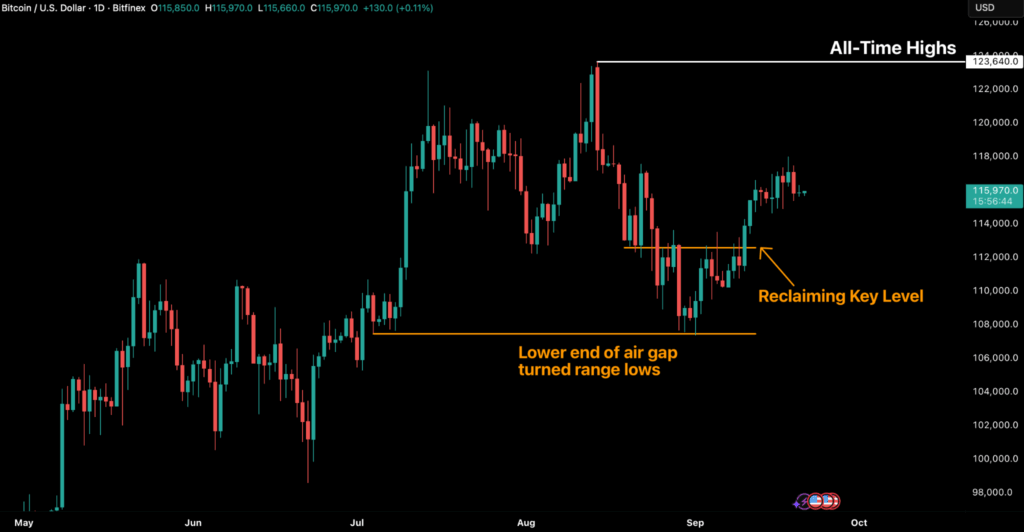

Perpetual futures played a central role, with open interest hitting a cycle high before moderating under policy-driven volatility. Short liquidations ahead of the FOMC announcement triggered squeezes that fueled the rally, though subsequent long liquidations highlighted the market’s sensitivity to leverage.

On-chain data show that Bitcoin now trades above the cost basis of 95 percent of supply (~$115,200), restoring profitability for most holders. Sustaining this level is key to maintaining momentum; a drop below could invite renewed selling pressure and retest the $105,500–$115,200 range.

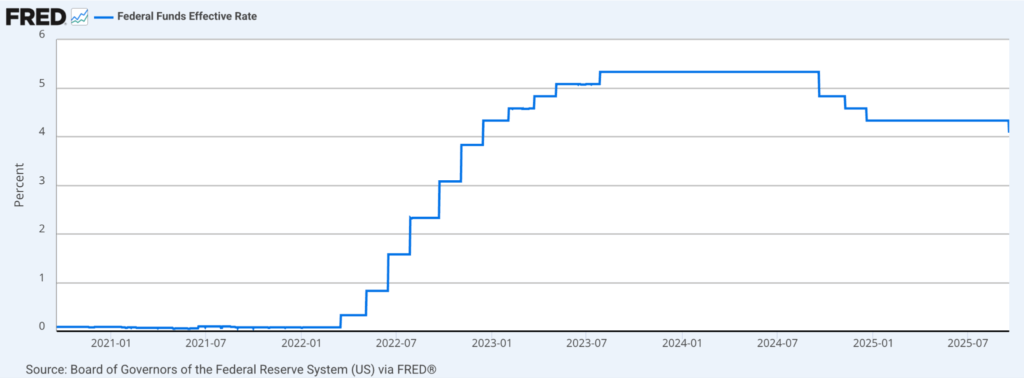

The Federal Reserve’s first rate cut since 2024 highlights its delicate balancing act between softening labour markets and stubborn inflation. Chair Jerome Powell stressed that employment risks are now taking priority, even as dissent within the Fed reveals divisions over how far easing should go. With growth slowing and inflation likely settling above target, the Fed appears willing to tolerate higher prices to cushion jobs, though political pressure and volatile market reactions continue to cloud the policy outlook.

These pressures are most evident in housing. New construction has dropped to multi-year lows, builder sentiment remains depressed, and price cuts are widespread as inventories swell. While mortgage rates have eased, affordability remains constrained by weak job markets and tighter liquidity, leaving residential investment a drag on growth. Taken together, the Fed’s cautious easing, the Treasury’s funding strategy, and a struggling housing market suggest that monetary relief alone may not prevent the economy from facing prolonged headwinds.

The global crypto landscape is being shaped by a convergence of macroeconomic stress, sovereign digital currency initiatives, and regulatory breakthroughs that could redefine digital asset markets. In the UK, surging government borrowing and rising debt costs have heightened volatility in bonds and sterling, strengthening the case for Bitcoin as a hedge against fragile fiscal foundations.In Europe, finance ministers advanced plans for a digital Euro by agreeing on frameworks for issuance and holding limits, framing the project as both payment modernisation and a step toward financial sovereignty. Meanwhile, in the US, the SEC’s adoption of generic listing rules for spot crypto ETFs could fast-track launches in as little as 75 days, opening the door to products beyond Bitcoin and Ethereum. Together, these shifts show how crypto is increasingly tied to fiscal pressures, central bank digital currency strategies, and regulatory reform, dynamics that will shape both growth and volatility ahead.

The post appeared first on Bitfinex blog.