices, highlighting financial strain for lower- and middle-income households and signalling a softer fourth quarter. Inflation remained stubborn at 2.8 percent year-over-year, complicating expectations for a widely anticipated December rate cut, especially as Fed officials remain divided over whether the economy has cooled enough to justify easing.

Meanwhile, labour and business indicators reveal a similarly uneven landscape. Private-sector hiring unexpectedly fell in November, led by small-business job losses, even as jobless claims dropped to their lowest level since 2022, showing employers are hesitant to cut staff. The services sector continued to expand, with stronger demand and rising backlogs, though hiring within the sector contracted and prices remained elevated. Together, the data suggest an economy that is cooling unevenly—supported by resilient services and stable employment—but increasingly vulnerable as persistent inflation erodes household strength and weighs on growth heading into the Fed’s next policy decision.

In the news, Vanguard, long known for rejecting cryptocurrencies as too speculative, has reversed its stance by allowing clients to trade third-party crypto ETFs and mutual funds, including those tied to Bitcoin and Ethereum. While it still does not plan to offer its own crypto products, and says explicitly that it will not endorse any investment allocation to meme coins, the decision reflects growing confidence in the maturity of crypto markets as well as strong investor demand.

Governments too are updating their view of the crypto industry, with the UK passing the Property (Digital Assets etc.) Act 2025, which recognises cryptocurrencies as a distinct form of personal property. This reform offers clearer rights in cases of theft, insolvency, and inheritance, and is viewed as a crucial step toward making the UK a more attractive environment for digital-asset businesses. In the United States, regulators are also moving forward: the Commodity Futures Trading Commission has authorised the first-ever listing of spot cryptocurrency products on federally regulated exchanges, aiming to provide a safer, regulated alternative to offshore markets. Collectively, these developments reflect a global trend toward integrating digital assets into established financial and legal systems, expanding access, protection, and legitimacy for crypto markets.

The post appeared first on Bitfinex blog.