Terra (LUNA) in a nutshell

Founded in 2018 by Daniel Shin and Do Kwon, Terra (LUNA) is a blockchain protocol that provides the foundation for an increasing number of payment platforms, with a focus on the Asia-Pacific region. The project has the objective of ensuring that fiat currencies such as USD, EUR, CNY, JPY, GBP or KRW get a digital counterpart as stablecoins, in order to then enable digital payments in payment apps, for example.

Terra (LUNA) uses a Proof of Stake algorithm and aims to combine price stability with growth. The Terra ecosystem is “home” to several stablecoins backed by the world’s major fiat currencies: the protocol is backed by the euro, US dollar, South Korean won, Mongolian tugrik, Chinese yuan, Japanese yen, Pound sterling and more are to be added. Terra stablecoins have the use cases and advantages of cryptocurrencies, while benefiting from the stability of the fiat currencies they’re backed by. Two use cases make Terra especially promising: the Mirror and the Anchor protocols.

Mirror and Anchor

Through Mirror, Terra users are able to create and use fungible assets - like tokens - keeping track of prices of “real-world” resources such as stocks. Mirror smart contracts are built on Terra and use UST, Terra’s stablecoin which is backed by the US dollar, as collateral. During a bullish market, Mirror enables users to buy equities, whereas Anchor protocol enters the fray in the event of a bearish market.

Anchor works as a saving and lending platform, allowing users from all over the world to deposit, lend and borrow money. Even though the uses of Anchor may sound exactly like what banks are offering, this protocol only requires users to have an internet connection, and it protects them from inflation by using the UST stablecoin instead of fiat currencies as would be the case of traditional banking.

The combination of Mirror and Anchor gives Terra users the exciting possibility of evening out profits and losses caused by market changes, all in line with Terra’s purpose of providing stability and usability for users (particularly those who may be living in unstable economic conditions).

As stated in Terra’s official Whitepaper:

“If Bitcoin’s contribution to cryptocurrency was immutability, and Ethereum’s expressivity, our value-add will be usability.”

1/ The official documentation guide for preparing and migrating Terra dapps to Columbus-5 is now available in the Github Wiki link below. #LUNAtics please help amplify and spread awareness to maximize the distribution of the details. https://t.co/5g5SxwLpPA

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) September 14, 2021

Terra and price volatility

One of the challenges the Terra project is facing is dealing with significant price changes. Why? Terra’s native token, LUNA, stabilises the prices of the protocol’s stablecoins by being burnt or minted to match Terra’s stablecoins supply with their demand: essentially, the token works as a tool against price fluctuations and possible inflation.

As mentioned before, Terra’s stablecoins are based on several fiat currencies. One would be the EUR euro-linked Terra Euro, EUT for short. Now, let’s consider EUT, Terra’s stablecoin backed by Euro.

If the price of 1 EUT is less than 1 EUR, holders can decide to send 1 EUT into the system and get 1 EUR worth of LUNA (that was minted).

Likewise, if the price of 1 EUT increases to more than 1 EUR, users can decide to send 1 EUR worth of LUNA in the system (for burning) and receive 1 EUT.

On the one hand, this process allows users to earn quick profits, on the other, it provides the protocol with a way of controlling price fluctuations and volatility.

Terra (LUNA) vs Solana (SOL) and Ethereum (ETH)

