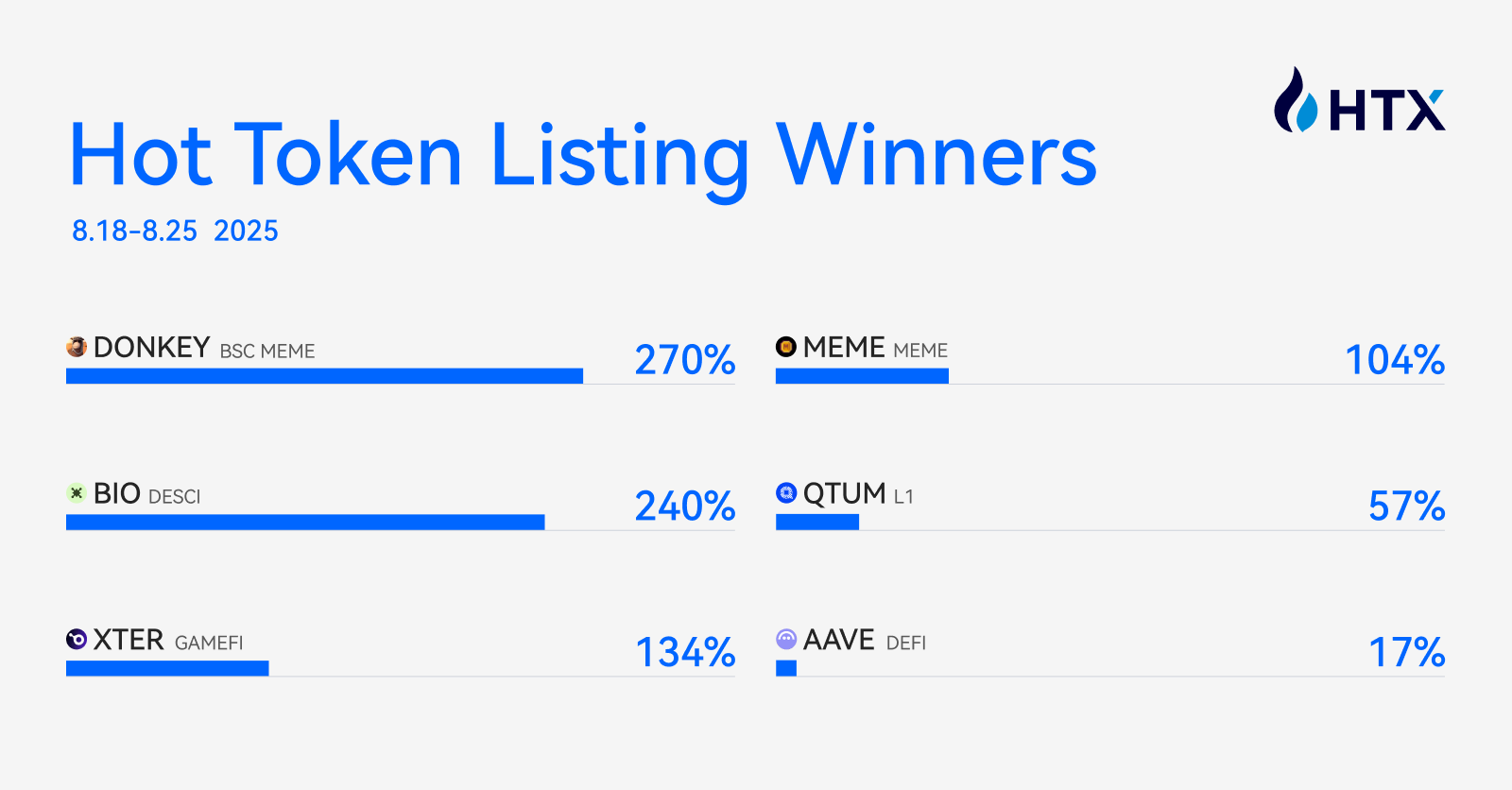

Over the past week (August 18–25), the crypto market’s momentum continued, with some emerging sectors surging and steadily lifting investor sentiment. HTX data shows that several tokens posted impressive gains. DONKEY from the BSC meme sector was the undisputed star, soaring 270% over the week and achieving a staggering 1,990% cumulative increase over 30 days. Meanwhile, DeSci newcomer BIO emerged as a “research superstar”, while blue-chip assets such as ETH and AAVE quietly rose. The entire market became a stage for both short-term frenzy and long-term stability.

Meme Coins Remain in the Spotlight: DONKEY and MEME Take Flight

The meme coin sector has long acted as a barometer of market sentiment in the past. With the “light narrative + strong community” model gaining traction, high volatility and popularity in meme coins are expected to continue presenting trading opportunities in the second half of the year.

● DONKEY (BSC Memecoin): The week’s top performer, surging 270% over the week and nearly 1,990% over 30 days, making it the most impressive dark horse. Its rise is fueled by the hyper-active BSC on-chain community, coupled with market sentiment and the ever-growing cultural narrative around memes.

● MEME: A veteran meme coin, up 104% over the week. MEME is the native ecosystem token of Memeland, a Web3 creative studio founded by 9GAG, the globally popular meme platform. It has inherent meme DNA and a massive traditional internet user base.

Emerging Sectors: DeSci and GameFi Stand Out

Beyond the meme coin frenzy, two emerging sectors deserve particular attention this week.

● BIO (DeSci): Up 240% this week, a true dark horse. The DeSci (Decentralized Science) sector has been gaining global traction in recent years by integrating scientific research with blockchains. BIO’s strong performance reflects both market enthusiasm for innovative narratives and DeSci’s potential in real-world adoption.

● XTER (GameFi): Up 134% this week. GameFi is reviving after a period of dormancy. With ongoing improvements in user experience and tokenomics, capital is flowing back into high-quality GameFi projects. XTER’s performance suggests that the GameFi sector may be gearing up for its next growth cycle.

Traditional Blue Chips: L1s and DeFi Rise Steadily

Compared with the explosive rallies in meme coins and emerging narratives, blue-chip assets have maintained a stable upward trajectory.

● QTUM (L1): Up 57% this week. Qtum Blockchain (shortened as “Qtum”) is dedicated to developing a third blockchain ecosystem beyond Bitcoin and Ethereum. As a long-established public blockchain project, QTUM continues to unlock its potential through renewed on-chain activity and ecosystem applications.

● AAVE (DeFi): Up 17% this week. Aave is an open-source decentralized lending protocol offering deposit and loan services. As a leader in decentralized lending, AAVE has once again earned market recognition thanks to ongoing protocol upgrades and its solid user base.

● ETH (L1): Up 8.8% this week to surpass $4,700, with mainnet TVL hitting a record high of $120 billion. As the industry infrastructure, ETH’s dominance is unshakable. With the Layer 2 scaling of the Ethereum ecosystem and the ongoing DeFi/NFT expansion, ETH’s steady appreciation also reinforces the market’s underlying confidence.

Structural Momentum Brings Opportunity: HTX Helps Capture the New Cycle

This week, HTX’s asset performance reflected a distinct “structural differentiation”: On the one hand, emerging narratives such as meme coins, DeSci, and GameFi drew in substantial capital with explosive growth. On the other hand, L1s and DeFi blue chips advanced steadily, providing a foundation of long-term value. This structural landscape means that while investors can seize short-term, high-volatility opportunities, they should also allocate stable assets to strike a balance between risk and return.

To learn more about HTX, please visit https://www.htx.com/?invite_code=9cqt3 or HTX Square , and follow HTX on X, Telegram, and Discord.

The post first appeared on HTX Square.