Walmart Enters Metaverse With Roblox Experiences

Retail giant Walmart is entering the metaverse with two new immersive experiences that premiered Monday on the online gaming platform Roblox. Find out more here.

Robinhood Debuts Web3 Wallet Beta With Polygon

Popular trading platform, Robinhood, has launched the beta for its web3 wallet for 10,000 iOS users who have signed up for the waitlist. Find out more here.

Stablecoin Landscape Shifts as Conversion Begins

Following the announcement earlier in September, several exchanges have proceeded with the conversion of a handful of stablecoins, including Circle’s USDC, Paxos’ Pax Dollar, and TrueUSD, to their exchange stablecoins.Find out more here.

Warner Music Group Announces Partnership With OpenSea

On Thursday, mega record label conglomerate, Warner Music Group (WMG), announced a collaboration with the NFT marketplace OpenSea to accelerate the company’s foray into the nascent space. Find out more here.

L1/L2 Development of the Week

This week, we take a look at Cardano’s Vasil hard fork which took place on September 22, 2022.

Cardano has finally completed its Vasil hard fork upgrade. The Vasil upgrade includes bringing diffusion pipelining and Plutus v2 to Cardano’s network, paving the way for DeFi development and network scaling on Cardano.

Read more details here as we look into details of the Vasil upgrade and Cardano’s network performance.

DeFi Updates of the Week

This week, we dive into Vertex, a vertically integrated decentralized orderbook exchange.

Vertex recently published its litepaper. While its testnet is still in the works, the team has introduced some innovative ideas such as AMM integration, cross-margin, and tokenomics that would incentivize users with long-term interests.

Read more here as we look into its architecture, tokenomics, and roadmap.

On-Chain Round-Up for the Week

The broader crypto market experienced a brief recovery mid-week after the Bank of England’s intervention, breaking a multi-day rout since the FOMC’s rate decision last week. However, the rebound was short-lived as major cryptocurrencies whipsawed due to investors seeking shelter in U.S. dollars. The market also registered an uptick in volatility as quarterly options expiry approaches. Despite the correlation with tech stock indices, both BTC and ETH remain well-bid above previous support levels.