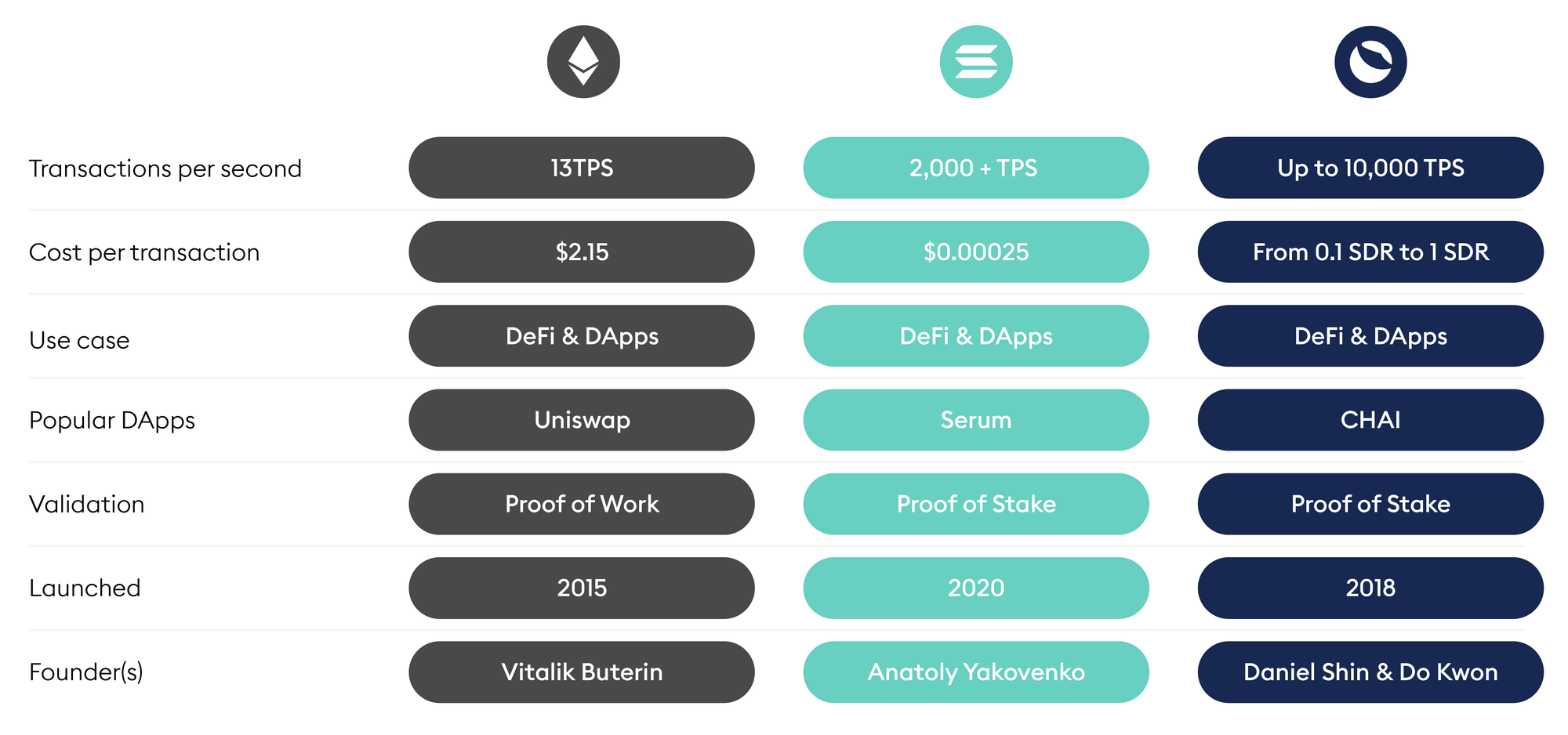

Like many other cryptocurrencies, Terra is also on its way to being termed an Ethereum competitor. Let’s see how Terra is doing compared to both Ethereum and another competitor, Solana:

Something that will definitely catch your attention is Terra’s TPS, which is significantly higher than Ethereum’s and Solana’s, making LUNA a high-performing protocol for scalability and throughput. However, with the new upcoming Ethereum upgrade, things could change in favour of the crypto-giant. Terra has been offering stablecoins linked to the IMF (International Monetary Fund) special drawing rights basket, the Mongolian tugrik, the South Korean won and the US dollar since September 2020.

In other news, LUNA’s cost per transaction may seem quite costly when compared to SOL. However, this aligns with Terra’s intention of increasing usability: no matter how large the transaction, miners are paid a fee that could range from 0.1% to a maximum of 1% of the total transaction, which is capped at 1 SDR ( special drawing right).

Where to start your research

We can’t stress enough that doing your research before you invest is crucial. For altcoins, as well as cryptocurrencies in general, a good starting point is the official website of the asset you’re researching, such as Terra’s official website. Read about the protocol’s projects, goals and values and find out if you are interested in learning more.

After getting familiar with a coin, you should analyse how comfortable you are with investment risk and how you feel about generating earnings from your assets. Higher and faster, but riskier returns, or long-term ones? Finally, how would this crypto fit in your investment portfolio?

Ready to buy LUNA?

At Bitpanda, LUNA is just a few moments away via your smartphone or computer. With Bitpanda’s easy-to-use interface, investing in crypto and other digital assets has never been easier.