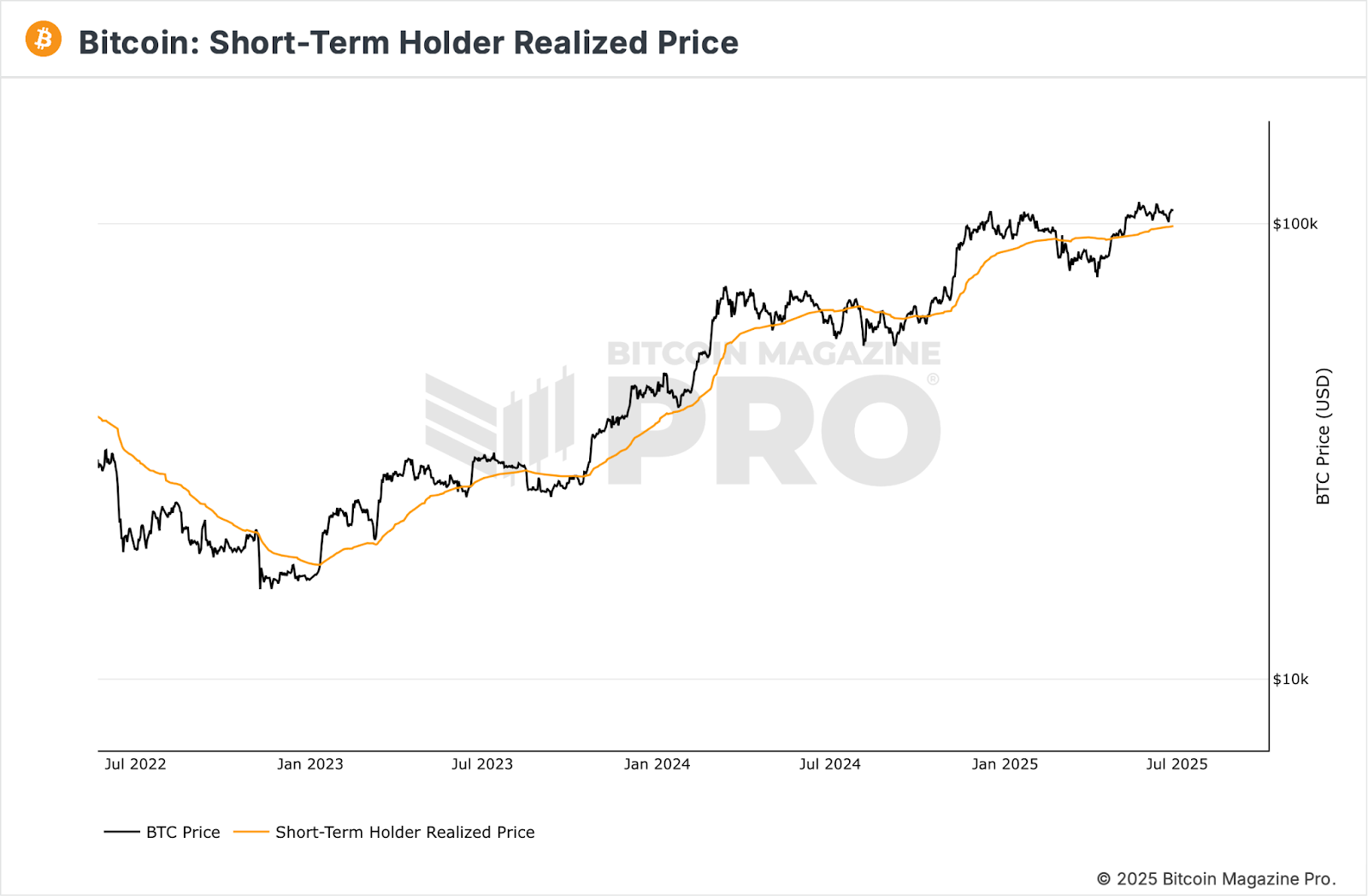

Bitcoin’s short-term holder realised price around $98,700 has acted as a key structural level, successfully acting as support with dip buyers accumulating Bitcoin there, especially during the most recent drawdown when Iranian-Israeli tension escalated. Despite the volatility, this level has continued to serve as both a support and a resistance zone throughout the current bull cycle. A brief breakdown last week to a low of $99,830 triggered significant liquidations on both the long and short side, with futures open interest levels dropping over 7 percent in a 24-hour window. This flush has cleared excess leverage and reset market positioning into the quarterly close.