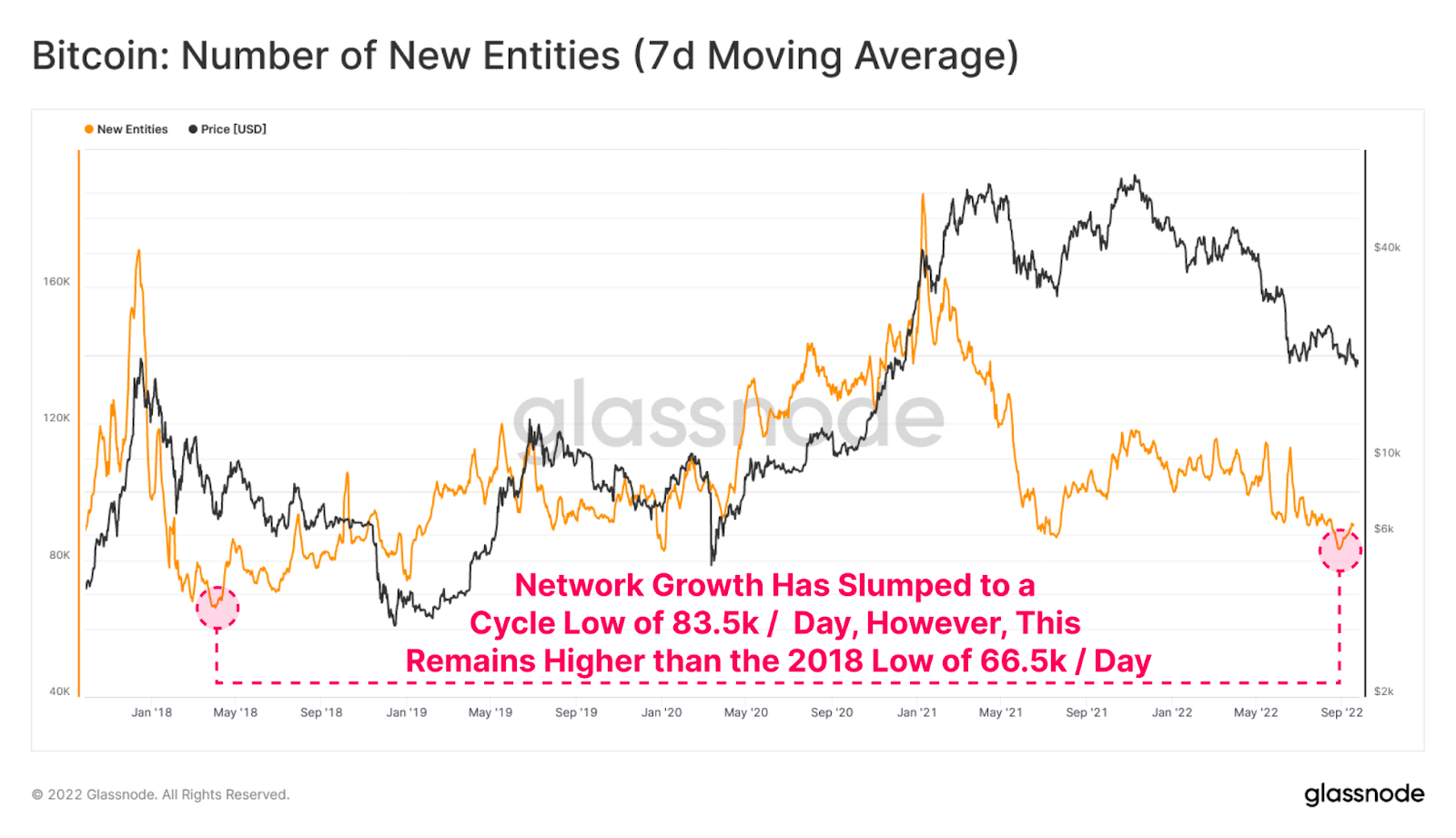

BTC’s on-chain activities returned to depressing levels after a slight rebound last week. The number of new entities transacting on the network has reached a new cycle low of 83.5k per day, although the figure is still significantly higher than the troughs in the 2018 bear cycle. Daily transaction fees have plummeted by 19%, reaching a historical low due to limited demand for block space. Meanwhile, the daily transaction volume has fallen by 39% over the past week on the back of a significant drop in average transaction value.

