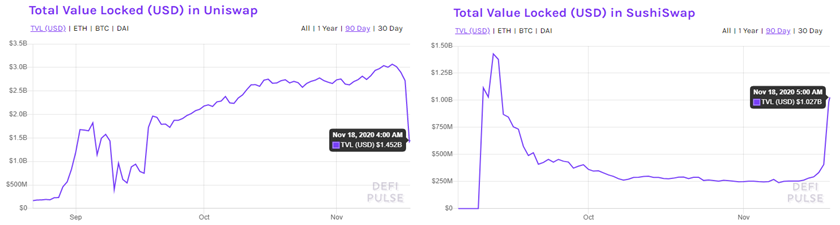

Liquidity mining on Uniswap ended yesterday. The total value locked in the leading decentralized exchange peaked at $3.068 billion on Nov. 14 and decreased to $2.718 billion by the end of the distribution of mining rewards. It then quickly fell by nearly half, to $1.452 billion, on Nov. 18, per data from DeFi Pulse.

As incentives dry up on Uniswap, yield farmers are looking around for more productive places to provide liquidity. Primary competitor SushiSwap has been the biggest beneficiary, with its TVL rising from $24 million on Nov. 8 to the current $1.027 billion. Other decentralized exchanges have all seen rapid TVL growth, such as Curve and Balancer.

Since Uniswap’s liquidity mining had a clear timetable for its cessation, this allowed its primary competitor to be well-prepared to attract liquidity. SushiSwap started the exact same pools as Uniswap, with boosted rewards, yesterday — including ETH/USDT, ETH/USDC, ETH/DAI and ETH/WBTC. It also provides a “Migrate” interface to facilitate the one-click transfer of liquidity from Uniswap — something many in the industry are calling a second vampire attack.

Previously, SushiSwap caused a stir by providing 10x SUSHI rewards for its liquidity mining and ended up having $1.43 billion in liquidity at its peak on Sept. 12. At the same time, Uniswap’s liquidity fell from $1.82 billion to around $400 million. However, Uniswap’s launch of its UNI token on Sept. 16 turned the tables and caused SushiSwap’s TVL to rapidly decline.

SushiSwap then decided to hard-cap its native token supply at 250 million tokens and reduce daily emissions, which caused some farmers to opt-out on account of decreasing yields. It also set a six-month lock-in period for two-thirds of the mining rewards in an effort to reduce short-term sell pressure. Furthermore, SushiSwap implemented Uniswap’s target business model — namely, the distribution of one-sixth of the taker fees (or 0.05% of the total trading volume) to xSUSHI stakers. These measures led to renewed market expectations for SUSHI’s price before Uniswap’s incentives ended. After a lengthy downturn, the price of SUSHI rose by over 90% in November.

Although liquidity has shifted to SushiSwap, Uniswap is still much higher in terms of actual trading volume. The end of the latter’s liquidity mining may not necessarily jeopardize its position as the top decentralized exchange. According to the website Crypto Fees, SushiSwap’s current seven-day average fees total $125,876, which is only 16% of Uniswap’s. More importantly, the number of users varies greatly. There were more than 25,000 users on Uniswap in the last 24 hours, while SushiSwap attracted only 607.

Visit https://www.okex.com/ for the full report.

OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.