Looking ahead, historical Q3 seasonality suggests a phase of lower volatility and muted directional movement. On average, Q3 has been Bitcoin’s weakest quarter, with just +6 percent returns historically, and price action tends to remain range-bound during this period.

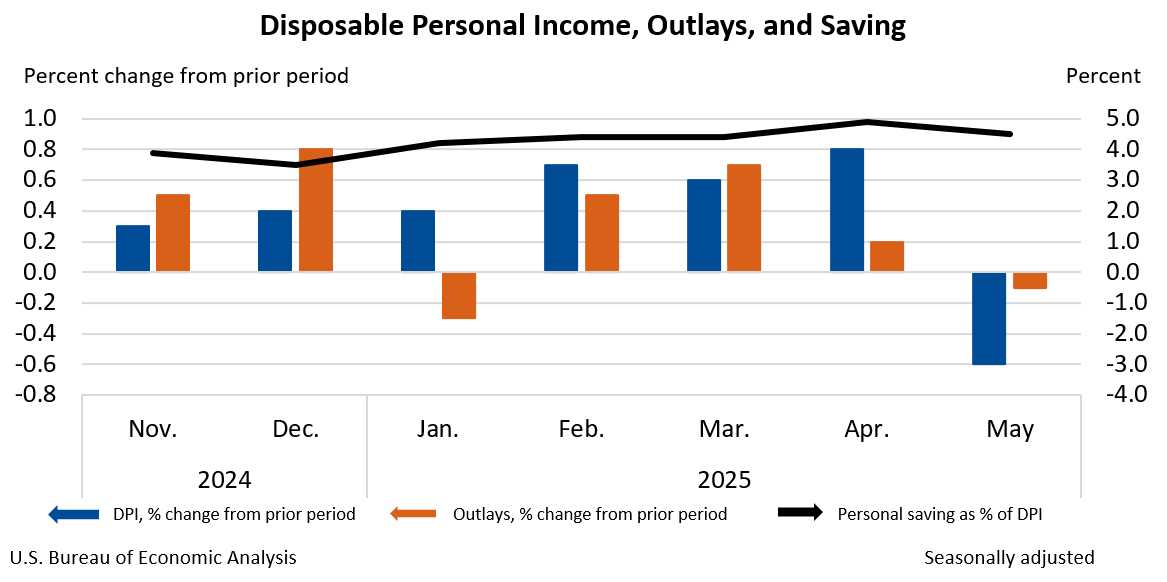

The US economy continues to send conflicting signals as consumer spending slows while inflation remains stubbornly above target, complicating the Federal Reserve’s decision-making. In May, personal income and spending both fell, with many households drawing on savings and cutting back on essentials like vehicles and dining out. Core inflation climbed to 2.7 percent, keeping rate cuts off the table for now as the Fed focuses on balancing price stability with the risk of weaker growth. Trade deficits widened further, jobless claims showed signs of a cooling labour market, and durable goods orders got a temporary lift from a spike in aircraft sales. Hopes for near-term Fed action have dimmed as policymakers await clearer evidence on the economy’s direction amid tariff pressures and global uncertainty.

In crypto, Gemini and GF Securities, a Chinese brokerage, are separately advancing tokenised asset offerings, giving EU and Hong Kong investors, respectively, new access to US stocks and digital securities as part of a growing effort to blend traditional finance with blockchain. Meanwhile, the sector’s risks were underscored by the sentencing of a Pennsylvania man to more than eight years in prison for defrauding investors in a $40 million crypto Ponzi scheme, reinforcing the need for vigilance as digital finance evolves.

The post appeared first on Bitfinex blog.