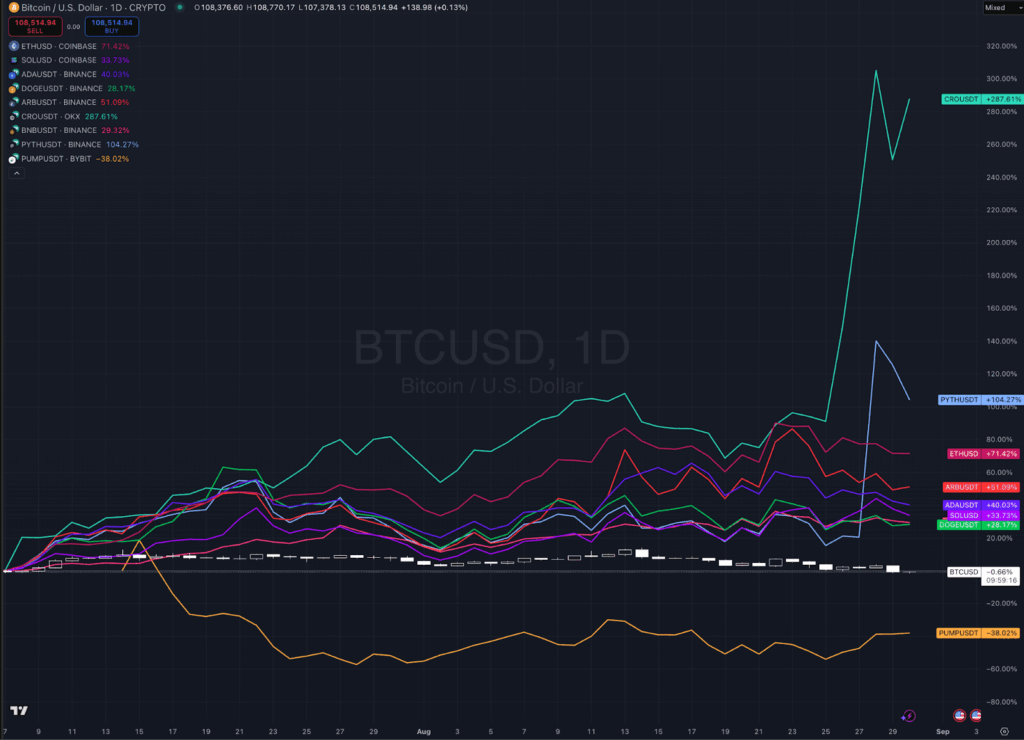

Altcoins have been faring worse, reflecting broad risk-off behaviour. ETH retreated 14 percent after briefly posting new ATHs, while XRP, ADA, and DOGE saw double-digit losses. Yet institutional demand remains resilient beneath the surface, with ETH treasuries and corporate buyers continuing to expand holdings. Mid-cap names like CRO and PUMP outperformed via narrative-driven rallies, though this rotation came at the expense of weaker names, not new inflows.

What is emerging is an Altcoin market cap that is stagnating, with any movement in alts signalling capital rotation rather than expansion. With ETF inflows seasonally muted and speculative excess flushed, September could mark the cyclical low point before structural drivers reassert for a Q4 recovery.

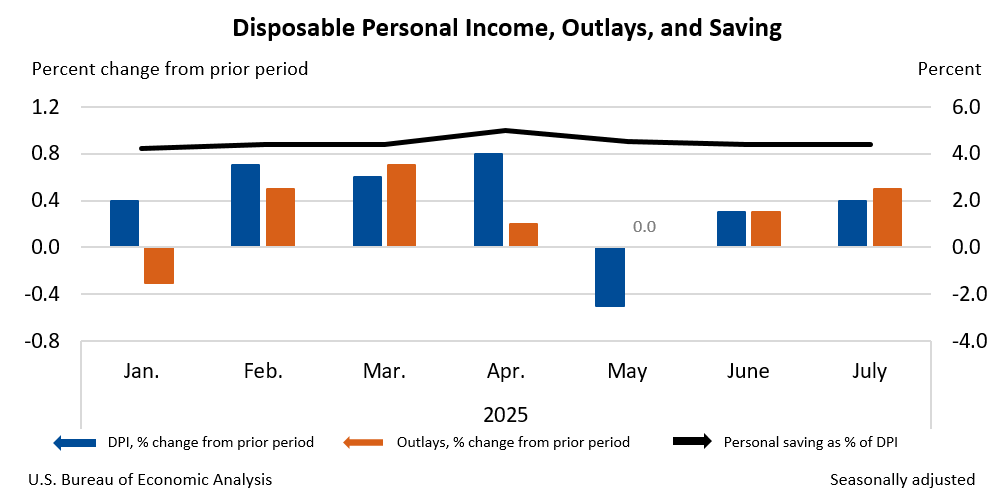

In the final week of August, US economic data presented a mixed picture for policymakers ahead of the Federal Reserve’s September meeting. Consumer spending in July rose 0.5 percent, the strongest in four months, but inflation pressures remained elevated, with core PCE advancing 2.9 percent year over year. At the same time, job creation slowed to an average of 35,000 per month, though updated benchmarks from the St. Louis Fed suggest fewer new jobs are now needed to sustain labour market stability. This recalibration lowers the threshold for policy easing, tilting expectations toward a September rate cut despite inflation staying above target. GDP data added to the complexity: second-quarter growth was revised higher to 3.3 percent, fuelled by strong intellectual property and equipment investment, yet regional surveys such as the Chicago Business Barometer signalled weakening business activity under the weight of tariffs and slowing confidence.

Alongside these macroeconomic shifts, regulatory and crypto market developments highlighted broader financial support for the asset class. The Commodity Futures Trading Commission reaffirmed the Foreign Board of Trade framework, clarifying that offshore exchanges can re-enter the US market under established rules—an adjustment expected to improve liquidity and reduce market fragmentation. Corporate adoption of digital assets also accelerated, with BitMine Immersion Technologies reinforcing its position as the world’s largest Ethereum treasury company, holding $8.82 billion in crypto and cash while pursuing its ambition to acquire 5 percent of Ethereum’s total supply.

Meanwhile, El Salvador advanced its sovereign Bitcoin strategy by dispersing its $682 million reserve across multiple wallets to mitigate security risks, paired with a public dashboard aimed at reinforcing transparency and positioning the country as a benchmark in state-level crypto governance.

The post appeared first on Bitfinex blog.