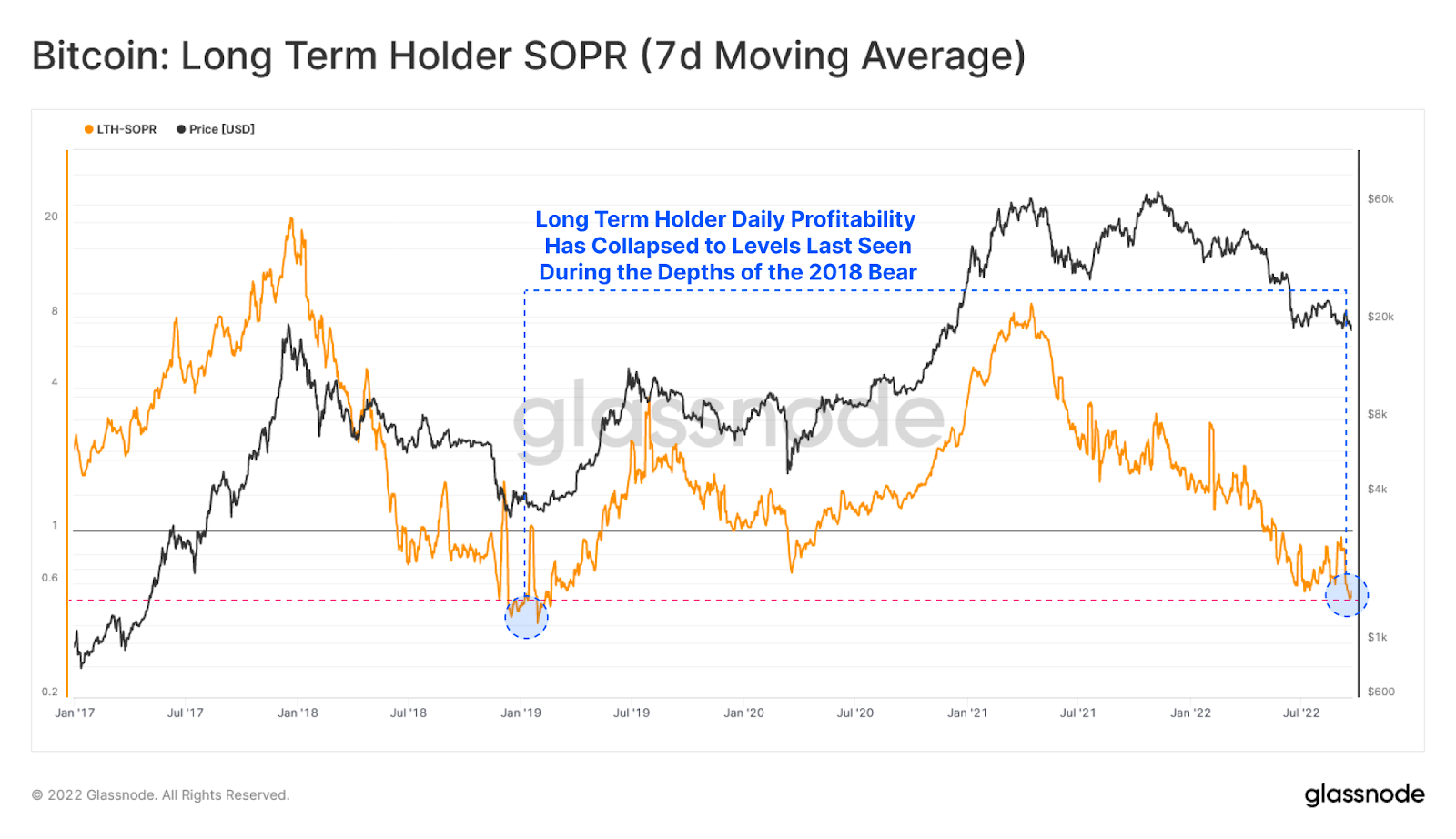

Due to price weaknesses in the spot market, both long-term and short-term holders are deep underwater. Long-term holders, in particular, have seen their profitability plunge to levels last seen during the depth of the crypto winter in 2018. In addition, these long-term holders, who are believed to share a stronger conviction, are selling at an average loss of 42%. The capitulation also brings the cost basis of these spent coins to around $32k.

