This capitulation phase culminated on August 2nd, with daily liquidations exceeding $1 billion—$922 million of which came from long positions. While BTC and ETH led the liquidation volume, altcoins experienced deeper drawdowns, with total crypto liquidations marking one of the most aggressive unwinds in 2025. Despite the high-beta nature of altcoins, even major assets like ETH closed the week down 9.7 percent, and the broader OTHERS index ended 11.4 percent lower. Only a few names like ENA and PENGU managed modest gains, underscoring how limited capital rotation has become amid growing macro pressure and receding risk appetite.

Structurally, BTC still retains a position of relative strength, with a market cap above $2.2 trillion—double its 2021 cycle peak, while ETH and altcoins remain below prior highs. This divergence underscores BTC’s growing role as a macro-resilient, institutionally driven asset, in contrast to the speculative fragility of the broader market. With ETF flows cooling, Fed policy turning more hawkish, and risk appetite waning, we expect consolidation or further downside unless aggressive spot buying re-emerges. While a technical bounce from the $112,000 area is plausible, broader recovery likely hinges on renewed demand via institutional flows or a clear macro catalyst.

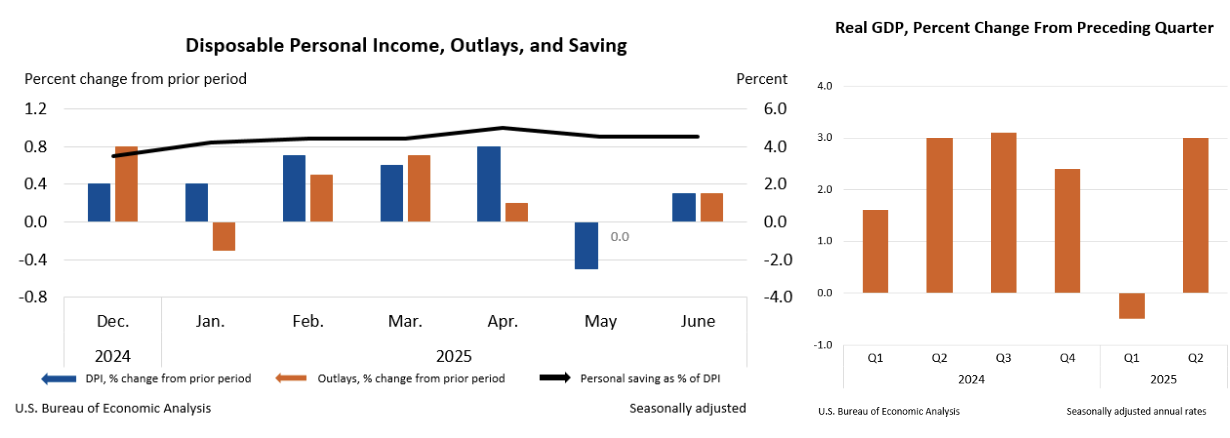

The latest economic data from the United States highlights growing fragility beneath seemingly resilient headline figures. June’s inflation report revealed persistent price pressures, largely driven by new tariffs that lifted the cost of goods like furniture, clothing, and recreational items.

While personal consumption expenditures (PCE) rose modestly, real consumer spending barely moved, indicating that inflation is eroding purchasing power. Wage growth has softened, and although GDP grew 3 percent in Q2, much of that was due to a sharp decline in imports—masking weak domestic demand.

Excluding trade and inventories, real GDP grew just 1.2 percent, pointing to stagnation in business investment and slowing consumer activity. Meanwhile, July’s job report added to the gloom: hiring slowed to just 73,000 new jobs, unemployment ticked up to 4.2 percent, and labour force participation continued to drop. Sectors like construction and hospitality underperformed despite seasonal tailwinds, while a drop in foreign-born workers reflected the drag of tightened immigration policies. These trends collectively complicate the Federal Reserve’s policy outlook. With inflation sticky and labour momentum fading, the Fed is likely to delay rate cuts, awaiting clearer signals before adjusting its stance.In parallel, the crypto industry is experiencing a strong resurgence in institutional engagement, marked by bold treasury allocations and more regulatory realignment. SharpLink Gaming made headlines with a $295 million purchase of ETH, boosting its total holdings to over 438,000 and establishing itself as the second-largest corporate holder globally. Backed by Ethereum co-founder Joseph Lubin and a former BlackRock executive, the firm’s aggressive capital deployment and staking strategy reflect growing institutional conviction in ETH as a core treasury asset. Meanwhile, regulatory momentum is also building. SEC Chairman Paul Atkins launched “Project Crypto”, a sweeping initiative to modernise the US digital asset framework. Moving away from the agency’s enforcement-heavy past, the initiative promises clarity on token classifications, enables licensed crypto “super-apps,” and encourages tokenised traditional finance—potentially reclaiming the US’s leadership in digital innovation. Finally, DevvStream, a Nasdaq-listed carbon credit company, announced a $10 million allocation into Bitcoin and Solana as part of its sustainable crypto treasury program. Funded by a $300 million convertible note raise, the move blends financial strategy with environmental impact, underscoring how crypto is increasingly being integrated into diversified corporate finance models. Together, these developments signal a maturing digital asset space, increasingly aligned with both institutional capital and a forward-looking regulatory framework.

The post appeared first on Bitfinex blog.