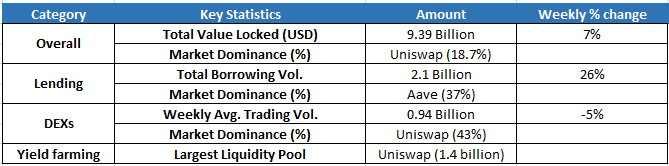

Following the release of the governance token UNI, Uniswap regained the top spot in the DeFi space for having the most USD value locked. The decentralized exchange also achieved a market dominance percentage of 18.7% — though DEXs have seen a 5% decline in weekly average trading volume.

In the yield-farming sphere, Uniswap was also the largest liquidity pool, with $1.4 billion locked. In terms of decentralized lending, the total borrowing volume reached $2.1 billion — a 26% weekly increase.

UniLogin shuts down

UniLogin, a provider of Ethereum onboarding solutions, announced its shutdown on Sept. 18, citing high gas fees on the Ethereum network. According to its co-founder, Alex Van de Sande, reasonable gas fees are crucial to the project’s survival.

Deploying a new multi-sig wallet for users, making Ethereum Name Service registrations and using UniLogin’s relayer to add DAI transactions all require a new on-chain transaction, which requires users to pay a gas fee — something that has become exceedingly expensive following the rise of DeFi. Van de Sande added that the cost of onboarding new users is over $130 per user, which costs the equivalent of setting up a new hardware wallet for each.

DeFi fever led to high gas fees

The gas fee on the Ethereum network is the price required to conduct a transaction or to execute a smart contract on the blockchain. The gas fee is most commonly measured in gwei, which equals 0.000000001 Ether (ETH).

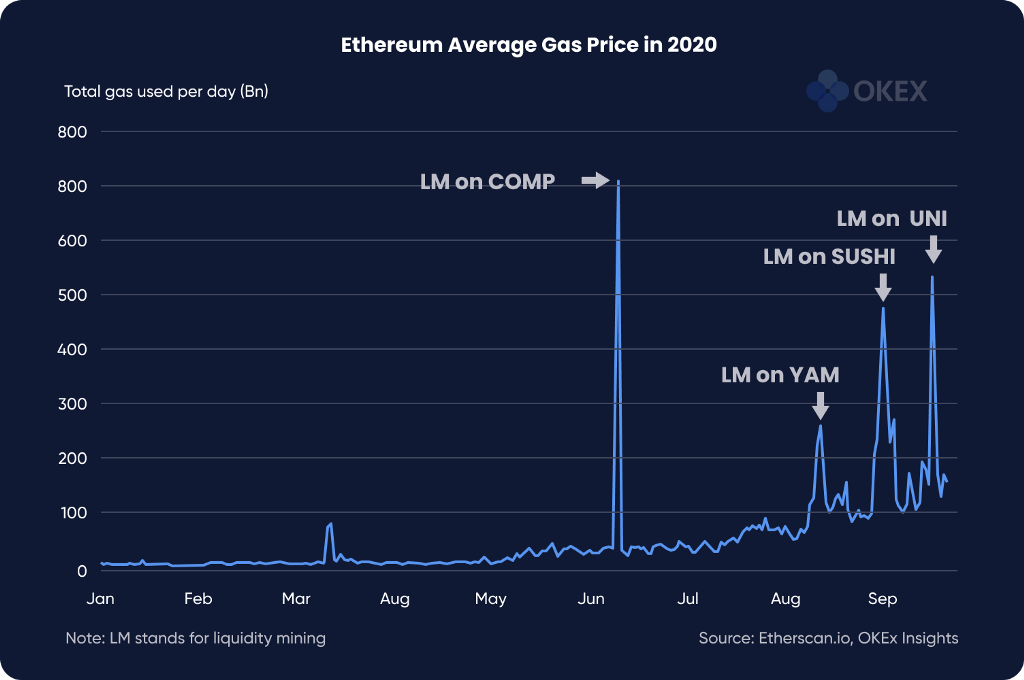

Following the gold rush into liquidity mining, the high gas fees on the Ethereum network have been widely discussed in the crypto community. Compound, an algorithmic money market protocol on Ethereum, released its governance token, COMP in mid-June — which marked the beginning of the liquidity mining craze in the DeFi sphere.

The release of COMP led to a huge demand for yield-farming projects, which drove up the number of transactions conducted on the Ethereum blockchain. This led to the congestion of the Ethereum network and participants paying higher gas fees to execute their transactions. As a result, the liquidity mining of DeFi tokens led to a sustained increase in daily gas fees over the past three months. The daily gas used reached an all-time high of 80.18 billion in early September.

The surging amount of gas used on the Ethereum network also coincided with a spike in the average gas fee spent. As seen in the chart below, the spikes of average gas fees in four places were caused by the launches of new DeFi tokens for liquidity mining. For instance, the average gas price topped at 709 gwei in mid-June, during the launch of COMP. Other notable listings of DeFi tokens — such as YAM in mid-August, SUSHI in early September and UNI last week — also led to congestion on the Ethereum network and notable increases in the average gas price spent.

The top users with the most Ether spent also indicated that DeFi dominates activity on the Ethereum network. Uniswap v2 accounted for 30% of total Ether spent for the last 30 days, followed by Tether’s 24%.

Visit https://www.okex.com/ for the full report.

Ready to get into DeFi? Start liquidity mining the easy way with OKEx Earn. Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.