In last week’s Futures Friday article, we noted how OKEx trading data showed Bitcoin still has room to rise despite retail fears, and if the price is able to break through the $16,000 resistance level, it could continue the bullish momentum.

This week, although the price has risen by nearly $2,000, several OKEx trading data are still not overheating, and investors are wary about whether the price is approaching the top of this phase. The margin lending ratio also dropped significantly as spot leveraged traders started taking profits. Meanwhile, the all-time high open interest has also forced traders to confront risk.

Buying power from institutions is still strong, however, and is the main driver of Bitcoin’s continued rise. As of Nov. 18, the Grayscale Bitcoin Trust’s assets under management had surged to $10 billion from $1.9 billion at the beginning of the year, an increase of approximately 426% in 2020.

OKEx trading data readings

Visit OKEx trading data page to explore more indicators.

BTC long/short ratio

Unlike last week, the BTC long/short ratio this week was roughly running in line with price movement, albeit with some delay. It essentially reflected the fact that retail traders are chasing the price surges and drops.

The ratio bottomed out at 0.75 on Monday when quarterly futures price surpassed $17,000 and hit a weekly high of 0.93 on Thursday morning when the price reached $18,000. At the moment, the ratio still does not reflect any retail FOMO sentiment, which is a good sign for further price growth.

The long/short ratio compares the total number of users opening long positions versus those opening short positions. The ratio is compiled from all futures and perpetual swaps, and the long/short side of a user is determined by their net position in BTC. In the derivatives market, whenever a long position is opened, it is balanced by a short position. The total number of long positions must be equal to the total number of short positions. When the ratio is low, it indicates that more people are holding shorts.

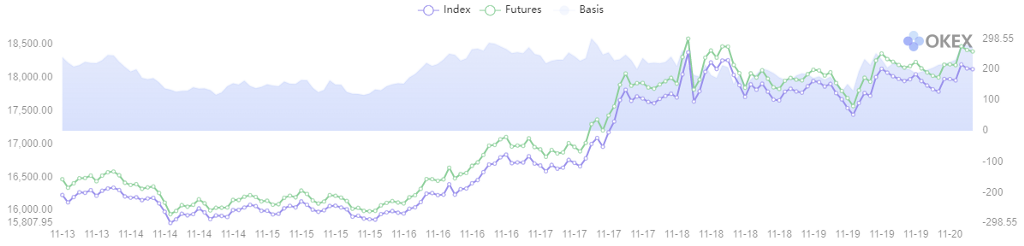

BTC basis

With quarterly futures set to expire in about a month, premium levels are starting to come down due to the impact of time decay. Despite the $2,000 increase in BTC price this week, the premium level now remains comparable to last Friday’s $250, or 1.45%, which is still healthy and reflective of bullish market sentiment.

This indicator shows the quarterly futures price, spot index price and also the basis difference. The basis of a particular time equals the quarterly futures price minus the spot index price. The price of futures reflects the traders’ expectations of the price of Bitcoin. When the basis is positive, it indicates that the market is bullish. When the basis is negative, it indicates that the market is bearish. The basis of quarterly futures can better indicate the long-term market trend. When the basis is high (either positive or negative), it means there’s more room for arbitrage.

Visit https://www.okex.com/ for the full report.

OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.