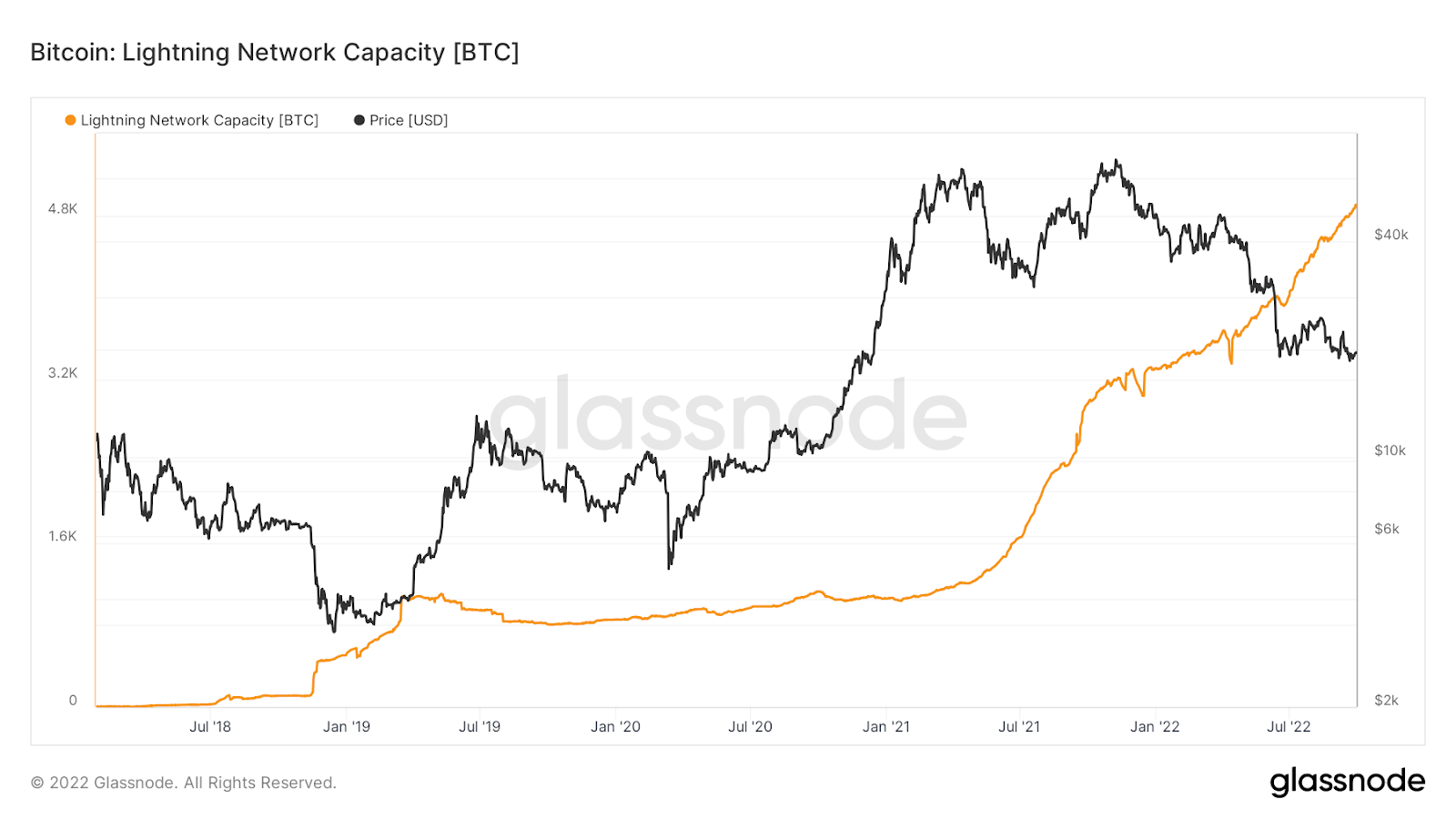

However, not all is gloom and doom. The Lightning Network, for instance, shows signs of steady growth and adoption. In addition, Lightning Labs has recently released the test version of a new piece of software that will allow Bitcoin developers to create, send, and receive assets on the Bitcoin blockchain.

Macro Events to look out for in the Coming Week

Sep 30, 2022 |

|

Oct 1, 2022 |

|

Oct 3, 2022 |

|

Oct 5, 2022 |

|

Oct 7, 2022 |

|

Three coins to watch

Token | Reason |

ATOM | Cosmos’ native token has been outperforming top crypto assets and its L1 counterparts in the recent market slump and demonstrated great resilience. Moreover, the network has recently introduced a new white paper that seeks to enhance its interoperability and repurpose the ATOM token. The new issuance model will strike a balance between the growth of the ecosystem and interchain adoption, as well as accrue more value to ATOM by enabling leveraged liquid staking. |

LINK | Interbank messaging system SWIFT is working with Chainlink on a cross-chain interoperability protocol that seeks to accelerate the adoption of blockchain technology and bring crypto to various institutions across capital markets. The collaboration will increase the use case of LINK when retrieving and preparing off-chain data. |

MATIC | Polygon has recently been chosen by popular trading platform Robinhood over Ethereum as the exclusive blockchain for its web3 wallet debut. The network is also making dynamic moves such as high-profile partnerships and VC plays, to cement its role as one of the biggest players in the web3 industry. |